Report ID: UCMIG40D2015

SkyQuest Technology's P2p payment market size, share and forecast Report is based on the analysis of market data and Industry trends impacting the global P2P Payment Market and the revenue of top companies operating in it. Market Size Data and Statistics are based on the comprehensive research by our Team of Analysts and Industry experts.

NFC innovation enables retailers to incorporate customer loyalty programmes into their payment cycles and customers to quickly reclaim coupons using cell phones. The expansion of web-based business stages and the consistent utilisation of cutting-edge innovation in monetary exchanges will most likely help the section's development. The growing popularity of wearable instalment gadgets, as well as the developing versatile trade pattern, will most likely accelerate the acceptance of NFC-based installments. During the COVID-19 epidemic, many banks and financial institutions are providing their customers with new high-level contraptions and approaches, such as flexible portion and dispersed portions, which have seen widespread adoption. Furthermore, the overall expansion in mobile phone entry increases the potential for the P2P portion business.

This report is being written to illustrate the market opportunity by region and by segments, indicating opportunity areas for the vendors to tap upon. To estimate the opportunity, it was very important to understand the current market scenario and the way it will grow in future.

Production and consumption patterns are being carefully compared to forecast the market. Other factors considered to forecast the market are the growth of the adjacent market, revenue growth of the key market vendors, scenario-based analysis, and market segment growth.

The market size was determined by estimating the market through a top-down and bottom-up approach, which was further validated with industry interviews. Considering the nature of the market we derived the Other Diversified Financial Services by segment aggregation, the contribution of the Other Diversified Financial Services in Diversified Financials and vendor share.

To determine the growth of the market factors such as drivers, trends, restraints, and opportunities were identified, and the impact of these factors was analyzed to determine the market growth. To understand the market growth in detail, we have analyzed the year-on-year growth of the market. Also, historic growth rates were compared to determine growth patterns.

REQUEST FOR SAMPLE

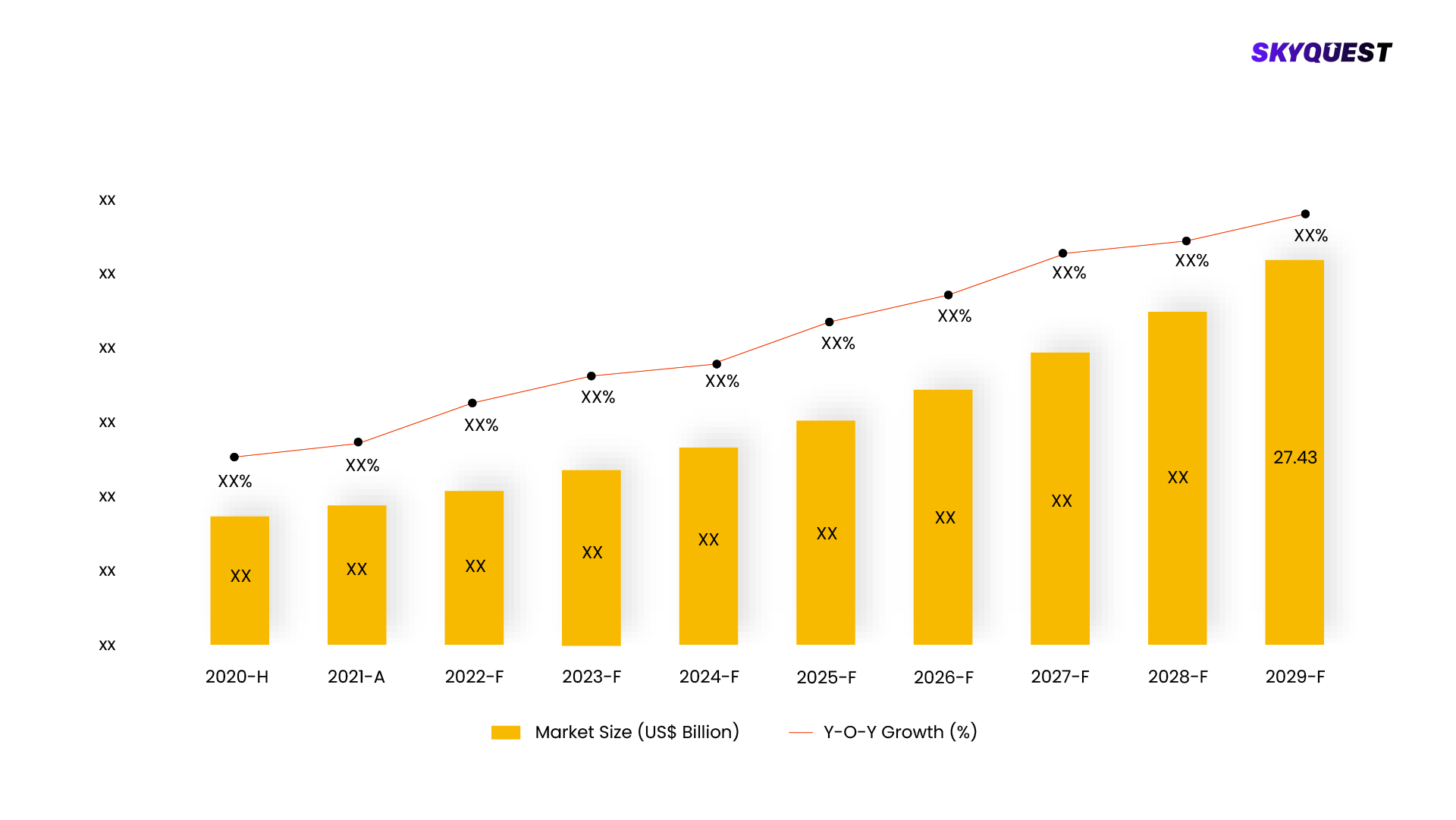

The market for P2P Payment was estimated to be valued at US$ XX Mn in 2021.

The P2P Payment Market is estimated to grow at a CAGR of XX% by 2028.

The P2P Payment Market is segmented on the basis of Transaction Mode, Payment Type, End User, Application, Region.

Based on region, the P2P Payment Market is segmented into North America, Europe, Asia Pacific, Middle East & Africa and Latin America.

The key players operating in the P2P Payment Market are Alibaba.com, Apple Inc., Circle International Financial Limited, Google LLC, One97 Communications Limited (Paytm), PayPal Holdings Inc., Square, Inc., WePay Inc., Wise Payments Limited, Zelle.

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients

Report ID: UCMIG40D2015

sales@skyquestt.com

USA +1 351-333-4748