Report ID: SQMIG45K2160

Report ID: SQMIG45K2160

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG45K2160 |

Region:

Global |

Published Date: July, 2025

Pages:

192

|Tables:

123

|Figures:

72

Global LiDAR Market size was valued at USD 3.03 Billion in 2024 and is poised to grow from USD 3.32 Billion in 2025 to USD 6.91 Billion by 2033, growing at a CAGR of 9.6% during the forecast period (2026–2033).

LiDAR provides precise distance measurements and high-resolution 3D mapping, ensuring the safe and efficient navigation of self-driving cars. According to a National Highway Traffic Safety Administration (NHTSA) report, advancements in autonomous vehicle technology are primarily responsible for the increasing use of LiDAR systems. By allowing cars to detect obstacles, pedestrians, and other vehicles, these sensors enhance advanced driver assistance systems (ADAS) and make fully autonomous driving possible. Furthermore, integrating LiDAR with complementary sensing technologies like cameras and radar has significantly expanded the capabilities of these systems. This development has sped up adoption across a variety of industries, including robotics, agriculture, and the automotive sector.

Moreover, due to technological advancements, the global LiDAR industry is growing rapidly. Innovations like solid-state LiDAR and advancements in sensor accuracy and resolution are enhancing the capabilities of LiDAR systems. For instance, Luminar unveiled Luminar Halo, a next-generation LiDAR, in April 2024. It boasts revolutionary enhancements like a 4x performance boost, a 3x size reduction, and a cost reduction of more than 2x. With this new technology, which is meant to be widely used, LiDAR's performance and integration have greatly improved. These developments make it possible to collect data more accurately and consistently, which is essential for applications in aerial mapping, driverless cars, and environmental monitoring. Additionally, LiDAR's integration with AI and machine learning is streamlining data processing and analysis, boosting the technology's versatility and efficacy across a range of sectors.

How are Real-World Applications Driving AI Integration in LiDAR?

By facilitating autonomous systems' ability to locate, categorize, and comprehend objects and scenes, artificial intelligence is revolutionizing the LiDAR market outlook. Drones, self-driving cars, and smart infrastructure are increasingly using AI-powered LiDAR systems to help people make decisions in real time and be more aware of their surroundings. Together, Nvidia and Hesai Technologies developed state-of-the-art self-driving systems in 2024 by fusing advanced LiDAR sensors with AI algorithms. In 2025, Seoul, South Korea, also integrated Velodyne's AI-enabled LiDAR into its intelligent traffic control systems. This enhanced signal timing and traffic flow. These practical implementations demonstrate how AI is increasing the efficiency and scalability of LiDAR applications in the transportation and city planning domains, making them smarter, faster, and more accurate. This results in global LiDAR market growth.

To get more insights on this market click here to Request a Free Sample Report

The global LiDAR market is segmented into component, type, end user, application, and region. By component, the market is classified into GPS GNSS, laser, inertial navigation system, camera, and micro electro mechanical system. Depending on type, it is divided into terrestrial, mobile, short range, and aerial. According to end user, the market is categorized into archaeology, forestry & agriculture, mining, transportation, civil engineering, and defense & aerospace. As per the application, it is fragmented into seismology, exploration & detection, and corridor mapping. Regionally, it is analyzed across North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa.

How Does LiDAR Enhance Corridor Mapping for Infrastructure Projects?

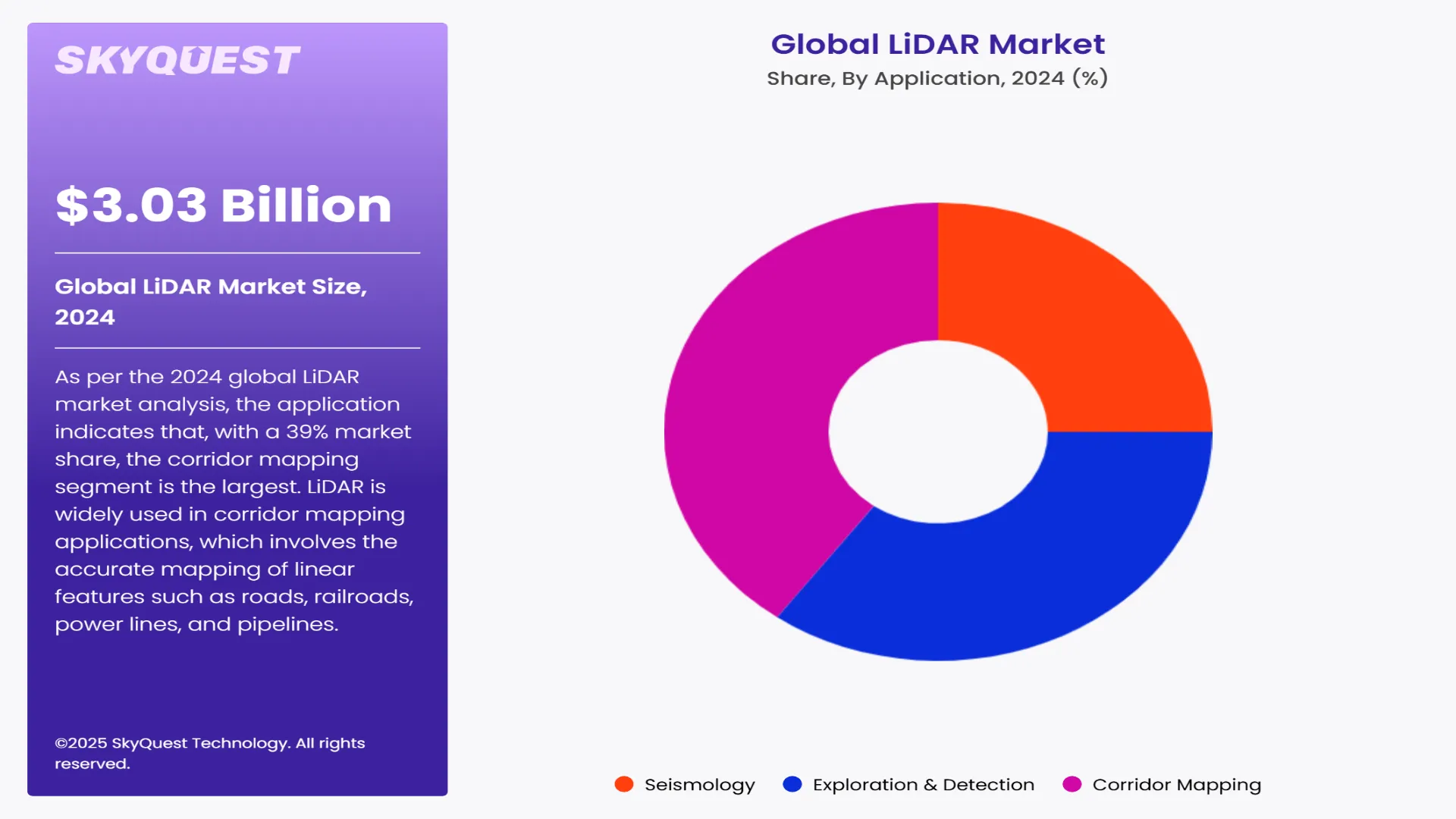

As per the 2024 global LiDAR market analysis, the application indicates that, with a 39% market share, the corridor mapping segment is the largest. LiDAR is widely used in corridor mapping applications, which involves the accurate mapping of linear features such as roads, railroads, power lines, and pipelines. Project planning, maintenance, and infrastructure development all depend on the accurate, high-resolution data that LiDAR-assisted corridor mapping provides.

The exploration & detection segment is anticipated to expand at a 14.1% CAGR during the forecast period. LiDAR is used for both exploration and detection in a wide range of industries. In fields like mining, archaeology, and natural resources exploration, LiDAR aids in mapping terrains, identifying geological features, and locating hidden structures. It improves the efficiency of exploration efforts and facilitates the discovery of valuable resources.

How is LiDAR Being Used in Civil Engineering Projects Today?

Based on the 2024 global LiDAR market forecast, with 45% of the market, the civil engineering segment had the biggest share based on end users. Civil engineering is a significant LiDAR end-user industry. Applications of the technology in civil engineering include surveying, infrastructure planning, topographic mapping, and construction monitoring. LiDAR makes it easier to create accurate and thorough models of terrain and structures.

The forestry & agriculture segment is anticipated to expand at a compound annual growth rate (CAGR) of 8.3% during the forecast period. Because LiDAR provides detailed information on crop conditions, vegetation health, and forests, it is crucial to both agriculture and forestry. LiDAR is used in forestry for inventory, canopy analysis, and monitoring changes over time. In agriculture, LiDAR aids in precision farming and crop management.

To get detailed segments analysis, Request a Free Sample Report

How is North America Leading the LiDAR Revolution in Autonomous Mobility?

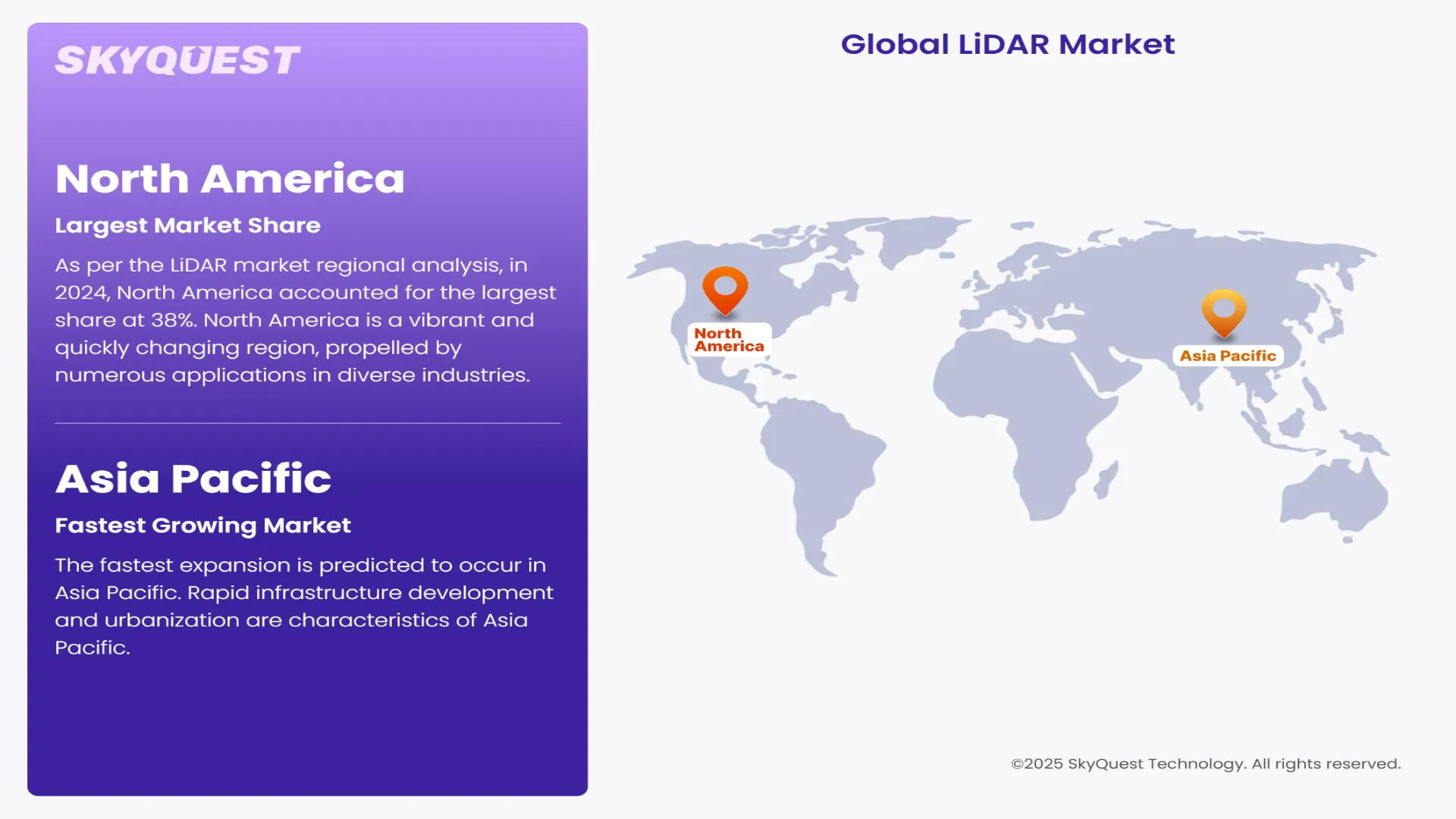

As per the LiDAR market regional analysis, in 2024, North America accounted for the largest share at 38%. North America is a vibrant and quickly changing region, propelled by numerous applications in diverse industries. The development and testing of autonomous vehicles have been a major driver of the LiDAR market in North America, and the region has seen a significant increase in the adoption of LiDAR. For self-driving cars to navigate safely, real-time mapping and object detection are critical functions of LiDAR sensors.

US LiDAR Market

The LiDAR sector in the United States is valued at USD 659.9 million in 2024. This resulted from its extensive application in environmental mapping, smart infrastructure, and self-driving automobiles. In late 2024, a significant OEM selected Aeva's 4D LiDAR technology to evaluate the navigation and safety of autonomous cars. Due to increased federal investments in high-resolution mapping for defense sensing and urban planning, the U.S. market is expanding significantly faster.

Canada LiDAR Market

The LiDAR market in Canada is predicted to reach a valuation of USD 72.14 million by 2025 due to demand from forestry, environmental monitoring, and urban planning. Recent aerial and ground-based LiDAR applications have contributed to the increased resilience of smart city infrastructure. High-resolution mapping initiatives are receiving increased funding from the federal and provincial governments in an effort to enhance environmental monitoring and resource management. This indicates that geospatial technology is gaining traction in Canada's business and public sectors.

Why is Asia Pacific Emerging as the Fastest-Growing Region in the LiDAR Market?

The fastest expansion is predicted to occur in Asia Pacific. Rapid infrastructure development and urbanization are characteristics of Asia Pacific. The need for LiDAR solutions is fueled by the importance of LiDAR technology for smart city projects, urban planning, and effective infrastructure development. Geological surveys, forestry, and environmental monitoring are among the other natural resource management applications for LiDAR. LiDAR is useful for evaluating and managing natural resources in the region because of its varied landscapes and ecosystems.

South Korea LiDAR Market

The LiDAR market in South Korea is valued at approximately USD 46.79 million in 2025. Self-driving cars, smart cities, and robots were the causes of this. Smart logistics hubs are utilizing AI-integrated scanning systems from companies like Seoul Robotics as LiDAR sensors for consumers become more reasonably priced. Government-sponsored infrastructure tests also encourage more people to use LiDAR systems for industrial automation, traffic monitoring, and public safety.

Japan LiDAR Market

In 2025, the LiDAR market in Japan will be valued at USD 53.81 million. This is due to the rapid growth of rail systems, precision surveying, and smart manufacturing. Powerful 4D LiDAR units designed for factory automation and next-generation logistics were released in 2024 by AEye and other companies. Japan is strategically focused on integrating high-resolution sensor technology, as evidenced by the demand from industrial automation projects and government smart city pilots.

What’s Driving Europe’s Growth in LiDAR Adoption Across Diverse Industries?

Europe has been expanding due to its emphasis on technological innovation and its wide range of industrial applications. It has taken an active part in the creation and testing of autonomous vehicles, including those that travel on roads and in the air. The LiDAR market is expanding as a result of LiDAR technology's critical role in supplying the sensing capabilities required for safe navigation.

UK LiDAR Market

By 2025, the UK LiDAR market is anticipated to grow to a value of USD 79.16 million. This is due to the fact that it will be utilized for tasks like monitoring infrastructure, planning cities, and testing automobiles. Pilot projects for mapping smart cities in British cities and validating self-driving cars are made possible by Aeva and AEye's OEM trials with 4D sensing systems. This increase is consistent with government initiatives to promote the development of digital twins and intelligent transportation networks.

France LiDAR Market

The LiDAR market in France is valued at USD 43.35 million in 2025. It aided in projects like environmental planning, urban mapping, and industrial automation. LiDAR scans mounted on vehicles and aircraft gained popularity in 2024 as a result of government investments in digital twins and flood mapping. Sub-meter 3D data is increasingly being used by French city planners and engineering firms to create smart cities and strengthen infrastructure.

Germany LiDAR Market

By 2025, the German LiDAR market is projected to be valued at USD 93.30 million. Industry 4.0 initiatives, smart infrastructure, and automotive validation are primarily to blame for this. 4D LiDAR systems are being used by German OEMs for vehicle testing and production. Sensors are also being used by cities to inspect buildings and control traffic. The widespread adoption of high-precision sensor technologies is further accelerated by government incentives for digital twin infrastructure.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

LiDAR Market Drivers

Rising Use of LiDAR in Self-Driving Cars

More Beneficial for Infrastructure and City Planning

LiDAR Market Restraints

High Costs of LiDAR Systems

Challenge of Data Processing

Request Free Customization of this report to help us to meet your business objectives.

The market is highly competitive, and both new startups and well-established companies are vying for LiDAR market share. Most of the key players focus on partnerships, Research & Development expenditures, and joint ventures with the automotive and aerospace industries. In 2024, Velodyne Lidar and Ouster teamed up to bring efficiency to their product lines and propel their binding into other markets. Established companies are lowering their manufacturing costs and sensor performance to give them an edge on their competition. Start-ups focus on niche markets like precision farming and drones.

Top Player’s Company Profile

Recent Developments in LiDAR Market

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected by means of Primary Exploratory Research backed by robust Secondary Desk research.

As per SkyQuest analysis, due to its increasing applications in self-driving cars, infrastructure construction, environmental monitoring, and the military, the global LiDAR market is expanding rapidly. Changes from technological innovations are shaking the roots with smaller and more accurate solutions that are less expensive and easier to use, like solid-state LiDAR technology with AI. Still, the issue of expensive systems and overall complexity of processing data also remains. The market is progressively becoming congested as larger entities are merging, newer ones are starting up, and more niche ideas are evolving. The governments of the two fastest-growing regions, North America and Asia-Pacific, are heavily investing in smart city planning and transportation. LiDAR is probably going to be a significant sensing technology as companies move toward automation and data-driven operations. In many fields, this will lead to new opportunities for intelligence, efficiency, and safety.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 3.03 Billion |

| Market size value in 2033 | USD 6.91 Billion |

| Growth Rate | 9.6% |

| Base year | 2024 |

| Forecast period | 2026-2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the LiDAR Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the LiDAR Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the LiDAR Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the LiDAR Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients