Report ID: SQMIG35A3064

Report ID: SQMIG35A3064

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG35A3064 |

Region:

Global |

Published Date: July, 2025

Pages:

183

|Tables:

114

|Figures:

69

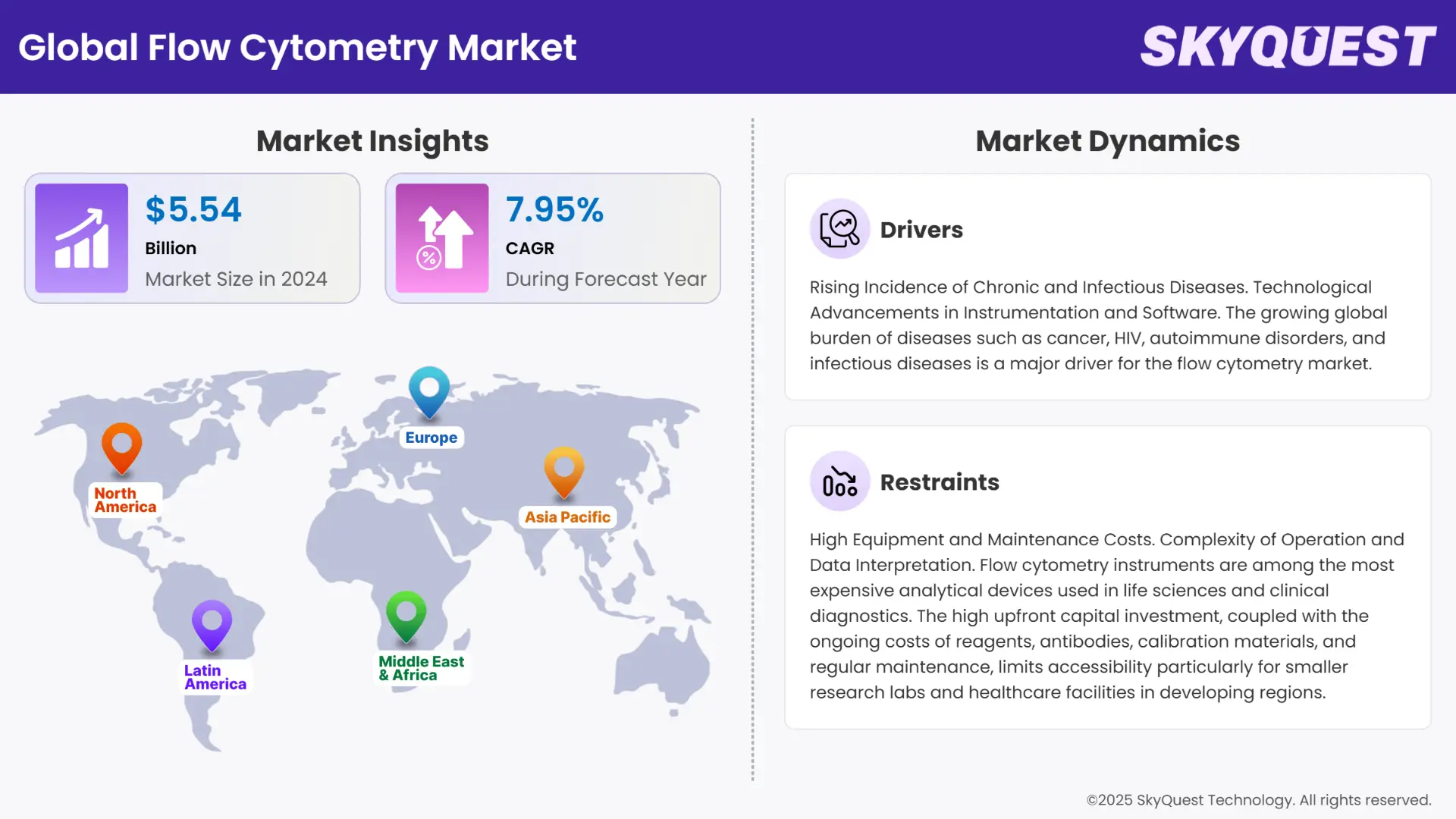

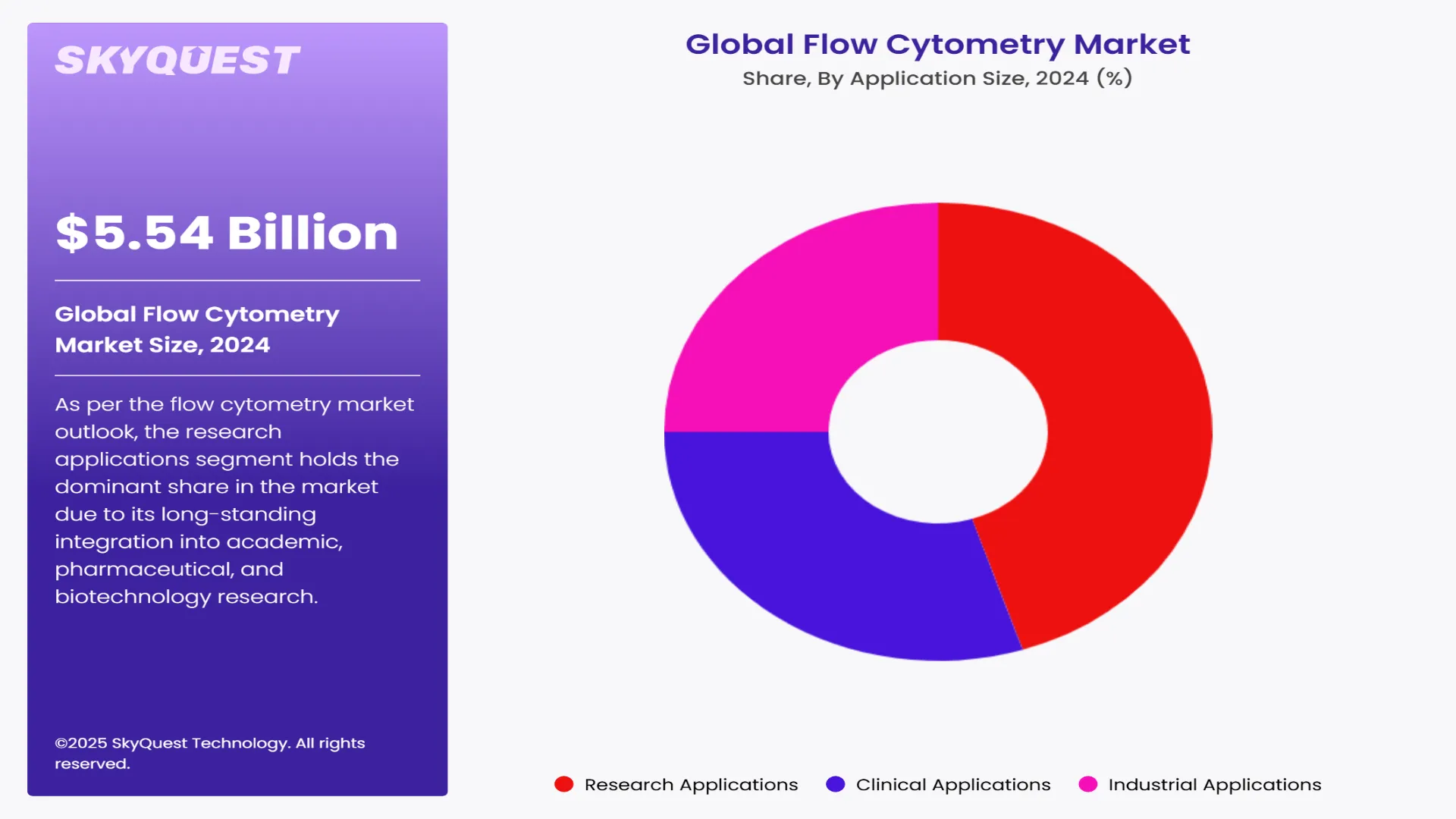

Global Flow Cytometry Market size was valued at USD 5.54 Billion in 2024 and is poised to grow from USD 5.98 Billion in 2025 to USD 11.03 Billion by 2033, growing at a CAGR of 7.95% in the forecast period (2026–2033).

The global flow cytometry market is experiencing substantial growth, driven by the increasing demand for advanced diagnostics, the rising incidence of chronic and infectious diseases, and the expanding use of flow cytometry in clinical and research applications.

Technological advancements, growing biomedical research, increasing focus on personalized medicine, rise in cancer research and immunotherapy and growing investments and collaborations among key industry players are primary growth factors that are impacting the market revenue.

Rising adoption flow cytometry technique in pharma companies for drug discovery and development processes, including target identification, lead compound screening, toxicity assessment, and immunogenicity testing are further fueling the flow cytometry market growth. Furthermore, the rising automation level of these systems and growing demand for point-of-care diagnostics are also propelling market expansion. Thus, the increasing demand for precise cellular analysis, expanding research areas, and rise in prevalence of infectious diseases among other variables are adding to product adoption rates.

High instrument cost, complexities associated with the technique, and limited standardization among other factors are likely to hamper the product adoption rate. The flow cytometry instruments and reagents used in the process can be expensive, making them less accessible to smaller research laboratories and resource-limited facilities. The high cost of entry and substantial maintenance expenses can limit the adoption of flow cytometry systems, thereby hindering the flow cytometry market growth. Further, availability of alternative technologies and stringent regulatory guidelines are anticipated to restrain the industry's growth.

How is AI Enhancing Data Analysis in Flow Cytometry?

Artificial Intelligence (AI) is significantly transforming the flow cytometry market by enhancing data analysis, automation, and diagnostic accuracy. In 2024, a notable example of this impact was the integration of AI-powered analytics by BD Biosciences, which launched an upgraded version of its FACSDuet™ Sample Preparation System. The updated system incorporates machine learning algorithms that streamline sample preparation, reduce manual errors, and enable real-time quality control.

AI applications in flow cytometry are particularly valuable in processing complex, high-dimensional datasets. Traditionally, flow cytometry generates vast amounts of multiparametric data that require expert interpretation. AI now enables automated gating, anomaly detection, and pattern recognition, which improves reproducibility and speeds up results, especially in clinical settings.

Furthermore, AI is advancing predictive diagnostics. For instance, in oncology research, AI-enhanced flow cytometry platforms are being used to identify rare cancer cell populations and predict patient response to immunotherapy, allowing for more personalized treatment strategies.

To get more insights on this market click here to Request a Free Sample Report

Global flow cytometry market is segmented by technology, product, application, end user and region. Based on technology, the market is segmented into cell-based flow cytometry and bead-based flow cytometry. Based on product, the market is segmented into reagents & consumables, instruments, services, software and accessories. Based on application, the market is segmented into research applications, clinical applications and industrial applications. Based on end user, the market is segmented into academic & research institutes, hospitals & clinical testing laboratories and pharmaceutical & biotechnology companies. Based on region, the market is segmented into North America, Asia-Pacific, Europe, Latin America, and Middle East & Africa.

As per the flow cytometry market outlook, the research applications segment holds the dominant share in the market due to its long-standing integration into academic, pharmaceutical, and biotechnology research. Flow cytometry is a fundamental tool in immunology, cancer biology, stem cell studies, and drug discovery, enabling detailed cellular characterization and functional assays. High adoption in universities, research institutions, and pharmaceutical R&D labs continues to drive the segment. The versatility, precision, and ability to analyze multiple parameters at the single-cell level make flow cytometry indispensable for exploratory and translational research, especially in immuno-oncology and vaccine development.

As per flow cytometry market forecast, clinical applications segment is experiencing the fastest growth, driven by its expanding role in diagnostics and disease monitoring. Technology is increasingly used for immunophenotyping, leukemia and lymphoma classification, HIV monitoring, transplantation assessment, and minimal residual disease (MRD) detection. The shift toward precision medicine, rising global disease burden, and increasing regulatory approvals for clinical cytometers (such as Beckman Coulter's DxFLEX) are accelerating clinical adoption.

Cell-based flow cytometry currently dominates the market due to its widespread use in research, clinical diagnostics, and drug development. This technique allows direct analysis of live or fixed cells, enabling the study of cell phenotype, function, viability, and complex immunological responses. It is a cornerstone in areas like cancer immunotherapy, stem cell research, and infectious disease profiling. The ability to perform high-resolution single-cell analysis across multiple parameters makes cell-based cytometry essential for both basic and translational research. Its dominance is also attributed to well-established protocols, broad reagent availability, and strong integration into academic and clinical workflows.

As per flow cytometry market analysis, bead-based flow cytometry is experiencing rapid growth, particularly in multiplexed biomarker analysis, immunoassays, and high-throughput screening. This method uses antibody-coated microspheres (beads) to capture and quantify soluble proteins, nucleic acids, and other analytes in complex samples like serum or cell culture media. The increasing demand for cytokine profiling, protein quantification, and diagnostic assay development is driving its adoption in pharmaceutical, biotech, and diagnostic labs.

To get detailed segments analysis, Request a Free Sample Report

North America holds the largest market share of the flow cytometry market, driven by strong R&D infrastructure, high healthcare spending, and early adoption of advanced technologies. The region benefits from a robust presence of global market leaders, including BD, Thermo Fisher Scientific, and Beckman Coulter, as well as strong academic research output and clinical trial activity. Government and private investments in life sciences and personalized medicine further boost demand for flow cytometry in diagnostics and drug development.

The U.S. dominates the North American flow cytometry market, supported by well-established biotechnology and pharmaceutical industries. The country’s focus on precision medicine, immuno-oncology research, and CAR-T cell therapy is creating high demand for advanced cytometry tools. Leading institutions and companies are also driving innovation by integrating AI and automation into cytometry workflows. Regulatory support, such as FDA approvals of new clinical flow cytometers, further strengthens market maturity in the U.S.

As per regional analysis, Canada represents a growing market within North America, propelled by increasing investments in healthcare research and expansion of diagnostic laboratory infrastructure. Government funding for immunology, infectious disease monitoring, and cancer research is encouraging wider adoption of flow cytometry across public health and academic institutions. The Canadian market is also witnessing a rise in partnerships between local labs and global technology providers to enhance data-driven diagnostics.

As per regional outlook, Asia-Pacific is emerging as one of the fastest-growing regions in the flow cytometry market, fueled by rising healthcare awareness, expanding biotech industries, and increasing investment in academic and clinical research. Countries like Japan and South Korea are at the forefront of this growth, backed by advanced infrastructure and strategic collaborations with global companies. The growing need for cell-based diagnostics and personalized therapies is driving demand for high-parameter and cost-efficient cytometry systems.

As per industry analysis, Japan’s flow cytometry market is supported by a strong base of pharmaceutical research, aging population, and high incidence of chronic diseases such as cancer and autoimmune conditions. Japanese research institutions are integrating flow cytometry in translational research and biomarker discovery. The government’s push toward regenerative medicine and biopharmaceutical innovation is increasing the use of flow cytometry in clinical trials and stem cell research.

South Korea’s flow cytometry market is expanding rapidly due to growing investments in biotech startups, government initiatives in biomedical innovation, and the rise of smart diagnostics. Korean universities and clinical labs are adopting multiparameter flow cytometry for immunophenotyping and vaccine development. The presence of domestic tech players, along with collaborations with U.S. and European firms, is accelerating the adoption of next-gen cytometry technologies.

Europe is a mature and steadily growing flow cytometry market, driven by advanced healthcare systems, strong government support for life sciences, and rising demand for personalized medicine. Key countries such as Germany, the U.K., and Italy are investing in flow cytometry to enhance clinical diagnostics, cancer research, and pharmaceutical manufacturing. Regulatory harmonization and pan-European research funding under initiatives like Horizon Europe are fostering cross-border technology transfer and innovation.

Germany is a leading European country in flow cytometry adoption, thanks to its world-class biomedical research ecosystem, strong industrial base, and high R&D spending. The country emphasizes immuno-oncology, vaccine research, and academic-industry collaboration, where flow cytometry is a critical analytical tool. German hospitals and diagnostics labs are increasingly deploying advanced systems for clinical testing and therapeutic monitoring.

The U.K. is at the forefront of flow cytometry innovation in Europe, driven by its focus on precision diagnostics, cancer genomics, and AI integration in healthcare. Major research hubs like London, Cambridge, and Oxford are utilizing flow cytometry in translational research and drug trials. The National Health Service (NHS) is also supporting flow cytometry for infectious disease surveillance and blood disorder diagnostics.

Italy is witnessing gradual flow cytometry market growth adoption, supported by academic research initiatives and increasing clinical applications. Italian universities and regional healthcare systems are implementing flow cytometry for immunology, hematology, and microbiology. Collaborations with EU-based biotechnology firms and diagnostic labs are also helping Italy expand its capabilities in both basic research and clinical workflows.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

Rising Incidence of Chronic and Infectious Diseases

Technological Advancements in Instrumentation and Software

High Equipment and Maintenance Costs

Complexity of Operation and Data Interpretation

Request Free Customization of this report to help us to meet your business objectives.

The flow cytometry industry remains highly competitive and innovation-driven, with major players leveraging strategic collaborations, acquisitions, and technological enhancements to strengthen their market positions.

As per market strategies, in 2024, Cytek Biosciences made a significant move by acquiring the Flow Cytometry & Imaging business unit from DiaSorin’s subsidiary Luminex, enhancing its capabilities in both conventional and image-based cytometry. This acquisition broadened Cytek’s portfolio, enabling it to address more complex cellular analysis needs and expand into clinical research applications.

Several emerging startups are reshaping the flow cytometry landscape by introducing novel technologies and targeted solutions to address existing market gaps. These companies are focusing on miniaturization, affordability, AI integration, and point-of-care compatibility, making flow cytometry more accessible and versatile.

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected by means of Primary Exploratory Research backed by robust Secondary Desk research.

As per SkyQuest analysis, the increasing incidence of cancer, immunodeficiency disorder and infectious diseases is an important factor that promotes market growth. In addition, extensive research and development investments in biotechnology, life science, and biopharmaceutical research have contributed to a leveraged demand for flow cytometry instruments. High cost of instruments and reagents, limiting adoption in low-resource settings, and small laboratories. Key drivers of market growth include the increasing prevalence of chronic and infectious diseases. The market is characterized by a high degree of innovation owing to rapid technological advancements. In addition, incorporation of automation and multi-processing technologies in flow cytometry are expected to have a positive impact on its adoption during the forecast period.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 5.54 Billion |

| Market size value in 2033 | USD 11.03 Billion |

| Growth Rate | 7.95% |

| Base year | 2024 |

| Forecast period | 2026-2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Flow Cytometry Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Flow Cytometry Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Flow Cytometry Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Flow Cytometry Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients