Report ID: SQMIG35A3045

Report ID: SQMIG35A3045

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG35A3045 |

Region:

Global |

Published Date: May, 2025

Pages:

178

|Tables:

134

|Figures:

71

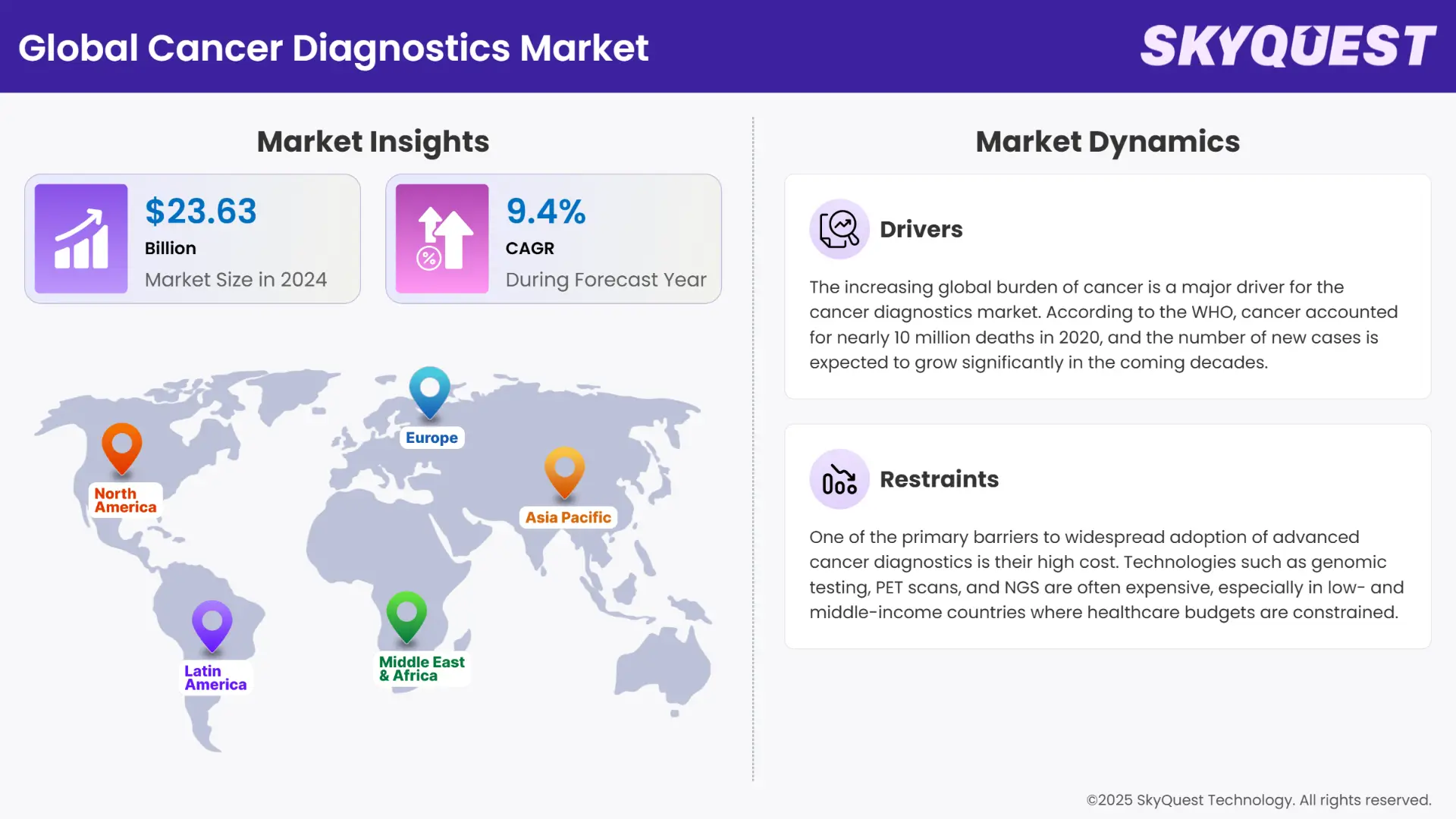

Global Cancer Diagnostics Market size was valued at USD 23.63 Billion in 2024 and is poised to grow from USD 25.85 Billion in 2025 to USD 53.04 Billion by 2033, growing at a CAGR of 9.4% in the forecast period (2026–2033).

The global cancer diagnostics market is undergoing significant transformation driven by advancements in technology, increasing cancer prevalence, and the growing demand for early detection tools. Healthcare systems worldwide are placing stronger emphasis on preventive care and timely diagnosis, which is fueling the adoption of innovative diagnostic methods. Emerging economies are witnessing rising healthcare expenditure and infrastructure development, enabling broader access to cancer diagnostic services. Additionally, collaborations between research institutions, diagnostic companies, and healthcare providers are enhancing the speed and accuracy of cancer detection. The market is also benefiting from increased awareness campaigns and screening programs supported by governments and non-profit organizations. As a result, the cancer diagnostics landscape is becoming more accessible, efficient, and patient-centric, opening new opportunities for growth globally.

The market is driven by the increasing global burden of cancer, necessitating more efficient and accurate diagnostic methods. Technological innovations, including liquid biopsy, next-generation sequencing, and AI-powered imaging tools, are enhancing diagnostic capabilities and expanding their applications. Rising demand for personalized medicine is also pushing the adoption of advanced molecular diagnostics that can identify specific cancer biomarkers. Government initiatives to improve cancer care infrastructure and increase early detection rates further support market growth. Additionally, the growing geriatric population, which is more susceptible to cancer, is contributing to the expanding patient base. Investments in research and development by both public and private entities are accelerating the pace of innovation, ensuring that diagnostic tools evolve to meet emerging clinical needs.

Despite promising growth, the cancer diagnostics market faces several challenges. High costs associated with advanced diagnostic technologies limit access, particularly in low-income regions. A lack of skilled professionals to operate sophisticated diagnostic tools also impedes widespread adoption. Regulatory complexities and lengthy approval processes delay the introduction of new diagnostic products. Furthermore, disparities in healthcare infrastructure between developed and developing regions contribute to unequal access to timely cancer detection. False positives or negatives in some diagnostic tests can lead to misdiagnosis, undermining trust in certain methods. Privacy concerns and limited interoperability of health data systems also pose barriers to implementing data-driven diagnostic solutions on a large scale, slowing the market’s full potential.

Artificial intelligence (AI) is revolutionizing cancer diagnostics by enhancing accuracy, accelerating detection, and enabling personalized care. AI-powered tools analyze medical images, pathology slides, and genomic data with remarkable precision, often surpassing human capabilities. For instance, in Germany, integrating AI into breast cancer screening increased detection rates by 17.6% without raising false positives. Similarly, Google's AI model reduced false negatives by 9.4% and false positives by 5.7% in breast cancer detection. These advancements alleviate radiologists' workloads and facilitate earlier interventions, improving patient outcomes. In India, AI's impact is evident through initiatives like Telangana's pilot program deploying AI-based screening for oral, breast, and cervical cancers across three districts. Additionally, IIT Indore's development of quantum AI nanotechnology enables early and accurate detection of genetic mutations associated with cancer. These innovations demonstrate AI's potential to transform cancer diagnostics, making them more accessible and effective globally.

A groundbreaking AI tool, FaceAge, can estimate a person's biological age using a simple selfie, offering significant implications for cancer prognosis. Unlike chronological age, biological age reflects an individual's physiological condition, influenced by genetics, lifestyle, and environment. By analyzing facial images, FaceAge provides insights into a patient's biological resilience, potentially leading to more accurate cancer prognoses and personalized treatment plans. This technology exemplifies how AI can leverage everyday tools to enhance healthcare outcomes.

To get more insights on this market click here to Request a Free Sample Report

The Global Cancer Diagnostics Market is segmented by Product Type, Technology, Application, End-User Industry and region. Based on Product Type, the market is segmented into Consumables and Instruments. Based on Technology, the market is segmented into IVD Testing, Imaging and Biopsy Technique. Based on Application, the market is segmented into Breast Cancer, Lung Cancer, Colorectal Cancer, Melanoma and Other Cancers. Based on End-User Industry, the market is segmented into Hospitals, Diagnostic Laboratories and Others. Based on region, the market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa.

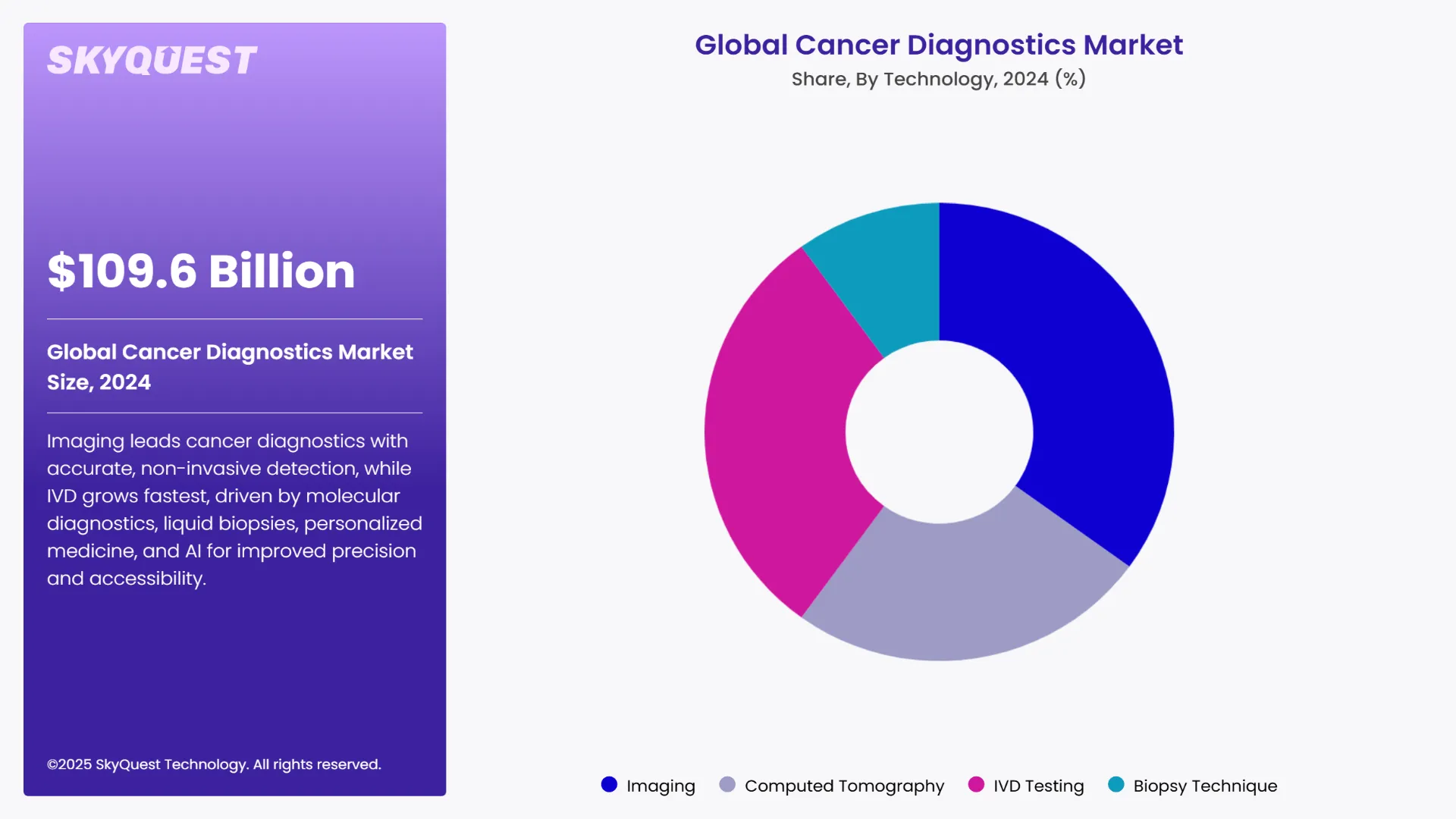

As per the 2024 global market analysis for Cancer Diagnostics, the imaging technology segment led the market by holding the largest share. The rapid growth of this segment is primarily driven by its broad application in detecting multiple cancer types with high accuracy and non-invasive procedures. Imaging techniques such as MRI, CT scans, and PET scans have become indispensable in clinical settings, enabling early detection and improved patient outcomes. In 2024, imaging remained the preferred diagnostic approach due to its ability to visualize tumors clearly and guide treatment decisions, contributing significantly to market revenue.

As per the 2024 global market analysis for Cancer Diagnostics, the In Vitro Diagnostics (IVD) segment is the fastest-growing technology in the market. This rapid growth is primarily fueled by advancements in molecular diagnostics, liquid biopsies, and genetic testing, which allow for early, minimally invasive cancer detection. The rising demand for personalized medicine is also accelerating this trend, as IVD enables tailored treatment plans based on a patient’s genetic profile. Furthermore, the integration of AI technologies in IVD testing enhances accuracy and accessibility, making these tests more efficient and widely adoptable.

For instance, in 2024, Guardant Health expanded Medicare coverage for its blood-based cancer tests, significantly increasing patient access to liquid biopsy diagnostics, marking a major milestone in the IVD segment’s growth.

To get detailed segments analysis, Request a Free Sample Report

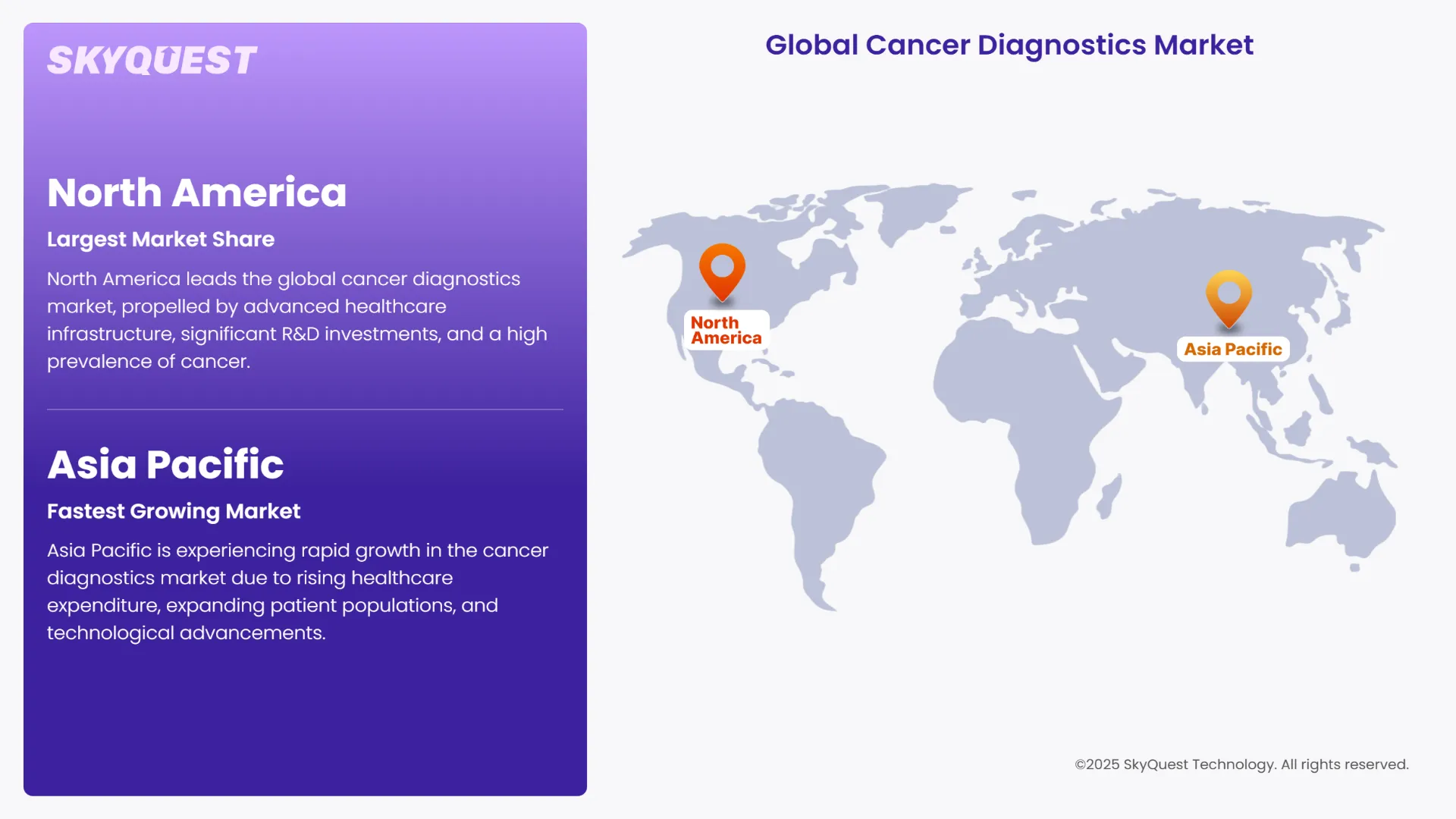

North America leads the global cancer diagnostics market, propelled by advanced healthcare infrastructure, significant R&D investments, and a high prevalence of cancer. The region's dominance is further strengthened by the presence of major market players and supportive government initiatives.

The United States Cancer Diagnostics Market

The U.S. commands the largest share in North America's cancer diagnostics market, driven by increasing awareness programs, a high prevalence of cancer, and a favorable reimbursement and regulatory landscape that adapts to rapid research progress.

Canada Cancer Diagnostics Market

Canada's cancer diagnostics market benefits from robust research institutions like the Ontario Institute for Cancer Research (OICR), which hosts resources such as the Ontario Tumor Bank and the Canadian Cancer Clinical Trials Network.

Asia Pacific is experiencing rapid growth in the cancer diagnostics market due to rising healthcare expenditure, expanding patient populations, and technological advancements. Government initiatives and collaborations with international players are enhancing the availability of sophisticated diagnostic equipment.

Japan Cancer Diagnostics Market

Japan's cancer diagnostics market is projected to reach USD 3.6 billion by 2033, with a CAGR of 12.2% from 2025 to 2033. The country's focus on precision medicine and early detection is driving demand for advanced diagnostic technologies.

South Korea Cancer Diagnostics Market

South Korea's cancer diagnostics market is bolstered by companies like Samsung Biologics, which partners with global pharmaceutical firms to develop and manufacture cancer therapies, enhancing the country's diagnostic capabilities.

Europe maintains a strong position in the cancer diagnostics market, supported by established healthcare systems and increasing awareness of cancer. The region's growth is driven by investments in advanced technologies and initiatives promoting precision diagnostics.

Germany Cancer Diagnostics Market

Germany leads Europe's cancer diagnostics market, attributed to its high adoption of advanced technologies, established healthcare systems, and significant investments in cancer research.

United Kingdom Cancer Diagnostics Market

The UK's cancer diagnostics market is evolving with the integration of AI in healthcare. The NHS is launching AI-enabled initiatives for breast screening to reduce waiting times, while private health scanning services are growing as more consumers seek quicker and more convenient services.

France Cancer Diagnostics Market

France's cancer diagnostics market is advancing through collaborations between public and private sectors, focusing on the development and implementation of innovative diagnostic solutions to improve early detection and treatment outcomes.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

Rising Cancer Incidence Worldwide

Advancements in Diagnostic Technologies

High Cost of Advanced Diagnostics

Regulatory and Approval Challenges

Request Free Customization of this report to help us to meet your business objectives.

The cancer diagnostics market is experiencing dynamic shifts, with companies adopting innovative strategies to gain a competitive edge. Guardant Health has expanded its market reach by securing Medicare coverage for its colon cancer blood test, Guardant Reveal, leading to a significant stock surge and positioning the company as a leader in blood-based cancer detection. Exact Sciences is intensifying competition by developing a blood test that detected 88.3% of cancers and 31.2% of advanced adenomas in a study, potentially surpassing Guardant's offerings. Meanwhile, startups like Dxcover and Quibim are introducing AI-driven diagnostics and imaging biomarkers, respectively, aiming to disrupt traditional diagnostic methods and offer more precise, early detection solutions.

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected using Primary Exploratory Research backed by robust Secondary Desk research.

SkyQuest’s study suggests that the cancer diagnostics market is experiencing strong growth, primarily driven by the rising global cancer burden, which is pushing demand for early and accurate detection solutions. However, high costs associated with advanced diagnostics and regulatory hurdles pose significant restraints, particularly in low-resource settings. North America dominates the market due to its robust healthcare infrastructure and heavy R&D investments. Among diagnostic methods, imaging continues to lead due to its wide application in detecting various cancer types. Another key driver is the integration of artificial intelligence (AI), which is enhancing diagnostic precision and efficiency. Initiatives like Telangana’s AI-based screening and Medicare’s coverage for Guardant Reveal exemplify how innovation and policy are shaping the market’s future.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 23.63 Billion |

| Market size value in 2033 | USD 53.04 Billion |

| Growth Rate | 9.4% |

| Base year | 2024 |

| Forecast period | 2026-2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Cancer Diagnostics Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Cancer Diagnostics Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Cancer Diagnostics Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Cancer Diagnostics Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients