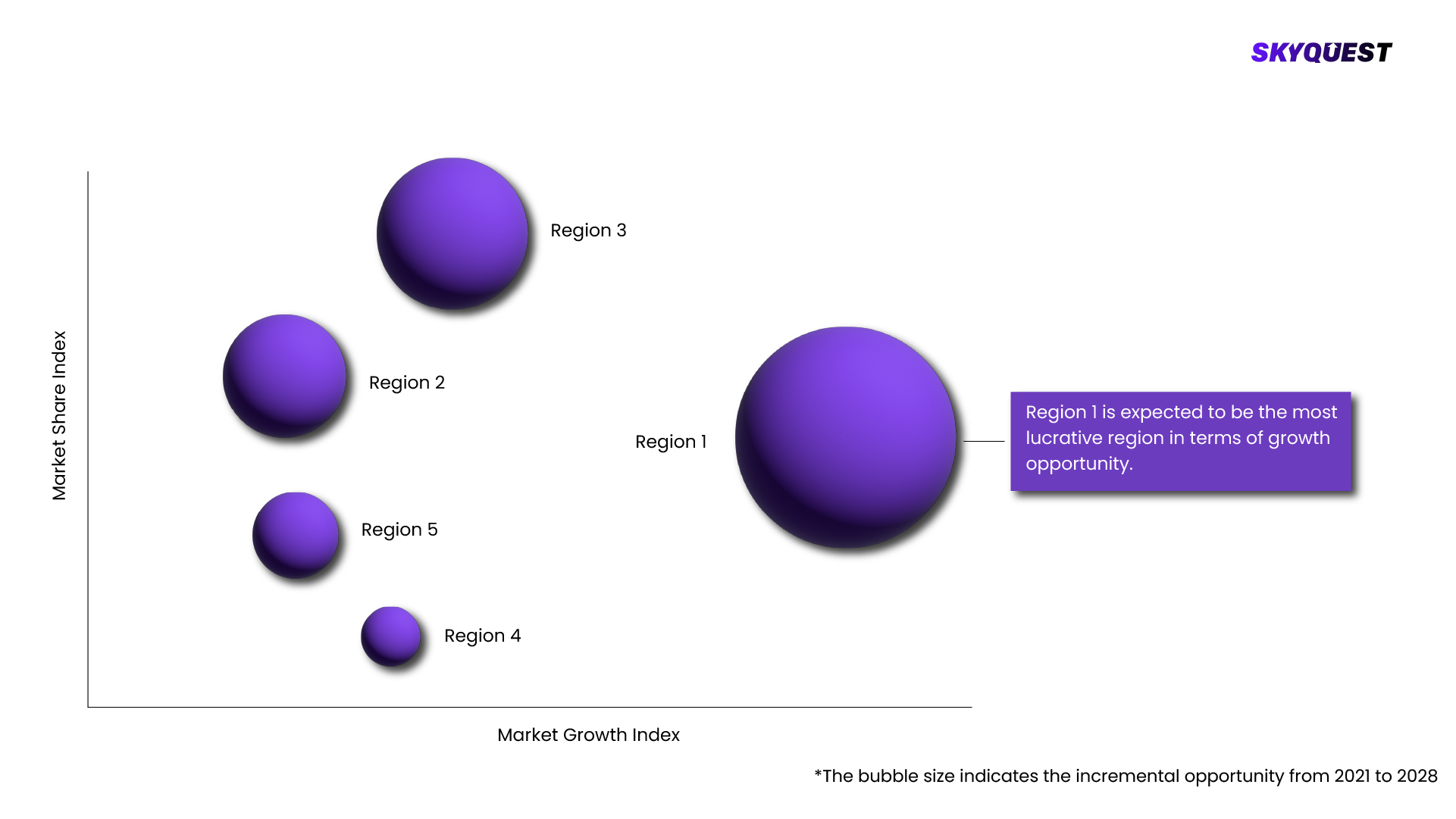

The key players operating in the Thermally Conductive Filler Dispersants Market are thermally conductive filler dispersants market size is projected to reach USD 0.4 billion by 2028 from USD 0.3 billion in 2023, at a CAGR of 10.2% during the forecast period. The growth of the thermally conductive filler dispersants market can be attributed to the increasing demand for high-performance and lightweight products. Thermally conductive filler dispersants play a crucial role in achieving the desired thermal properties in these high-performance products. Additionally, ongoing research and development activities aimed at improving the thermal conductivity of polymer composites drive the demand for thermally conductive filler dispersants. , Thermally Conductive Filler Dispersants Market Dynamics , Driver: Increasing demand for consumer electronics products , Consumer electronics, such as smartphones, tablets, laptops, and gaming consoles, generate significant amounts of heat during operation. Efficient heat dissipation is crucial to ensure the optimal performance and longevity of these devices. Thermally conductive filler dispersants play a vital role in enhancing the thermal conductivity of polymer composites used in electronic components and heat sinks. Effective heat dissipation through the use of thermally conductive filler dispersants helps to prevent overheating, which can lead to performance degradation and reduced reliability of electronic components. , Restraint: Higher cost consideration , Cost is a significant factor that impacts on the thermally conductive filler dispersants market. The cost of thermally conductive filler dispersants can be a restraint for some applications. Certain high-performance fillers, such as silver or graphene, can be expensive, which can increase the overall cost of the thermally conductive polymer composites. The cost of high-performance fillers like silver or graphene is influenced by factors such as production methods, availability, and demand. These fillers often require specialized manufacturing processes and have limited availability, which can drive up their cost. Additionally, the demand for these high-performance fillers in various industries, including electronics and automotive, can further contribute to their higher price. , Opportunity: Increasing demand for fuel-efficient and high-end home appliance products , The demand for high-performance and lightweight products is driving the growth of the thermally conductive polymer composites market. Thermally conductive filler dispersants play a crucial role in achieving the desired thermal properties in these high-performance products. Polymer-based thermal interface materials consisting of polymer and thermally conductive fillers occupy the most commercial markets because of their thermal conductivity and mechanical properties. Thermally conductive filler dispersants play a crucial role in achieving optimal thermal conductivity in these materials. In addition, the demand for fuel-efficient products is driving the development of high-thermal-conductivity fillers such as aluminum nitride for use in polymer/ceramic composites. These fillers can be used in conjunction with thermally conductive filler dispersants to achieve optimal thermal conductivity. , Challenges: Compatibility with different polymers , Thermally conductive filler dispersants need to be compatible with a wide range of polymer matrices to ensure effective dispersion and interfacial interaction. Achieving compatibility with different polymers can be a challenge due to differences in chemical composition and processing conditions. The interfacial compatibility between fillers and the polymer matrix is crucial for effective dispersion and interfacial interaction, which ultimately affects the heat transfer efficiency of the composites. Surface modification techniques can be employed to improve the interface compatibility, but their effectiveness in improving overall thermal conductivity is limited. The thermal conductivity of polymer composites with dispersed fillers is influenced by several factors, including filler type, size, and aspect ratios. These factors need to be considered when selecting the appropriate thermally conductive filler dispersants for different polymer matrices. In addition, the quality of dispersion plays a significant role in achieving compatibility between fillers and polymers. For a single polymer, the dispersion quality may influence the outcome with the same filler. , By dispersant type, non-silicone is the largest in thermally conductive filler dispersants market, in 2022. , The rising demand for non-silicone thermally conductive filler dispersants is driven by their compatibility with different polymers, form-in-place gap fillers, enhanced thermal conductivity, high thermal conductivity paste, and improved mechanical properties. These advantages make non-silicone thermally conductive filler dispersants a preferred choice for various industries, including electronics, automotive, healthcare, aerospace, and telecommunication. , By filler material, carbon-based are the second largest in thermally conductive filler dispersants market, in 2022. , Carbon-based fillers, such as carbon black, carbon fibers, synthetic graphite particles, and carbon nanotubes, exhibit high thermal conductivity. This makes them attractive for enhancing the thermal conductivity of polymer composites. Carbon-based fillers, particularly carbon fibers, offer a high strength-to-weight ratio, making them suitable for applications where weight reduction is important. In addition, surface modification techniques can be employed to enhance the interfacial compatibility between carbon-based fillers and the polymer matrix, improving dispersion and interfacial interaction. All these factors contribute to the growth of carbon-based filler materials in the thermally conductive filler dispersants market. , By application, heat dissipation accounts for the largest share in the thermally conductive filler dispersants market, in 2022. , In general, higher filler loadings are needed to achieve higher thermal conductivity in pastes used for heat transfer applications. This highlights the importance of thermally conductive filler dispersants in achieving efficient heat dissipation. High thermal conductivity pastes, which serve as heat transfer means for cooling electronic components like VLSI chips, rely on thermally conductive filler dispersants to enhance their thermal conductivity. Adding high thermal conductivity fillers into polymer matrices is an effective way to improve the heat transfer performance of polymer materials. Thermally conductive filler dispersants facilitate the dispersion and interaction of these fillers, contributing to enhanced heat dissipation. , By end-use industry, electronics is the largest in thermally conductive filler dispersants market, in 2022. , Electronics is the largest end-use segment. TIMs are commonly used for transferring thermal conductivity from the CPU or GPU to heat sink coolers. Electronic products such as CPUs, chipsets, graphics cards, and hard disk drives, are susceptible to failure in case of overheating. Thermally conductive filler dispersants for TIMs are used in computers to remove the excess heat to maintain the components operating temperature limits. They are used in computers to optimize performance and reliability for smooth functioning. They are used for improving the heat flow in computers by filling voids or irregularities between the heat sink and SSE base plate mounting surfaces. The increased demand for electronic products is driving the market for thermally conductive filler dispersants. , Asia Pacific is projected to be fastest growing amongst other regions in the thermally conductive filler dispersants market, in terms of value. , Based on the region, the thermally conductive filler dispersants market is segmented into Asia Pacific, North America, Europe, South America, and the Middle East & Africa. Currently, Asia Pacific is the fastest growing market for thermally conductive filler dispersants. The region has a large and growing population with increasing disposable income, a rising awareness of health and wellness, and the expanding middle-class population and changing lifestyles have led to a surge in demand for electronic products, and electric vehicles. Additionally, advancements in technologies and increased R&D activities in the thermally conductive filler dispersants market have further fueled the growth of the market in Asia Pacific. , Recent Developments , In December 2019, the specialty chemicals group ALTANA acquired Schmid Rhyner AG, a Swiss overprint varnish specialist to generate value-creating growth through targeted acquisitions. The acquisition helped ALTANA ALTANA to expand its product portfolio and offer new solutions to its customers in various industries. , In October 2022, BYK launched BYK-MAX CT 4275, is a specially developed additives that can be used in a wide variety of polyamides and thermoplastic. BYK-MAX CT 4275 is used to enhance the performance of thermal interface materials by improving the dispersion and incorporation of the additive into the thermoplastic matrix, resulting in improved thermal conductivity and mechanical properties. , In April 2022, Shin-Etsu Co. Ltd. developed thermal interface silicone rubber sheet series (TC-BGI Series) for use in components of electric vehicles as the technology for high voltage devices advances. It is a hard, thermal-interface silicone rubber sheet that combines good levels of voltage resistance and heat dissipation. , In January 2021, Momentive Performance Materials acquired KCC Corporation's Silicones business in Korea and the UK, as well as its sales operations in China. KCC Corporation offers silicone and silicone-based products. The acquisition strengthens Momentive's capabilities in advanced silicones and enhances its ability to serve customers in the Asia-Pacific region. , In February 2023, Evonik Industries invested USD 1 miilion into fumed aluminum oxide production plant expansion for battery applications in Yokkaichi, Japan. The investment helped Evonik Industries to meet the growing demand for fumed aluminum oxide in the battery industry and strengthen its position in the market. It also expanded Evonik's presence in Asia, where the demand for lithium-ion batteries was high. , KEY MARKET SEGMENTS , On the basis of dispersant type , Silicone-based , Non-silicone based , Others , On the basis of filler material , Ceramic , Metal , Carbon-based , Others , On the basis of application , Thermal Insulation Glue , Potting Glue , Plastic , Rubber , Heat Dissipation Ceramic , Coatings , Others , On the basis of the end-use industry , Electronics , Automotive , Energy , Building & Construction , Industrial , Aerospace , Others , On the basis of region , North America , Asia Pacific , Europe , South America , Middle East & Africa , Key Market Players , BYK , Shin-Etsu Chemical , Dow Chemical Company , JNC Corporation , Momentive Performance Materials , Kusumoto Chemicals , Evonik , Croda International , Lubrizol Corporation , Wacker Chemie.