Product ID: UCMIG40M2003

Report ID:

UCMIG40M2003 |

Region:

Global |

Published Date: Upcoming |

Pages:

165

| Tables: 55 | Figures: 60

Major factors for the growth of the market are the rise in focus toward protecting & mitigating risk from non-payment across many types of goods & services and the expansion of trade in different regions demanding credit insurance are becoming major. Another major factor propelling the trade credit insurance market growth are benefits offered, such as sales support & account receivable support provided by credit insurance, which is becoming significant. Providing opportunities for credit insurance solutions offered by developing economies providers to expand & developed their offerings, especially among emerging economies such as Australia, China, India, Singapore, and South Korea. In the coming years, to provide lucrative opportunities to the trade credit insurance market share is expected to surge in small & medium-sized enterprises expanding their businesses. During the forecast period, the large enterprises segment dominated the trade credit insurance market and is projected to maintain its dominance.

This report is being written to illustrate the market opportunity by region and by segments, indicating opportunity areas for the vendors to tap upon. To estimate the opportunity, it was very important to understand the current market scenario and the way it will grow in future.

Production and consumption patterns are being carefully compared to forecast the market. Other factors considered to forecast the market are the growth of the adjacent market, revenue growth of the key market vendors, scenario-based analysis, and market segment growth.

The market size was determined by estimating the market through a top-down and bottom-up approach, which was further validated with industry interviews. Considering the nature of the market we derived the Insurance Brokers by segment aggregation, the contribution of the Insurance Brokers in Insurance and vendor share.

To determine the growth of the market factors such as drivers, trends, restraints, and opportunities were identified, and the impact of these factors was analyzed to determine the market growth. To understand the market growth in detail, we have analyzed the year-on-year growth of the market. Also, historic growth rates were compared to determine growth patterns.

Our industry expert will work with you to provide you with customized data in a short amount of time.

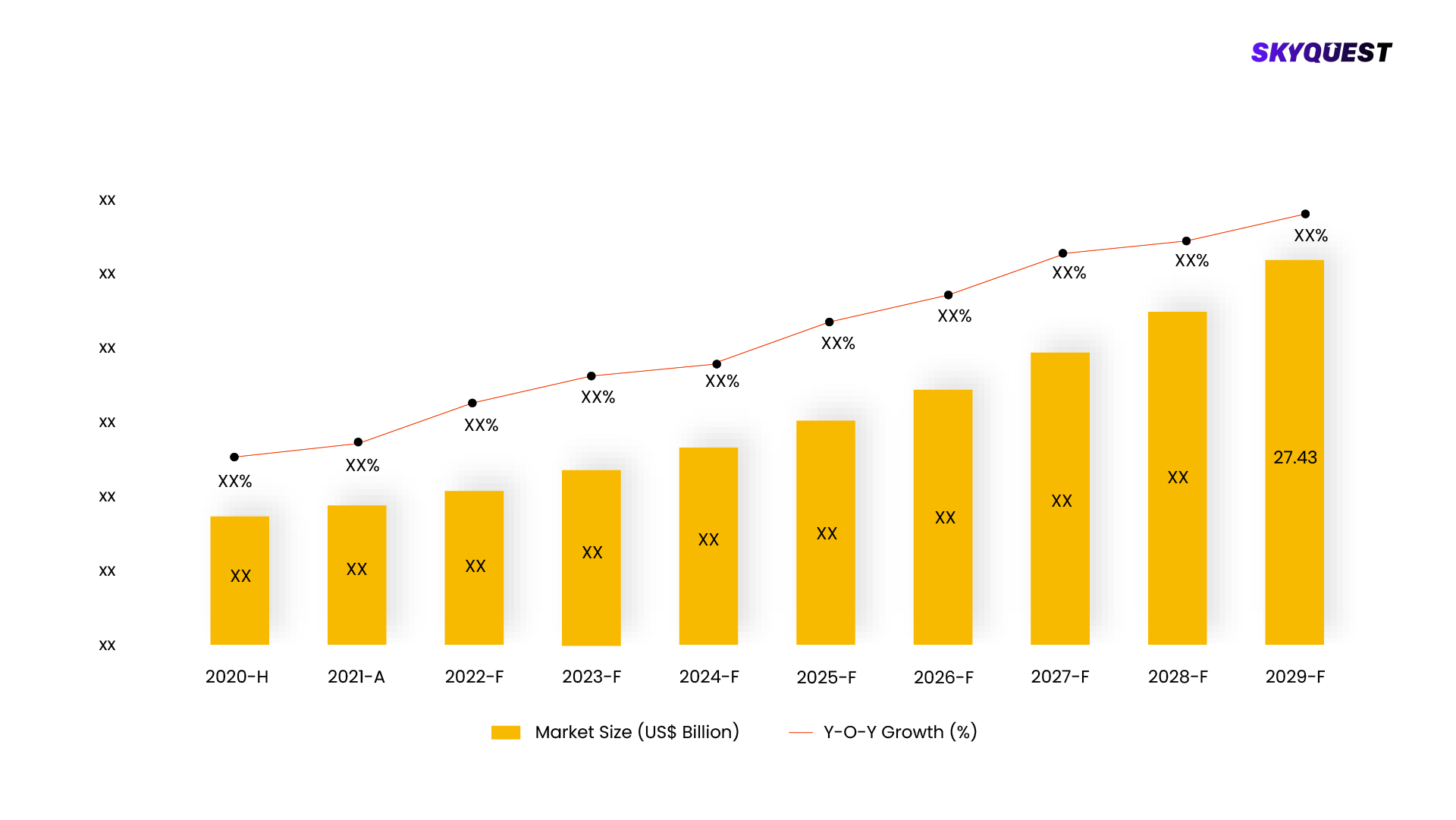

REQUEST FREE CUSTOMIZATIONThe market for Trade Credit Insurance was estimated to be valued at US$ XX Mn in 2021.

The Trade Credit Insurance Market is estimated to grow at a CAGR of XX% by 2028.

The Trade Credit Insurance Market is segmented on the basis of Component, Enterprise Size, Application, Coverage, Industry Vertical, Region.

Based on region, the Trade Credit Insurance Market is segmented into North America, Europe, Asia Pacific, Middle East & Africa and Latin America.

The key players operating in the Trade Credit Insurance Market are American International Group Inc., Aon plc, Atradius N.V., Coface, Credendo, EULER HERMES, Export Development Canada, QBE Insurance (Australia) Ltd., SINOSURE, Zurich.

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Product ID: UCMIG40M2003