Report ID: SQMIG35H2218

Report ID: SQMIG35H2218

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG35H2218 |

Region:

Global |

Published Date: December, 2025

Pages:

194

|Tables:

208

|Figures:

80

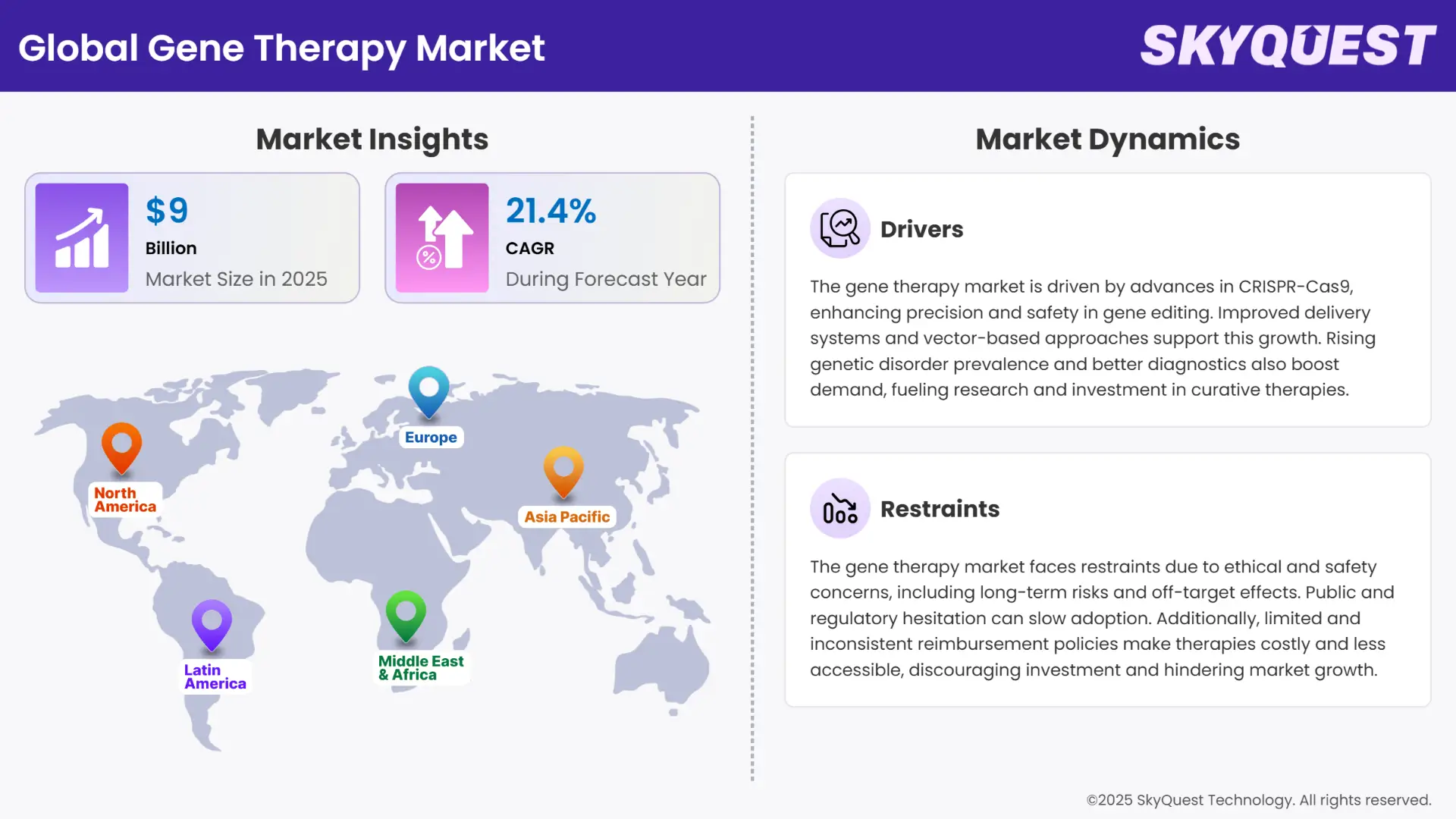

Global Gene Therapy Market size was valued at USD 9.00 Billion in 2024 and is poised to grow from USD 10.93 Billion in 2025 to USD 51.55 Billion by 2033, growing at a CAGR of 21.4% during the forecast period (2026–2033).

The gene therapy market is experiencing strong growth propelled by a combination of scientific breakthroughs and escalating cases of genetic disorders. The key drivers are escalating incidence of uncommon and long-term illnesses like hemophilia, cystic fibrosis, and specific cancers, which are being targeted with gene-based treatments with escalating intensity. In addition, advances in technology such as CRISPR-Cas9 and adeno-associated virus (AAV) vectors have notably enhanced the accuracy, safety, and effectiveness of gene delivery and editing systems. Commercial viability has also been underlined by the regulatory approvals of headline gene therapies Zolgensma and Luxturna, further stimulating research and investment in the space.

On the constraint side, several key challenges confront the gene therapy market and may deter its wider uptake. Foremost among them are the hefty treatment costs, which are usually more than hundreds of thousands to millions of dollars per individual and thus become out of reach for many and put a strain on healthcare systems. Also, the production of viral vectors at large scale continues to be tricky and expensive, which creates supply chain bottlenecks. Safety issues like immune reactions, off-target actions, and durability of the therapy over long periods are also critical considerations, especially in early phases of clinical trials. Regulatory challenges and reimbursement issues make market entry even more challenging, particularly in developing economies.

All these limitations notwithstanding, the gene therapy market is likely to change fast, with clinical trials in progress and collaborations between biotech companies and pharma majors speeding up product development. Growing use of AI in genomics and drug discovery is expected to maximize therapeutic design and patient targeting. Governments and venture capitalists alike are also accelerating funding efforts, appreciating the long-term potential of gene therapy in reshaping disease treatment models. With scientific and economic hurdles eventually fading away, the market is expected to see continuous growth over the next few years.

How is Artificial Intelligence Reshaping the Gene Therapys Landscape?

Artificial Intelligence (AI) is transforming the gene therapy industry by increasing accuracy, speeding up development, and refining manufacturing efficiency. AI programs scan immense genomic data sets to determine best-gene targets, forecast treatment effects, and engineer customized therapies. In production, AI ensures real-time monitoring and control of cell cultures, guaranteeing consistent quality and compressing production cycles. These innovations are overcoming classic gene therapy challenges, including high expense and intricate manufacturing procedures, thus making therapies more available and efficient.

AI's contribution is the creation of a customized CRISPR-based treatment for KJ Muldoon, an infant with a rare genetic disease, CPS1 deficiency. In 2024, a team of researchers used AI-powered tools to quickly pinpoint KJ's individualized genetic mutations and engineer a personalized base-editing treatment. The therapy, created and greenlighted in record speed, has produced encouraging results, as KJ attained developmental milestones and enjoyed enhanced health results. The case highlights the capability of AI to increase efficiency in producing personalized gene therapies at a faster rate, providing hope to individuals suffering from rare and heretofore incurable diseases.

To get more insights on this market click here to Request a Free Sample Report

The global gene therapy market is segmented by Gene Type, Therapy type, Vector type, Delivery Method, Route Of Administration, Application, End-user and region. Based on Gene Type, the market is segmented into Antigen, Cytokine, Tumor Suppressor, Suicide, Deficiency, Receptors and Others. Based on Therapy type, the market is segmented into Gene silencing therapy, Cell replacement therapy, Gene augmentation therapy and Other therapies. Based on Vector type, the market is segmented into Viral vector and Non-Viral Vector. Based on Delivery Method, the market is segmented into Ex-Vivo and In-Vivo.

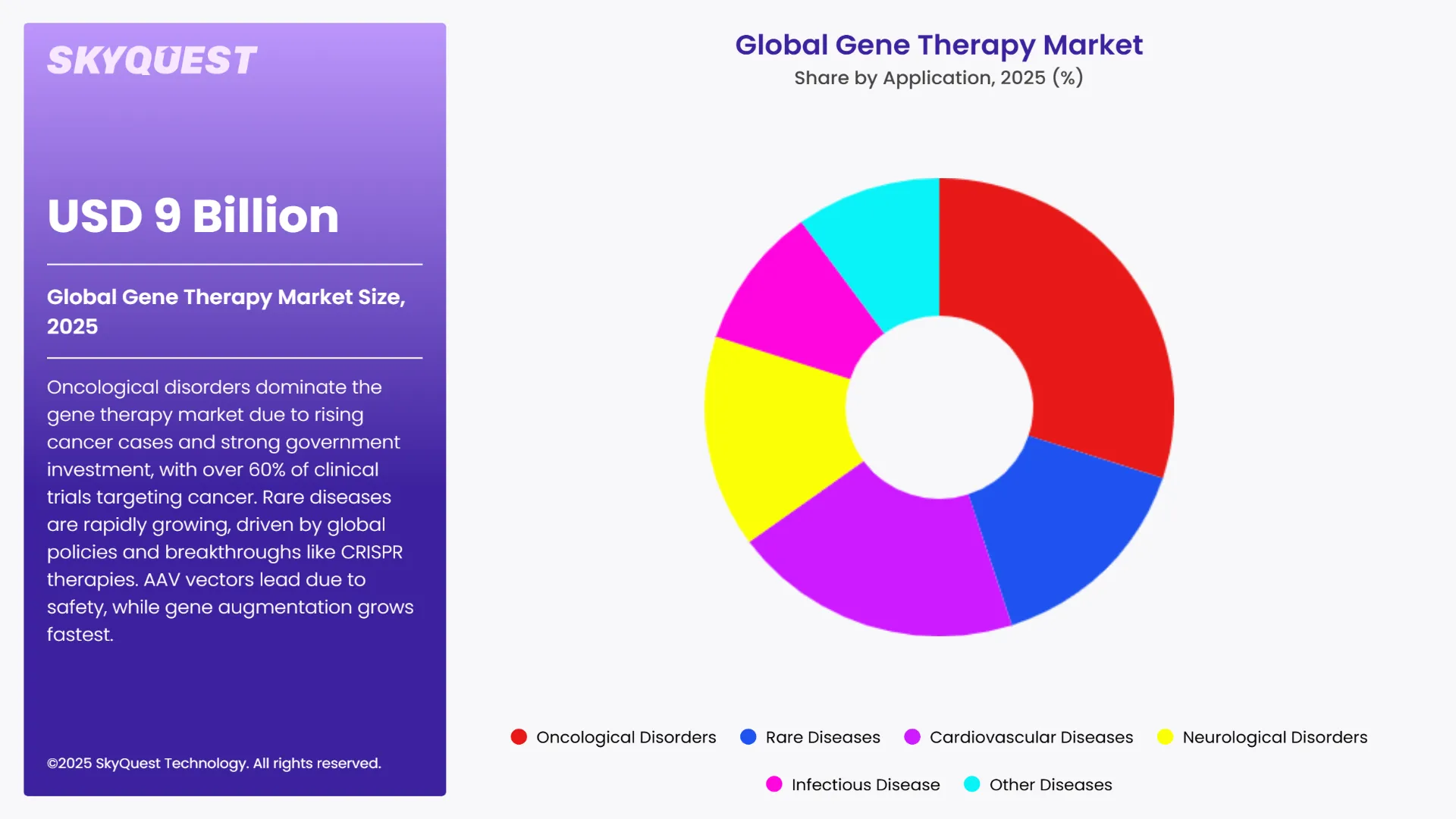

Based on Route of Administration, the market is segmented into Intravenous Route, Subcutaneous Route and Others. Based on Application, the market is segmented into Oncological Disorders, Rare Diseases, Cardiovascular Diseases, Neurological Disorders, Infectious Disease and Other Diseases. Based on End-user, the market is segmented into Cancer Institutes, Hospitals, Research institutes and Others. Based on region, the gene therapy market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa.

Oncological disorders lead the gene therapy market owing to the growing global cancer burden—20 million new cases and 9.7 million deaths in 2022 and estimated to increase by 77% through 2050. Governments across the globe are investing in gene therapies, of which more than 60% of clinical trials aim against cancer. Specifically, China approved the first oncolytic virus gene therapy for cancer treatment in 2005, a landmark event. These efforts reflect the high priority that is being given to gene therapy to combat cancer across the world.

Rare diseases are the most rapidly expanding segment in the gene therapy market due to global government policies and the growth in personalized medicine. An estimated 400 million individuals globally suffer from more than 7,000 rare diseases, 72% of which are genetically caused. Government initiatives such as the U.S. NIH's Bespoke Gene Therapy Consortium seek to speed the development of gene therapies for rare disorders. One such example is the successful CRISPR-based therapy of an infant suffering from CPS1 deficiency, designed in only six months in collaboration between Penn Medicine and the Children's Hospital of Philadelphia and funded by the NIH.

Adeno-associated virus (AAV) vectors are the leaders in the gene therapy market with their better safety profile, tissue specificity, and extended gene expression. In 2022, the AAV segment was the leader in the global viral vector market with USD 1.47 billion revenues and is expected to witness growth at a CAGR of 14.80% during 2030.

Government initiatives have played a crucial role; the U.S. FDA approved AAV-based medicines such as Zolgensma for spinal muscular atrophy and Hemgenix for hemophilia B, supporting regulatory confidence in the efficacy and safety of AAV. Gene augmentation therapy represents the fastest-growing sector of the gene therapy industry, fueled by its effectiveness in the treatment of monogenic diseases and backed by heavy government efforts. As an example, the expanded approval of Sarepta Therapeutics' Elevidys by the U.S. FDA for Duchenne muscular dystrophy now encompasses about 90% of U.S. patients, with estimated sales reaching $1.07 billion in 2024.

To get detailed segments analysis, Request a Free Sample Report

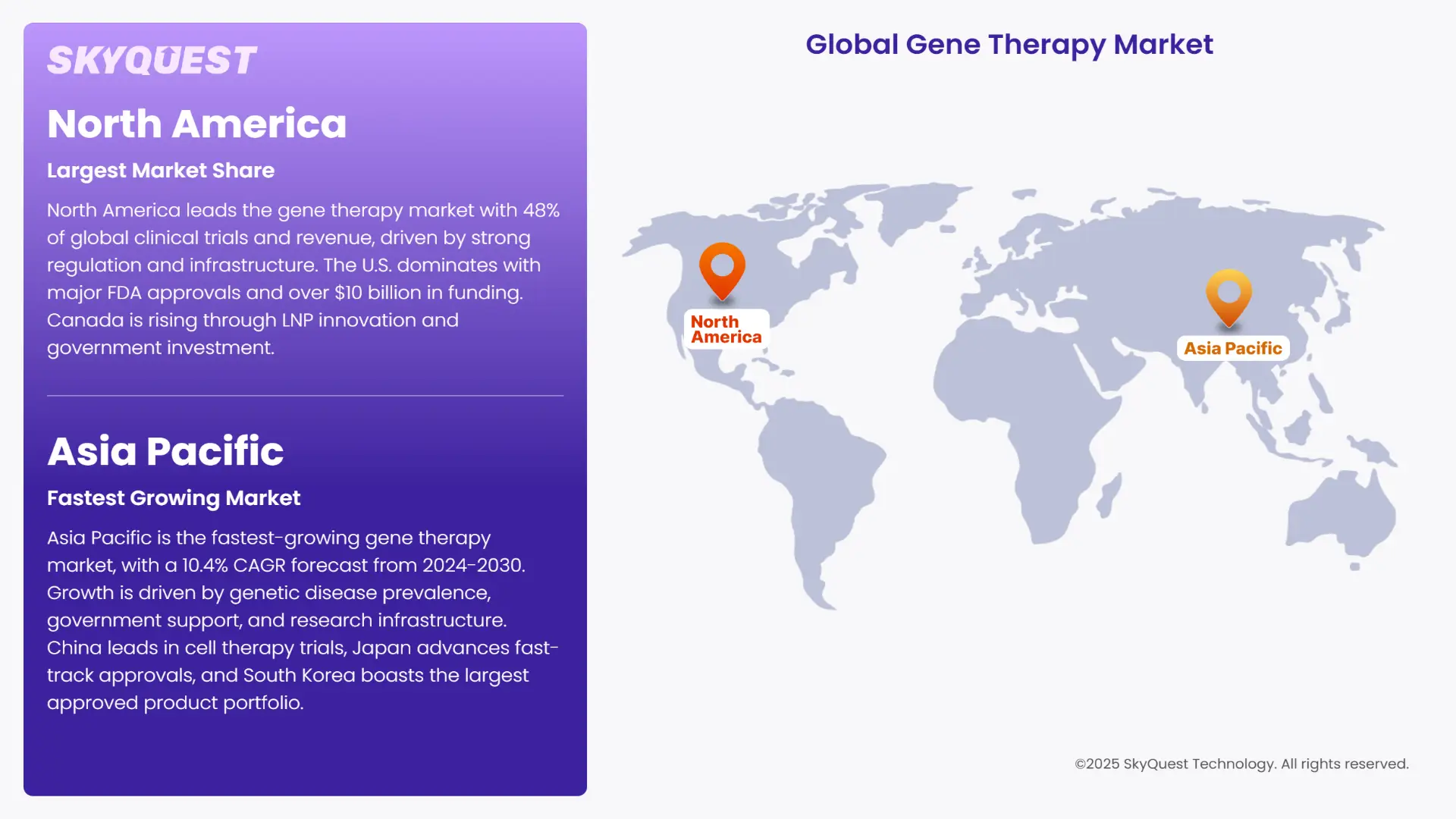

North America is dominating the world market for gene therapy with around 48% global clinical trials and 48.32% of revenue share in 2023. This dominance is due to a strong regulatory environment, ample government spending, and sophisticated healthcare infrastructure.

U.S. Gene Therapy Market

The U.S. Food and Drug Administration (FDA) approved several gene therapies, such as Luxturna, Zolgensma, & Casgevy, promoting commercialization and acceptance. The U.S. had more than 65% of international gene therapy clinical trials in 2023 with National Institutes of Health (NIH) and private investment of more than USD 10 billion.

Canada Gene Therapy Market

Canada is becoming an important force in the gene therapy space, with prominent contributions from players such as Acuitas Therapeutics. Acuitas has expertise in lipid nanoparticle (LNP) technology, which is important for delivering mRNA vaccines, and has collaborated with multinational companies like Pfizer & BioNTech. The Canadian government has spent around CAD 2.2 billion between 2020 and 2024 to enhance local biomanufacturing and life sciences capacity.

Asia Pacific is becoming the fastest-growing region in the gene therapy market, with a forecast compound annual growth rate (CAGR) of 10.4% from 2024 to 2030. The high growth is fueled by a high incidence of genetic diseases, growing government support, and increasing research infrastructure.

China Gene Therapy Market

China is a leader in gene therapy, with more than 50% of worldwide cell therapy trials. Fosun Kite's Yescarta and JW Therapeutics' Relma-cel received the approval of the National Medical Products Administration (NMPA) in 2021, which were major achievements. The regulatory reforms initiated by the government and reduced production expenses have welcomed multinational corporations to the country.

Japan Gene Therapy Market

Japan has been at the forefront of cell and gene therapies, with its first cell therapy for macular degeneration approved in 2014. The Pharmaceuticals and Medical Devices Agency (PMDA) uses the Sakigake designation for fast-track review of innovative treatments. The government of Japan has also set up a council to hasten regenerative medicine and gene therapy development.

South Korea Gene Therapy Market

South Korea has the highest approved cell therapy product portfolio in the world with 18 products. The government enacted the "Act on the Safety and Support of Advanced Regenerative Medical and Advanced Gene Therapys" in 2019 to permit conditional drug approval after phase two trials. This law seeks to promote market access of gene therapies.

Europe is also witnessing high growth in the gene therapy market with a forecasted CAGR of 25.87% during the forecast period. The region's advancement is supported by efforts such as the European Union's 'Horizon Europe Mission on Cancer,' initiated in September 2023, to hasten research and innovation in cancer medicines.

Germany Gene Therapy Market

Germany dominates the European gene therapy market, with a market share of more than 21% in 2023. Germany has over 660 biotechnology companies and over 50 ongoing gene therapy clinical trials. Government-supported programs such as NecstGen and significant public and private funding are driving research and development on gene-based drugs.

France Gene Therapy Market

France is proactively moving forward with gene therapy in partnership with research centers and pharma industries. The government programs promote innovation, helping the country make its place in the market for gene therapy.

UK Gene Therapy Market

The UK is a prominent hub for gene therapy, with 84 drugs in clinical development as of October 2023. The National Health Service (NHS) has integrated cutting-edge therapies, including CRISPR-based treatments for sickle cell disease. BioNTech's £1 billion investment in UK R&D, supported by a £129 million government grant, underscores the nation's commitment to advancing personalized medicine.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

CRISPR-Cas9 Propelling Market Growth

Rising Prevalence of Genetic Disorders

Ethical and Safety Concerns

Limited Reimbursement Policies

Request Free Customization of this report to help us to meet your business objectives.

The competitive dynamics of the global gene therapy market are controlled by major players such as Novartis, Gilead Sciences, and Pfizer, with strategic partnerships and product innovation. Governments across the world are nurturing this through financial support and regulatory ease, and the European Commission's Horizon Europe program had earmarked €95.5 billion (2021-2027) to enhance biotech inventions, including gene therapies. In contrast, Canada's Strategic Innovation Fund released CAD 250 million in 2023 for the expansion of biotech manufacturing. Firms use collaborations, mergers, and R&D expenditure to accelerate pipeline advancement and market access in concordance with facilitative governments having streamlined clinical trials and approvals worldwide.

Government programs such as the U.S. NIH's Precision Medicine Initiative, with more than USD 1.5 billion funding (2023), are speeding up gene therapy development based on personal genetic profiles. This change is making it possible to treat more complex diseases and cancers, driving market growth worldwide.

Regulatory organizations across the globe, including the EMA's PRIME scheme and the FDA's Accelerated Approval, are making clinical trial and approval processes more streamlined. The EU invested €95.5 billion in Horizon Europe (2021–2027) to fund biotech innovation, accelerating gene therapy commercialization.

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected using Primary Exploratory Research backed by robust Secondary Desk research.

As per SkyQuest analysis, strong government funding, accelerated regulatory approvals, and advancements in precision medicine are expected to drive the gene therapy market growth through 2032. However, drawbacks such as high production costs and advanced delivery mechanisms may restrain market growth. North America remains in the leading position with strong NIH investments, FDA approvals of innovative gene therapies, and a well-established clinical trial network. Meanwhile, fresh hotspots in Asia Pacific and Europe are developing robustly due to favorable policies, increased investments in biomanufacturing, and welcoming regulatory reforms. AI-AI convergence, CRISPR technologies, and scalable manufacturing solutions will create new growth prospects for industry players globally.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 9.00 Billion |

| Market size value in 2033 | USD 51.55 Billion |

| Growth Rate | 21.4% |

| Base year | 2024 |

| Forecast period | 2026–2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Gene Therapy Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Gene Therapy Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Gene Therapy Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Gene Therapy Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

Global Gene Therapy Market size was valued at USD 9.00 Billion in 2024 and is poised to grow from USD 10.93 Billion in 2025 to USD 51.55 Billion by 2033, growing at a CAGR of 21.4% during the forecast period (2026–2033).

Krystal Biotech (United States), CRISPR Therapeutics (Switzerland), Beam Therapeutics (United States), Intellia Therapeutics (United States), Korro Bio (United States), Neurogene (United States), Sangamo Therapeutics (United States), MeiraGTx (United States), Verve Therapeutics (United States), Prime Medicine (United States), Taysha Gene Therapies (United States), enGene (Canada), Voyager Therapeutics (United States), Poseida Therapeutics (United States), uniQure (Netherlands), Editas Medicine (United States), Benitec Biopharma (United States), Cellectis S.A. (France), Adverum Biotechnologies (United States), Generation Bio (United States)

The key driver of the gene therapy market is the rising prevalence of genetic and chronic diseases, which boosts demand for innovative, targeted treatments that can provide long-term benefits and improve patient outcomes.

A key market trend in the gene therapy market is the increasing development of personalized and advanced gene-editing technologies, such as CRISPR, which enable more precise, effective treatments and attract substantial investment and clinical research globally.

North America accounted for the largest share in the gene therapy market, driven by strong biotechnology infrastructure, high research funding, early adoption of advanced therapies, supportive regulatory frameworks, and the presence of major pharmaceutical and biotech companies.

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients