Report ID: SQMIG30G2027

Report ID: SQMIG30G2027

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG30G2027 |

Region:

Global |

Published Date: May, 2025

Pages:

198

|Tables:

186

|Figures:

74

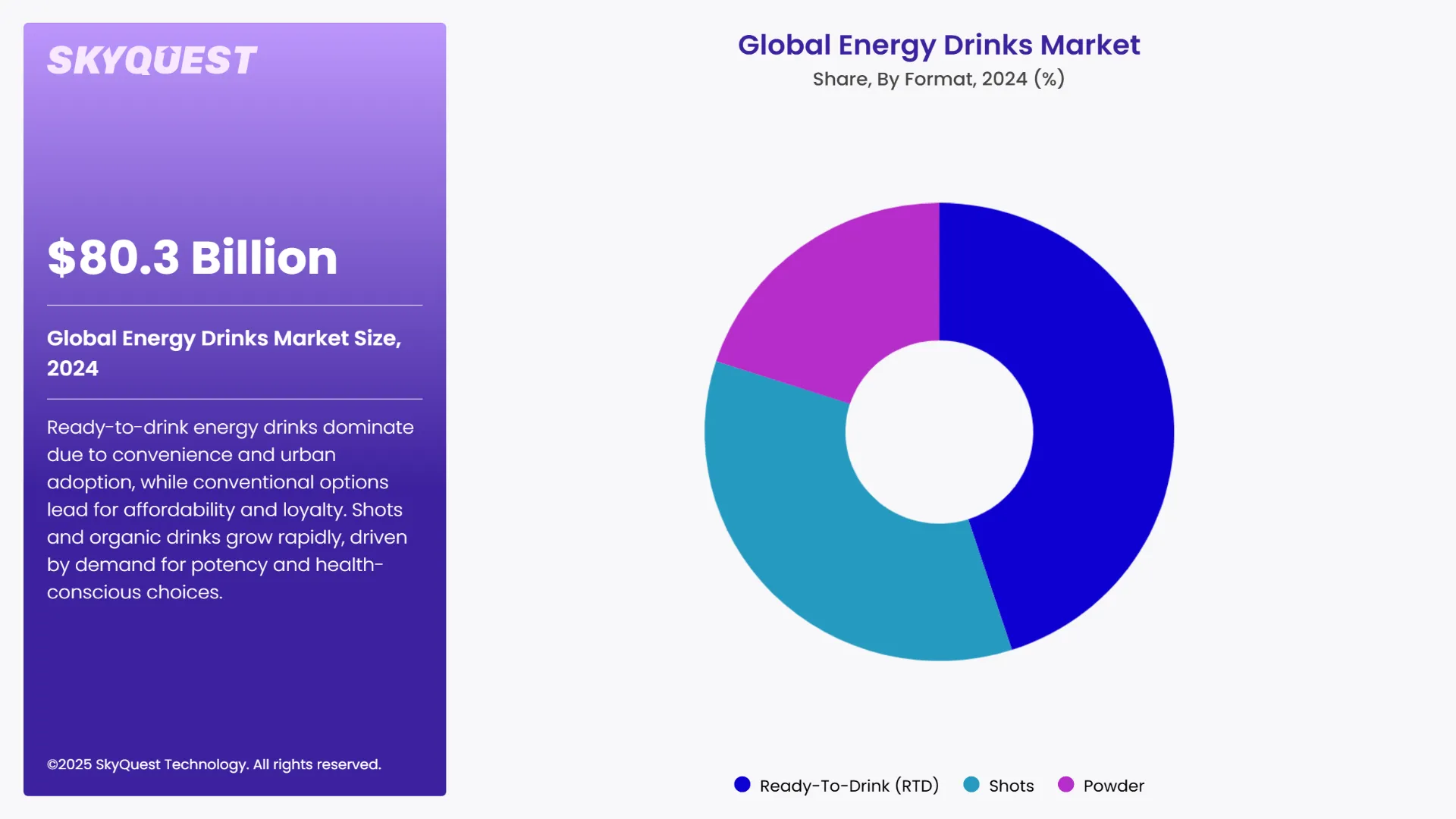

Global Energy Drinks Market size was valued at USD 80.39 Billion in 2024 and is poised to grow from USD 86.74 Billion in 2025 to USD 159.36 Billion by 2033, growing at a CAGR of 7.9% in the forecast period (2026–2033).

Growing adoption of active lifestyles, high demand for energy drinks among young adults, expansion of e-commerce and retail, surge in popularity of e-sports and gaming, and use of aggressive marketing campaigns are driving up the sales of energy drinks on a global level. Consumers are increasingly adopting active lifestyles, fueling demand for products that support physical and mental performance. Energy drinks offer quick stamina boosts and increased alertness, which is why they are popular among athletes, gym-goers, and busy professionals. Millennials and Gen Z consumers who use these energy drinks to stay energized during studies, work, gaming, and nightlife are also driving revenue.

The availability of energy drinks across various retail formats including supermarkets, convenience stores, gyms, gas stations, and online platforms is also promoting energy drinks market growth. Energy drinks are closely aligned with gaming and e-sports cultures, where long hours of screen time and the need for mental alertness drive consumption. On the contrary, health concerns regarding caffeine and sugar content, stringent regulatory policies, intense competition and energy drinks market saturation, and environmental concerns regarding packaging waste are anticipated to slow down energy drinks market penetration across the study period and beyond.

The energy drinks market is rapidly aligning with digital culture, especially through partnerships with e-sports, influencers, and streaming platforms. Brands like Red Bull and G Fuel sponsor gaming tournaments, streamers, and YouTubers to reach Gen Z and millennial audiences. Digital-first marketing strategies—including viral content, interactive social media campaigns, and limited-edition virtual collaborations—drive engagement and brand loyalty. Subscription-based e-commerce and direct-to-consumer models enhance convenience and personalization. As e-sports and gaming viewership soar globally, energy drinks positioned as cognitive enhancers and lifestyle products gain traction. This trend is redefining traditional advertising, emphasizing immersive experiences and culturally relevant digital touchpoints.

To get more insights on this market click here to Request a Free Sample Report

The global energy drinks market is segmented by product type, format, flavor, category, nature, distribution channel, and region. Based on product type, the market is segmented into caffeinated beverages and de-caffeinated beverages. Based on format, the market is segmented into shots, powder, and ready-to-drink (RTD). Based on flavor, the market is segmented into unflavored and flavored ones. Based on category, the market is segmented into natural energy drinks, sports drinks, non-alcoholic beverages, functional beverages, and non-carbonated packaged drinks. Based on nature, the market is segmented into organic and conventional sectors. Based on distribution channel, the market is segmented into B2B, B2C (store-based retailing, hypermarkets /supermarkets, convenience stores, mom and pop stores, discount stores, specialty stores, independent small groceries, online retail). Based on region, the market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa.

The ready-to-drink (RTD) segment is slated to spearhead the global energy drinks market revenue generation potential in the future. High convenience and widespread availability of RTD energy drinks is helping this segment maintain its dominant share. Adoption of active lifestyles and rising consumers in urban settings are also helping this segment generate more business.

Meanwhile, the demand for shots is slated to rise at a robust pace across the study period. Rising demand for compact, potent, and functional beverages from consumers seeking immediate energy boosts is helping this segment generate new business scope in the future.

The conventional segment is forecasted to hold a major chunk of the global energy drinks market share going forward. High consumer familiarity, affordability, and strong brand loyalty are helping this segment bring in the most business for companies. Consumers often choose conventional options for reliable performance and flavor variety, which cements the dominance of this segment on a global level.

On the other hand, the demand for organic offerings is slated to rise at a notable pace as per this energy drinks industry analysis. Increase in health consciousness and emphasis on wellness among people are driving the adoption of energy drinks made with clean-label and natural ingredients.

To get detailed segments analysis, Request a Free Sample Report

Strong presence of global energy drink brands such as Monster and Red Bull backed by a deeply entrenched consumption culture help this region lead global energy drink sales. High disposable income, busy lifestyles, and demand for on-the-go functional beverages are also ensuring a sustained demand outlook for energy drink companies operating in North America. Digital-first marketing, influencer sponsorships, and extreme sports collaborations are highly popular strategies among energy drink brands looking to expand their visibility in this region.

Energy Drinks Market in United States

Strong brand presence, aggressive marketing, and high demand for performance beverages make this country a top energy drink market suppliers on a global level. Fitness culture, digital marketing, and widespread retail access are further contributing to rising sales of energy drinks in the United States. Functional innovation, such as zero-sugar and brain-enhancing formulas is focused on targeting a health-conscious consumer base. Regulatory scrutiny over caffeine and sugar content persists, but reformulated products and transparent labeling help maintain consistent consumption of energy drinks in the country.

Energy Drinks Market in Canada

Presence of a health-aware and tech-savvy population allows Canada to emerge as a rewarding country for energy drink suppliers. Regulatory frameworks require clear labeling and limit marketing to minors, shaping product formulation. Health-conscious Canadians are open to clean-label and plant-based offerings, making innovation critical. With increasing lifestyle stress and growing sports culture, Canada's market is evolving into a sophisticated, regulation-aligned one in the North American region.

The Asia Pacific region emerges as the fastest growing energy drinks market on the back of growing work and academic pressures, changing lifestyles, and demand for performance-enhancing beverages. Urbanization and expansion of youth populations are also helping generate new opportunities for energy drink suppliers operating in the region. Mobile commerce, e-sports popularity, and convenience store proliferation are slated to improve accessibility of energy drinks for consumers in this region. Cultural shifts toward Westernized consumption patterns also create new business scope for market players.

Energy Drinks Market in Japan

Japan has a compact yet impactful market for energy drinks. Consumer preference for functional, health-focused beverages is helping generate new opportunities for energy drinks market players. Unlike Western markets, Japan emphasizes subtle energy enhancement over intense stimulation. Local brands such as Oronamin C and Lipovitan are known for offering vitamin-rich, medicinal-style energy boosters as compared to conventional energy drinks. With an aging population and demanding work culture, Japan’s market thrives on traditional trust, health efficacy, and innovation rather than flashy branding or high caffeine content.

Energy Drinks Market in South Korea

The youth population of South Korea is expected to primarily bolster the demand for energy drinks over the coming years. Students, gamers, and professionals in the country prefer energy drinks from brands such as Monster and Bacchus. Digital culture and social media trends have a major impact on the consumption patterns of energy drinks in the country. Healthier variants and nootropic drinks are slated to be gaining popularity among Koreans through 2032. With a tech-savvy, image-conscious population, South Korea remains a fast-evolving market with high innovation potential.

Busy work cultures, health-focused product innovation, and increased interest in sports and fitness are helping boost the demand for energy drinks in Europe. Regulatory frameworks and the presence of a health-conscious consumer base encourage demand for low-sugar and natural ingredient formulations. While traditional caffeine drinks still dominate, functional and clean-label energy drinks are gaining massive popularity in the region.

Energy Drinks Market in Germany

The energy drinks industry of Germany can be characterized by emphasis on health, transparency, and eco-consciousness. Functional drinks with natural caffeine sources like guarana, low sugar content, and clear labeling are gaining popularity in the country. Retail chains, fitness outlets, and online stores account for majority of distribution of energy drinks in Germany. Innovation in energy shots, natural blends, and hybrid hydration drinks appealing to a broad consumer base are expected to ensure sustained demand in the long run.

Energy Drinks Market in United Kingdom

Strong youth engagement, fitness culture, and digital influence are helping govern the consumption pattern of energy drinks in the United Kingdom. Red Bull, Monster, and Relentless are still dominating energy drink sales, but challenges are emerging from new companies offering sugar-free, natural, and nootropic formulations. Gaming and e-sports culture in the country is also influencing the marketing of energy drinks in the United Kingdom.

Energy Drinks Market in France

Conservative consumption habits and strong health regulations are gradually shaping the demand for energy drinks in France. Advertising restrictions and strict sugar and caffeine regulations are hampering the full growth potential of leading brands such as Monster and Red Bull. Prioritization of quality, health-conscious ingredients, and minimal additives is also playing a crucial role in governing energy drinks consumption in the country. Cultural preferences for natural and moderately functional beverages drive innovation and steady market development.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

Product Diversification and Innovation

Use of Aggressive Marketing Strategies and Celebrity Endorsements

Health Concerns Related to Caffeine and Sugar Content

‘Environmental Concerns and Packaging Waste

Request Free Customization of this report to help us to meet your business objectives.

Energy drink providers should focus on incorporation of natural ingredients to appease conscious consumers. Adding functional ingredients is also emerging as a popular trend among energy drink manufacturers. Countries with growing e-sports and active sports culture are offering more opportunities for companies as per this energy drinks market analysis.

Startups should focus on offering unique formulations that cater to diverse preferences of consumers. Here are a few startups that could change the trajectory of energy drinks industry development in the long run.

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected by means of Primary Exploratory Research backed by robust Secondary Desk research.

As per SkyQuest analysis, growing participation in active lifestyles and use of aggressive marketing strategies are slated to primarily drive the demand for energy drinks going forward. However, environmental concerns regarding packaging waste and high caffeine and sugar content concerns are expected to slow down the adoption of energy drinks in the future. North America is forecasted to emerge as the leading market for energy drink providers owing to the presence of brands such as Monster and Red Bull coupled with high consumer spending potential. Development of functional energy drinks and use of natural and clean-label ingredients are key trends driving the energy drink sector in the long run.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 80.39 Billion |

| Market size value in 2033 | USD 159.36 Billion |

| Growth Rate | 7.9% |

| Base year | 2024 |

| Forecast period | 2026-2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Energy Drinks Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Energy Drinks Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Energy Drinks Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Energy Drinks Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

Global Energy Drinks Market size was valued at USD 80.39 Billion in 2024 and is poised to grow from USD 86.74 Billion in 2025 to USD 159.36 Billion by 2033, growing at a CAGR of 7.9% in the forecast period (2026–2033).

Energy drink providers should focus on incorporation of natural ingredients to appease conscious consumers. Adding functional ingredients is also emerging as a popular trend among energy drink manufacturers. Countries with growing e-sports and active sports culture are offering more opportunities for companies as per this energy drinks market analysis. 'Monster Beverage Corp.', 'Kraft Foods Inc.', 'The Gatorade Company, Inc.', 'PepsiCo Inc.', 'Coca-Cola Co.', 'Red Bull GmbH', 'Nestlé S.A.', 'Carlsberg A/S', 'NEALKO ORAVAN, spol s.r.o', 'Kabisa B.V.', 'Suntory Holdings Ltd.', 'Asia Brewery Incorporated', 'Otsuka Pharmaceutical Co.', 'Dali foods group', 'LT Group Inc.'

Continuous innovation in flavors, ingredients, and formats is expected to create new opportunities for energy drink providers going forward. Energy drinks brands are introducing clean-label, plant-based, zero-calorie, and organic variants to appeal to evolving consumer preferences. Synthetic additives are being replaced with natural ingredients such as green tea extract, ginseng, guarana, and B-vitamins to attract health-conscious consumers. Cans with resealable lids, powdered mixes, and energy shots offer convenient alternatives. Innovation extends to branding and packaging with vibrant designs and celebrity endorsements. This product innovation and diversification is slated to benefit the energy drinks market outlook through 2032.

Energy drink companies are focusing on incorporation of nootropics such as L-theanine, ginkgo biloba, and B-vitamins to enhance mental performance, focus, and cognitive health. These drinks appeal to professionals, students, and gamers seeking sustained energy without jitteriness or crashes. This energy drinks industry trend reflects a broader consumer desire for holistic wellness, combining mental clarity, physical stamina, and mood enhancement.

Strong presence of global energy drink brands such as Monster and Red Bull backed by a deeply entrenched consumption culture help this region lead global energy drink sales. High disposable income, busy lifestyles, and demand for on-the-go functional beverages are also ensuring a sustained demand outlook for energy drink companies operating in North America. Digital-first marketing, influencer sponsorships, and extreme sports collaborations are highly popular strategies among energy drink brands looking to expand their visibility in this region.

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients