Report ID: SQMIG45A2611

Report ID: SQMIG45A2611

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG45A2611 |

Region:

Global |

Published Date: May, 2025

Pages:

191

|Tables:

124

|Figures:

77

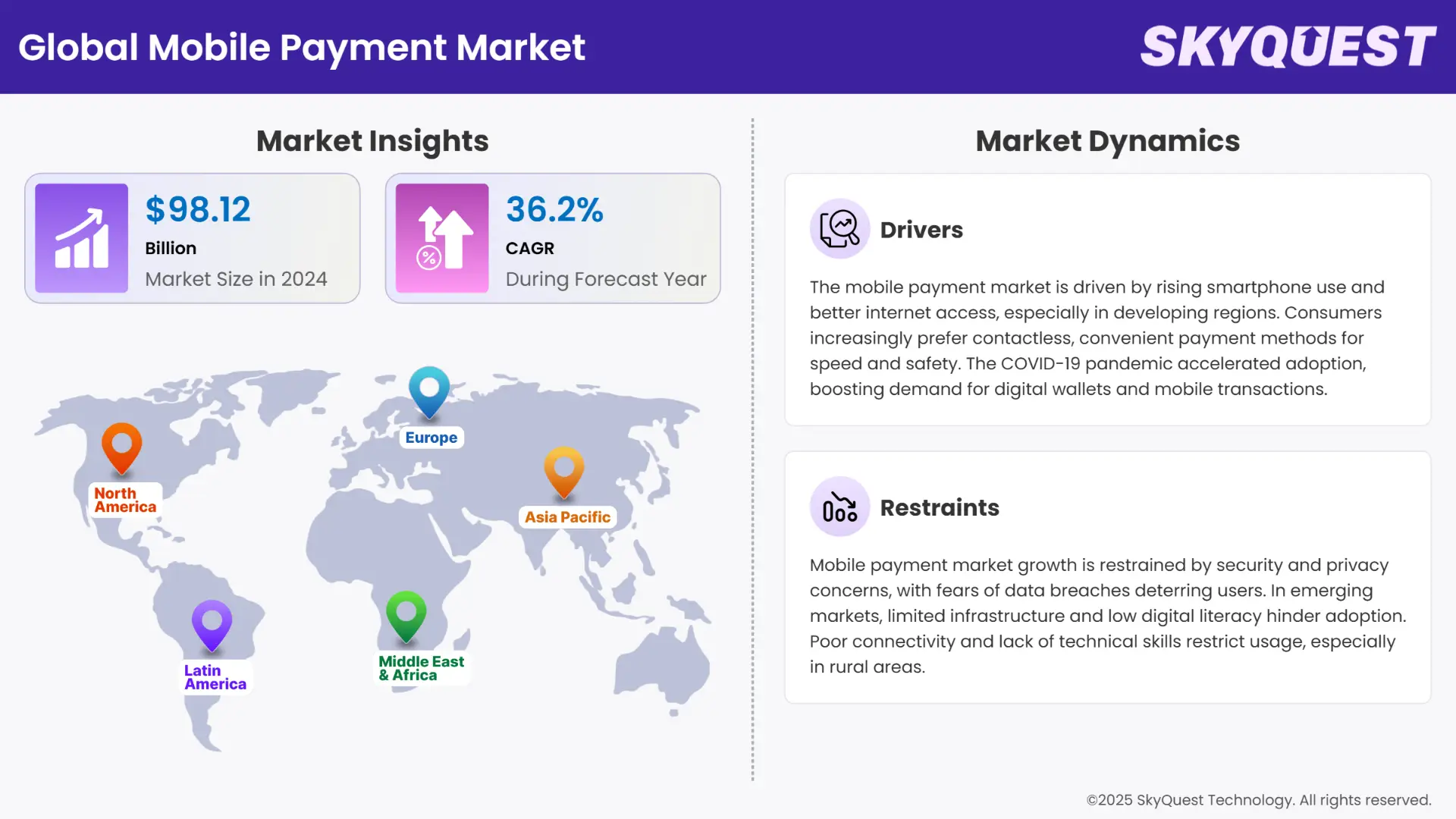

Global Mobile Payment Market size was valued at USD 98.12 Billion in 2024 and is poised to grow from USD 133.64 Billion in 2025 to USD 1582.5 Billion by 2033, growing at a CAGR of 36.2% during the forecast period (2026–2033).

