Report ID: SQMIG35D2002

Report ID: SQMIG35D2002

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG35D2002 |

Region:

Global |

Published Date: December, 2025

Pages:

197

|Tables:

71

|Figures:

75

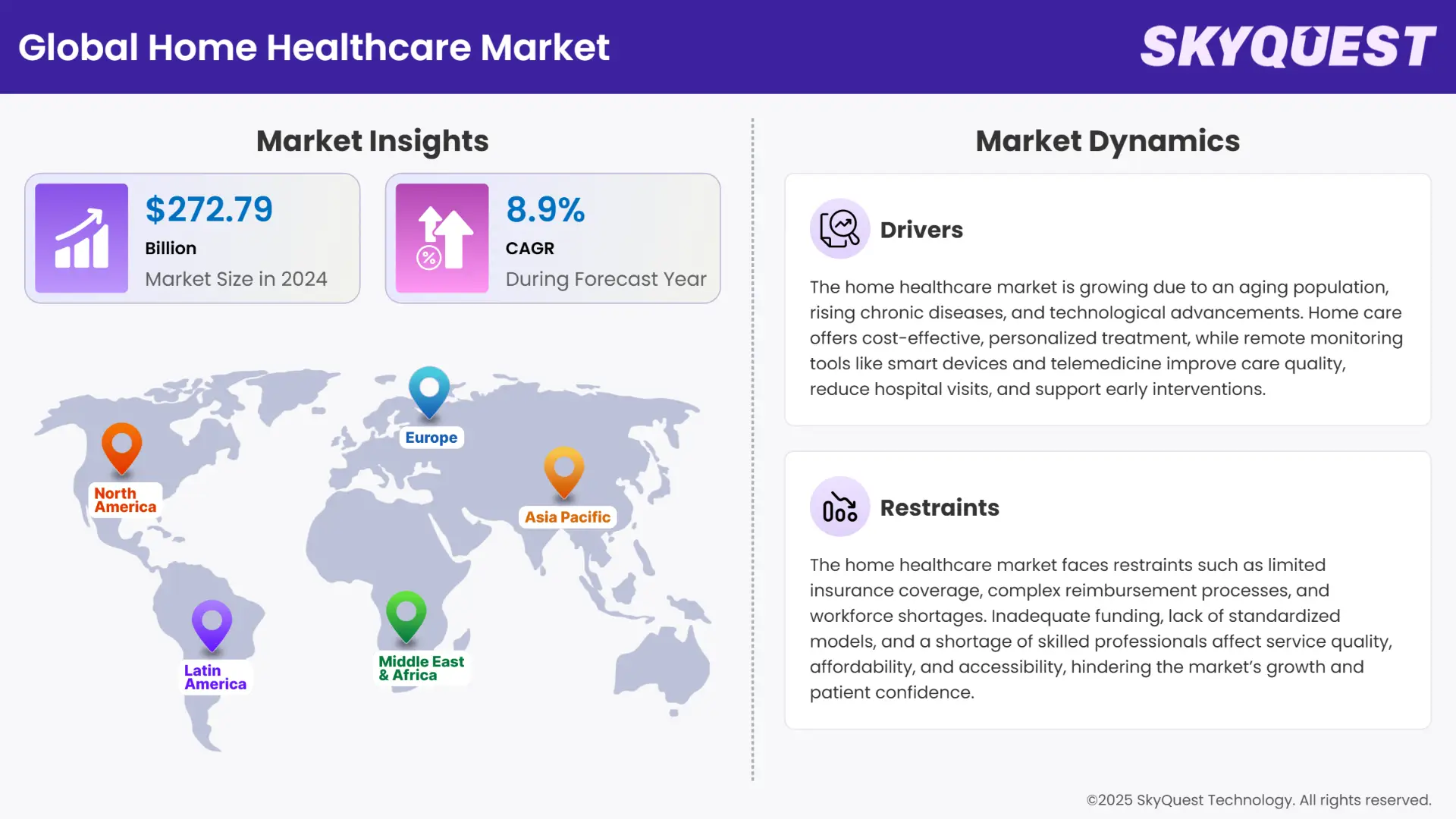

Global Home Healthcare Market size was valued at USD 272.79 Billion in 2024 and is poised to grow from USD 297.07 Billion in 2025 to USD 587.61 Billion by 2033, growing at a CAGR of 8.9% during the forecast period (2026–2033).

The home healthcare industry is advancing rapidly because of new trends in demographics, care models and technology. There is increasing demand due to both an aging population around the globe and an increase in chronic health problems such as diabetes, heart issues and lung diseases. These tendencies have medical services being offered at home, including skilled nursing, physical therapy and remote devices to keep everything simple and low-cost. Thanks to new technologies, more elderly and people facing physical restrictions can now get quality and secure assistance at home.

There are still significant challenges blocking the market. Difficult regulations and payments delay the use of home healthcare options, most often in developing countries. A shortage of trained home care nurses and therapists holds back how quickly this care can be expanded. Besides, security issues and problems related to platforms working together prohibit services from being easy to integrate. Yet, high healthcare costs, a preference for home care by many and greater investments by both public and private groups are leading the home healthcare market to grow steadily, mainly where there is pressure to lower hospital admissions and improve the care of chronic diseases.

Is the aging global population fueling demand for home healthcare services?

The rising geriatric population is a fundamental driver of the home healthcare market. As aging individuals face increased prevalence of chronic illnesses such as arthritis, Alzheimer’s disease, cardiovascular conditions, and diabetes, the need for continuous care outside traditional hospital settings is growing rapidly. Home healthcare offers elderly patients a cost-effective and comfortable alternative to prolonged hospital stays, promoting better quality of life and personalized care. The shift also aligns with healthcare system goals to reduce hospital readmissions and lower the burden on inpatient facilities. With life expectancy increasing globally—particularly in developed nations like Japan, Germany, and the United States—the demand for long-term home-based care services, including skilled nursing, physiotherapy, and remote monitoring, is anticipated to accelerate significantly.

Is technological advancement transforming the landscape of home healthcare delivery?

Innovations such as wearable health devices, remote patient monitoring tools, AI-powered health assistants, and telehealth platforms have revolutionized how care is administered at home. These technologies enable real-time monitoring, reduce emergency interventions, and provide healthcare professionals with actionable data. Patients with chronic conditions can now receive consistent, tech-enabled care, boosting adherence to treatment regimens and outcomes. In addition, software-driven logistics and scheduling platforms enhance care coordination among nurses, doctors, and families, contributing to system efficiency. As consumers increasingly adopt smart health devices, the ecosystem of connected care will continue to expand, driving growth in the home healthcare sector.

To get more insights on this market click here to Request a Free Sample Report

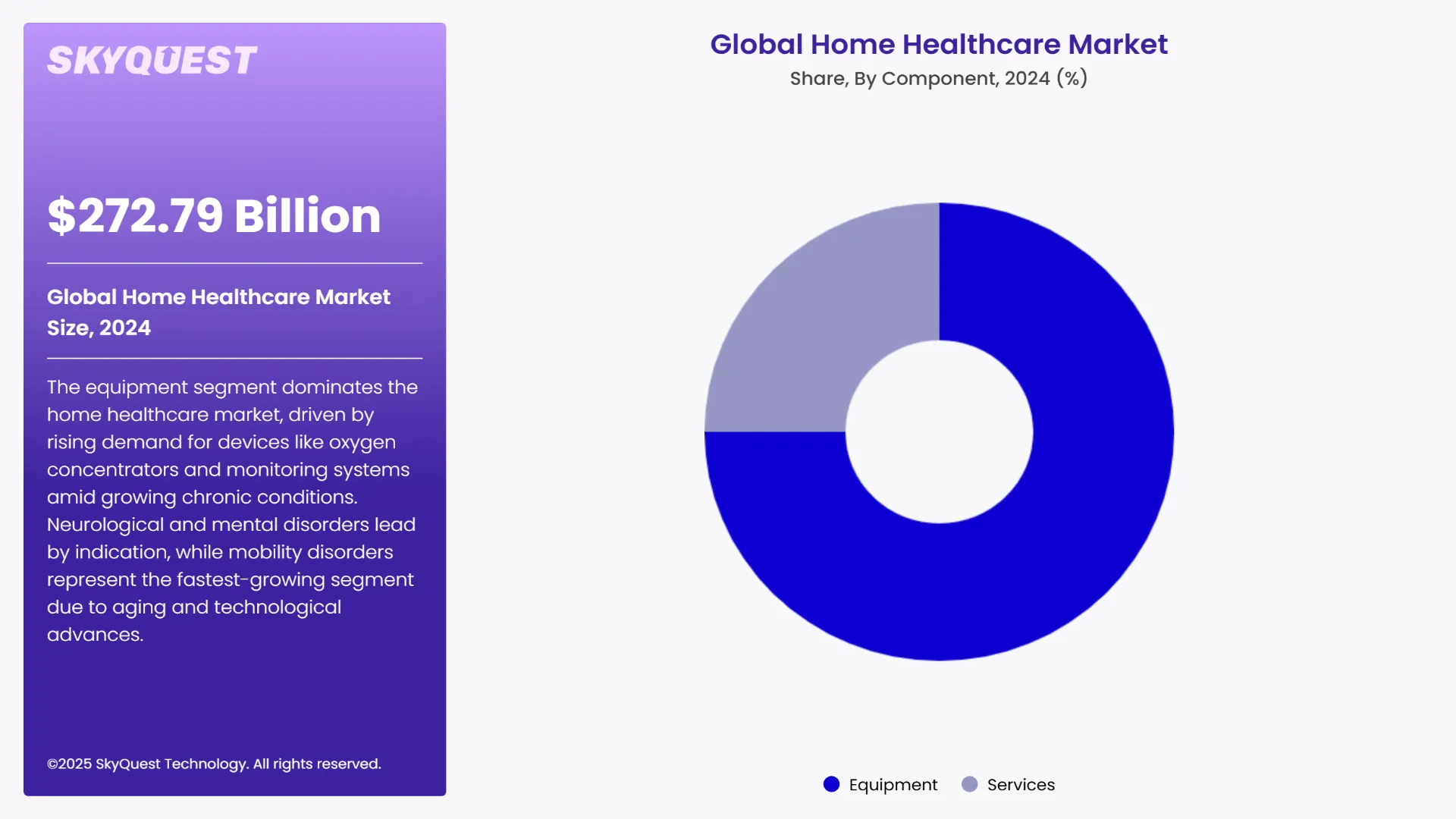

Global Home Healthcare Market is segmented by Component, Indication and region. Based on Component, the market is segmented into Equipment (Therapeutic, Diagnostic, Mobility assist), Services (Skilled home healthcare, Unskilled home healthcare). Based on Indication, the market is segmented into Cardiovascular Disorder & Hypertension, Diabetes & Kidney Disorders, Neurological & Mental Disorders, Respiratory Disease & COPD, Maternal Disorders, Mobility Disorders, Cancer, Wound Care, and Others. Based on region, the market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa.

In the home healthcare market, the equipment segment has emerged as both the largest and fastest-growing component, reflecting the increasing reliance on medical devices for at-home patient care. This segment encompasses essential devices such as infusion pumps, oxygen concentrators, respiratory therapy equipment, and patient monitoring systems, which are critical for chronic disease management and post-acute care. The surge in prevalence of chronic conditions like diabetes, cardiovascular diseases, and respiratory disorders is driving the adoption of home-based medical equipment, as patients and caregivers seek cost-effective alternatives to hospital stays.

Technological advancements, including IoT-enabled and wearable devices, have further enhanced the efficiency, safety, and ease of use of home healthcare equipment, boosting patient compliance and monitoring capabilities. Additionally, rising awareness among patients, coupled with supportive reimbursement policies and growing geriatric populations, continues to propel the demand for home healthcare equipment, positioning it as the primary growth engine within the market.

Neurological and mental disorders dominate the home healthcare market growth due to the increasing incidence of conditions such as Alzheimer’s, Parkinson’s, and depression among the elderly population. The chronic nature of these diseases requires long-term management, which is more feasible and comfortable in home settings. Moreover, growing awareness of mental health and better diagnostic capabilities support the demand for home-based therapeutic and monitoring solutions, driving consistent growth in this segment.

The mobility disorders segment is the fastest-growing indication owing to rising cases of stroke, arthritis, and other musculoskeletal conditions globally. Increasing geriatric population and advancements in mobility aids and rehabilitation equipment have accelerated demand for home care services tailored to mobility-impaired patients. This segment benefits from technological innovations like powered wheelchairs and exoskeleton devices, enhancing patient independence and quality of life at home.

To get detailed segments analysis, Request a Free Sample Report

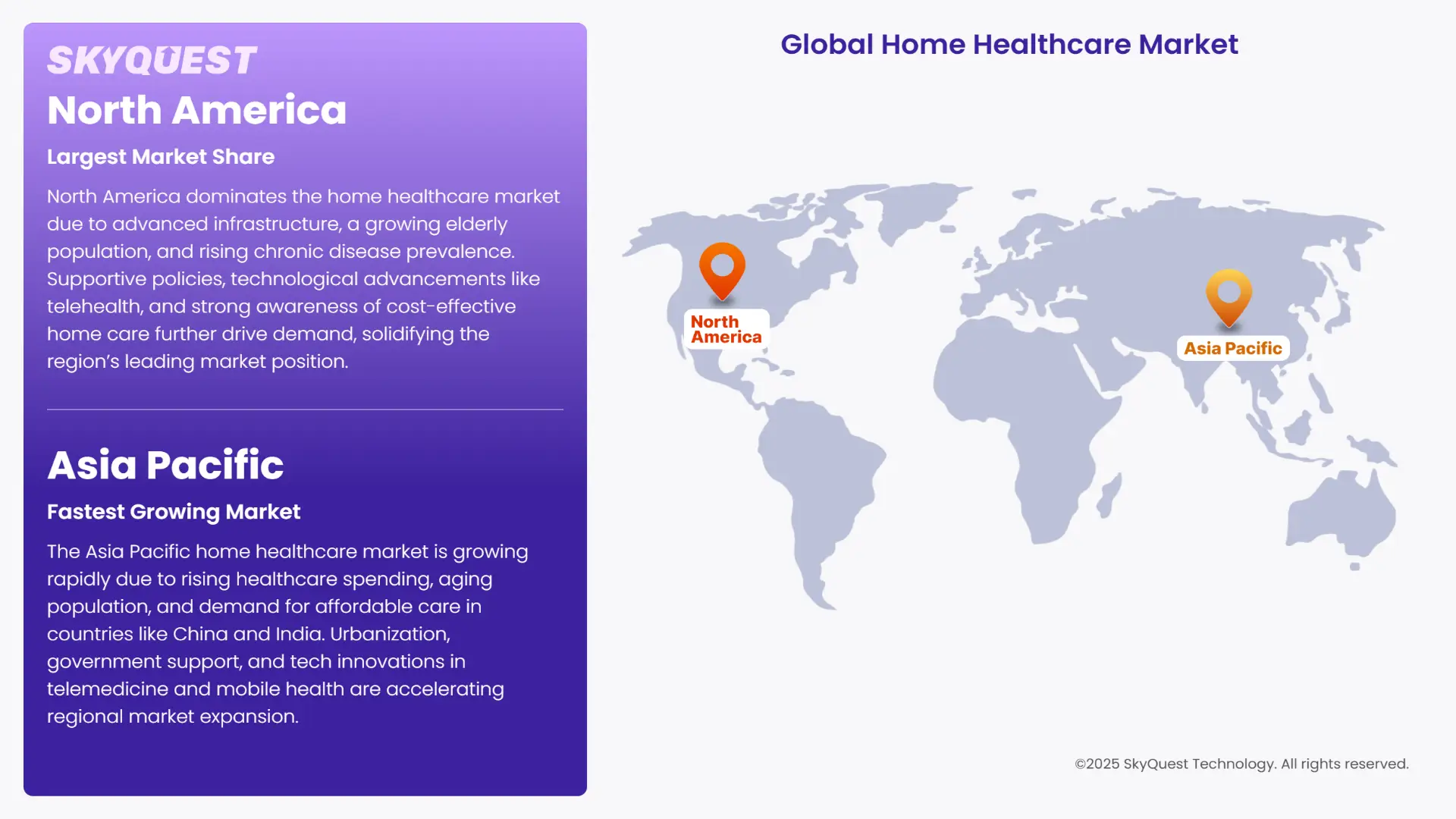

North America leads the global home healthcare market demand due to its advanced healthcare infrastructure, rising geriatric population, and growing preference for home-based care over hospital stays. Increasing prevalence of chronic diseases like diabetes, cardiovascular conditions, and respiratory disorders drives demand for continuous monitoring and care at home. Furthermore, supportive government initiatives and reimbursement policies in the U.S. and Canada promote home healthcare adoption. Technological advancements, including remote patient monitoring and telehealth services, also contribute to market growth. The region’s well-established healthcare providers and rising awareness among patients about cost-effective care alternatives solidify North America’s dominant position in this market.

U.S. Home Healthcare Market

The U.S. is the largest home healthcare market within North America, supported by a high elderly population and increasing chronic disease incidence. The government’s initiatives such as the Medicare Home Health Benefit enhance accessibility to home healthcare services. Recently, the integration of AI-powered remote monitoring devices has surged, improving patient outcomes and reducing hospital readmissions. Telehealth adoption accelerated post-COVID-19, further expanding home healthcare services. Leading companies are focusing on partnerships and innovations to improve service delivery and patient engagement.

Canada Home Healthcare Market

Canada’s home healthcare market benefits from government funding and policies aimed at reducing hospital burdens. The rise in aging population and chronic illnesses like arthritis and dementia are key growth drivers. Recent developments include increased investment in digital health platforms to enable remote monitoring and virtual consultations. The Canadian government’s support for aging-in-place initiatives is fostering market expansion. Several provincial health authorities have launched pilot programs integrating AI and IoT devices for enhanced patient care at home.

The Asia Pacific home healthcare market growth is witnessing rapidly due to increasing healthcare expenditures, expanding elderly population, and rising awareness about home care services. Growing prevalence of lifestyle diseases and preference for affordable care solutions in emerging economies such as China and India drive demand. Urbanization and rising middle-class income levels also fuel market expansion. Governments in the region are investing heavily in healthcare infrastructure and launching policies to support home-based care models. Additionally, technological advancements in mobile health applications and telemedicine platforms are bridging gaps in healthcare access, especially in rural areas, propelling the market’s fast growth trajectory.

China Home Healthcare Market

China’s home healthcare market demand is expanding rapidly due to the country’s massive aging population and increasing chronic disease cases. The government has introduced policies like the “Healthy China 2030” initiative, emphasizing elderly care and home-based healthcare. Recent developments include widespread deployment of AI-driven health monitoring devices and telemedicine platforms to enhance access in remote regions. Partnerships between tech firms and healthcare providers are accelerating the adoption of smart home healthcare solutions. The shift towards patient-centric care models is also driving investments in home healthcare infrastructure.

India Home Healthcare Market

India’s home healthcare market growth is fueled by rising chronic diseases, growing elderly population, and increasing awareness of home care benefits. Limited hospital capacity and high healthcare costs push patients towards home-based care alternatives. Recent developments include the expansion of telehealth services and remote monitoring technologies supported by improved internet penetration. Government programs aimed at elderly welfare and healthcare digitization are further boosting market potential. Startups and established healthcare providers are collaborating to introduce innovative home healthcare services, focusing on rural and semi-urban areas.

Europe holds the third position in the global home healthcare market share, backed by a robust public healthcare system, increasing elderly population, and strong government support for home-based care services. The region is experiencing rising demand for chronic disease management and rehabilitation at home, driven by cost-containment pressures and aging demographics. Technological integration, such as telecare, wearable health devices, and remote monitoring systems, is gaining traction across leading countries. Governments in Europe are promoting home healthcare as a means to reduce hospital burden and enhance patient quality of life. The presence of established healthcare providers and favorable reimbursement policies further strengthen market expansion.

Germany Home Healthcare Market

Germany is one of Europe’s leading home healthcare markets, fueled by a rapidly aging population and a well-established health insurance system that supports home-based services. The country emphasizes reducing hospital readmissions and enhancing geriatric care through at-home treatment and monitoring. Recent developments include the implementation of digital health tools under the Digital Healthcare Act, enabling reimbursement for telehealth services. Startups and medical device manufacturers are increasingly developing AI-powered tools for at-home diagnostics and care. The government’s support for eHealth infrastructure and funding for smart home integration is boosting market growth significantly.

France Home Healthcare Market

France’s home healthcare market trends are growing due to rising healthcare expenditures, increased life expectancy, and a supportive public health system. The country has adopted policies aimed at enabling “hospital at home” (HAD - Hospitalisation à Domicile) to improve efficiency and reduce healthcare costs. Recent initiatives include expanding remote patient monitoring programs for chronic illnesses such as diabetes and heart failure. France is also investing in connected medical devices and teleconsultation platforms, supported by national health insurance coverage. These developments are creating favorable conditions for home healthcare providers to scale their services and reach more patients.

United Kingdom Home Healthcare Market

The UK’s home healthcare sector is evolving in response to NHS efforts to decentralize care and alleviate pressure on hospitals. The aging population and rise in long-term health conditions such as arthritis and COPD have increased demand for at-home treatment and monitoring. Recent developments include the launch of virtual wards and community-based care pilots under NHS England, aimed at managing patients safely in their homes. Investment in digital health technologies and remote diagnostics is accelerating, while public-private collaborations are enhancing service availability. The UK government’s integrated care strategy is also prioritizing home-based support for vulnerable and elderly individuals.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

Aging Population and Rising Chronic Diseases

Technological Advancements in Remote Patient Monitoring

Limited Insurance Coverage and Reimbursement Challenges

Workforce Shortages and Quality of Care Concerns

Request Free Customization of this report to help us to meet your business objectives.

The home healthcare market is highly competitive, with players leveraging acquisitions, strategic partnerships, and technology integration to strengthen their positioning. Amedisys Inc., for example, has focused on expanding its footprint through merger activity—most notably, its planned acquisition by UnitedHealth Group's Optum unit, which follows Optum’s previous acquisition of LHC Group. This move is reshaping the competitive dynamics by consolidating major home health services under one of the largest managed care organizations. Meanwhile, Bayada Home Health Care has entered into partnerships with hospitals to deliver coordinated post-acute care, aiming to reduce readmission rates and secure value-based care contracts. On the technology front, companies like Kindred at Home, now rebranded as CenterWell under Humana, are integrating remote patient monitoring and predictive analytics to personalize care and improve patient outcomes. These strategies reflect a shift from traditional care models toward integrated, tech-enabled solutions that align with value-based healthcare trends and aging population needs. The competitive edge increasingly depends on care coordination, data-driven insights, and strategic alignments with payers and health systems.

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected using Primary Exploratory Research backed by robust Secondary Desk research.

As per SkyQuest analysis, The Home Healthcare Market is witnessing significant growth, primarily driven by the rising geriatric population and the increasing prevalence of chronic diseases such as diabetes, neurological disorders, and cardiovascular conditions. One major driver fueling market expansion is the growing preference for value-based healthcare models. These models emphasize improved patient outcomes and cost-efficiency, encouraging the adoption of home-based healthcare services as a viable alternative to hospital stays. Additionally, advancements in remote patient monitoring technologies and telehealth solutions are enabling effective chronic disease management at home, further boosting market penetration.

However, the market faces restraints such as concerns over data security and privacy, especially with the growing use of connected health devices and digital platforms. Additionally, regulatory variations across countries and the lack of reimbursement for certain home healthcare services continue to challenge the market’s growth potential.

North America dominates the home healthcare market, supported by robust healthcare infrastructure, high healthcare expenditure, and strong government support for homecare initiatives. By component, Therapeutic Products hold the largest market share due to their critical role in chronic disease treatment. By indication, Neurological & Mental Disorders represent the leading segment, driven by rising cases of dementia, Alzheimer’s, and depression among aging populations.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 272.79 Billion |

| Market size value in 2033 | USD 587.61 Billion |

| Growth Rate | 8.9% |

| Base year | 2024 |

| Forecast period | 2026–2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Home Healthcare Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Home Healthcare Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Home Healthcare Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Home Healthcare Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

Favorable reimbursement in developed nations encourages adoption, while inadequate insurance cover, lack of favorable payment models, and complexity of regulations in developing economies inhibit growth and affordability.

Home care services are the most rapidly growing segment due to growing elderly care demands, management of chronic diseases, and technological progress in telehealth and remote patient monitoring tools.

The challenges are stringent regulations, reimbursement issues, shortage of skilled employees, platform integration problems, and delivery of consistent quality of care across a variety of home environments.

Artificial intelligence, wearable devices, and home monitoring provide for real-time data exchange, early treatment, customized care, and better coordination among caregivers, which improves efficiency and outcomes.

Older patients with long-term conditions like Alzheimer's disease, cardiovascular illnesses, and mobility impairments spearhead demand for cost-effective, personalized, and technology-driven home care solutions.

UnitedHealth's Optum's acquisition of Amedisys, Bayada's hospital collaborations, and New Day Healthcare's acquisitions indicate consolidation and partnership tendencies, which strengthen networks and technology integration.

Global Home Healthcare Market size was valued at USD 272.79 Billion in 2024 and is poised to grow from USD 297.07 Billion in 2025 to USD 587.61 Billion by 2033, growing at a CAGR of 8.9% during the forecast period (2026–2033).

Philips Healthcare, Siemens Healthineers, Medtronic, B. Braun, Fresenius Kabi, Abbott Laboratories, GE Healthcare, Omron Healthcare, Amedisys, Linde Healthcare, Bayada Home Health Care, Drive Devilbiss Healthcare Limited, Sunrise Home Healthcare, ResMed, Medline Industries, Baxter International, Invacare Corporation, Cardinal Health, Contec Medical Systems, Advin Health Care

The key driver of the home healthcare market is the rising demand for cost-effective and convenient healthcare services, especially for aging populations and chronic disease patients, which encourages the adoption of remote monitoring, home nursing, and personalized care solutions.

A key market trend in the home healthcare market is the increasing use of digital health technologies, such as remote patient monitoring, telehealth, and wearable devices, which enable real-time care, improve patient outcomes, and reduce hospital visits.

North America accounted for the largest share in the home healthcare market, driven by advanced healthcare infrastructure, high adoption of home care services, supportive government policies, and a growing aging population requiring continuous medical care at home.

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients