Report ID: UCMIG40P2007

SkyQuest Technology's Commercial auto insurance market size, share and forecast Report is based on the analysis of market data and Industry trends impacting the global Commercial Auto Insurance Market and the revenue of top companies operating in it. Market Size Data and Statistics are based on the comprehensive research by our Team of Analysts and Industry experts.

A commercial auto insurance policy typically includes a customised motor insurance policy that covers damages and losses caused to or by a commercial vehicle and its owner-driver. Businesses primarily purchase this insurance for their motor vehicles, which include trucks, pick-up vans, cabs, auto-rickshaws, tractors, commercial vans, and school buses, among others. Commercial auto insurance covers only business-owned vehicles and covers damages and losses in situations such as accidents, collisions, natural disasters, fires, and others.

This report is being written to illustrate the market opportunity by region and by segments, indicating opportunity areas for the vendors to tap upon. To estimate the opportunity, it was very important to understand the current market scenario and the way it will grow in future.

Production and consumption patterns are being carefully compared to forecast the market. Other factors considered to forecast the market are the growth of the adjacent market, revenue growth of the key market vendors, scenario-based analysis, and market segment growth.

The market size was determined by estimating the market through a top-down and bottom-up approach, which was further validated with industry interviews. Considering the nature of the market we derived the Property & Casualty Insurance by segment aggregation, the contribution of the Property & Casualty Insurance in Insurance and vendor share.

To determine the growth of the market factors such as drivers, trends, restraints, and opportunities were identified, and the impact of these factors was analyzed to determine the market growth. To understand the market growth in detail, we have analyzed the year-on-year growth of the market. Also, historic growth rates were compared to determine growth patterns.

REQUEST FOR SAMPLE

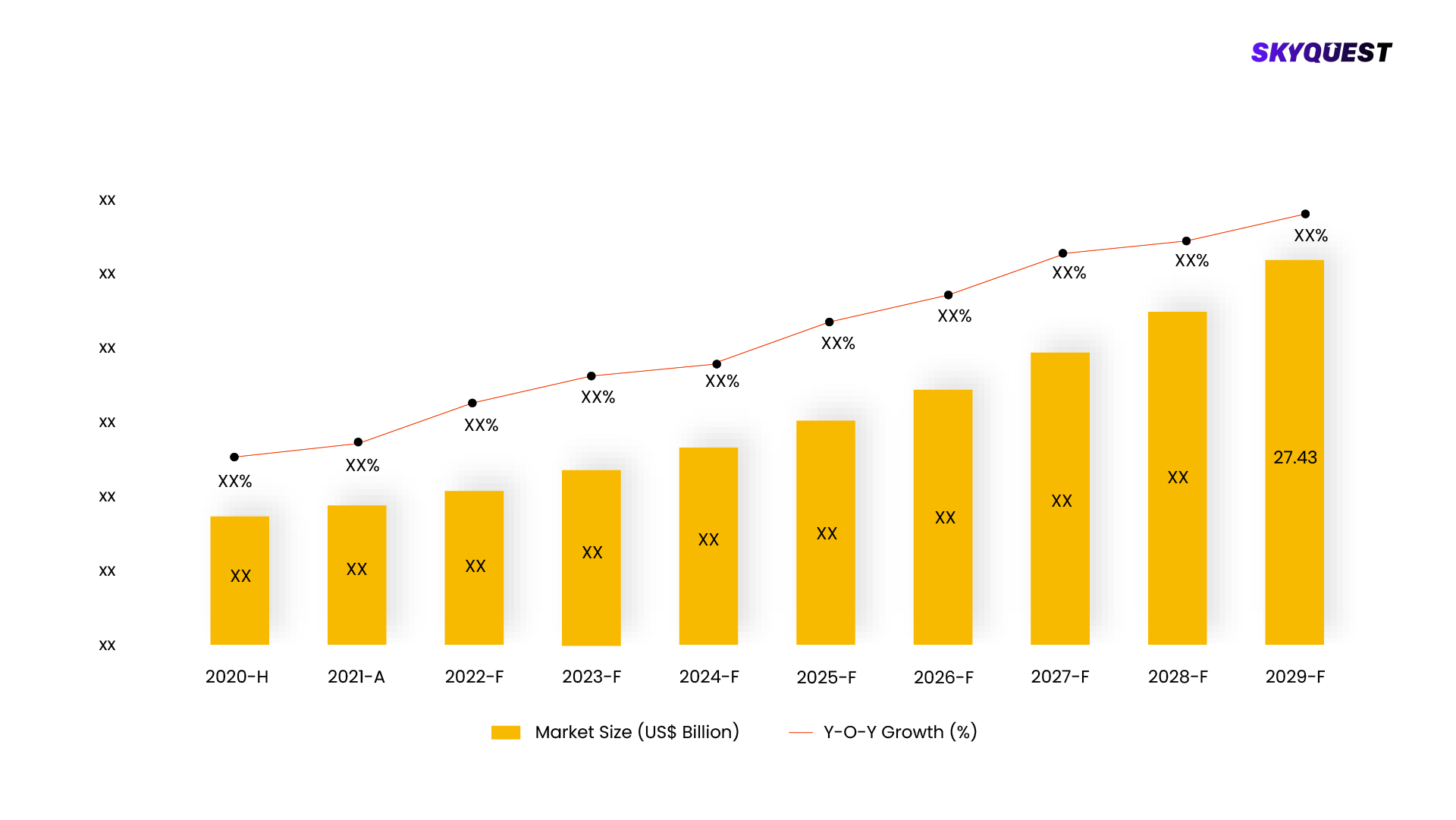

The market for Commercial Auto Insurance was estimated to be valued at US$ XX Mn in 2021.

The Commercial Auto Insurance Market is estimated to grow at a CAGR of XX% by 2028.

The Commercial Auto Insurance Market is segmented on the basis of Type, Application, Region.

Based on region, the Commercial Auto Insurance Market is segmented into North America, Europe, Asia Pacific, Middle East & Africa and Latin America.

The key players operating in the Commercial Auto Insurance Market are PICC, Progressive Corporation, Ping An, AXA, Sompo Japan, Tokyo Marine, Travelers Group, Liberty Mutual Group, Zurich, CPIC, Nationwide, Mitsui Sumitomo Insurance, Aviva, Berkshire Hathaway, Old Republic International, Auto Owners Grp., Generali Group, MAPFRE, Chubb, AmTrust NGH.

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients

Report ID: UCMIG40P2007

sales@skyquestt.com

USA +1 351-333-4748