Report ID: UCMIG40D2031

Report ID:

UCMIG40D2031 |

Region:

Global |

Published Date: Upcoming |

Pages:

165

| Tables: 55 | Figures: 60

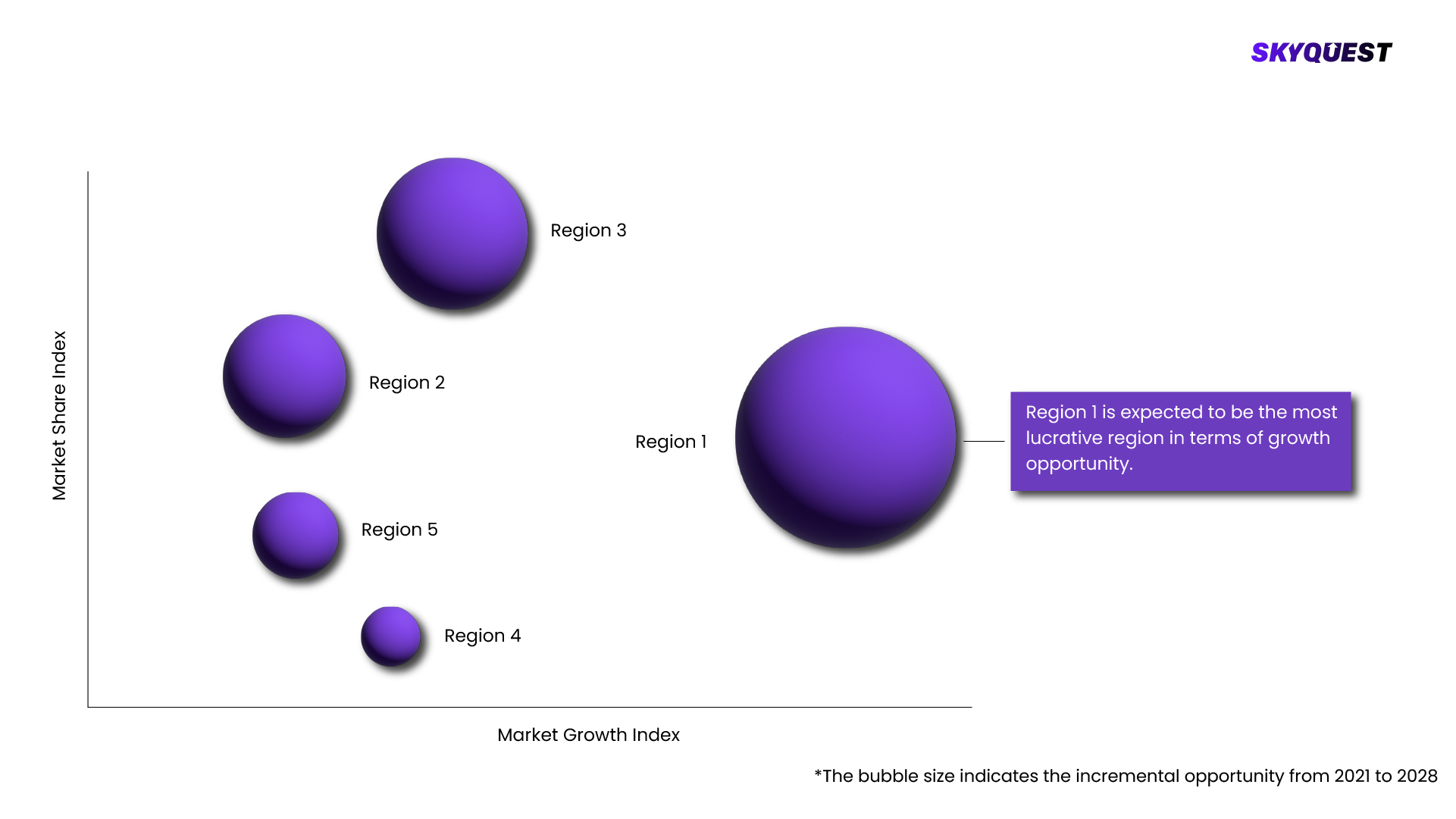

Merchant Banking Services Market is being analyzed by North America, Europe, Asia-Pacific (APAC), Latin America (LATAM), Middle East & Africa (MEA) regions. Key countries including the U.S., Canada, Germany, France, UK, Italy, Spain, China, India, Japan, Brazil, GCC Countries, and South Africa among others were analyzed considering various micro and macro trends.

Our industry expert will work with you to provide you with customized data in a short amount of time.

REQUEST FREE CUSTOMIZATIONWant to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Report ID: UCMIG40D2031