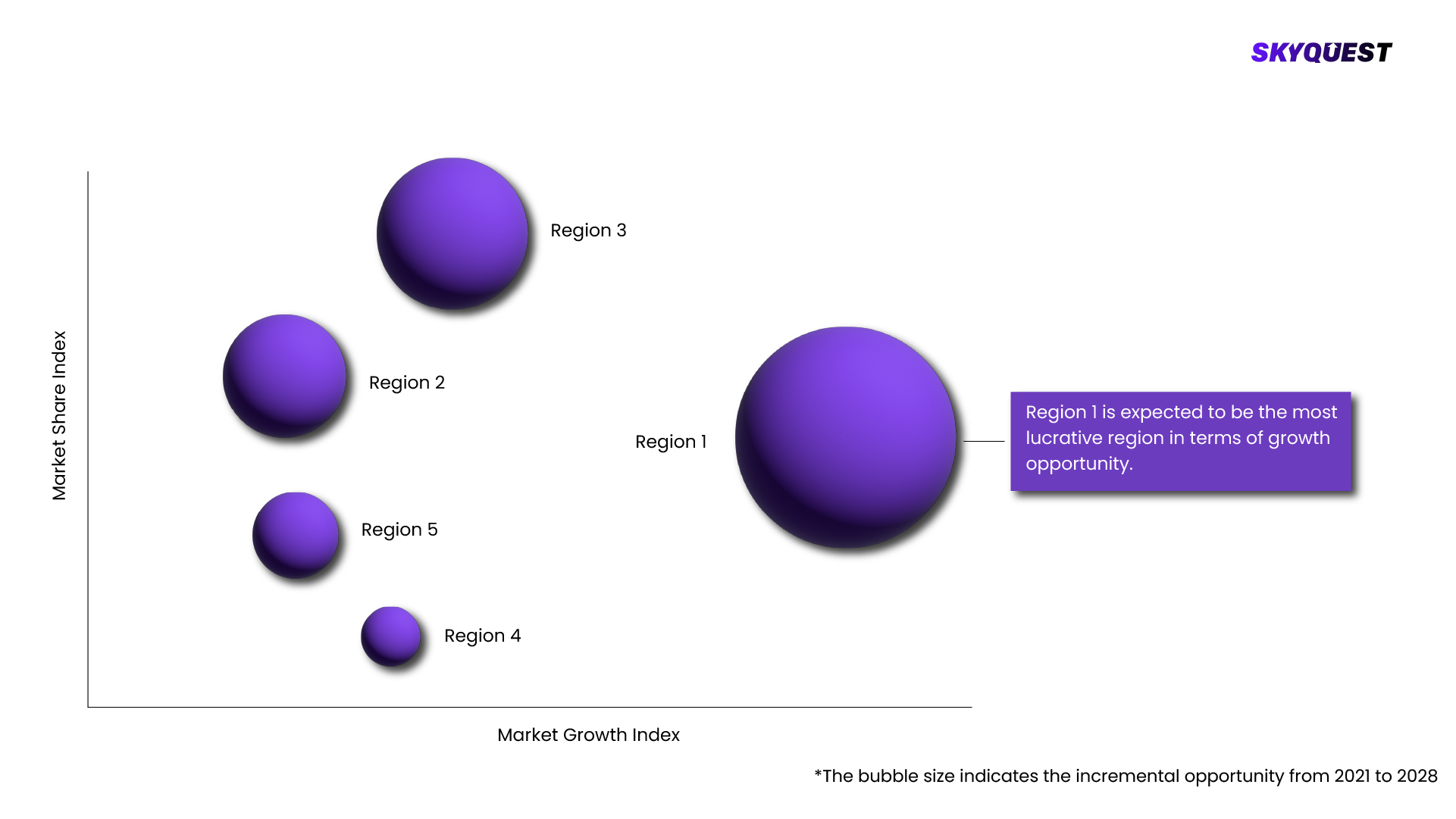

The key players operating in the Application Integration Market are application integration market size is projected to grow from USD 15.4 billion in 2023 to USD 38.4 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 20.0% during the forecast period. Growing demand for B2B integration, improved productivity, and scalability is driving market growth, but the high initial investment is a hindrance to market growth. , Driver: Rising need to eliminate data silos and improve productivity , A data silo is a collection of information inaccessible to each part of a company's hierarchy. Data silos cause expensive and time-consuming problems for companies. And hence, they must be resolved. Enterprise application integration solutions cater to eliminating data silos and the costs associated with them and enable the productive use of data. To gain a competitive edge, enhance operational efficiencies, and generate new business opportunities simultaneously, cutting down on costs may motivate companies to achieve more with their data. To achieve this, access to enterprise-wide information is vital. This is expected to drive the market for application integration systems. , Restraint: High initial investment , Investments in enterprise applications are elevated right now. As businesses continue to make investments, gaps between their expanding array of applications are affecting their performance. Though, with application integration, their efficiency is increased, as the tools work together, the initial investments for application integration are high for the organizations, limiting the prospects of this market. , Opportunity: Growing demand for B2B integration , To integrate all the complex processes, such as the B2B and electronic data interchange (EDI) processes of an enterprise across their partner communities in a single gateway, a B2B integration platform is necessary. B2B integration software can be used for on-premises or integration services. It can be accessed through hosted cloud services. The Business-to-Business Middleware (B2B Integration) industry will increase at a substantial CAGR during the forecast interval. , Challenge: Data inaccessibility because of its widespread storage , In the case of most tech-savvy companies, some data is stored so that it remains inaccessible to those who could gain an advantage from it. One of the primary reasons for this problem is that cloud apps are not adequately connected and thus leave business data spread across the cloud. The other reason is that some data is stored on-premises in legacy databases or older apps. These factors are proving an obstacle to the growth of enterprises looking to increase their efficiency and boost revenue. , Market Ecosystem , Leading companies in the application integration market include a definite provider of application integration solutions and services. These companies have been active in the market for several years and possess a varied product portfolio, innovative technologies, and strong sales and marketing networks. Prominent companies in this market include Salesforce (US), Informatica (US), SAP (Germany), Oracle (US), SnapLogic (US), Software AG (Germany), IBM (US), Microsoft (US), TIBCO Software (US), Celigo (US), Boomi (US), Adeptia (US), WSO2 (US), DBSync (US), Flowgear (South Africa), InterSystems (US), SEEBURGER (Germany), Workato (US), Magic Software (Israel), OpenLegacy (US), Jitterbit (US), Elastic.io (Germany), Talend (US), Tray.io (US), Cyclr Systems (UK), APIFuse (US), and Zapier (US). , Services segment is expected to grow at a higher rate during the forecast period , Services in this market have been categorized into professional and managed services. Professional services are essential in the management of the entire lifecycle of solutions. Managed services, on the other hand, assess business networks, monitor the health of infrastructure, and perform remote maintenance activities. These services provide security and expert assurance, helping the entire business be more productive. Professional services are further segmented into consulting, integration, support, and maintenance. , Integration Platform as a Service (iPaaS) segment to account for the largest market share during the forecast period , iPaaS allows the building and deploying integrations between cloud and on-premises applications and data. It uses an API-led approach without requiring installing or managing any middleware or hardware. iPaaS includes capabilities such as Application Programming Interface (API) management, data transformation, data integration, and real-time monitoring and integration, offering simplicity, visibility, business agility, and governance with minimal cost and resource requirements. Enterprises and SMEs are moving toward adopting a cloud-based iPaaS solution to benefit from flexibility and robustness in internal business operations. , North America segment to account for the largest market share forecast period , North America is expected to account for the largest application integration market share. The US contributes the maximum share in the application integration market. Various factors driving the adoption of application integration in this region are the diversification of services delivered and the shift of focus from SaaS to cloud services for infrastructure and platforms. Also, with an increasing number of enterprises and prominent players in the region, the demand for the application integration market is increasing. These enterprises have to manage the increasing number of applications and hence need application integration solutions. , Recent Developments: , In March 2023, Oracle extended its collaboration with NVIDIA to allow the functioning of NVIDIA AI applications on the new Oracle Cloud Infrastructure (OCI) Supercluster. , In September 2022, AWS and Salesforce announced the integration between the Salesforce platform and Amazon SageMaker to enable customers to use ML modeling services on the Salesforce platform. , In December 2021, IBM announced a relationship with Mulesoft to deliver increased integrations and solutions around the IBM Z product family to support financial services and other mutual customers. , KEY MARKET SEGMENTS, By Offering , Platforms , Services , Professional Services , Consulting , Integration , Support and Maintenance , Managed Services , By Integration Type , Point-To-Point Integration , Enterprise Application Integration , Enterprise Service Bus , Integration Platform as a Service , Hybrid Integration , By Application , Customer Relationship Management , Enterprise Resource Planning , Human Resource Management System , Supply Chain Management , Business Intelligence , Electronic Health Record Management , Other Applications , By Vertical , Banking, Financial Services, and Insurance , Retail & eCommerce , Manufacturing , Healthcare & Life Sciences , Energy & Utilities , Automotive , Transportation and Logistics , Government & Public Sector , Other Verticals , By Region , North America , US , Canada , Europe , UK , Germany , France , Italy , Spain , Nordic Region , Rest of Europe , Asia Pacific , China , India , Japan , Australia and New Zealand , Southeast Asia , Rest of Asia Pacific , Middle East & Africa , Middle East , UAE , KSA , Rest of Middle East , Africa , Latin America , Brazil , Mexico , Rest of Latin America , KEY MARKET PLAYERS , Salesforce , Informatica , SAP , Oracle , SnapLogic , Software AG , IBM , Microsoft , TIBCO Software , Celigo , Boomi , Adeptia , WSO2 , DBSync , Flowgear , InterSystems , SEEBURGER , Workato , Magic Software , OpenLegacy , Jitterbit , Elastic.io , Talend , Tray.io , Cyclr Systems , APIFuse , Zapier .