Report ID: SQMIG15H2114

Report ID: SQMIG15H2114

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG15H2114 |

Region:

Global |

Published Date: June, 2025

Pages:

192

|Tables:

59

|Figures:

75

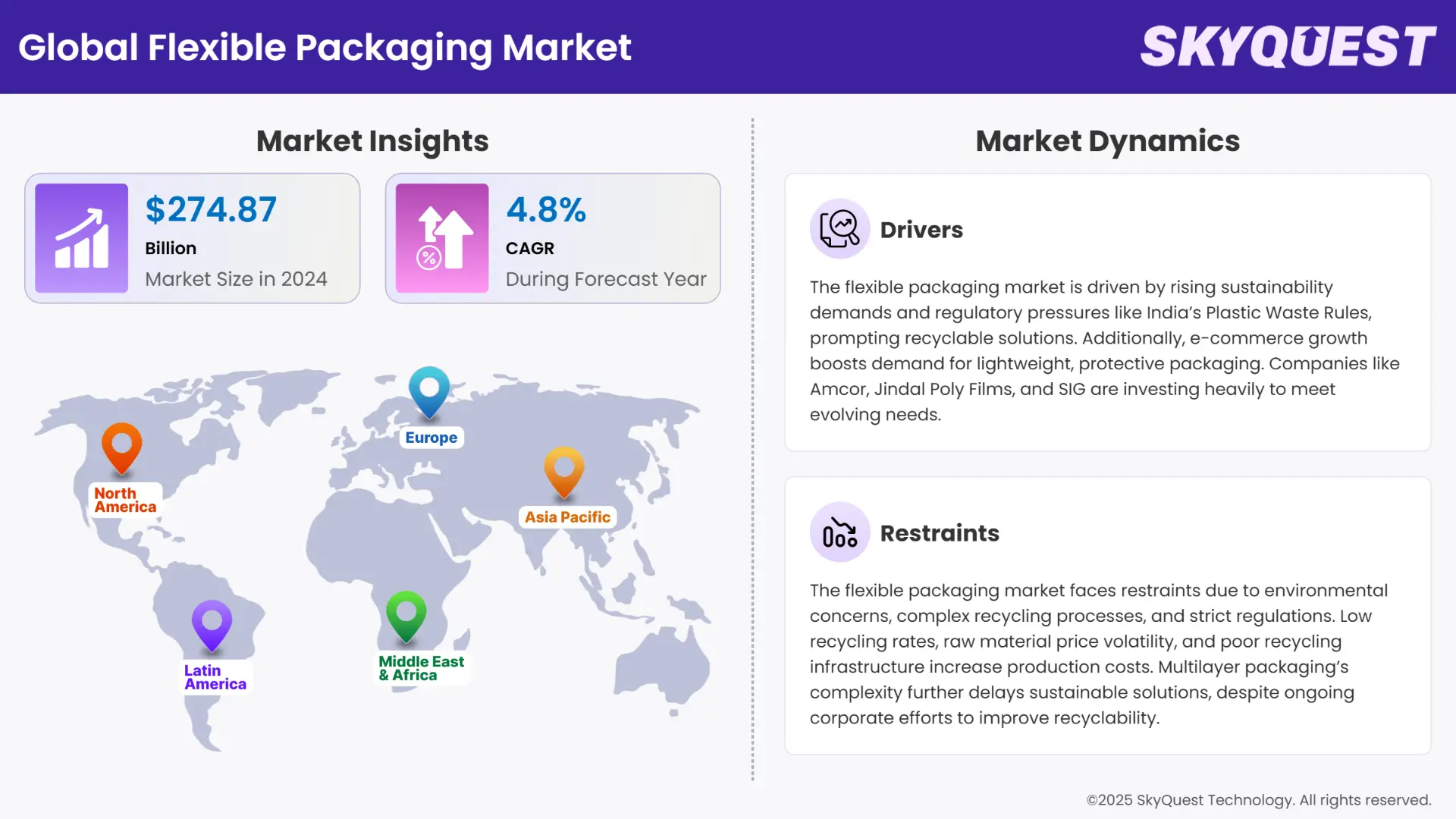

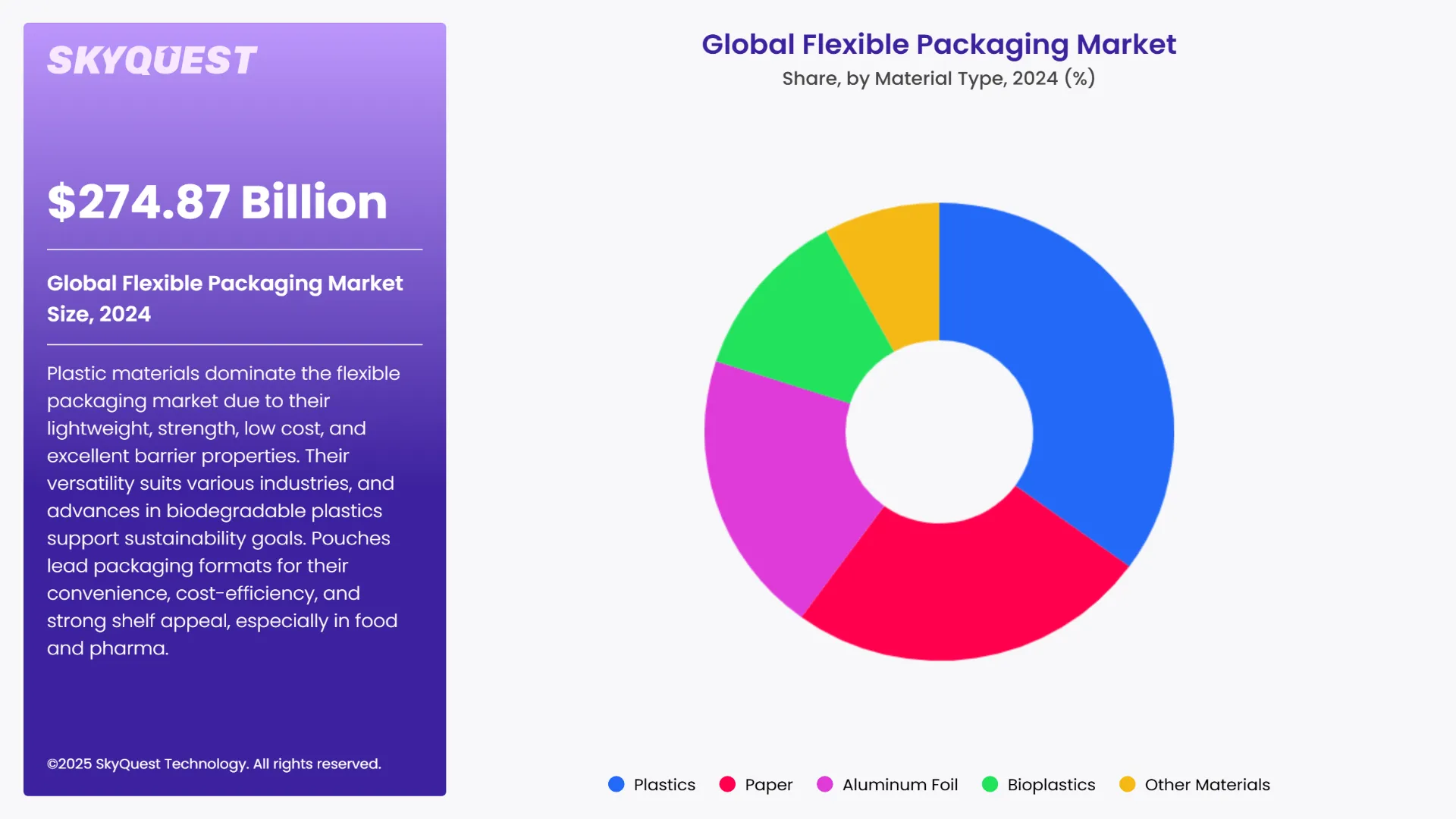

Global Flexible Packaging Market size was valued at USD 274.87 Billion in 2024 and is poised to grow from USD 288.06 Billion in 2025 to USD 419.16 Billion by 2033, growing at a CAGR of 4.8% during the forecast period (2026–2033).

The flexible packaging market is growing dramatically, due to rising demand across food, beverage, pharmaceuticals and personal care industries. Consumer demand for convenience, extended shelf life and light-weight packaging is giving flexible packaging the edge over more traditional rigid formats. Urbanization and more demanding lifestyles have created a demand for on-the-go and single-serve packaging which has led to even more demand across all packaging formats in developing economies. Manufacturers are also under pressure to develop recyclable and biodegradable materials due to sustainability trends and their commitment to reducing plastic waste.

However, the market has some constraints. In the general flexible packaging industry and the larger packaging industry as a whole have challenges associated with regulated plastic utilizes, recycling facilities and fluctuating raw materials. And then, there is attention drawn to the environmental footprint around recyclable associated to multi-layer packaging structures. However, the industry continues to search for solutions and we have made great progress in material science, mono-material submissions, and the circular economy. While there may be hopping hurdles in the shorter-term due to regulatory challenges or scarce raw materials, the view for flexible packaging looks good overall, with smart packaging and digital print serialization to drive further value for mills and customers.

How are integrated AI‑IoT systems revolutionizing real‑time monitoring of food freshness in flexible packaging?

Flexible packaging is undergoing dramatic transformations driven by a synergy of AI and IoT. Pouches and films that embed sensors continuously monitor temperature, humidity and gas levels, transmitting this data to cloud systems. In just a few milliseconds, AI models analyze this data, identify amounts of food spoilage, and provide alerts before product integrity is compromised. This dynamic monitoring and alarming provides advantages to brands—freshness is not just a claim, but rather a quantified promise, reducing recalls, and elevating their brand credibility, and ultimately trust.

A notable and entertaining example was a recent arXiv report that highlighted battery-free, stretchable, smart packaging that included passive NFC antennas and gas sensors to continuously monitor fish freshness. Once spoilage was detected, the sensors could release antioxidants into the fish to extend freshness and shelf-life by as much as 14 days. This was proof-of-concept for passive IoT with embedded AI logic. The packaging was even acting as an agent to actively preserve food. This example raises questions for research on scalability, barriers to cost, and integration with their flexible packaging processes.

How Can AI Optimize Packaging Design and Material Use Efficiently?

AI is not only for monitoring: it is getting better packaging design. Machine learning solutions scour many material combinations, many geometric shapes, and various thicknesses to arrive at an optimal trade-off between strength, durability, and waste. For example, neural networks can simulate performance with an applied stress, identifying thinner layers or different biopolymers without losing the necessary protections.

An interesting example is EcoPackAI's work with beverage companies: AI-based redesigns reduced the amount of plastic in an optimized plastic bottle design by 18% and carbon footprints by 25%. This shows that AI can also reduce material use in flexible packaging, film laminate gauge, resin formulations, barrier layers, and still meet functional performance.

To get more insights on this market click here to Request a Free Sample Report

The global flexible packaging market is segmented by Material Type, Packaging Type, Printing Technology, End-Use Industry and region. Based on Material Type, the market is segmented into Plastics, Paper, Aluminum Foil, Bioplastics and Other Materials. Based on Packaging Type, the market is segmented into Pouches, Bags, Sachets, Rollstock, Films & Wraps and Other Packaging Types. Based on Printing Technology, the market is segmented into Flexography, Rotogravure, Digital Printing and Others. Based on End-Use Industry, the market is segmented into Food & Beverage, Pharmaceuticals, Cosmetics & Personal Care, Household Products, Industrial & Chemical, Pet Food and Others. Based on region, the global flexible packaging market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa.

Plastics currently are leading the flexible packaging sector by virtue of their light weights, high strengths, and low costs. Owing to their extreme versatility, they are appropriately complemented with most products from packaged beverages and foods to pharmaceutical and personal care products. Barrier features in oxygen and moisture resistance formats further include more enhancements in shelf stability and product protection. Due to biodegradable and reusable plastic technologies continuing to justify sector leadership in response to sustainability drives and while simultaneously maintaining plastic packaging strengths of functional excellence, plastics are continuously selected.

Paper is presently the fastest-growing material segment because of environmental concerns and regulatory pushes to sustainable solutions. Penetration is being pushed by consumers' demand for sustainable and recyclable packaging, especially through retail and food service markets. The technological developments of coating and lamination technologies assist to improve paper's barrier properties, so that it is a better alternative to plastic for some applications.

Pouches are currently the most popular packaging format due to their convenience, mobility, and cost-effectiveness. Widely applied in beverages, foods, pharmaceuticals, and home care products, pouches achieve higher product-to-package ratios to reduce materials usage and shipping cost. Innovative improvements in reclosable and spouted pouches also enhance user convenience and product preservation. Pouches are further favored by brand owners due to their printability and ability to facilitate product differentiation and marketing at shelf.

Meanwhile, Films & Wraps are booming, especially for e-commerce and packaged foods. Their ability to form to many product shapes, remain fresh, and offer tamper evidence are driving usage. Light and flexible, these formats offer shipping cost savings and sustainability enhancements when produced with recyclable or compostable materials.

To get detailed segments analysis, Request a Free Sample Report

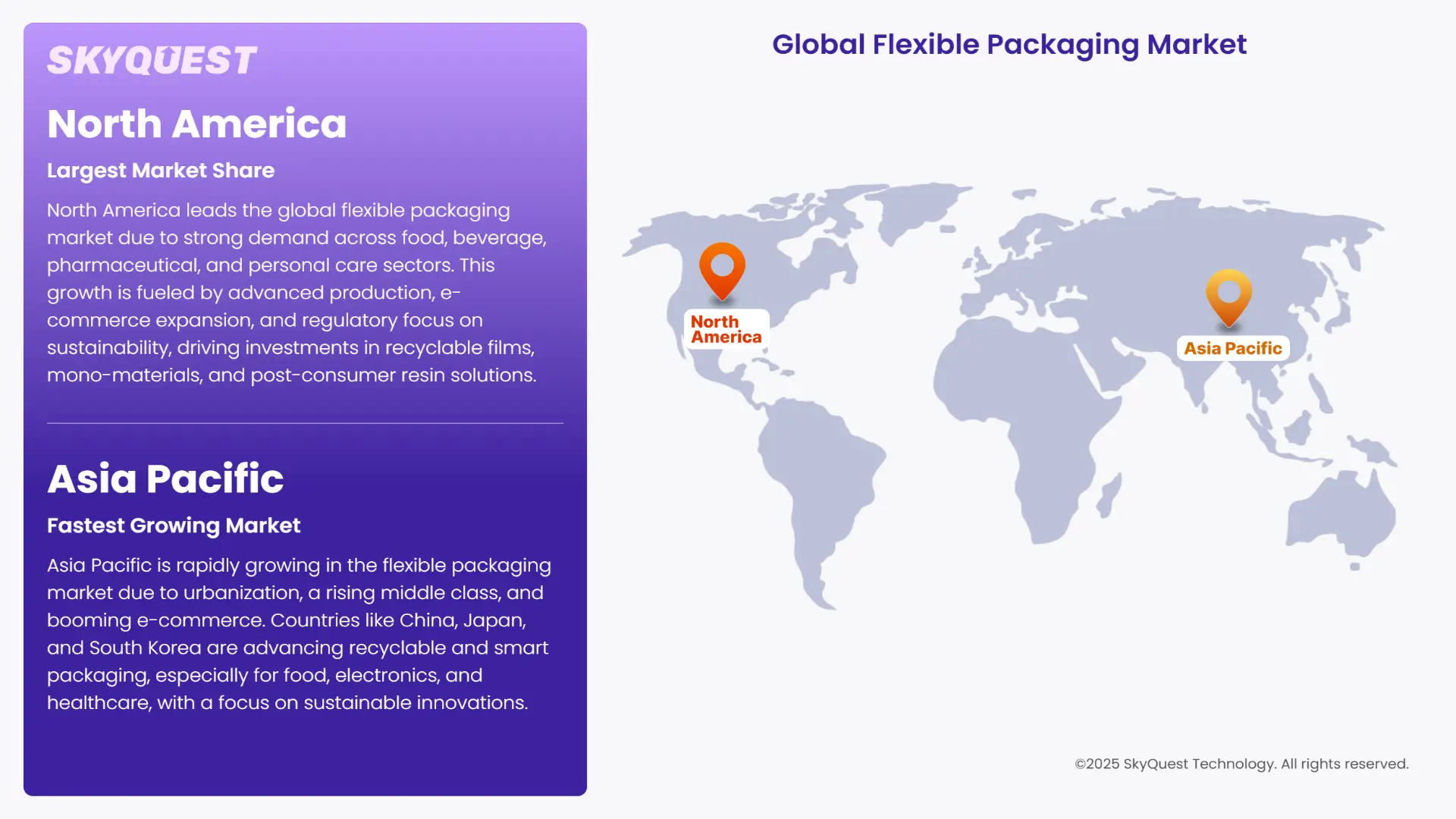

North America dominates the global flexible packaging market share because of strong demand for packaging used in foods, beverages, pharmaceuticals, and personal care sectors. The region is supported by high demand for lightweight, resealable, and tough packaging formats. The development is also buttressed by modern production capacity, wide usage of e-commerce, and regulatory pushes for recyclability and sustainable packaging materials. Companies are placing huge bets on recyclable films, mono-material packaging, and post-consumer resin to fulfill environmental requirements and consumer demand, further securing the region’s leadership status.

U.S. Flexible Packaging Market

Flexibles are most utilized by the U.S., with significant volume usage arising from packaged foods, pharmaceuticals, and pet care. Innovation of simpler-to-use, recyclable versions is gaining traction with anticipated demand for sustainability and ease of use by consumers. Amcor collaborated with Cadbury in early 2024 to supply over ~1,000 tons of recycled plastic for chocolate packaging, marking a large step towards virgin plastic independence across mass-market applications.

Canada Flexible Packaging Market

Continued Canadian expansion for flexible packaging is sustained by rising demand for frozen foods, snacks, and e-commerce packaging. Sustainability concerns are leading to a shift towards recyclable and compostable packaging, with countrywide initiatives such as the Canada Plastics Pact leading that shift. Mondi acquired Alberta's Hinton Pulp Mill in 2024 to boost sustainable paper-based materials production to complement its sustainable flexible packaging solutions for Canadian customers.

Europe witnesses exponential rise in flexible packaging adoption due to tough environmental regulations, high consumer awareness, and sustainable format developments. The EU's circular economy targets and country laws are forcing producers to go for recyclable, reusable, and biodegradable packaging. The trend is being pioneered by the food, pharmaceutical, and personal care markets using intelligent packaging and mono-material films. Innovation in advanced technologies is turning Europe into a hub for sustainable flexible packaging innovations worldwide.

Germany Flexible Packaging Market

Germany is still the largest flexible packaging market share in Europe because of strong packaging demand by the healthcare and food sectors. National packaging laws like VerpackG are driving companies to develop sustainable solutions and increase recyclability. Flint Group introduced nitrocellulose-free ink systems during March 2025 to make higher recyclable standards easier and help converters meet demanding environmental specifications with printing performance guarantees.

France Flexible Packaging Market

France is currently experiencing a crucial packaging transition with AGEC Law requiring packaging to be reusable or recyclable by 2025. The flexible packaging market segment is evolving with mono-material packaging bags and biodegradable films to meet regulation requirements. Consumers are being offered refillable packaging systems for home and personal care products as part of a trend towards lesser waste and sustainable products for consumers

Spain Flexible Packaging Market

Spain is adapting rapidly to EU packaging regulations, with production and retail using recyclable flexible packaging, especially for food and beverages. The compostable laminates and light packaging market is emerging. Berlin Packaging expanded its footprint in Spain by acquisition and enhanced distribution of sustainable packaging solutions, through more centralized distribution of flexible films utilized by packers of food and cosmetics.

Asia Pacific is emerging as a large flexible packaging market growth because of urbanization, rising consumption by the expanding middle class, and fast expansion of e-commerce. Japan, South Korea, and China are taking initiatives towards recyclable and smart packaging to meet changing consumer needs and sustainability goals by governments. Food, electronics, and healthcare are leading markets, and innovations are towards light-weight, high-barrier, and bio-based packaging solutions tailored for home and export markets.

Japan Flexible Packaging Market

Japan’s flexible packaging market is well known for advanced and premium formats, particularly in pharmaceutical and food sectors. Intelligent and active packaging, for example, oxygen-absorbing films and freshness indicators, is gaining momentum. Packaging firms are experimenting with QR-enabled packs for better product tracing and consumer engagement, and also with convenience store food products, fitting Japan’s requirements for exactness and security.

South Korea Flexible Packaging Market

South Korea is rapidly transitioning to sustainable flexible packaging as government initiatives and expanding demand for sustainable products stimulate the trend. New sectors like beverages and cosmetics are making a switch to recyclable and biodegradable films to replace traditional plastic. LG Chem launched a bio-based polyethylene film for packaging for food products in 2024 towards national efforts to reduce plastic waste and increase bio-circular economy targets.

China Flexible Packaging Market

China’s flexible packaging market demand is rising due to growth in e-commerce and fast-moving consumer goods. National environmental policies lead packaging producers to turn to recyclable mono-materials and post-consumer resin. For example, certain home-grown converters ordered production lines of new packaging of high-barrier recyclable films to adapt to China’s double carbon policy and China’s shift to sustainable packaging infrastructure.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

Sustainability & Regulatory Pressure

E-commerce Expansion & Demand for Convenience

Environmental and Regulatory Challenges Impacting Flexible Packaging

Raw Material Price Volatility and Recycling Infrastructure Gaps

Request Free Customization of this report to help us to meet your business objectives.

To stay competitive in the flexible packaging market, companies are focusing on developing sustainable materials like recyclable and biodegradable films to meet rising environmental regulations and consumer demand. Investment in advanced technologies, such as multi-layer laminates and high-barrier films, enhances product quality and extends shelf life. Collaborations among packaging manufacturers, raw material suppliers, and brand owners drive innovation and customization across industries like food, pharmaceuticals, and consumer goods. Emphasizing circular economy principles, companies adopt recyclable and compostable packaging solutions to reduce environmental impact. Additionally, integrating digital printing and smart packaging improves brand engagement and supply chain transparency. These strategies help market players maintain sustainability, address evolving needs, and strengthen their position in the growing flexible packaging market.

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected using Primary Exploratory Research backed by robust Secondary Desk research.

As per SkyQuest analysis, the global flexible packaging market is set for robust growth, driven by rising demand for convenience, sustainability, and enhanced product protection across food, beverage, pharmaceutical, and personal care sectors. Key drivers include regulatory pressure for recyclable materials, e-commerce expansion, and innovations like AI‑IoT smart packaging and AI-optimized design. Plastics dominate due to versatility, while paper is the fastest-growing segment amid environmental awareness. North America leads with advanced manufacturing and recycling initiatives, Europe advances through strict regulations and circular economy goals, and Asia Pacific grows fastest driven by urbanization and government policies. Challenges include recycling infrastructure gaps, multilayer packaging recyclability, and raw material volatility. Despite this, companies invest in sustainable materials, smart technologies, and circular practices, maintaining optimistic long-term market prospects.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 274.87 Billion |

| Market size value in 2033 | USD 419.16 Billion |

| Growth Rate | 4.8% |

| Base year | 2024 |

| Forecast period | 2026-2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Flexible Packaging Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Flexible Packaging Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Flexible Packaging Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Flexible Packaging Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

Consumer demand for sustainable packaging is often associated with convenience and portability and has prompted innovations such as recyclable films, compostable laminates, enclosable pouches, and high-barrier paper packaging to satisfy needs whilst enabling brands to maximize functionality, shelf appeal and eco-friendly initiatives.

Manufacturers are progressively leaning towards recyclable, biodegradable, and post-consumer recycled (PCR) materials, mainly due to international sustainability regulations and initiatives linking to environmental goals that promote these alternative materials. This has resulted in changes to mono-material products and eco-friendly laminates while also minimizing plastic waste and supporting reduction targets within circular economies.

Due to the various benefits of digitally printed packaging, there has been a shift in focus for most brands, as the emergence of variable data printing, shelf appeal, quick turnaround times and waste reduction have been the result of digital printing. All of which support smart packaging integration to enhance supply chain visibility or consumer engagement.

With flexible packaging, the main users in terms of demand are food, beverage, and over-the-counter (OTC) pharmaceuticals, with cosmetics and personal care areas showing significant growth. This growth is backed by the demand for lightweight, durable and high-barrier options to protect product longevity and improve branding and presentation.

Volatile pricing for resins and limited recycling infrastructures, continue to increase production costs, and adversely impact profit margins especially for multilayer films, consequently limiting production levels. There has been a welcome shift from brands towards alternative materials and recycling technologies that stabilize their supply chains.

Despite many developing regions suffering from little or no recycling infrastructure, and established regulatory frameworks, the potential for growth in those areas could be phenomenal due to the spike in urbanization, aspirational middle-class consumers, and e-commerce, as well as the continued adoption of sustainable, lightweight and cost-effective packaging formats.

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients