Report ID: UCMIG35A2832

Report ID: UCMIG35A2832

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

UCMIG35A2832 |

Region:

Global |

Published Date: Upcoming |

Pages:

165

|Tables:

0

|Figures:

0

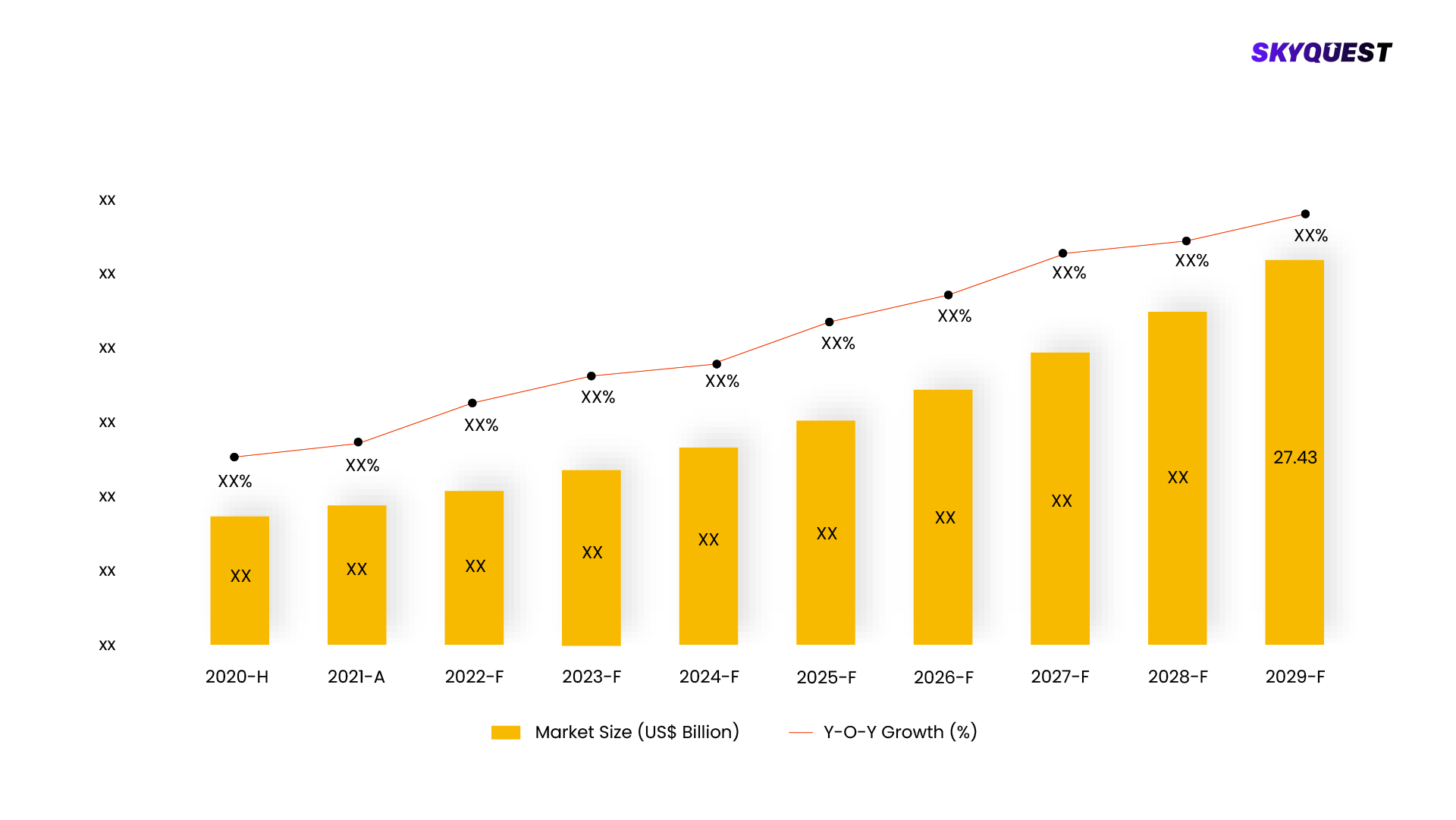

In 2019, the global market for oncology companion diagnostics achieved a significant valuation of USD 2.2 billion. This market is poised for substantial expansion, with a projected compound annual growth rate (CAGR) of 12.7% throughout the period spanning from 2020 to 2027. This upward trajectory is driven by a convergence of factors, notably the increasing demand for personalized medicine in the field of oncology. Companion diagnostics play a crucial role in tailoring treatment approaches to individual patients, enhancing the efficacy of therapies while minimizing potential side effects. As medical advancements continue to revolutionize cancer care and treatment paradigms, the global oncology companion diagnostic market stands as a pivotal component in shaping the future landscape of cancer management.

This report is being written to illustrate the market opportunity by region and by segments, indicating opportunity areas for the vendors to tap upon. To estimate the opportunity, it was very important to understand the current market scenario and the way it will grow in future.

Production and consumption patterns are being carefully compared to forecast the market. Other factors considered to forecast the market are the growth of the adjacent market, revenue growth of the key market vendors, scenario-based analysis, and market segment growth.

The market size was determined by estimating the market through a top-down and bottom-up approach, which was further validated with industry interviews. Considering the nature of the market we derived the Health Care Equipment by segment aggregation, the contribution of the Health Care Equipment in Health Care Equipment & Services and vendor share.

To determine the growth of the market factors such as drivers, trends, restraints, and opportunities were identified, and the impact of these factors was analyzed to determine the market growth. To understand the market growth in detail, we have analyzed the year-on-year growth of the market. Also, historic growth rates were compared to determine growth patterns.

The Oncology Companion Diagnostic Market is segmented by Product and Services, Technology, Indication, Sample Types, End User. We are analyzing the market of these segments to identify which segment is the largest now and in the future, which segment has the highest growth rate, and the segment which offers the opportunity in the future.

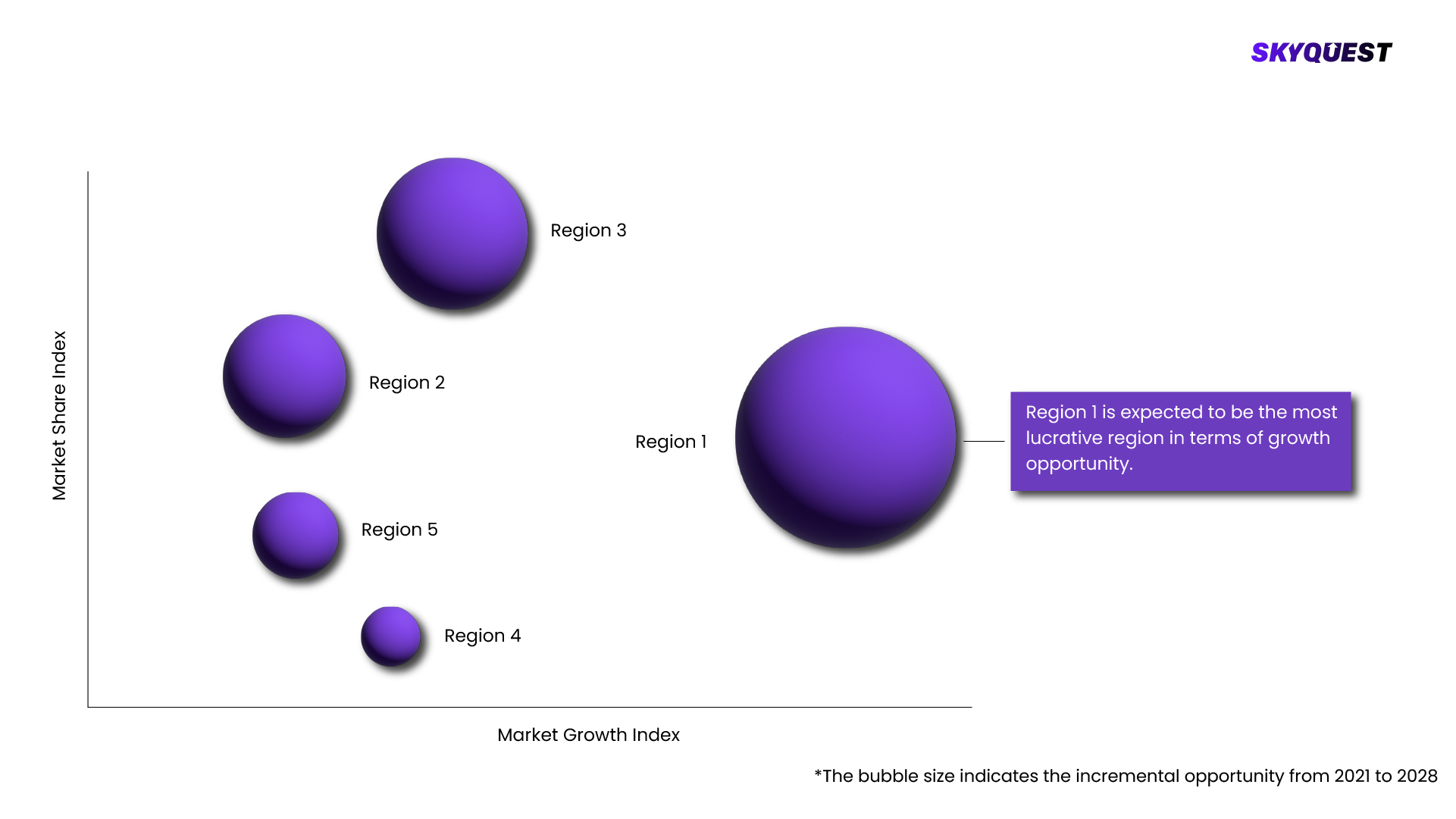

Oncology Companion Diagnostic Market is being analyzed by North America, Europe, Asia-Pacific (APAC), Latin America (LATAM), Middle East & Africa (MEA) regions. Key countries including the U.S., Canada, Germany, France, UK, Italy, Spain, China, India, Japan, Brazil, GCC Countries, and South Africa among others were analyzed considering various micro and macro trends.

SkyQuest's expert analysts have conducted a risk analysis to understand the impact of external extremities on Oncology Companion Diagnostic Market. We analyzed how geopolitical influence, natural disasters, climate change, legal scenario, economic impact, trade & economic policies, social & ethnic concerns, and demographic changes might affect Oncology Companion Diagnostic Market's supply chain, distribution, and total revenue growth.

To understand the competitive landscape, we are analyzing key Oncology Companion Diagnostic Market vendors in the market. To understand the competitive rivalry, we are comparing the revenue, expenses, resources, product portfolio, region coverage, market share, key initiatives, product launches, and any news related to the Oncology Companion Diagnostic Market.

To validate our hypothesis and validate our findings on the market ecosystem, we are also conducting a detailed porter's five forces analysis. Competitive Rivalry, Supplier Power, Buyer Power, Threat of Substitution, and Threat of New Entry each force is analyzed by various parameters governing those forces.

The Oncology Companion Diagnostic Market is being analyzed by SkyQuest's analysts with the help of 20+ scheduled Primary interviews from both the demand and supply sides. We have already invested more than 250 hours on this report and are still refining our date to provide authenticated data to your readers and clients. Exhaustive primary and secondary research is conducted to collect information on the market, peer market, and parent market.

Our cross-industry experts and revenue-impact consultants at SkyQuest enable our clients to convert market intelligence into actionable, quantifiable results through personalized engagement.

| Report Attribute | Details |

|---|---|

| The base year for estimation | 2021 |

| Historical data | 2016 – 2022 |

| Forecast period | 2022 – 2028 |

| Report coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments covered |

|

| Regional scope | North America, Europe, Asia-Pacific (APAC), Latin America (LATAM), Middle East & Africa (MEA) |

| Country scope | U.S., Canada, Germany, France, UK, Italy, Spain, China, India, Japan, Brazil, GCC Countries, South Africa |

| Key companies profiled |

|

| Customization scope | Free report customization (15% Free customization) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Reap the benefits of customized purchase options to fit your specific research requirements. |

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Oncology Companion Diagnostic Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Oncology Companion Diagnostic Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Oncology Companion Diagnostic Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Oncology Companion Diagnostic Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

The market for Oncology Companion Diagnostic was estimated to be valued at US$ XX Mn in 2021.

The Oncology Companion Diagnostic Market is estimated to grow at a CAGR of XX% by 2028.

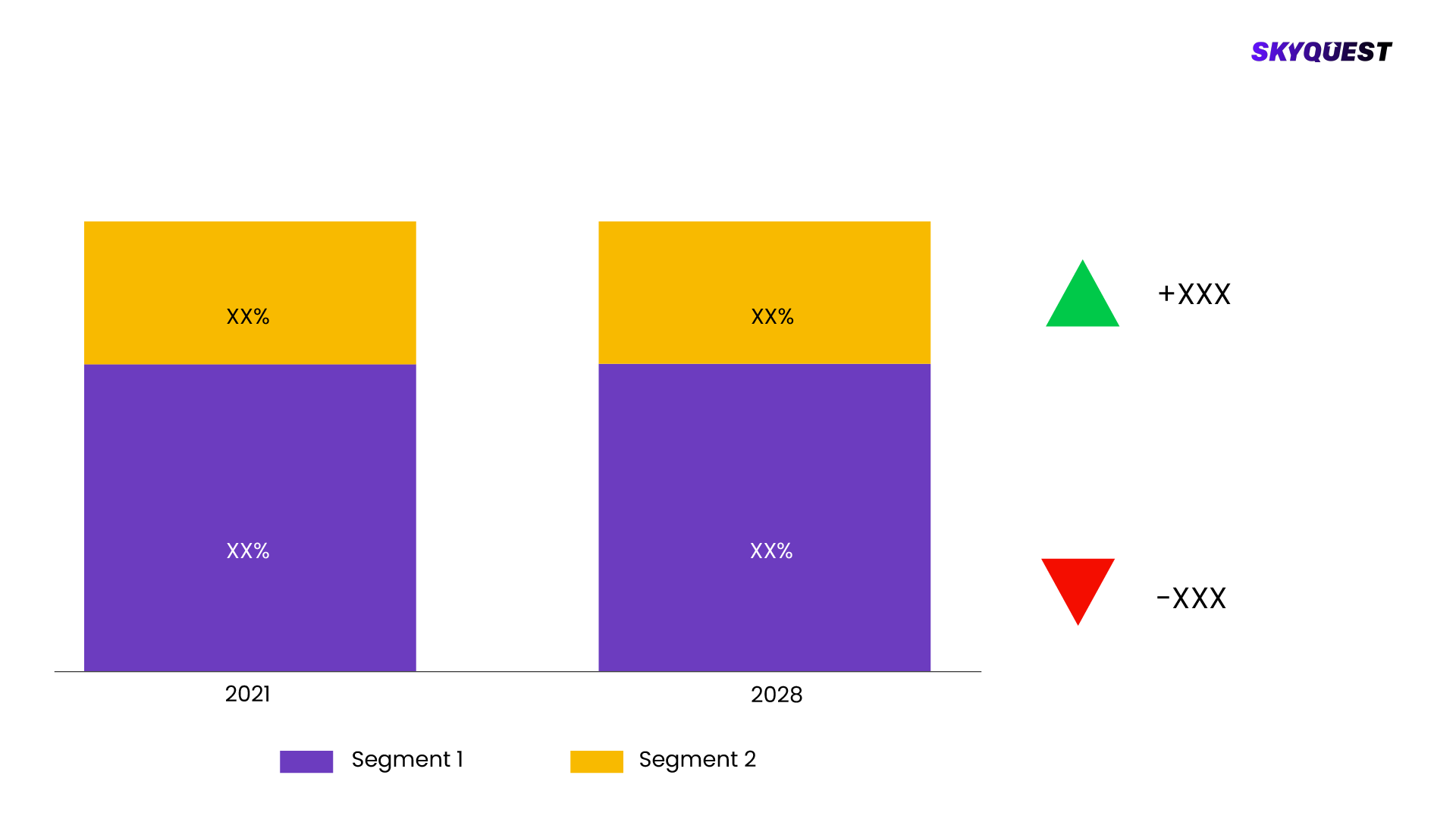

The Oncology Companion Diagnostic Market is segmented on the basis of Product & Service (Revenue, USD Million, 2016 - 2027), Technology (Revenue, USD Million, 2016 - 2027), Disease Type (Revenue, USD Million, 2016 - 2027), End-use (Revenue, USD Million, 2016 - 2027), Regional (Revenue, USD Million, 2016 - 2027).

Based on region, the Oncology Companion Diagnostic Market is segmented into North America, Europe, Asia Pacific, Middle East & Africa and Latin America.

The key players operating in the Oncology Companion Diagnostic Market are rview , The oncology companion diagnostic market size was valued at USD 2.2 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 12.7% from 2020 to 2027. The evolving role of oncology companion diagnostics in the era of next-generation omics is expected to drive the market. The FDA has already approved ten new combinations and single-agent regimens that are being used with a specific CDx assay since January 2020. For instance, in July 2020, the FDA approved the Ventana HER2 Dual ISH DNA Probe Cocktail assay as a quick novel method to detect HER2 biomarker for breast cancer and as a companion diagnostic for Herceptin therapy. Similarly, August 2020 witnessed FDA approvals of Guardant360 CDx assay; an NGS test that uses circulating cell-free DNA as a CDx; and FoundationOne Liquid CDx; a pan-tumor liquid biopsy test. , Economic benefits offered by oncology Companion Diagnostics (CDx) assays coupled with their ability to reduce clinical trial timelines have enhanced the adoption rate of these assays by pharmaceutical manufacturers. Companion diagnostics can enhance treatment effects of different diseases by providing clinicians with clear clinical grounds for diagnosis and treatment, as well as proper management of patient resources and national insurance policies by reducing unnecessary treatment of costly targeted chemotherapy drugs. , Drug and diagnostics co-development models have significantly improved since FDA issued “In Vitro Companion Diagnostic Devices” guidance in 2016 which emphasized the contemporaneous approval of a diagnostic assay along with its corresponding therapeutic product. This allows streamlining research between companies, enabling selection of a lead compound and corresponding biomarker from pharmaceutical and diagnostic companies, respectively. , Therefore, key pharmaceutical and diagnostic developers have collaborated to co-develop drugs and oncology companion diagnostic assays. For instance, in June 2020, ThermoFisher Scientific expanded its partnership with Agios Pharmaceuticals for the co-development of a companion diagnostic for vorasidenib; an investigational drug for low-grade glioma. Similarly, in June 2020, Burning Rock Biotech Limited entered into a strategic partnership with CStone Pharmaceuticals to commercialize and Co-develop CDx for pralsetinib in China. , Product and Service Insights , The product segment accounted for a significant revenue share of 66.0% in 2019 in the market for the oncology companion diagnostics market. The segment is anticipated to grow at a healthy pace during the forecast period owing to the emergence of highly sensitive technologies such as NGS for cancer diagnosis. Leading companies such as Illumina, Roche, and ThermoFisher Scientific are expected to see lucrative growth opportunities in the coming years, as a result of increased use of cancer companion diagnostic equipment due to the rising disease burden across the globe. , Consumables and reagents play a crucial role in maintaining the result reliability of cancer testing through various technologies. Therefore, key players are engaged in the development of consumables for oncology CDx. For instance, in February 2020, Biocare Medical launched seven novel IVD IHC antibody markers. Such initiatives are anticipated to enhance the growth of the consumables segment in the market for oncology companion diagnostics. , Fujifilm Wako Diagnostics, Thermo Fisher Scientific, Sysmex Corporation, Abbott Diagnostics, and Roche Diagnostics are some of the major companies offering reagents for cancer diagnosis, as well as various cancer research products. Similarly, the presence of service providers including Covance, Q2 Solutions, and LabCorp that offer CDx development services is anticipated to propel the growth of the services segment in the market for oncology companion diagnostics. , Technology Insights , Immunohistochemistry (IHC) accounted for the largest revenue share of 60.7% in 2019 owing to the wide availability of IHC-based CDx solutions in the oncology companion diagnostics market. Key players are also continuously engaged in product approvals and launches in the market space, thus propelling segment growth. IHC-based CDx helps in facilitating the rapid drug development process and leads to a high chance of successful approvals. , The adoption of IHC-based oncology companion diagnostic assays tends to aid at every stage of the development process. A wide variety of antibody therapies such as Antibody-Dependent Cell-Mediated Cytotoxicity (ADCC), Antibody Drug Conjugates (ADC), immune checkpoint blockade, and signal transduction blockade utilize the beneficial features of IHC technology as a CDx, thus, aiding in accelerating clinical trials and marketing procedures. , The Next-Generation Sequencing (NGS) segment is projected to grow at the fastest rate over the forecast period in the market for oncology companion diagnostics. This is because NGS-based tools are accurate and can provide detailed information on biomarkers. In addition, NGS-based CDx tests are widely used for Non-small Cell Lung Cancer (NSCLC) diagnosis as these uncover a broad range of actionable driver mutations along with the related therapy options. Owing to this, the market has witnessed the launch of novel NGS-based CDx such as FoundationOne CDx and FoundationFocus CDx BRCA LOH. , Disease Type Insights , Non-small Cell Lung Cancer (NSCLC) dominated the disease type segment with a revenue share of 25.3% in 2019 in the market for oncology companion diagnostics. This is because of a high incidence rate of NSCLC coupled with a rise in the development of oncology companion diagnostic tests for the disease. For instance, In May 2020, FDA approved FoundationOne CDx assay for use with Capmatinib for the treatment of metastatic NSCLC. , The breast cancer segment is anticipated to grow with a lucrative rate over the forecast period in the market for oncology companion diagnostics. Breast cancer is one of the most common types of cancer with a high mortality rate, which, in turn, is driving demand for oncology companion diagnostics for the disease. According to data published by the National Cancer Institute (NIH), in 2019, around 271,270 new cases of cancer were diagnosed in the U.S. and around 42,260 people died due to it. , Furthermore, a favorable reimbursement scenario for novel breast cancer diagnostic solutions in key regions is anticipated to facilitate their adoption. In January 2020, CMS expanded its coverage of NGS as a diagnostic tool for patients with germline (inherited) breast cancer. The growth of the leukemia segment with a substantial rate is attributed to an increase in strategic initiatives by key players for the development and launch of novel NGS and CDx solutions for leukemia diagnosis. , End-use Insights , The hospital segment accounted for the largest share of 52.6% in 2019 in the market for oncology companion diagnostics. Well-equipped facilities, coupled with the presence of a substantial number of skilled healthcare professionals, are anticipated to drive this segment’s growth. In addition, improving healthcare coverage and favorable reimbursement policies for early diagnosis & cancer prevention provided in the U.S. hospitals are expected to contribute to the market share of this segment. , The presence of sensitive and accurate cancer screening and diagnostic tests is expected to boost revenue generation in the pathology/diagnostic laboratory segment. CSI Laboratories, Laboratory Corporation of America Holdings, Quest Diagnostics, Sonic Healthcare Limited, and Bio-Reference Laboratories are some of the leading diagnostic laboratory service providers that offer testing in the market. , The penetration of oncology companion diagnostics is relatively low in academic medical centers owing to lower testing volume for clinical oncology. However, the segment is expected to witness a considerable CAGR throughout the forecast period in the market for oncology companion diagnostics. This is owing to an increase in partnerships of academic centers with diagnostic developers. For instance, QIAGEN has a co-exclusive license with Johns Hopkins University for PCR-based oncology companion diagnostics to detect mutations of the PIK3CA gene. This led to the CE approval of the therascreen PIK3CA RGQ PCR kit in February 2020. , Regional Insights , North America dominated the market for oncology companion diagnostics and accounted for a revenue share of 39.3% in 2019. Funding and grants provided by bodies, such as the National Cancer Institute (NCI), to accelerate precision therapy development are anticipated to positively influence the market in the region. Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) initiatives by NCI are aimed at the promotion and development of novel technologies and products for the prevention, detection, and treatment of cancer. , The presence of effective regulations pertaining to the approval of oncology companion diagnostic tests for cancer coupled with accelerated R&D for integrated and personalized medicine in the U.S. is expected to drive the market over the forecast period. Moreover, several conferences conducted in Canada to improve awareness about the trends and innovations in CDx further supplements this growth. , Key Companies & Market Share Insights , The market for oncology companion diagnostics is marked by the presence of high competition among market players. Roche holds a significant market share owing to its wide portfolio for oncology companion diagnostics. The company also acquired Foundation Medicine in June 2018 which further increased its penetration in the market for oncology companion diagnostics. , KEY MARKET SEGMENTS , By Product & Service (Revenue, USD Million, 2016 - 2027) , Product , Instrument , Consumables , Software , Service , By Technology (Revenue, USD Million, 2016 - 2027) , Polymerase Chain Reaction (PCR) , Next-Generation Sequencing (NGS) , Immunohistochemistry (IHC) , In situ hybridization (ISH)/Fluorescence in situ hybridization (FISH) , Other Technologies , By Disease Type (Revenue, USD Million, 2016 - 2027) , Breast Cancer , Non-Small Cell Lung Cancer , Colorectal Cancer , Leukemia , Melanoma , Prostate Cancer , Others , By End-use (Revenue, USD Million, 2016 - 2027) , Hospital , Pathology/Diagnostic Laboratory , Academic Medical Center , By Regional (Revenue, USD Million, 2016 - 2027) , North America , The U.S. , Canada , Europe , Germany , France , The U.K. , Italy , Spain , Asia Pacific , Japan , China , South Korea , Singapore , Taiwan , Hong Kong , Latin America , Brazil , Mexico , The Middle East and Africa (MEA) , South Africa , Saudi Arabia , KEY PLAYRS , Agilent Technologies, Inc. , Illumina, Inc. , QIAGEN N.V. , Thermo Fisher Scientific, Inc. , F. Hoffmann-La Roche Ltd. , ARUP Laboratories , Abbott , Myriad Genetics, Inc. , bioMérieux SA , Invivoscribe, Inc.".

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients