Product ID: UCMIG45J2043

Report ID:

UCMIG45J2043 |

Region:

Global |

Published Date: Upcoming |

Pages:

165

| Tables: 55 | Figures: 60

Over the forecast period, the growing adoption of cloud-based services, cloud computing, and cloud-based solutions for algorithmic trading will offer robust opportunities for the algorithmic trading market. While executing trades, cloud services are used by traders for trading strategies, backtesting, and run-time series analysis. For services like backup and recovery, data storage, trading networks, and data management are expensive, traders prefer cloud computing because building one's own data centers for services. As a result, rather than developing hardware or software infrastructure, renting space via the cloud is more convenient. During the forecast period, the factors further propel the growth of the segment are the cloud-based algorithmic trading solution are gaining popularity among traders as it ensures the effective automation of process and data maintenance along with cost-friendly management.

This report is being written to illustrate the market opportunity by region and by segments, indicating opportunity areas for the vendors to tap upon. To estimate the opportunity, it was very important to understand the current market scenario and the way it will grow in future.

Production and consumption patterns are being carefully compared to forecast the market. Other factors considered to forecast the market are the growth of the adjacent market, revenue growth of the key market vendors, scenario-based analysis, and market segment growth.

The market size was determined by estimating the market through a top-down and bottom-up approach, which was further validated with industry interviews. Considering the nature of the market we derived the Electronic Equipment & Instruments by segment aggregation, the contribution of the Electronic Equipment & Instruments in Technology Hardware & Equipment and vendor share.

To determine the growth of the market factors such as drivers, trends, restraints, and opportunities were identified, and the impact of these factors was analyzed to determine the market growth. To understand the market growth in detail, we have analyzed the year-on-year growth of the market. Also, historic growth rates were compared to determine growth patterns.

Our industry expert will work with you to provide you with customized data in a short amount of time.

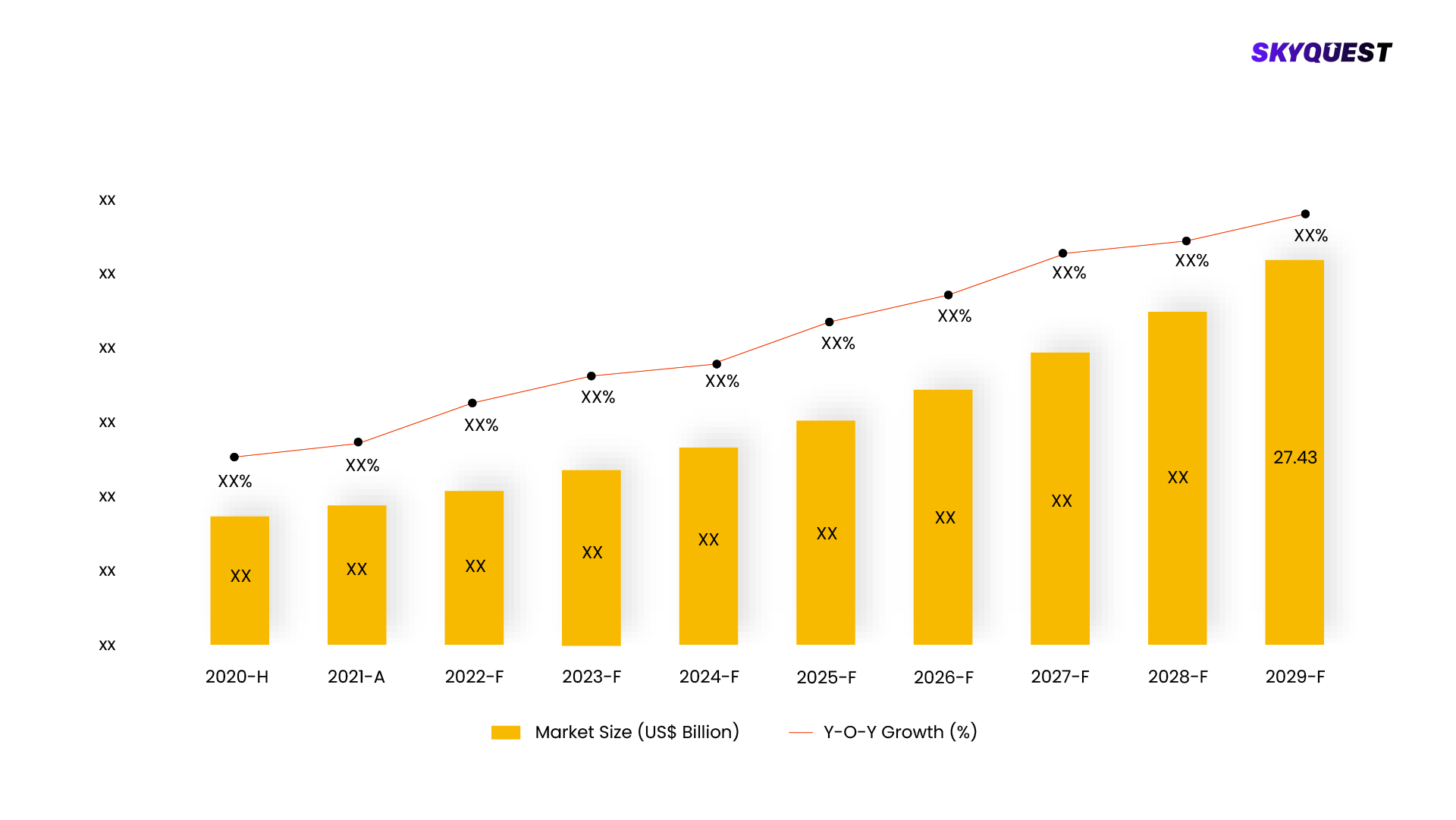

REQUEST FREE CUSTOMIZATIONThe global market for Algorithmic Trading was estimated to be valued at US$ XX Mn in 2021.

The global Algorithmic Trading Market is estimated to grow at a CAGR of XX% by 2028.

The global Algorithmic Trading Market is segmented on the basis of COMPONENT, TYPE, DEPLOYMENT MODE, TYPE OF TRADERS, Region.

Based on region, the global Algorithmic Trading Market is segmented into North America, Europe, Asia Pacific, Middle East & Africa and Latin America.

The key players operating in the global Algorithmic Trading Market are 63MOONS, Virtu Financial, Software AG, Refinitiv Ltd., MetaQuotes Software Corp., Symphony Fintech Solutions Pvt Ltd., Argo SE,, Tata Consultancy Services, Algo Trader AG, Tethys.

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Product ID: UCMIG45J2043