U.S. Institutional Cleaning Ingredients Market Insights

Market Overview:

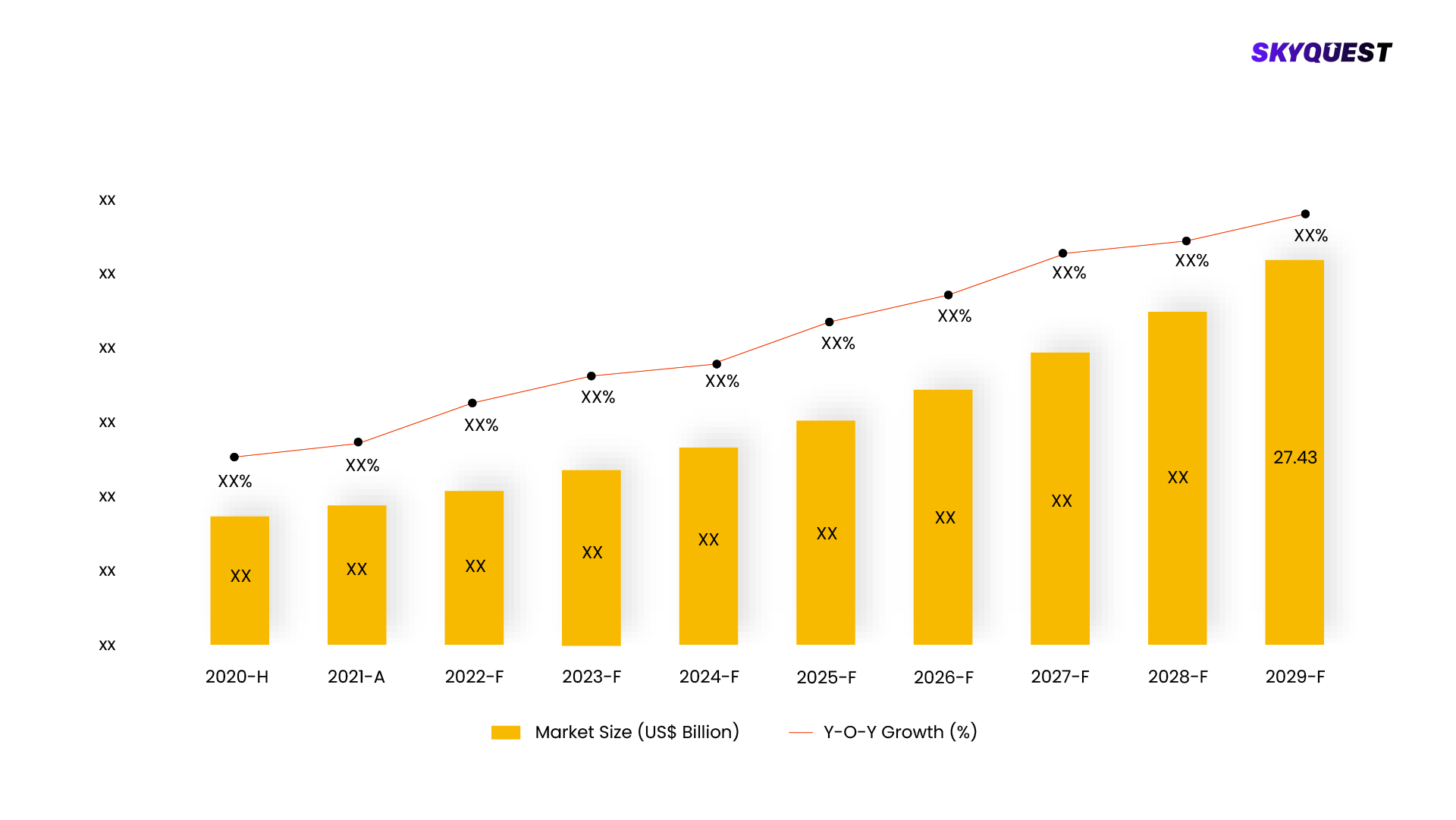

In 2020, the dishwashing segment within the U.S. institutional cleaning ingredients market demonstrated substantial growth, reaching a value exceeding USD 500 million. Furthermore, industry projections indicate a continuous upward trajectory, with an estimated compound annual growth rate (CAGR) of over 3.0% anticipated from 2021 to 2025. These statistics reflect the expanding demand for cleaning ingredients specifically designed for dishwashing purposes within institutional settings across the United States. As the market evolves, this upward trend is expected to persist, driven by various factors such as increasing hygiene standards, rising awareness of cleanliness, and advancements in cleaning technology and formulations.

U.S. Institutional Cleaning Ingredients Market, Forecast & Y-O-Y Growth Rate, 2020 - 2028

To get more reports on the above market click here to

GET FREE SAMPLEThis report is being written to illustrate the market opportunity by region and by segments, indicating opportunity areas for the vendors to tap upon. To estimate the opportunity, it was very important to understand the current market scenario and the way it will grow in future.

Production and consumption patterns are being carefully compared to forecast the market. Other factors considered to forecast the market are the growth of the adjacent market, revenue growth of the key market vendors, scenario-based analysis, and market segment growth.

The market size was determined by estimating the market through a top-down and bottom-up approach, which was further validated with industry interviews. Considering the nature of the market we derived the Specialty Chemicals by segment aggregation, the contribution of the Specialty Chemicals in Diversified Materials and vendor share.

To determine the growth of the market factors such as drivers, trends, restraints, and opportunities were identified, and the impact of these factors was analyzed to determine the market growth. To understand the market growth in detail, we have analyzed the year-on-year growth of the market. Also, historic growth rates were compared to determine growth patterns.

Segmentation Analysis:

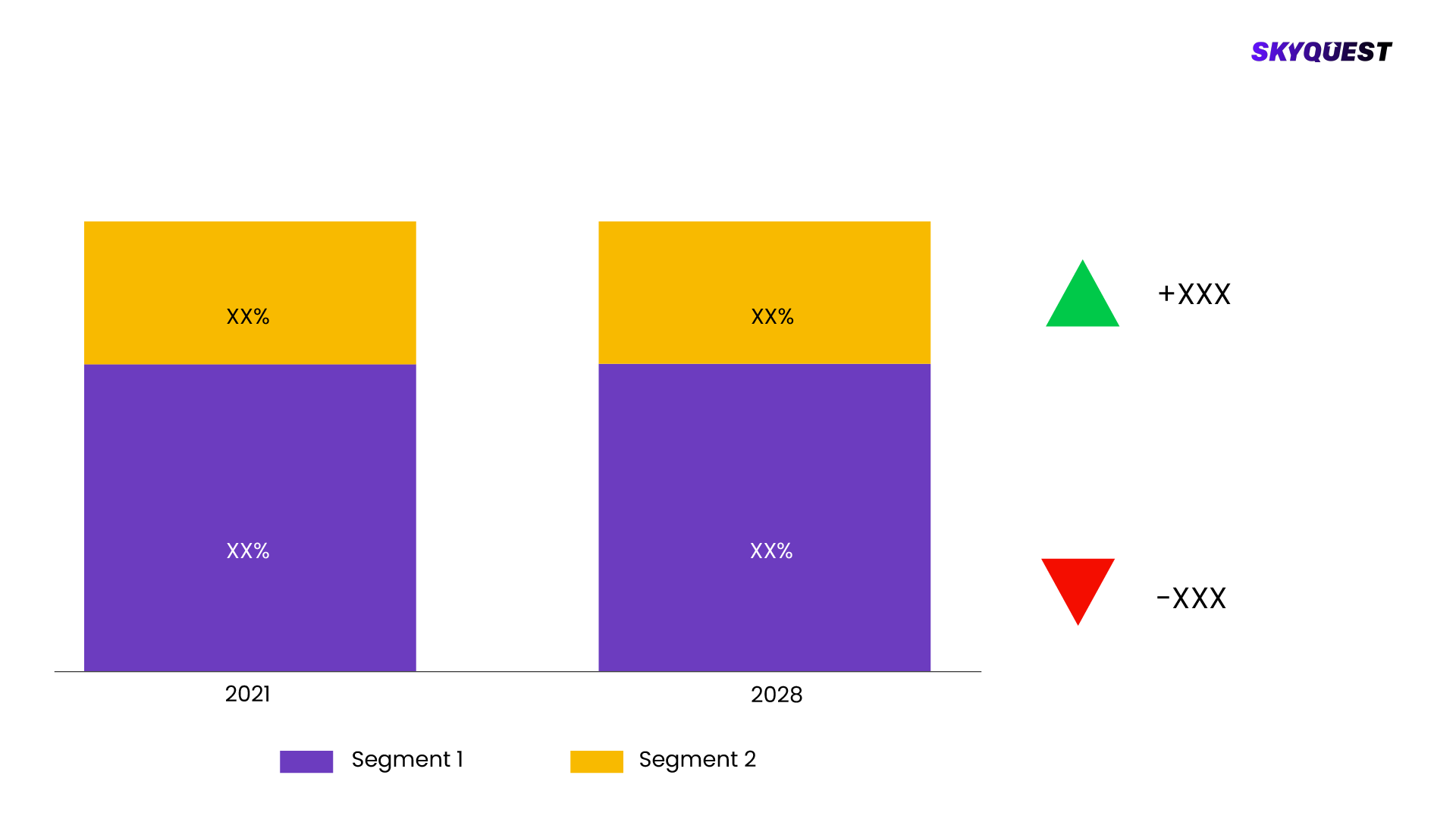

The U.S. Institutional Cleaning Ingredients Market is segmented by Ingredients Type, Application. We are analyzing the market of these segments to identify which segment is the largest now and in the future, which segment has the highest growth rate, and the segment which offers the opportunity in the future.

U.S. Institutional Cleaning Ingredients Market Basis Point Share Analysis, 2021 Vs. 2028

To get detailed analysis on all segments

<

BUY NOW

- Based on Ingredients Type the market is segmented as, Surfactants, Nonionic Surfactant, Anionic Surfactants, Amphoteric Surfactants, Others (Cationic surfactant, Enzymes, Lipase, Cellulase, Amylase, Protease, Others, Bleaching agents, Hydrogen peroxide, Sodium Percarbonate, Others (Tetraacetylethylenediamine), Water Softeners, Sodium Carbonate, Sodium Chloride, Trisodium Phosphate, Sodium Metasilicate, Others (Sodium Polyacrylate, Benzotriazole), Emulsifiers, binders and antimicrobials, Polyethylene glycol, Glycerin, Magnesium stearate, Magnesium stearate, Chelating agent, Citric acid, Nitrilotriacetic acid, Polycarboxylates, Phosphonates, Others (Sodium Tripolyphosphate, Cyclodextrin), Preservatives, Sodium Benzoate, Formaldehyde, Others (Phenoxyethanol), Others (Essential Oils, Fragrances and dyes)

- Based on Application the market is segmented as, Dishwashing Machine Type, Dishwashing Manual Type

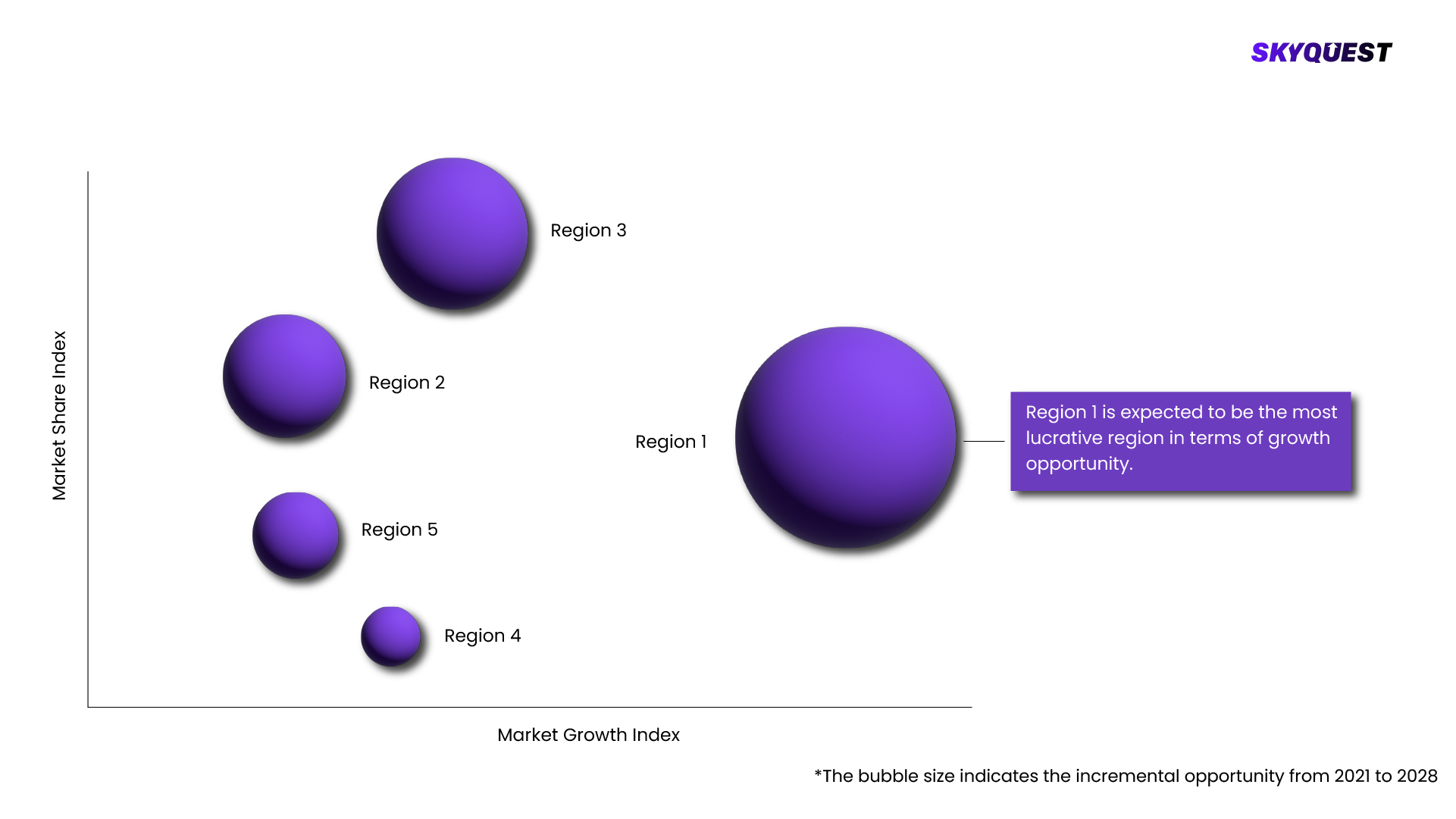

Regional Analysis:

U.S. Institutional Cleaning Ingredients Market is being analyzed by North America, Europe, Asia-Pacific (APAC), Latin America (LATAM), Middle East & Africa (MEA) regions. Key countries including the U.S., Canada, Germany, France, UK, Italy, Spain, China, India, Japan, Brazil, GCC Countries, and South Africa among others were analyzed considering various micro and macro trends.

U.S. Institutional Cleaning Ingredients Market Attractiveness Analysis, By Region 2020-2028

To know more about the market opportunities by region and country, click here to

REQUEST FREE CUSTOMIZATIONU.S. Institutional Cleaning Ingredients Market : Risk Analysis

SkyQuest's expert analysts have conducted a risk analysis to understand the impact of external extremities on U.S. Institutional Cleaning Ingredients Market. We analyzed how geopolitical influence, natural disasters, climate change, legal scenario, economic impact, trade & economic policies, social & ethnic concerns, and demographic changes might affect U.S. Institutional Cleaning Ingredients Market's supply chain, distribution, and total revenue growth.

Competitive landscaping:

To understand the competitive landscape, we are analyzing key U.S. Institutional Cleaning Ingredients Market vendors in the market. To understand the competitive rivalry, we are comparing the revenue, expenses, resources, product portfolio, region coverage, market share, key initiatives, product launches, and any news related to the U.S. Institutional Cleaning Ingredients Market.

To validate our hypothesis and validate our findings on the market ecosystem, we are also conducting a detailed porter's five forces analysis. Competitive Rivalry, Supplier Power, Buyer Power, Threat of Substitution, and Threat of New Entry each force is analyzed by various parameters governing those forces.

Key Players Covered in the Report:

- ends

- U.S. institutional cleaning ingredients market size for dishwashing application was over USD 500 million in 2020 and is estimated to grow at over 3.0% CAGR between 2021 and 2025. Rising popularity of preservatives, antibacterial agents, and anti-fungal agents among detergent manufacturers owing to their numerous benefits such as avoiding bacteria growth, low cost and easy availability should drive the preservatives growth.

- There are number of preservatives being used in detergent manufacturing including phenoxyethanol, methyl-and propylparaben, and methylisothiazolinone and many others. In addition, rising consumer awareness regarding hazardous effects of chemicals in detergents should propel the demand for organic ingredients. including essential oils, dyes and many others over foreseeable timeframe.

- The outbreak of the COVID-19 pandemic has positively affected the demand for U.S. institutional cleaning ingredients market for dishwashing application after the unlock of U.S. lockdown. Strict guideline by government to maintain the cleanliness after unlocking of U.S lockdown increase the demand for detergents from multiple institutes for dishwashing application. However, in the years 2020, when lockdown imposed by government to prevent the spread of COVID-19 has caused some disrupted in the manufacturing and supply of ingredients, which negatively affected the production and supply of product in the market.

- Growth Drivers:Increasing application scope of cleaning agents in industrial & commercial sector Low cost and easy availability of surfactants fuel its market growthPitfalls & Challenges:Ban of several ingredients in the U.S market

- The stringent regulation laid down by governing bodies of U.S on the application and manufacturing of institutional cleaning ingredients are likely to restrain the growth of the U.S. Institutional cleaning ingredients market for dishwashing application to some extent during the forecast period. For instance, approximately half of the states in the U.S. have approve restriction law for phosphate.

- Many states, such as Washington, Oregon, and Massachusetts, has ban on detergents comprising more than 0.5% phosphate. Along with following state phosphate laws, companies must confirm that consumer cleaning products obey the legislations set out by the Consumer Product Safety Commission. Hence, these strict regulation in the U.S market are likely to decline the growth of the U.S. institutional cleaning ingredients market for dishwashing application growth during the forecast period.

- Rising demand for biobased ingredients led to support the growth of enzymes over the forecasted period.

- Enzymes ingredients is anticipated to grow with the high pace with a CAGR of over 5.0% and should surpass USD 110 million by 2025. Dishwashing detergent manufacturers have increased the use of enzymes in dishwashing detergents and biobased ingredients to reduce the use of chemicals ingredients, owing to different side effects of chemical ingredients. For instance, modern dishwashing detergents manufacturing use enzymes as catalysts to break down stains rather than phosphates as these are less harmful to the environment. In addition, dishwashing detergent manufacturers are exploring other alternatives of chemical cleaning ingredients present in cleaning products. Wherein, enzymes are becoming favorable choices among manufacturers as these are organic compounds and biobased ingredients.

- Strict regulation for cleanliness and hygiene in HoReCa sector led to fuel the demand for product in manual dishwashing detergents

- U.S. institutional cleaning ingredient for manual dishwashing application is expected to surpass USD 180 million by year 2025 and anticipated to so reasonable growth compares to other application, owing to multiple invention in technology for dishwashing. Manual dishwashing is practiced mainly in small and medium sized institutes, those are unable to afford high technology dishwashing machines. The utilization of high-quality manual dishwashing detergents in such institutions has soared as institutions are emphasizing on complying with the health & safety regulations stated by authorities. Therefore, large number of small institutes such as small restaurants and cafes led to fuel the demand for cleaning ingredients in the U.S market over the coming years.

- Strategic partnership and collaboration among market participants to innovate the category of cleaning ingredients

- U.S. institutional cleaning ingredients industry for dishwashing application consists of major players including Stepan Company, BASF SE, The Dow Chemical Company, Evonik Industries AG, Solvay, Croda International Plc and Ashland Global Holdings Inc. Key players in the market are engaged in collaboration and partnership with other market participants, for expansion their business and innovate new products in the market. Also, players applying strategy of joint ventures with the players in emerging countries and investment for new manufacturing units and research and development to improvise their portfolio to meet the growing need for detergents for dishwashing.

- In March 2021, Reckitt partnered with Halo, a networking platform for R&D comprising of a numerous PhDs across 65 countries and six continents. The strategic initiative is aimed at enhancing the company’s R&D and develop new products and create a strategic advantage for the company.

- In January 2021, Unilever and Innova Partnerships launched a joint venture biotechnology company named Penrhos Bio, in order to commercialize the technology of self-cleaning surfaces. This new technology is expected to enhance the product offerings of the company and hence enhance revenue and brand value.

- In March 2021, Stepan initiated a partnership with the Resilience and Sustainability Collaboratory (RSC) and Emory University. The strategic initiative is aimed at providing the infrastructure required for conduct multi-disciplinary and transformative research projects that generate innovative solutions for sustainability challenges worldwide.

- KEY MARKET SEGMENTS

- By Ingredients Type

- Surfactants

- Nonionic Surfactant

- Anionic Surfactants

- Amphoteric Surfactants

- Others (Cationic surfactant

- Enzymes

- Lipase

- Cellulase

- Amylase

- Protease

- Others

- Bleaching agents

- Hydrogen peroxide

- Sodium Percarbonate

- Others (Tetraacetylethylenediamine)

- Water Softeners

- Sodium Carbonate

- Sodium Chloride

- Trisodium Phosphate

- Sodium Metasilicate

- Others (Sodium Polyacrylate, Benzotriazole)

- Emulsifiers, binders and antimicrobials

- Polyethylene glycol

- Glycerin

- Magnesium stearate

- Magnesium stearate

- Chelating agent

- Citric acid

- Nitrilotriacetic acid

- Polycarboxylates

- Phosphonates

- Others (Sodium Tripolyphosphate, Cyclodextrin)

- Preservatives

- Sodium Benzoate

- Formaldehyde

- Others (Phenoxyethanol)

- Others (Essential Oils, Fragrances and dyes)

- By Application

- Dishwashing Machine Type

- Dishwashing Manual Type

SkyQuest's Expertise:

The U.S. Institutional Cleaning Ingredients Market is being analyzed by SkyQuest's analysts with the help of 20+ scheduled Primary interviews from both the demand and supply sides. We have already invested more than 250 hours on this report and are still refining our date to provide authenticated data to your readers and clients. Exhaustive primary and secondary research is conducted to collect information on the market, peer market, and parent market.

Our cross-industry experts and revenue-impact consultants at SkyQuest enable our clients to convert market intelligence into actionable, quantifiable results through personalized engagement.

Scope Of Report

| Report Attribute |

Details |

| The base year for estimation |

2021 |

| Historical data |

2016 – 2022 |

| Forecast period |

2022 – 2028 |

| Report coverage |

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments covered |

- By Ingredients Type - Surfactants, Nonionic Surfactant, Anionic Surfactants, Amphoteric Surfactants, Others (Cationic surfactant, Enzymes, Lipase, Cellulase, Amylase, Protease, Others, Bleaching agents, Hydrogen peroxide, Sodium Percarbonate, Others (Tetraacetylethylenediamine), Water Softeners, Sodium Carbonate, Sodium Chloride, Trisodium Phosphate, Sodium Metasilicate, Others (Sodium Polyacrylate, Benzotriazole), Emulsifiers, binders and antimicrobials, Polyethylene glycol, Glycerin, Magnesium stearate, Magnesium stearate, Chelating agent, Citric acid, Nitrilotriacetic acid, Polycarboxylates, Phosphonates, Others (Sodium Tripolyphosphate, Cyclodextrin), Preservatives, Sodium Benzoate, Formaldehyde, Others (Phenoxyethanol), Others (Essential Oils, Fragrances and dyes)

- By Application - Dishwashing Machine Type, Dishwashing Manual Type

|

| Regional scope |

North America, Europe, Asia-Pacific (APAC), Latin America (LATAM), Middle East & Africa (MEA) |

| Country scope |

U.S., Canada, Germany, France, UK, Italy, Spain, China, India, Japan, Brazil, GCC Countries, South Africa |

| Key companies profiled |

- ends

- U.S. institutional cleaning ingredients market size for dishwashing application was over USD 500 million in 2020 and is estimated to grow at over 3.0% CAGR between 2021 and 2025. Rising popularity of preservatives, antibacterial agents, and anti-fungal agents among detergent manufacturers owing to their numerous benefits such as avoiding bacteria growth, low cost and easy availability should drive the preservatives growth.

- There are number of preservatives being used in detergent manufacturing including phenoxyethanol, methyl-and propylparaben, and methylisothiazolinone and many others. In addition, rising consumer awareness regarding hazardous effects of chemicals in detergents should propel the demand for organic ingredients. including essential oils, dyes and many others over foreseeable timeframe.

- The outbreak of the COVID-19 pandemic has positively affected the demand for U.S. institutional cleaning ingredients market for dishwashing application after the unlock of U.S. lockdown. Strict guideline by government to maintain the cleanliness after unlocking of U.S lockdown increase the demand for detergents from multiple institutes for dishwashing application. However, in the years 2020, when lockdown imposed by government to prevent the spread of COVID-19 has caused some disrupted in the manufacturing and supply of ingredients, which negatively affected the production and supply of product in the market.

- Growth Drivers:Increasing application scope of cleaning agents in industrial & commercial sector Low cost and easy availability of surfactants fuel its market growthPitfalls & Challenges:Ban of several ingredients in the U.S market

- The stringent regulation laid down by governing bodies of U.S on the application and manufacturing of institutional cleaning ingredients are likely to restrain the growth of the U.S. Institutional cleaning ingredients market for dishwashing application to some extent during the forecast period. For instance, approximately half of the states in the U.S. have approve restriction law for phosphate.

- Many states, such as Washington, Oregon, and Massachusetts, has ban on detergents comprising more than 0.5% phosphate. Along with following state phosphate laws, companies must confirm that consumer cleaning products obey the legislations set out by the Consumer Product Safety Commission. Hence, these strict regulation in the U.S market are likely to decline the growth of the U.S. institutional cleaning ingredients market for dishwashing application growth during the forecast period.

- Rising demand for biobased ingredients led to support the growth of enzymes over the forecasted period.

- Enzymes ingredients is anticipated to grow with the high pace with a CAGR of over 5.0% and should surpass USD 110 million by 2025. Dishwashing detergent manufacturers have increased the use of enzymes in dishwashing detergents and biobased ingredients to reduce the use of chemicals ingredients, owing to different side effects of chemical ingredients. For instance, modern dishwashing detergents manufacturing use enzymes as catalysts to break down stains rather than phosphates as these are less harmful to the environment. In addition, dishwashing detergent manufacturers are exploring other alternatives of chemical cleaning ingredients present in cleaning products. Wherein, enzymes are becoming favorable choices among manufacturers as these are organic compounds and biobased ingredients.

- Strict regulation for cleanliness and hygiene in HoReCa sector led to fuel the demand for product in manual dishwashing detergents

- U.S. institutional cleaning ingredient for manual dishwashing application is expected to surpass USD 180 million by year 2025 and anticipated to so reasonable growth compares to other application, owing to multiple invention in technology for dishwashing. Manual dishwashing is practiced mainly in small and medium sized institutes, those are unable to afford high technology dishwashing machines. The utilization of high-quality manual dishwashing detergents in such institutions has soared as institutions are emphasizing on complying with the health & safety regulations stated by authorities. Therefore, large number of small institutes such as small restaurants and cafes led to fuel the demand for cleaning ingredients in the U.S market over the coming years.

- Strategic partnership and collaboration among market participants to innovate the category of cleaning ingredients

- U.S. institutional cleaning ingredients industry for dishwashing application consists of major players including Stepan Company, BASF SE, The Dow Chemical Company, Evonik Industries AG, Solvay, Croda International Plc and Ashland Global Holdings Inc. Key players in the market are engaged in collaboration and partnership with other market participants, for expansion their business and innovate new products in the market. Also, players applying strategy of joint ventures with the players in emerging countries and investment for new manufacturing units and research and development to improvise their portfolio to meet the growing need for detergents for dishwashing.

- In March 2021, Reckitt partnered with Halo, a networking platform for R&D comprising of a numerous PhDs across 65 countries and six continents. The strategic initiative is aimed at enhancing the company’s R&D and develop new products and create a strategic advantage for the company.

- In January 2021, Unilever and Innova Partnerships launched a joint venture biotechnology company named Penrhos Bio, in order to commercialize the technology of self-cleaning surfaces. This new technology is expected to enhance the product offerings of the company and hence enhance revenue and brand value.

- In March 2021, Stepan initiated a partnership with the Resilience and Sustainability Collaboratory (RSC) and Emory University. The strategic initiative is aimed at providing the infrastructure required for conduct multi-disciplinary and transformative research projects that generate innovative solutions for sustainability challenges worldwide.

- KEY MARKET SEGMENTS

- By Ingredients Type

- Surfactants

- Nonionic Surfactant

- Anionic Surfactants

- Amphoteric Surfactants

- Others (Cationic surfactant

- Enzymes

- Lipase

- Cellulase

- Amylase

- Protease

- Others

- Bleaching agents

- Hydrogen peroxide

- Sodium Percarbonate

- Others (Tetraacetylethylenediamine)

- Water Softeners

- Sodium Carbonate

- Sodium Chloride

- Trisodium Phosphate

- Sodium Metasilicate

- Others (Sodium Polyacrylate, Benzotriazole)

- Emulsifiers, binders and antimicrobials

- Polyethylene glycol

- Glycerin

- Magnesium stearate

- Magnesium stearate

- Chelating agent

- Citric acid

- Nitrilotriacetic acid

- Polycarboxylates

- Phosphonates

- Others (Sodium Tripolyphosphate, Cyclodextrin)

- Preservatives

- Sodium Benzoate

- Formaldehyde

- Others (Phenoxyethanol)

- Others (Essential Oils, Fragrances and dyes)

- By Application

- Dishwashing Machine Type

- Dishwashing Manual Type

|

| Customization scope |

Free report customization (15% Free customization) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options |

Reap the benefits of customized purchase options to fit your specific research requirements. |

Objectives of the Study

- To forecast the market size, in terms of value, for various segments with respect to five main regions, namely, North America, Europe, Asia-Pacific (APAC), Latin America (LATAM), Middle East & Africa (MEA)

- To provide detailed information regarding the major factors influencing the growth of the Market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the micro markets with respect to the individual growth trends, future prospects, and contribution to the total market

- To provide a detailed overview of the value chain and analyze market trends with the Porter's five forces analysis

- To analyze the opportunities in the market for various stakeholders by identifying the high-growth Segments

- To identify the key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for the market leaders

- To analyze competitive development such as joint ventures, mergers and acquisitions, new product launches and development, and research and development in the market

What does this Report Deliver?

- Market Estimation for 20+ Countries

- Historical data coverage: 2016 to 2022

- Growth projections: 2022 to 2028

- SkyQuest's premium market insights: Innovation matrix, IP analysis, Production Analysis, Value chain analysis, Technological trends, and Trade analysis

- Customization on Segments, Regions, and Company Profiles

- 100+ tables, 150+ Figures, 10+ matrix

- Global and Country Market Trends

- Comprehensive Mapping of Industry Parameters

- Attractive Investment Proposition

- Competitive Strategies Adopted by Leading Market Participants

- Market drivers, restraints, opportunities, and its impact on the market

- Regulatory scenario, regional dynamics, and insights of leading countries in each region

- Segment trends analysis, opportunity, and growth

- Opportunity analysis by region and country

- Porter's five force analysis to know the market's condition

- Pricing analysis

- Parent market analysis

- Product portfolio benchmarking