The mobile payment market is growing rapidly due to the fast rise of mobile commerce and the spreading popularity of smartphones globally. Because the number of internet users is increasing in developing parts of the world, people are buying more goods and services online. Because people are now shopping more on their mobile devices, many businesses are introducing mobile-friendly payment methods to explore new possibilities. Mobile payments are becoming more popular mainly because they are easy and fast. Many people globally are choosing to pay with their smartphones or tablets through mobile wallets and contactless systems, instead of using cash or credit cards. When COVID-19 appeared, people turned to cashless and contactless methods more, as they tried to keep themselves clean and safe. Therefore, both e-commerce operations and traditional retail shops are introducing more ways to make payments with mobile devices.

Advancements in technology are playing a major part in the mobile payment market growth. NFC technology helps move encrypted data fast and safely to point-of-sale systems which makes buying easier and enhances the customer experience. A user can simply tap their phone on an NFC-enabled reader, unlike chip-and-PIN systems where customers are required to hold their cards. In areas where cutting-edge phones or reliable internet are scarce, sound wave-based payment systems are becoming popular. Since they work with unique sound frequencies, these systems provide safe and inexpensive ways to meet the needs of underserved areas.

How Is Sound Wave Technology Revolutionizing Mobile Payments in Emerging Markets?

In some regions where high-speed internet and sophisticated smartphones are not widespread, standard mobile payment methods using NFC or QR codes may not be convenient. Here, sound wave-based payment methods are making a big difference. Because they send coded transaction data using special sound frequencies, these systems remove the requirement for internet access and top of the line equipment. Because they cost very little and are simple to use such solutions are perfect for small traders and buyers in less developed regions.

Therefore, sound wave technology helps make mobile payments available to more people, especially in markets that were feared to be difficult for digital adoption. For Instances, in July 2023, Paytm launched two technologies - Paytm Pocket and Paytm Music Soundbox that are thoughtfully designed to improve the way merchants in India accept payments. Pocket Soundbox is a device that can be carried in your pocket, giving instant notifications for financial payments, plus features like 5 days of battery, 4G service and a torch. The Music Soundbox notifies merchants about payments and also allows them to use Bluetooth to play music during their transactions.

To get more insights on this market click here to Request a Free Sample Report

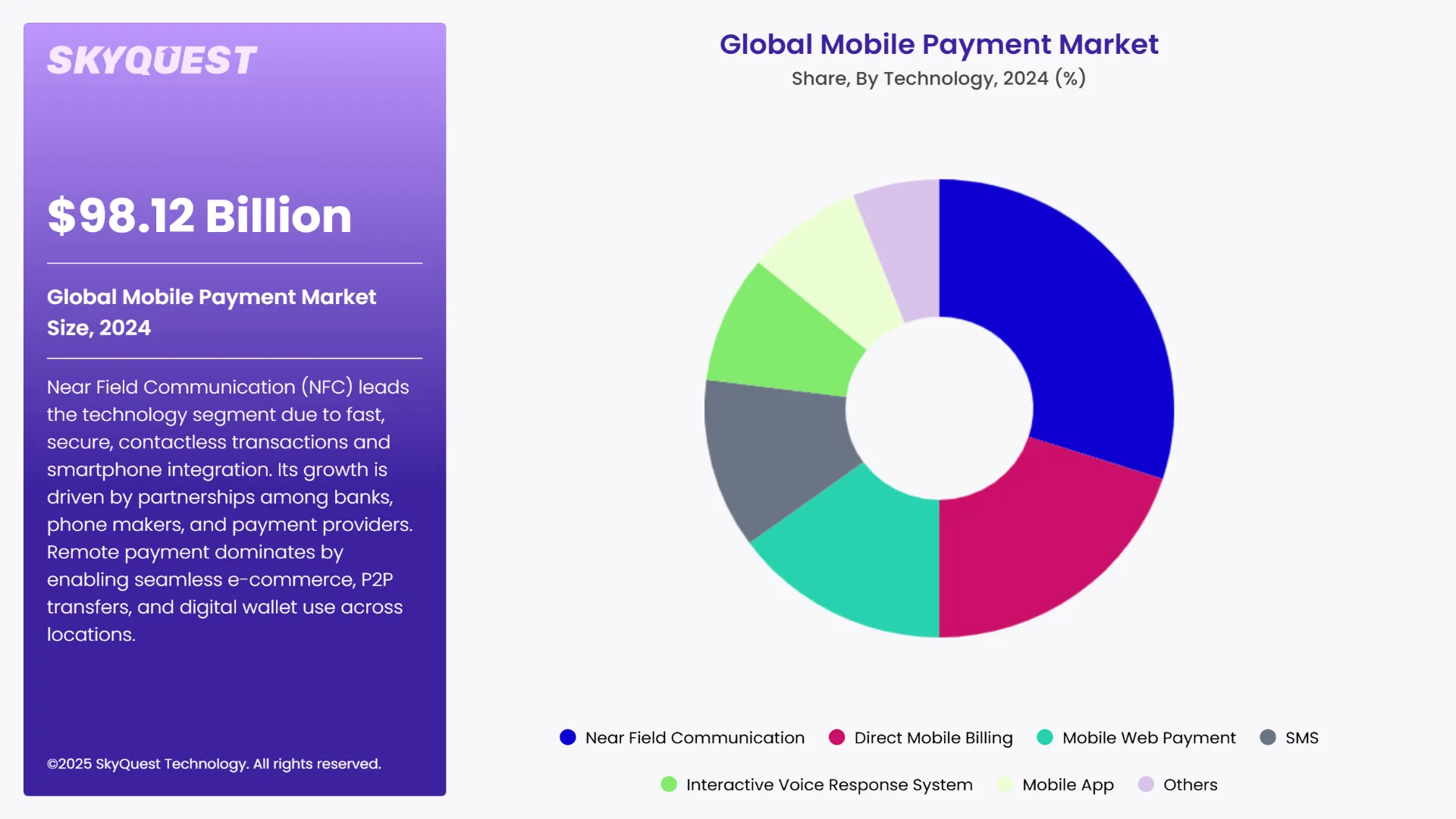

The global mobile payment market is segmented by Technology, by Payment Type, by Location, by End Use and by Region. Based on Technology, the market is segmented into Near Field Communication, Direct Mobile Billing, Mobile Web Payment, SMS, Interactive Voice Response System, Mobile App, Others. Based on Payment Type, the market is segmented into B2B, B2C, B2G, Others. Based on Location, the market is segmented into Remote Payment, Proximity Payment. Based on End User, the market is segmented into BFSI, Healthcare, IT & Telecom, Media & Entertainment, Retail & E-commerce, Transportation, Others. Based on region, the mobile payment market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & and Africa.

Near Field Communication (NFC) dominates the technology segment due to its seamless, contactless transaction capability, offering high-speed connectivity and user convenience. Its integration into most modern smartphones and widespread adoption at point-of-sale (POS) terminals has strengthened its market hold. Additionally, increased security features like tokenization and biometric authentication have enhanced user trust, making NFC the preferred method for both retailers and consumers across developed and developing markets.

A key factor driving the growth of Near Field Communication (NFC) in the global mobile payment market is the increasing collaboration between financial institutions, smartphone manufacturers, and payment service providers to create unified, interoperable payment ecosystems. These partnerships enable broader merchant acceptance, simplified onboarding for users, and seamless integration with banking and digital wallet apps. Additionally, the global push for cashless economies and government support for digital payment infrastructures are encouraging NFC adoption, particularly in urban centers. The minimal infrastructure requirement and low transaction time further enhance its appeal in fast-paced retail environments and transit systems.

Remote Payment leads this segment as it supports transactions without physical presence, essential for e-commerce and subscription-based services. It has gained traction with the rise of digital platforms, online banking, and peer-to-peer (P2P) transfer apps. Additionally, increased internet access and mobile banking usage, especially in rural and semi-urban regions, have bolstered its dominance, making it essential for cross-border and convenience-driven payments.

A pivotal factor fueling the growth of remote payment in the global mobile payment market demand is the widespread integration of digital wallets and mobile-first payment platforms into everyday consumer experiences. From food delivery apps to online education portals, remote payment systems are embedded within digital ecosystems that prioritize speed and ease of use. As consumers increasingly engage in digital interactions across multiple touchpoints, the convenience of initiating payments without location constraints has become indispensable. This behavioral shift, supported by app-driven financial services and automated billing features, positions remote payments as a core enabler of modern, frictionless commerce.

To get detailed segments analysis, Request a Free Sample Report

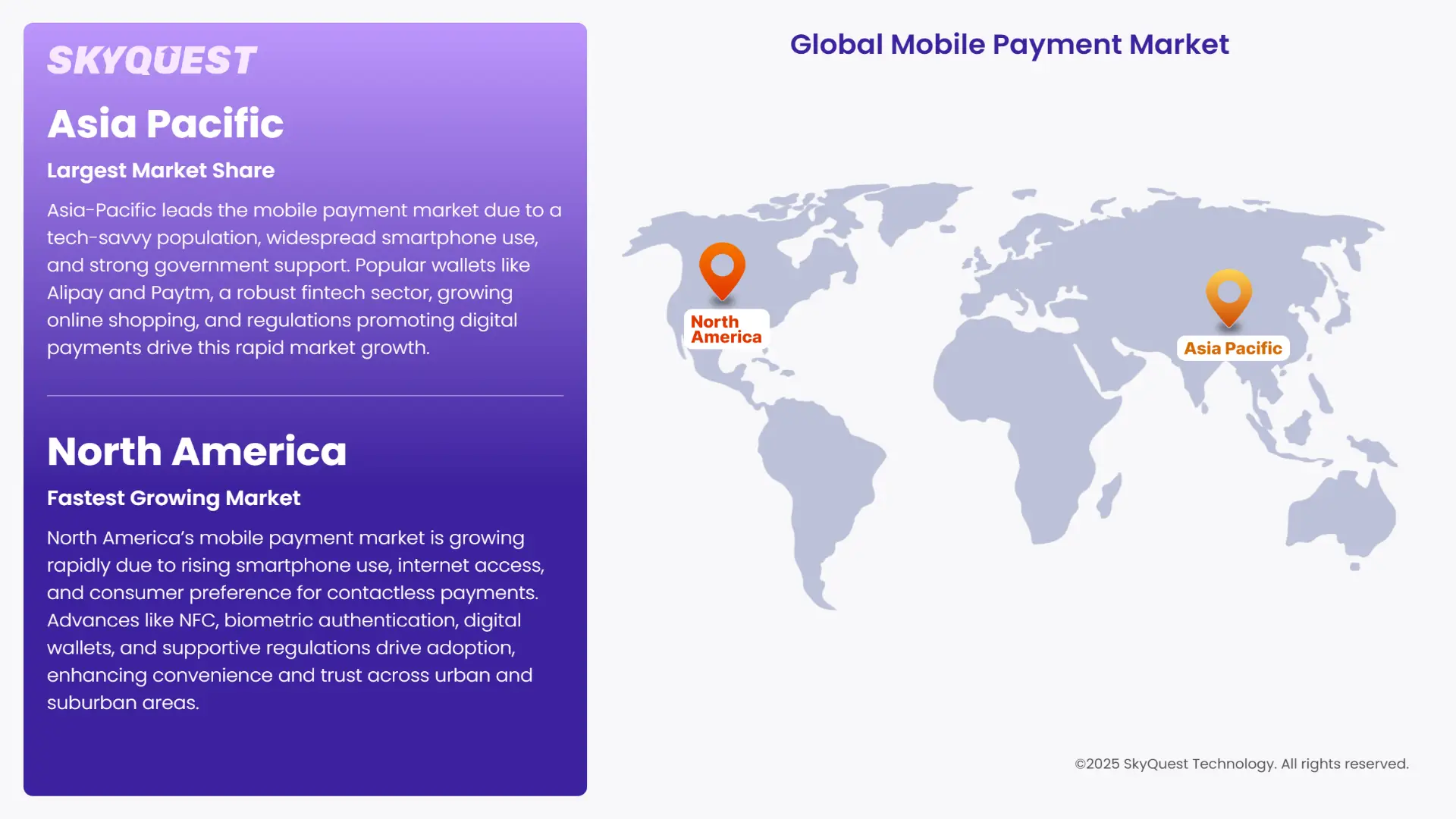

The Asia-Pacific dominates in mobile payment market share because its population is technology-friendly, many have smartphones and the government supports this field. Many people in China, India and South Korea are now using mobile wallets more, encouraged by brands such as Alipay, WeChat Pay and Paytm. The trend toward mobile-first transactions has been quickened by the strong fintech industry, plus rising internet shopping and little use of traditional banks. Asian-Pacific’s leadership in the mobile payment market is also supported by stricter regulations encouraging less cash and the investment in new digital systems.

China Mobile Payment Market

Mobile payment transactions in China are expanding swiftly, mainly because of the latest mobile payment guidelines added by the People’s Bank of China (PBOC) in November 2021. These latest rules define how to use and group payment collection barcodes to prevent illegal gambling and ensure safe transactions. By adopting these guidelines, users and companies gain trust in the system encourage broader participation. Furthermore, the guidelines make it possible for China to release its digital currency which will further support digital payments in the financial system. These two things, smartphone use and strong digital payment services, are supporting the steady China’s mobile payment market growth.

India Mobile Payment Market

India’s mobile payment market demand is expanding fast because of efforts by the government, new technology and shifts in people’s habits. In order to push for more digital payments, the Indian government introduced an incentive scheme worth INR 3,500 crores in 2024. Because there are many smartphones and cheaper internet access, mobile payments have become easier to use in rural communities. Many people now like to use cashless methods because they find them to be easy and safe. Moreover, the rising number of mobile payments is making traditional banking available to people who did not previously have access, bringing India to the forefront of digital payment usage globally.

The North America mobile payment market demand is rapidly expanding due to increased smartphone penetration and widespread internet access. Consumers prefer the convenience and speed of contactless payments, especially post-pandemic. Key drivers include technological advancements such as NFC and biometric authentication, the rise of digital wallets like Apple Pay and Google Pay, and growing adoption among retailers for seamless checkout experiences. Additionally, strong financial infrastructure and supportive regulations encourage innovation and trust. These factors collectively fuel the growing acceptance and usage of mobile payments across both urban and suburban populations in the region.

United States Mobile Payment Market

The United States mobile payment market share is growing rapidly due to several factors. Increased smartphone ownership makes mobile payment apps widely accessible. Consumers prefer the convenience and speed of contactless payments, especially after the COVID-19 pandemic boosted demand for safer, touch-free transactions. Enhanced security features like biometrics and tokenization build trust. Widespread merchant acceptance and integration with loyalty programs encourage usage. Additionally, younger generations, who are more tech-savvy, drive adoption, while mobile wallets improve financial inclusion for underbanked populations. These combined trends contribute to the steady growth of mobile payments across the country.

Canada Mobile Payment Market

Canada's mobile payment market demand is experiencing rapid growth due to several key factors. The widespread adoption of smartphones and high-speed internet has made digital payments more accessible and convenient for Canadians. The COVID-19 pandemic accelerated the shift towards contactless payments, with 42% of Canadians believing the epidemic has permanently affected their preference for digital and contactless payments. Technological advancements, such as Near Field Communication (NFC) and biometric authentication, have enhanced the security and user experience of mobile payments. Additionally, supportive regulatory frameworks and the integration of mobile payment solutions in various sectors, including retail and e-commerce, have further fueled market expansion.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

Rising Smartphone Penetration and Internet Accessibility

Growing Consumer Preference for Contactless and Convenient Payments

Security and Privacy Concerns Restraints the Market Growth

Limited Infrastructure and Digital Literacy in Emerging Markets

Request Free Customization of this report to help us to meet your business objectives.

The mobile payment market is highly competitive, with major players offering diverse features. PayPal leads with its global reach and strong online presence, favored for secure peer-to-peer and merchant payments. Apple Pay excels in seamless integration within the Apple ecosystem, offering robust security via Face ID and Touch ID. Google Pay provides versatility across Android devices, focusing on convenience and broad merchant acceptance. Samsung Pay stands out with its MST technology, allowing compatibility with traditional card readers, enhancing usability. Alipay, dominant in Asia, emphasizes a vast user base and extensive lifestyle services, aiming for global expansion. Each player leverages unique strengths to capture market share.

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected by means of Primary Exploratory Research backed by robust Secondary Desk research.

As per SkyQuest analysis, the expanding m-commerce business and the increased global smartphone penetration can be linked to market growth. Increased access to the internet for purchasing products online is likely to drive market growth during the forecast period. Businesses all around the world are making payment methods mobile-friendly, resulting in market development potential. Mobile payment solutions are increasingly targeting emerging markets where traditional banking infrastructure may be limited. These solutions provide financial inclusion by allowing individuals to access digital payment services, even without a traditional bank account.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 98.12 Billion |

| Market size value in 2033 | USD 1582.5 Billion |

| Growth Rate | 36.2% |

| Base year | 2024 |

| Forecast period | 2026–2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered | |

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Mobile Payment Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Mobile Payment Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Mobile Payment Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Mobile Payment Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

Global Mobile Payment Market size was valued at USD 98.12 Billion in 2024 and is poised to grow from USD 133.64 Billion in 2025 to USD 1582.5 Billion by 2033, growing at a CAGR of 36.2% during the forecast period (2026–2033).

PayPal, Apple Pay, Google Pay, Samsung Pay, Alipay, WeChat Pay, Amazon Pay, Paytm, Square, Inc., Visa Inc., Mastercard, Stripe, Zelle, Venmo, Huawei Pay, Xiaomi Pay, M-Pesa, KakaoPay, LG Pay, American Express

The key driver of the mobile payment market is the rapid adoption of smartphones and digital technologies, which facilitates convenient, fast, and secure transactions, supported by growing e-commerce, cashless payment initiatives, and consumer preference for contactless payments.

A key market trend in the mobile payment market is the integration of advanced technologies such as digital wallets, QR codes, and biometric authentication, enabling seamless, secure, and personalized payment experiences for consumers and businesses.

Asia-Pacific accounted for the largest share in the mobile payment market, driven by high smartphone penetration, widespread adoption of digital wallets, strong e-commerce growth, supportive government initiatives, and the presence of major mobile payment platforms.

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients