Report ID: SQMIG15E2738

Report ID: SQMIG15E2738

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG15E2738 |

Region:

Global |

Published Date: May, 2025

Pages:

196

|Tables:

71

|Figures:

75

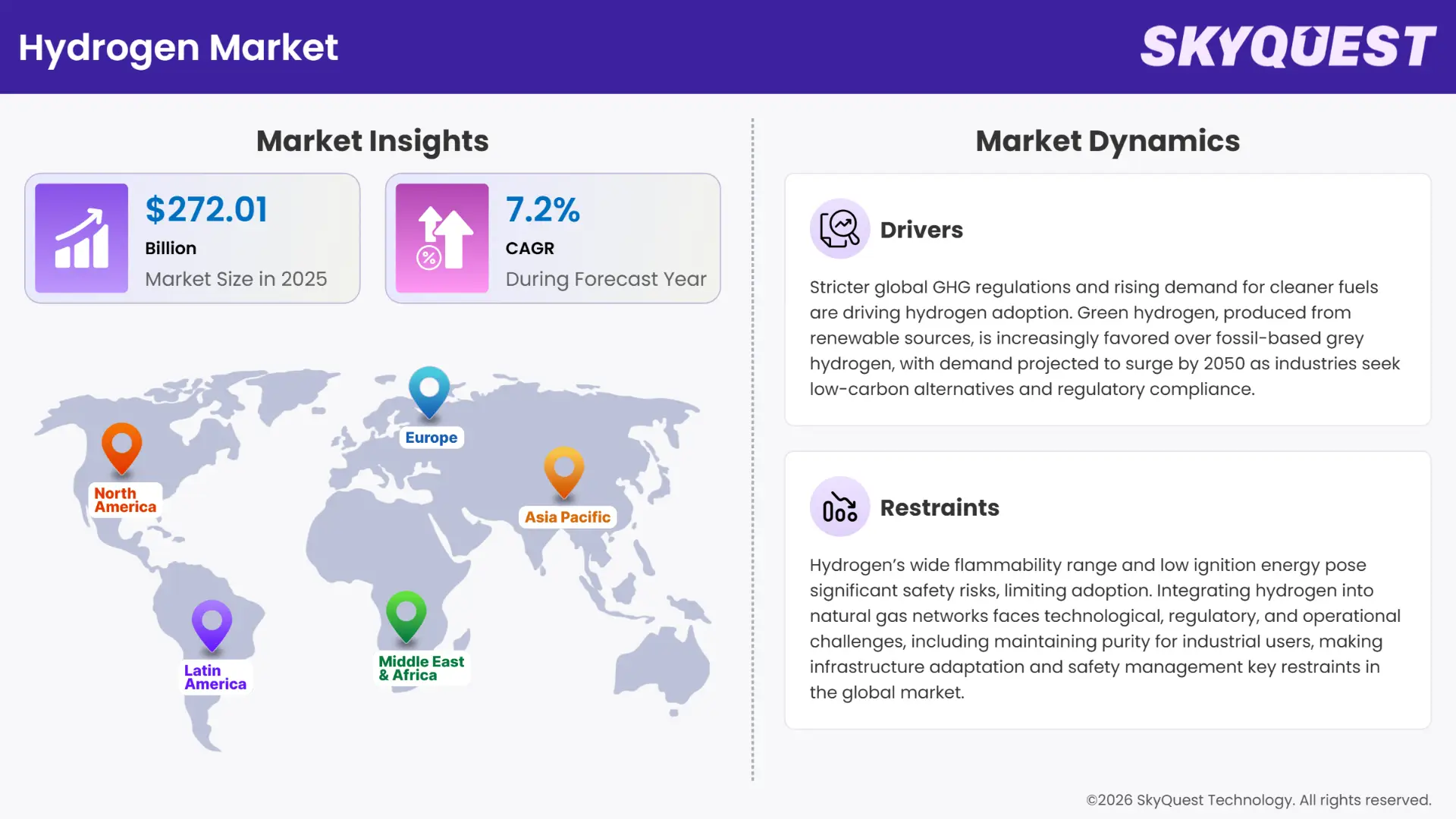

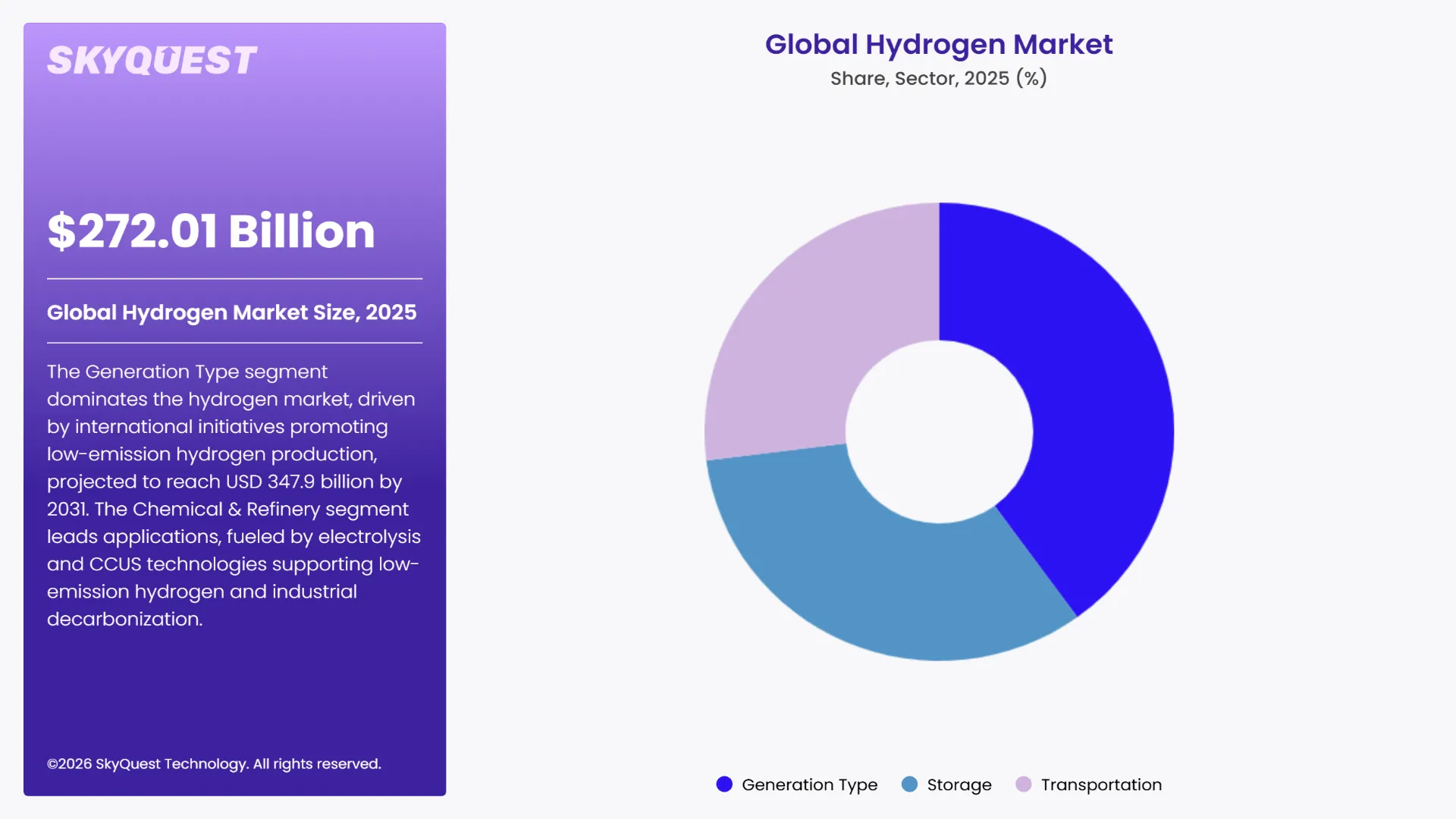

Global Hydrogen Market size was valued at USD 253.74 Billion in 2024 and is poised to grow from USD 272.01 Billion in 2025 to USD 474.4 Billion by 2033, growing at a CAGR of 7.2% during the forecast period (2026–2033).

The growth is driven by increasing demand for clean energy solutions and technological advancements. The market is forecast to grow at a strong CAGR until the end of the forecast, thanks to hydrogen being seen as a major factor in meeting global decarbonization goals. Results from our analysis indicate that government steps and incentives, along with significant investment in hydrogen infrastructure, strongly affect the shape of the market. Further improvements in production, including electrolysis and steam methane reforming, help this market to prosper.

Because its use has expanded into transportation, industries and storing energy, hydrogen is becoming increasingly important in moving towards a greener future. Opportunities and challenges are visible in the market, as continuous innovations are expected to guide future trends.

Can growing investments in hydrogen infrastructure drive large-scale adoption?

The increasing global investments in hydrogen infrastructure are significantly boosting the market’s growth. Governments and private players are investing heavily in electrolyzers, hydrogen refueling stations, and transportation pipelines to foster a hydrogen-based economy. Countries like Germany, Japan, and South Korea have introduced national hydrogen strategies to decarbonize industries and transportation. This infrastructure development is crucial in creating a reliable supply chain, which is necessary for mass adoption. With rising concerns over energy security and fossil fuel dependency, hydrogen offers a clean, scalable alternative.

In April 2024, Air Liquide and TotalEnergies partnered to launch one of Europe’s largest renewable hydrogen production sites in Normandy, France. The facility, with an initial capacity of 30,000 tons per year, will help decarbonize TotalEnergies’ nearby refinery and other industrial operations in the region.

Will industrial decarbonization accelerate hydrogen demand?

Hard-to-abate sectors like steelmaking, cement, chemicals, and heavy-duty transport are increasingly turning to hydrogen as a key solution for cutting carbon emissions. Green hydrogen, produced using renewable energy, enables these sectors to transition from fossil fuels without compromising output. For instance, the steel industry—accounting for 7–9% of global CO₂ emissions—is now piloting hydrogen-based direct reduction methods. As regulatory pressure and carbon pricing mechanisms intensify, hydrogen's role in industrial decarbonization will likely become indispensable.

To get more insights on this market click here to Request a Free Sample Report

The global hydrogen market is segmented by Sector, Application and region. Based on Sector, the market is segmented into Generation Type (Gray Hydrogen, Blue Hydrogen, Green Hydrogen), Storage (Physical, Material-based), Transportation (Long Distance, Short Distance). Based on Application, the market is segmented into Energy (Power Generation, Combined Heat and Power (CHP)), Mobility, Chemical & Refinery (Combined Heat and Power (CHP), Ammonia Production, Methanol Production), Others. Based on region, the market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa.

The Generation Type segment is currently the dominating segment in the global market. This segment recorded a market value of USD 199.4 billion in 2023 and is projected to grow significantly, reaching USD 347.9 billion by 2031, with a robust Compound Annual Growth Rate (CAGR) of 7.3%. The dominance of this segment is attributed to several key factors that are driving hydrogen market growth. The generation type segment's prominence is largely driven by international cooperation initiatives aimed at fostering low-emission hydrogen production. These initiatives, involving governments and companies worldwide, are expected to create a demand of 0.8-3 million tons of low-emission hydrogen by 2030.

Although the actual impact of these initiatives remains to be fully realized, their focus on new applications of hydrogen, particularly in energy generation, positions the Generation Type segment for continued growth. The lack of dedicated coalitions for the chemical and refining sectors further highlights the importance of hydrogen generation for these new applications, reinforcing the segment's dominance.

In 2023, the Chemical & Refinery segment dominated the market, recording a substantial USD 161.5 billion. This dominance is expected to persist, with projections indicating that the segment will reach USD 280.3 billion by 2031, achieving a robust Compound Annual Growth Rate (CAGR) of 7.3%. This growth is underpinned by several critical factors, making the Chemical & Refinery segment a central driver in the global hydrogen market.

The Chemical & Refinery segment's dominance can be attributed to the expanding number of projects focused on low-emission hydrogen production. With an annual production capacity of low-emission hydrogen expected to reach 38 million tons by 2030, the segment benefits significantly from this surge. Notably, 17 million tons of this capacity come from projects in the early stages of development. The potential production from announced projects by 2030 is 50% larger than projections from the previous year, as per SkyQuest in-depth study, we found that the rapid growth in low-emission hydrogen production is primarily driven by advancements in electrolysis technology and carbon capture, utilization, and storage (CCUS), which are integral to the Chemical & Refinery segment. The implementation of these technologies is crucial for producing low-emission hydrogen, which is essential for reducing the carbon footprint of chemical and refinery operations.

To get detailed segments analysis, Request a Free Sample Report

The Asia-Pacific region continues to lead the global hydrogen market share, driven by robust government policies, substantial investments, and technological advancements. Countries like China, Japan, South Korea, and India are at the forefront, promoting hydrogen as a clean energy source to decarbonize various sectors, including transportation and industry. The region's commitment is evident through national hydrogen strategies, infrastructure development, and international collaborations. For instance, China plans to have over 1,000 hydrogen refueling stations by 2030, while Japan aims for 800,000 fuel cell vehicles on the road by the same year.

Japan Hydrogen Market

Japan’s hydrogen market demand is shaped by the country’s energy security concerns and the need to reduce reliance on fossil fuels. The Japanese government’s support, through initiatives like the Basic Hydrogen Strategy, has fostered significant investments in hydrogen production technologies, particularly those based on renewable energy. The focus on Generation Type dominance is clear as Japan aims to integrate hydrogen into its energy mix, aligning with its long-term energy security and decarbonization goals. The industrial demand for hydrogen, especially in sectors like steel and chemicals, further drives market growth. Japan’s strategic approach ensures that hydrogen will play a central role in its energy future.

South Korea Hydrogen Market

South Korea’s hydrogen market growth is expanding rapidly, driven by the government’s energy transition goals and efforts to reduce air pollution. The South Korean government’s support, through policies and financial incentives, has led to significant investments in hydrogen production technologies, particularly green hydrogen. The focus on Generation Type dominance is evident as South Korea aims to integrate hydrogen into its energy system, aligning with its long-term energy and environmental goals. The industrial demand for hydrogen, especially in sectors like steel and chemicals, is a key driver of market growth. Industry giants are investing in hydrogen projects to reduce their carbon footprint and enhance energy efficiency. The strategic emphasis on hydrogen within these sectors is key to South Korea’s energy transition, supporting the country’s commitment to reducing greenhouse gas emissions and achieving industrial sustainability.

North America is experiencing rapid growth in the hydrogen market share, propelled by supportive policies, technological innovation, and substantial investments. The U.S. and Canada are focusing on developing hydrogen infrastructure, production capabilities, and applications across various industries. The U.S. National Clean Hydrogen Strategy and Roadmap outlines plans to advance clean hydrogen to contribute to national decarbonization goals.

U.S. Hydrogen Market

The United States hydrogen market growth is rapidly advancing due to a strategic focus on integrating renewable energy sources like wind and solar into hydrogen production. Federal policy support, including tax incentives and substantial research funding, has catalyzed the growth of green hydrogen initiatives across the country. The US government’s commitment to achieving net-zero emissions by 2050 has further accelerated investments in hydrogen production technologies, positioning the Generation Type segment, particularly green hydrogen, at the forefront. The government's focus on decarbonization and clean energy has fostered initiatives such as the Department of Energy's Hydrogen Shot, aiming to reduce hydrogen costs and boost adoption. Major industry players are investing in blue and green hydrogen projects, aligning with the nation's broader energy transition goals.

Canada Hydrogen Market

Canada’s hydrogen market demand is largely driven by its abundant renewable energy resources, particularly hydropower and wind, which provide a strong foundation for green hydrogen production. The Canadian government’s proactive approach, including substantial investments in research and infrastructure, is aimed at developing a sustainable hydrogen economy. Initiatives such as the Hydrogen Strategy for Canada emphasize the role of hydrogen in achieving the country’s climate goals, particularly in decarbonizing industries and transportation. The Canadian government’s Hydrogen Strategy highlights the potential of green hydrogen, leveraging the country’s vast renewable energy resources. Leading companies are exploring hydrogen production and storage solutions to enhance energy security and reduce greenhouse gas emissions. This focus on hydrogen, particularly in the chemical and refinery sectors, aligns with Canada’s ambitious climate targets and drives the growth of a sustainable hydrogen economy, making the country a global leader in low-carbon hydrogen technologies.

Europe is actively developing its hydrogen market growth, focusing on green hydrogen to achieve climate neutrality. The European Union's Hydrogen Strategy aims to install at least 40 GW of renewable hydrogen electrolyzers by 2030. Countries like Germany and Spain are leading with significant investments and projects.

Germany Hydrogen Market

Germany's hydrogen market growth is at the core of the country's ambitious energy transition goals, which include a significant reduction in fossil fuel dependency. The industrial demand, especially from sectors like steel and chemicals, has driven substantial investments in hydrogen production, particularly green hydrogen derived from renewable energy sources. The German government’s financial support and policy incentives, such as the National Hydrogen Strategy, are crucial in promoting these developments.

France Hydrogen Market

France’s hydrogen market demand is deeply intertwined with its vast renewable energy resources, including solar and wind, which are pivotal for green hydrogen production. The French government’s initiatives, such as the National Hydrogen Plan, have significantly boosted research and infrastructure investments, aiming to establish a sustainable hydrogen economy. The focus on Generation Type dominance is evident as France leverages its renewable energy potential to drive hydrogen production, aligning with its climate goals. The French government's ambitious Hydrogen Plan aims to develop a robust hydrogen economy by investing in green hydrogen projects and infrastructure. Industry leaders are collaborating on large-scale hydrogen production facilities, aligning with France’s energy transition objectives.

United Kingdom Hydrogen Market

The United Kingdom’s hydrogen market share is advancing rapidly, driven by the government’s commitment to reducing carbon emissions and transitioning to a low-carbon economy. The UK’s industrial sector, particularly in steel and chemicals, is increasingly reliant on hydrogen, which has led to significant investments in green hydrogen production. The UK's hydrogen market is primarily propelled by the chemical and refinery sectors, where hydrogen is critical for refining processes and chemical manufacturing. The UK government's Hydrogen Strategy aims to position the country as a global leader in hydrogen production, particularly focusing on blue hydrogen. Key industry players are investing in hydrogen technologies to decarbonize industrial processes, reducing the sector's carbon footprint.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

Increased regulations on greenhouse gas (GHG) emissions

Rising demand for cleaner fuels

Recognized for its potential as a clean energy carrier

Integrating hydrogen into existing natural gas networks

Request Free Customization of this report to help us to meet your business objectives.

In the global hydrogen market, partnerships and collaborations are crucial for the global hydrogen market's ecosystem. Our study also reveals that these alliances drive technological advancements, scale production, and expand market reach. Companies are joining forces with research institutions and industrial partners to enhance hydrogen production technologies and infrastructure. Strategic collaborations, such as those between energy firms and technology innovators, facilitate the development of green hydrogen solutions and accelerate the deployment of hydrogen fuel cells. This cooperative approach is pivotal in overcoming cost and scalability challenges, thus shaping a robust and dynamic hydrogen market landscape.

Acquisitions and mergers are significantly shaping the ecosystem of the global hydrogen market. Major players are strategically acquiring smaller firms and startups to enhance their technological capabilities and market reach. This trend is driven by the need to consolidate resources and accelerate innovation in hydrogen production, storage, and distribution technologies. Our study also reveals that these strategic moves enable companies to access advanced technologies and diversify their portfolios. For instance, large energy firms are merging with tech startups specializing in electrolysis and hydrogen fuel cells to bolster their green energy initiatives. This consolidation not only strengthens their market position but also fosters collaboration across the hydrogen value chain, driving overall market growth and technological advancements. The trend reflects a broader industry shift towards integrated solutions and competitive consolidation in the rapidly evolving hydrogen sector.

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected using Primary Exploratory Research backed by robust Secondary Desk research.

As per SkyQuest analysis, The Global Hydrogen Market is poised for substantial growth, driven by the increasing focus on sustainable energy solutions and the global commitment to decarbonization. As nations and industries strive to reduce their carbon footprints, hydrogen, particularly green hydrogen, is emerging as a critical component of the energy transition. The market is witnessing significant investments in hydrogen production technologies, infrastructure development, and the integration of hydrogen into various sectors such as transportation, industrial manufacturing, and energy storage. The strong growth in the Generation Type segment, which is projected to dominate the market with a substantial share, highlights the escalating demand for hydrogen as a clean energy source. This growth is further bolstered by international cooperation initiatives and government policies that encourage the adoption of low-emission hydrogen technologies, laying the foundation for a robust and sustainable hydrogen economy.

However, the market's expansion is not without challenges. The high cost of clean hydrogen production, limited infrastructure, and the need for technological advancements in storage and transportation are significant hurdles that need to be addressed. Despite these challenges, the increasing focus on innovation, coupled with strong policy support, is expected to drive significant advancements in the hydrogen market over the forecast period. The transition from grey to green and blue hydrogen, along with the development of new applications, is expected to create substantial opportunities for market players. As these trends continue to unfold, the hydrogen market is likely to see a shift from niche applications to broader, more widespread use across various industries, further solidifying its role in the global energy landscape.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 253.74 Billion |

| Market size value in 2033 | USD 474.4 Billion |

| Growth Rate | 7.2% |

| Base year | 2024 |

| Forecast period | 2026–2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Hydrogen Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Hydrogen Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Hydrogen Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Hydrogen Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

Global Hydrogen Market size was valued at USD 253.74 Billion in 2024 and is poised to grow from USD 272.01 Billion in 2025 to USD 474.4 Billion by 2033, growing at a CAGR of 7.2% during the forecast period (2026–2033).

Air Products and Chemicals Inc, Air Liquide SA, Linde plc, Saudi Aramco, Chevron Corporation, Chart Industries Inc. (Chart), Uniper SE, Worthington Enterprises Inc., Hexagon Purus, Luxfer Holdings PLC, INOX India Limited, Cryolor, NPROXX B.V, Oxygen Service Company, Inc., Weldship Corporation, Pragma Industries, BNH Gas Tanks, BayoTech, Quantum Fuel Systems, AMS COMPOSITE CYLINDERS

The key driver of the hydrogen market is the global push toward clean and sustainable energy, with governments and industries investing in hydrogen production and infrastructure to reduce carbon emissions, support renewable energy integration, and achieve climate change targets.

A key market trend in the hydrogen market is the rapid development of green hydrogen technologies and large-scale production projects, alongside increasing collaborations between governments and private companies to expand hydrogen infrastructure for energy, transportation, and industrial applications.

Asia-Pacific accounted for the largest share in the hydrogen market, driven by strong government support, large-scale industrial applications, rapid adoption of clean energy initiatives, and significant investments in hydrogen production and infrastructure, particularly in countries like China, Japan, and South Korea.

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients