Report ID: SQMIG35A3044

Report ID: SQMIG35A3044

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG35A3044 |

Region:

Global |

Published Date: May, 2025

Pages:

196

|Tables:

96

|Figures:

76

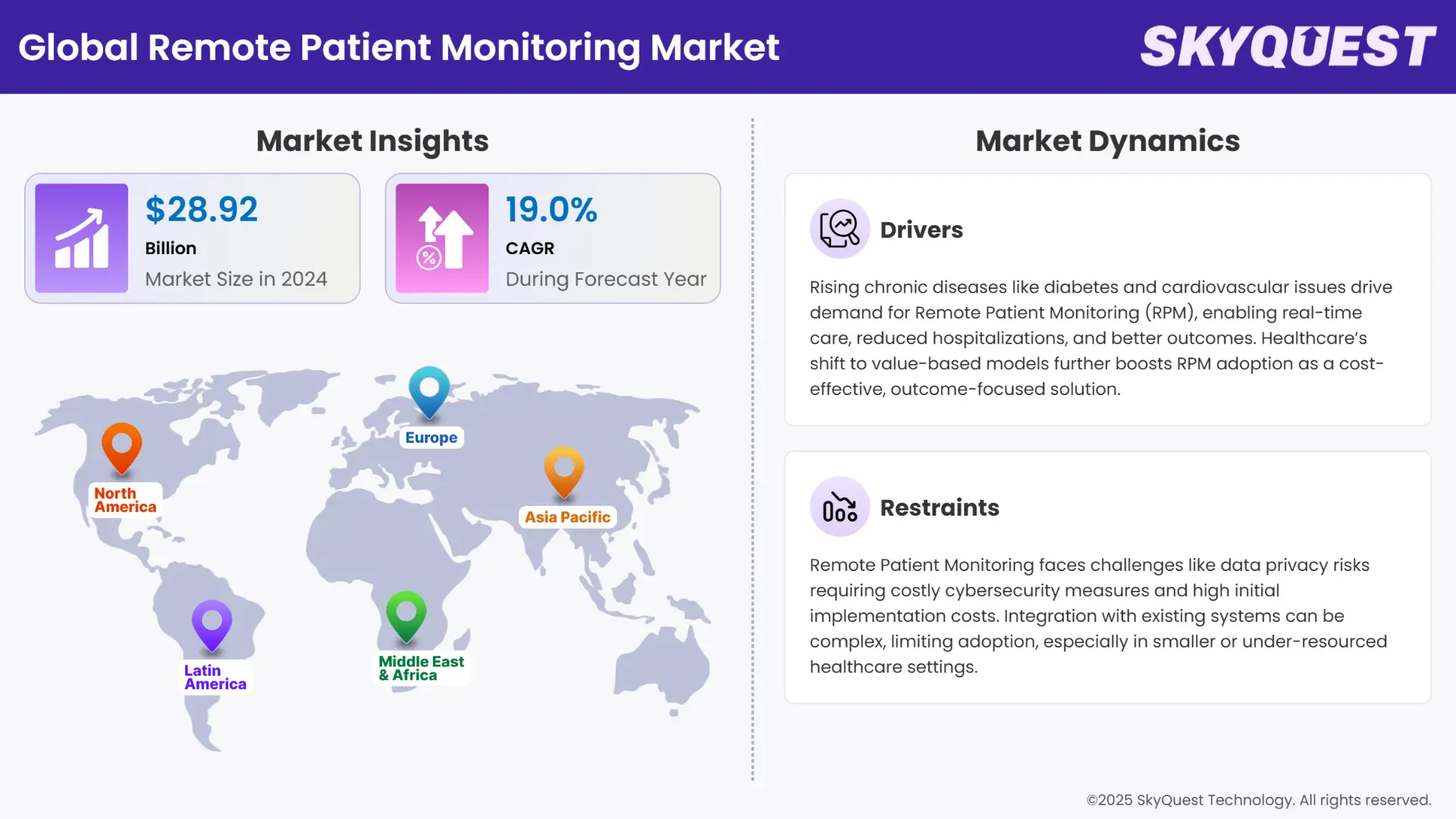

Global Remote Patient Monitoring Market size was valued at USD 28.92 Billion in 2024 and is poised to grow from USD 34.41 Billion in 2025 to USD 138.4 Billion by 2033, growing at a CAGR of 19% during the forecast period (2026–2033).

The remote patient monitoring market is surfing on strong growth, and it is driven by a combination of chronic disease prevalence growth, aging populations, and value-based care momentum around the globe. Payors and healthcare providers are being compelled to implement volume-driven RPM technologies with growing demand for real-time patient data and forward-looking care management.

In addition, government incentives, especially in advanced economies such as the U.S., are also driving adoption. Technological innovation, such as wearable sensors, AI-driven analytics, and safe cloud-based infrastructure, is improving scalability and accuracy of RPM solutions. These drivers combined with increasing home care demand resulting from COVID-19 are driving consistent growth in the remote patient monitoring market.

However, the market also still faces major difficulties. Data privacy concerns, especially of patient data transmitted via digital interfaces, continue to hinder adoption in certain regions. Incompatibility issues between various RPM devices and existing healthcare systems are another major obstacle, complicating integration. Financial challenges also exist in emerging markets where a shortage of healthcare infrastructure and fiscal factors limit large-scale deployment. Resistance. Healthcare professionals who are poorly educated about digital tools, as well as fear of excessive dependency on technology for the treatment of patients, also retard the adoption pace of RPM.

Despite such headwinds, the remote patient monitoring market is discovered to be robust and is poised to achieve remarkable growth in the coming years. The market participants are gradually seeking greater usability, regulatory compliance, and interoperability to address these challenges. As payers, providers, and technology firms re-adjust their strategies, the market is poised to witness even more innovation and higher adoption across developed and emerging economies.

How is AI Enhancing Predictive Healthcare in Remote Monitoring?

Artificial Intelligence (AI) is now revolutionizing predictive healthcare via remote monitoring of patients using advanced algorithms to forecast potential health issues before they are emergent. Through the analysis of high volumes of patient data, AI recognizes the early warning signs of deteriorating health, allowing the doctor to act early. The technology has yielded great promise in enhancing patient outcomes as well as reducing hospital readmission. For example, the UK health technology firm Cera Care applies AI solutions to prevent and forecast hospitalization of older, frail adults, halving hospital admissions by up to 70%.

This proactive strategy not only improves patient outcomes but also reduces the strain on the healthcare system. The return is tremendous—Cera Care's AI solutions have saved the UK Government and NHS nearly £1 million each day. By facilitating early interventions, AI remote patient monitoring helps to make healthcare delivery more efficient, cost-effective, and ultimately better for long-term patient health and system sustainability.

How Are AI-Enabled Wearables Advancing the Management of Chronic Conditions?

Artificial intelligence-enabled wearables have made great waves in the monitoring of chronic diseases, providing constant observation and sophisticated data analytics. Some such devices include the Empatica Embrace2, which was approved by the FDA for seizure detection. These devices are crucial for monitoring basic life signs such as electrodermal activity and heart rate, allowing healthcare professionals to intervene in real-time. This has greatly helped those with chronic diseases in the early identification and control. In 2024, GE Healthcare joined hands with Biofourmis to blend AI-powered solutions for enhanced care of chronic disease, strengthening again the application of AI for optimizing patient outcomes.

Additionally, the U.S. Department of Veterans Affairs will introduce AI-driven systems by 2025, extending the scope of remote patient monitoring to several VA centers. The increasing trend is a part of a larger movement to leverage AI to enable proactive, data-informed healthcare, in which real-time monitoring and timely intervention guarantee enhanced control over chronic ailments and thus overall patient care.

To get more insights on this market click here to Request a Free Sample Report

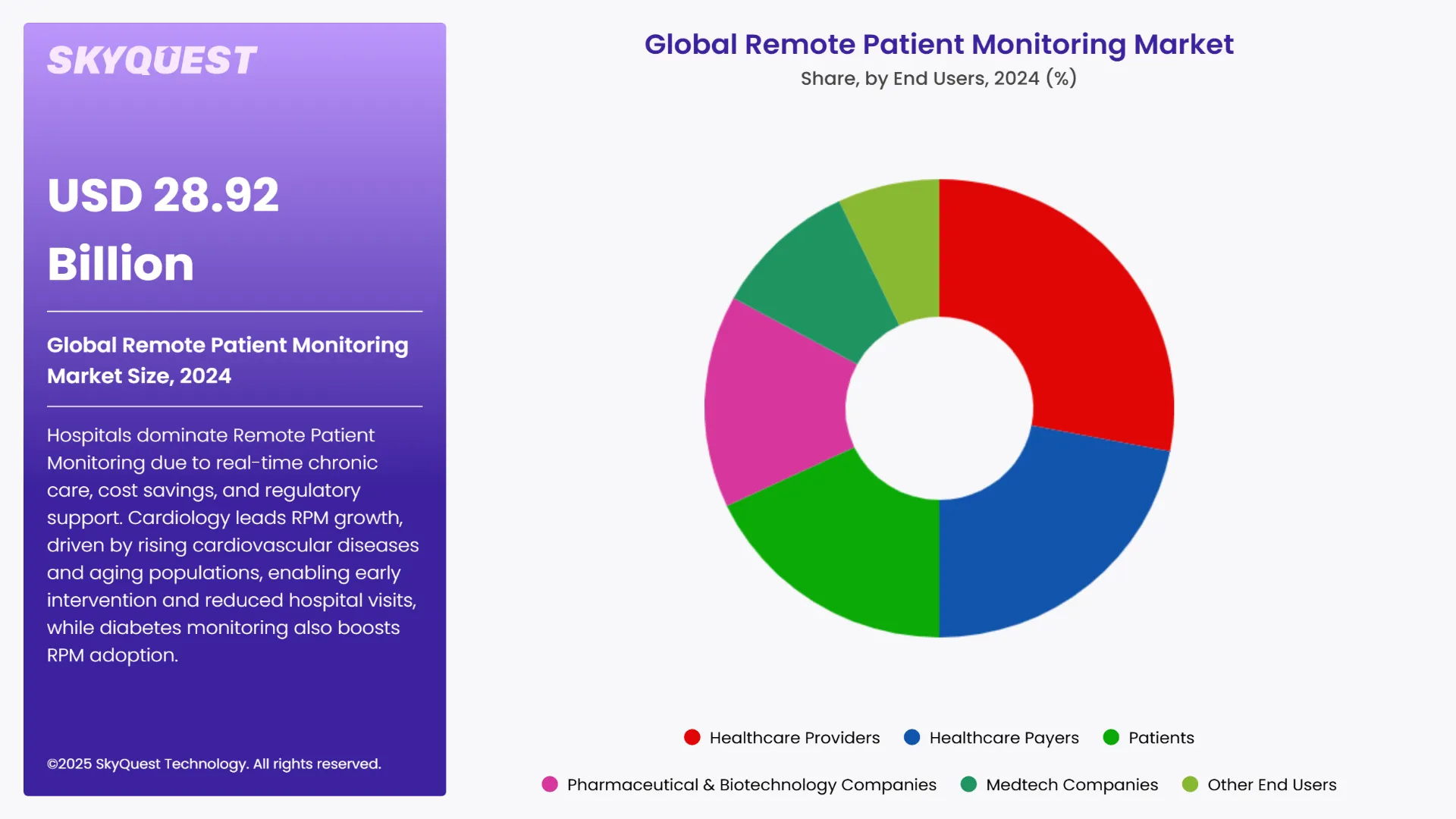

The global remote patient monitoring market is segmented by Component, Indication, End-User and region. Based on Component, the market is segmented into Devices, Software and Services. Based on Indication, the market is segmented into Oncology, Cardiology, Neurology, Diabetes, Sleep Disorders, Respiratory Diseases, Wellness Improvement, Mental Health and Other Indications. Based on End-User, the market is segmented into Healthcare Providers, Healthcare Payers, Patients, Pharmaceutical & Biotechnology Companies, Medtech Companies and Other End Users. Based on region, the remote patient monitoring market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa.

Hospitals dominates the remote patient monitoring (RPM) market as they play a pivotal role in patient care. The adoption of RPM technologies by hospitals is driven by the need for improved patient management, especially for chronic conditions. By using RPM, hospitals can monitor patient vitals in real-time, reducing readmissions and providing timely interventions. Factors like the growing focus on patient-centric care, advanced technology integration, and regulatory support have propelled RPM adoption. Hospitals also benefit from enhanced operational efficiency and cost savings, making them the primary users of RPM solutions.

Patients are the fastest-growing sub-segment within RPM. Increased awareness about health monitoring, the desire for personalized care, and growing health consciousness among the general population are driving RPM adoption. Patients' preference for remote care solutions that allow continuous monitoring and avoid frequent hospital visits is a key factor. As telemedicine becomes more accessible, patients are increasingly turning to RPM devices to manage chronic diseases from home, boosting remote patient monitoring market growth.

Among medical indications, diabetes is the fastest-growing segment driving the growth of remote patient monitoring solutions. The increasing prevalence of diabetes worldwide has led to a growing demand for continuous monitoring of blood sugar levels. RPM enables patients to track glucose levels, receive immediate alerts for abnormal readings, and adjust their lifestyle accordingly, reducing the need for frequent hospital visits. The integration of RPM with diabetes management tools ensures more effective disease control, contributing to this segment’s dominance.

Cardiology is the fastest-growing RPM segment. With the rise in cardiovascular diseases and the increasing aging population, RPM solutions are being adopted to remotely monitor heart conditions like hypertension, arrhythmias, and heart failure. The ability to monitor key cardiac parameters in real-time and provide immediate feedback supports early intervention, improving patient outcomes. RPM also reduces hospital visits, which is a key benefit for cardiology patients.

To get detailed segments analysis, Request a Free Sample Report

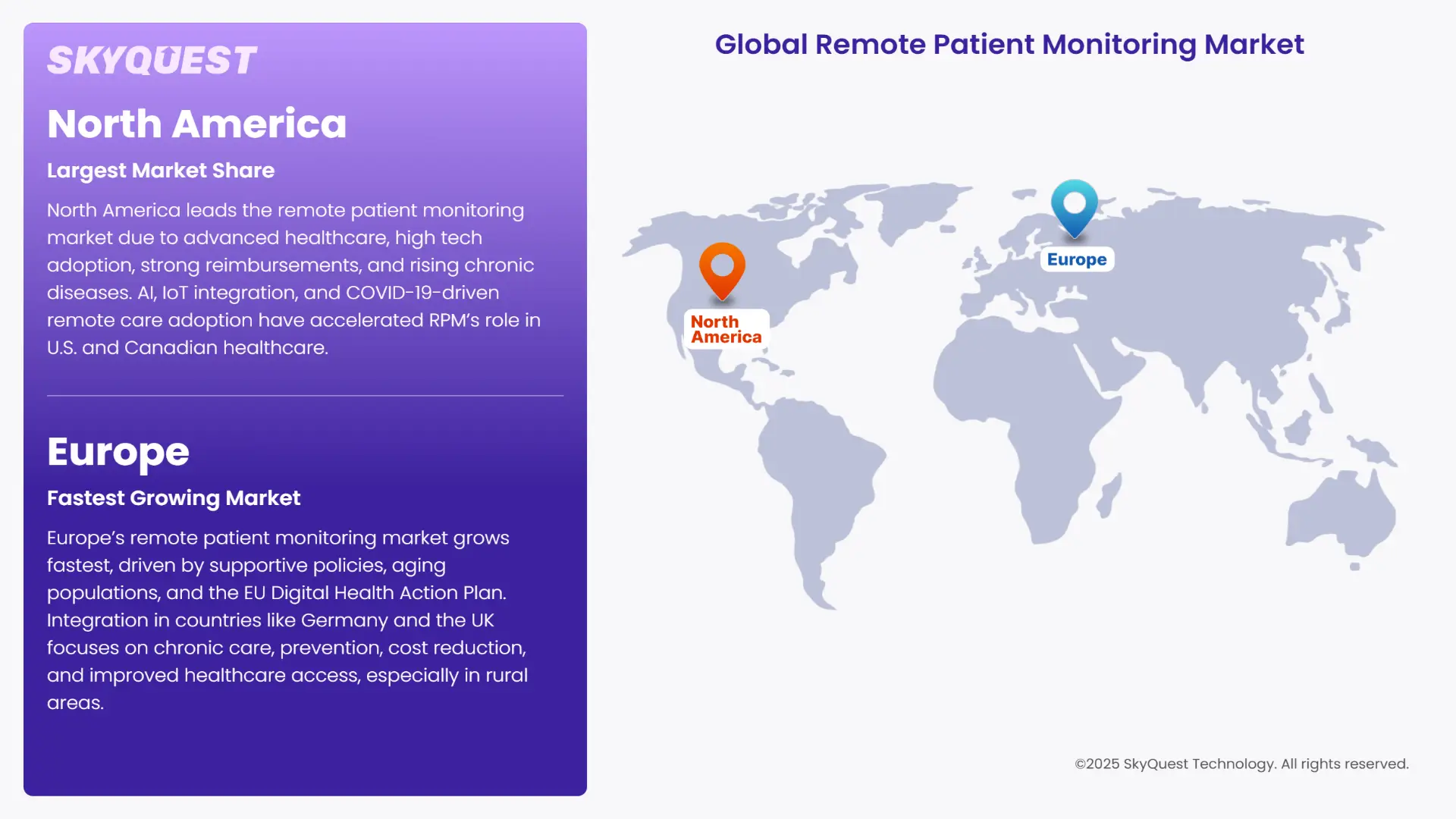

North America leads the global remote patient monitoring market, driven by advanced healthcare infrastructure, high technology adoption, and strong reimbursement policies. The region is experiencing rapid growth due to a geriatric population and rising cases of chronic illnesses such as diabetes, cardiovascular conditions, and respiratory disease. The implementation of Artificial Intelligence (AI) and the Internet of Things (IoT) in healthcare equipment is making RPM systems more efficient. Moreover, the COVID-19 pandemic accelerated the shift toward remote care solutions, and as a result, RPM became an integral part of U.S. and Canadian healthcare.

U.S. Remote Patient Monitoring Market

In the United States, the market for RPM is thriving with firm federal backing in the form of Medicare's extended reimbursement policies for remote patient monitoring services. To date, through 2024, Medicare has begun covering RPM services for individuals with chronic illnesses, allowing more widespread adoption in the healthcare continuum. In addition, advances in wearable health technologies, including blood glucose monitors and heart rate monitors, are optimizing the performance of remote care solutions, lowering hospitalization rates and allowing for disease management proactively.

Canada Remote Patient Monitoring Market

Canada is experiencing consistent RPM adoption growth, spearheaded by the federal government's leadership in expanding digital health programs. Ontario and British Columbia provinces have rolled out telehealth programs aimed at facilitating better healthcare access, particularly in rural communities and remote locations. Importantly, the Ontario Telemedicine Network (OTN) has been increasing its services, enabling patients to access remote care for chronic diseases like diabetes and hypertension. These innovations are making healthcare cheaper and patient care better nationwide.

Europe is the fastest-growing remote patient monitoring market share due to positive government policies and a growing population of older people. The European Union Digital Health Action Plan is supporting investment in digital health technologies like RPM. Remote monitoring is being integrated in the healthcare systems of many European countries, including Germany, France, and the UK, to manage chronic illness and improve patient outcomes. The focus of the region on preventive care, reducing hospitalization, and reducing healthcare expenditure is driving adoption of RPM. The move towards digital health also helps improve access to healthcare, particularly in rural and underdeveloped regions in Europe.

Germany Remote Patient Monitoring Market

Germany leads the European remote patient monitoring market growth, with the government's Digital Healthcare Act (DVG) driving digital health technology adoption. The legislation makes it easier for digital health apps to be reimbursed, and thus adopted by healthcare providers, by making payment easier. Latest news sees several digital health apps approved to manage chronic disease, with a focus on enhancing long-term care of diabetes and hypertension.

France Remote Patient Monitoring Market

France is leading the way in RPM adoption via its national health policy, including reimbursement of telemedicine services. The French government has also been putting money into the digital health environment, incorporating RPM into chronic disease management for diseases like diabetes and cardiovascular illnesses. This is intended to enhance patient outcomes and cut back on hospital admissions. One interesting development is pilot projects that are being implemented nationwide to remotely monitor patients and make healthcare more accessible.

United Kingdom Remote Patient Monitoring Market

The United Kingdom is also experiencing large-scale adoption of RPM via its National Health Service (NHS) Long Term Plan, which encourages the deployment of digital health solutions for chronic disease management. The NHS recently launched a mass program for the provision of remote monitoring to patients with respiratory conditions such as asthma and COPD. All these initiatives are decreasing hospital readmission and improving access to care, particularly in rural settings. Besides, the NHS has also partnered with private firms to promote RPM infrastructure.

The Asia Pacific region is experiencing robust growth in the RPM market as a result of increased healthcare needs, aged populations, and rising chronic diseases. Japan, South Korea, and India lead the adoption of remote patient monitoring with government policies, enhanced accessibility to healthcare, and rural population needs. Telemedicine advancements, as well as growing digital literacy throughout the region, are also creating opportunities for RPM adoption. As the healthcare infrastructure becomes stronger, RPM solutions would become even more crucial in managing chronic diseases and providing affordable healthcare to greater numbers of patients in Asia Pacific.

Japan Remote Patient Monitoring Market

Japan leads RPM adoption in Asia, fueled by its aging population and government encouragement of digital health solutions. The Japanese Ministry of Health, Labour, and Welfare has initiated efforts to encourage the adoption of remote patient monitoring, especially for elderly patients with chronic conditions such as diabetes and hypertension. Some of the significant advancements involve integrating RPM technologies with hospitals and home healthcare networks to lower hospital admissions and enhance the quality of care for elderly patients.

South Korea Remote Patient Monitoring Market

South Korea is quickly adopting RPM technologies with government policies in place to enhance healthcare access. Reimbursement schemes for telemedicine services, including RPM, have been introduced in the country to promote increased adoption. The recent trend has been the application of RPM systems in chronic disease management, including diabetes and cardiovascular disease. The government of South Korea has been investing in telehealth and RPM infrastructure to facilitate more effective delivery of healthcare and lighten the load on hospitals.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

Increasing Chronic Disease Cases Requiring Continuous Monitoring and Long-Term Health Management

Transition to Outcome-Based Healthcare Models Increasing Focus on Remote Monitoring Adoption

Privacy and Data Security Concerns in Remote Monitoring Systems

High Initial Implementation Costs and Technological Barriers

Request Free Customization of this report to help us to meet your business objectives.

The remote patient monitoring (RPM) space is highly competitive, with players like Philips Healthcare, Medtronic, and Dexcom leading the charge of innovation. Philips is focusing on packaging RPM along with its telehealth platforms as bundled chronic disease management solutions. Medtronic, through its CareLink platform, boasts an experience with remote cardiac monitoring and diabetes management. Abbott, however, has partnered with health systems to enhance its RPM solutions for real-time glucose monitoring. Companies are adopting methods like AI-enabled analytics, strategic acquisitions, and enhancing device interoperability to compete and enhance patient care outcomes.

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected using Primary Exploratory Research backed by robust Secondary Desk research.

As per SkyQuest analysis, the global Remote Patient Monitoring (RPM) market is poised for significant growth, driven by increasing chronic disease prevalence, aging populations, and a shift toward value-based care. Technological advancements like AI-driven analytics, wearable sensors, and cloud integration are enhancing scalability and accuracy. Government incentives, especially in North America and Europe, are accelerating adoption. However, concerns around data privacy, integration challenges, and high initial costs, particularly in emerging markets, may hinder progress. Leading players such as Philips, Medtronic, and GE HealthCare are focusing on AI innovations and strategic partnerships to drive adoption and address barriers, ensuring strong long-term market expansion.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 28.92 Billion |

| Market size value in 2033 | USD 138.4 Billion |

| Growth Rate | 19% |

| Base year | 2024 |

| Forecast period | 2026–2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Remote Patient Monitoring Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Remote Patient Monitoring Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Remote Patient Monitoring Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Remote Patient Monitoring Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

RPM applications are prominent in chronic disease management, such as diabetes management, cardiology, respiratory disease management, mental health, and oncology. Both hospitals and patients and payers use RPM theories to lower readmissions, and include proactive healthcare instead of reactive healthcare.

The remote patient monitoring market experiences competitive dynamics and several players are working towards improved AI integration and partnerships, as well as continued innovation. Often companies are developing interoperability, approaches to real-time data analysis, and bundled solutions to maximize market share.

AI can be used effectively in predictive analytics and early detection of disease, while IoT can be used to enable continuous real time data acquisition from wearables. Together both elements can add value by improving patient outcomes, lowering hospital visits, and improving chronic disease management.

Significant regulatory challenges include patient data privacy, compliance with regulations like HIPAA, interoperability of devices with existing systems, and high cost of cybersecurity, especially with emerging health and underfunded healthcare markets.

Lenient reimbursement policies are enhancing COVID-19 remote patient monitoring adoption, which is particularly relevant in the U.S. at the Medicare level. with supportive reimbursement policies from the government (e.g., Medicare) providers of healthcare have incentives to invest in remote care for their patients which is enhancing access and chronic disease outcomes.

Hospitals use remote patient monitoring to manage chronic conditions and monitor patients remotely. Potential benefits include front-loading chronic conditions, improving patient safety, reducing readmissions and reducing patient demand on services, Improving overall capacity within hospitals and community services. Finally, with the use of inter-operable law compliant technology and regulation sector support, hospitals will be become the most recognised segment of end-users in the remote patient monitoring market.

Global Remote Patient Monitoring Market size was valued at USD 28.92 Billion in 2024 and is poised to grow from USD 34.41 Billion in 2025 to USD 138.4 Billion by 2033, growing at a CAGR of 19% during the forecast period (2026–2033).

Koninklijke Philips N.V., Medtronic, OMRON Corporation, GE Healthcare, Oracle Health, Boston Scientific Corporation, Abbott, NIHON KOHDEN CORPORATION, Siemens Healthineers AG, Baxter, Biobeat, Biotronik, VitalConnect, VivaLNK, Inc, Clear Arch, Inc, Optum, Inc (Vivify Health), Blue Spark Technologies, Inc, Lightbeam Health Solutions, Health Recovery Solutions, Teladoc Health, Inc

The key driver of the remote patient monitoring market is the growing demand for efficient, cost-effective healthcare delivery, as it enables continuous monitoring of patients’ health, reduces hospital visits, supports chronic disease management, and improves overall patient outcomes.

A key market trend in the remote patient monitoring market is the integration of advanced technologies like IoT, AI, and connected wearable devices, enabling real‑time health data tracking, predictive analytics, and improved patient engagement across healthcare systems.

North America accounted for the largest share in the remote patient monitoring market, driven by advanced healthcare infrastructure, widespread adoption of digital health technologies, supportive government initiatives, high prevalence of chronic diseases, and strong investments in telehealth solutions.

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients