Report ID: SQMIG45E2078

Report ID: SQMIG45E2078

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG45E2078 |

Region:

Global |

Published Date: June, 2025

Pages:

191

|Tables:

95

|Figures:

71

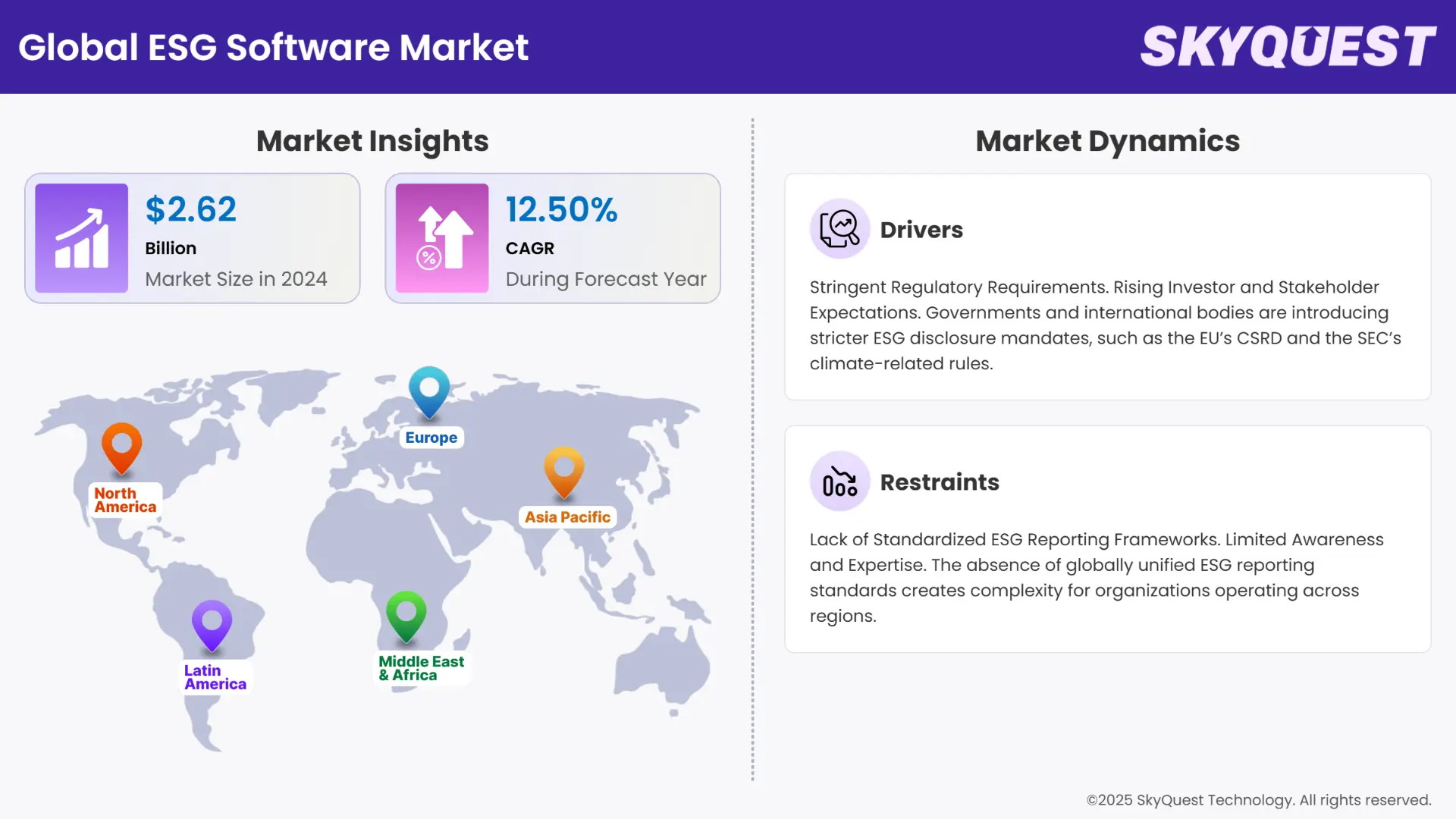

Global ESG Software Market size was valued at USD 2.62 Billion in 2024 poised to grow between USD 2.95 Billion in 2025 to USD 7.56 Billion by 2033, growing at a CAGR of 12.5% in the forecast period (2026–2033).

Governments and international regulatory bodies are enforcing increasingly strict ESG compliance frameworks, such as the EU’s Corporate Sustainability Reporting Directive (CSRD) and the SEC’s proposed climate disclosure rules. These mandates require companies to disclose detailed ESG metrics, including carbon emissions, diversity practices, and governance structures. Failure to comply can result in legal penalties, loss of stakeholder trust, and reputational damage. As a result, organizations are turning to ESG software solutions to automate data collection, streamline reporting, and ensure alignment with regulatory standards. This regulatory environment is driving widespread adoption, making compliance a key business priority and a primary driver of the market.

Institutional and retail investors are increasingly prioritizing ESG performance when allocating capital, seeking companies that align with ethical, social, and environmental values. This trend is fueled by a belief that sustainable companies are more resilient, future-ready, and better at managing long-term risks. To meet these evolving investor expectations and secure funding, organizations are leveraging ESG software to track key sustainability indicators, generate transparent reports, and benchmark performance. Accurate ESG data helps companies build credibility with stakeholders and differentiate themselves in competitive markets. This investor-driven demand has been a key trend driving the global ESG software market, encouraging adoption across industries seeking to enhance visibility and trust.

How does AI Help in Cleaning and Organizing Complex ESG Data Sets?

Artificial intelligence is significantly transforming the global ESG software market by enhancing the accuracy, efficiency, and predictive capabilities of ESG reporting. As ESG data sources grow in complexity and volume, AI algorithms can automatically collect, clean, and analyze unstructured data from sustainability reports, social media, and satellite imagery. This automation reduces manual errors and speeds up compliance reporting. Additionally, AI enables real-time risk analysis and scenario modeling, helping companies anticipate ESG risks. A notable development is Microsoft’s integration of AI into its Cloud for Sustainability, allowing firms to track carbon emissions and forecast sustainability metrics—illustrating AI’s growing role in ESG management.

In May 2025, UK-based startup Zevero launched an AI-powered ESG Disclosure Reporting solution that automatically extracts and interprets data from sustainability reports, policies, and governance records. This development accelerates ESG disclosures across frameworks like CDP and CSRD by reducing manual effort and enhancing report accuracy.

To get more insights on this market click here to Request a Free Sample Report

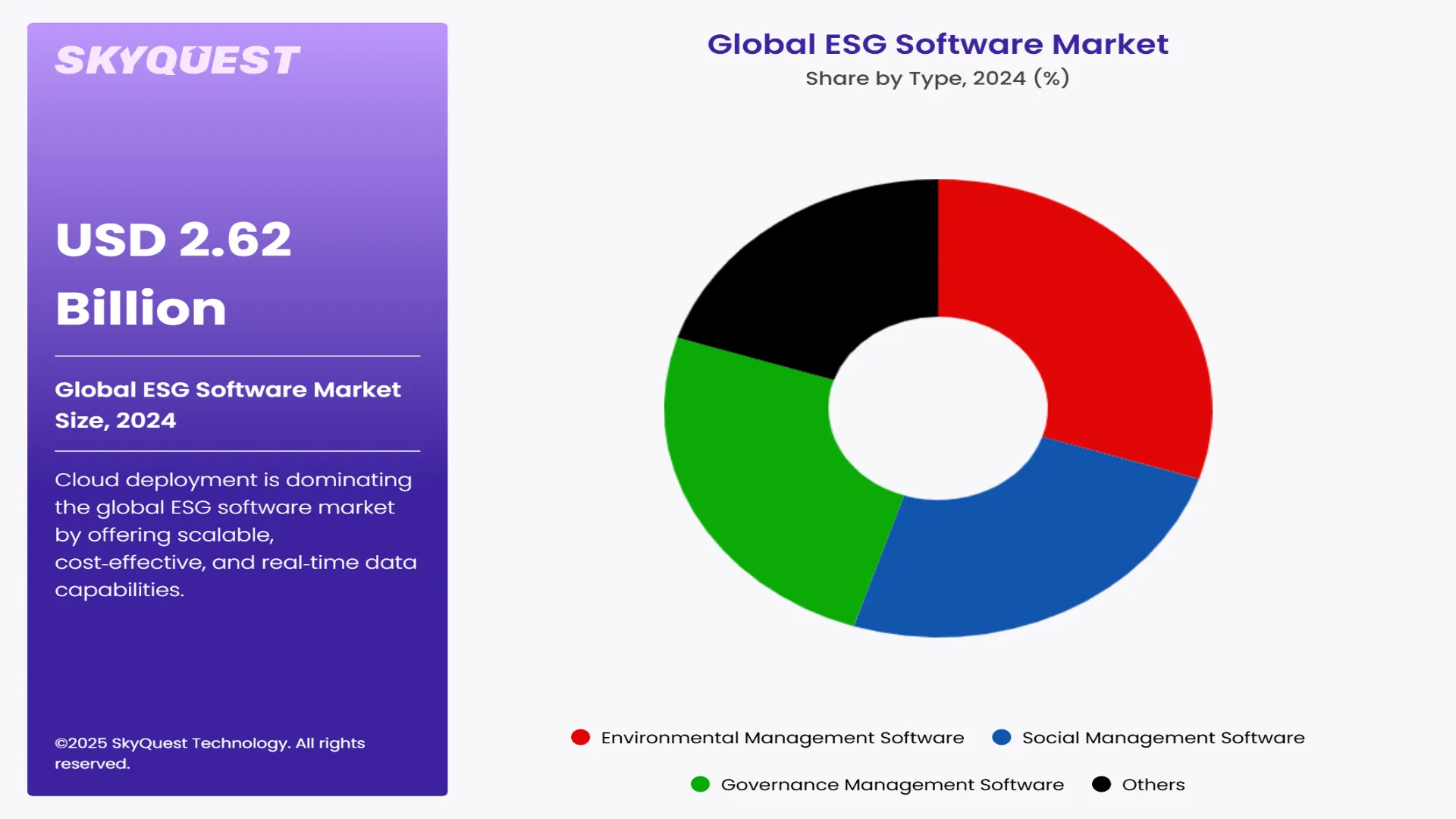

The global ESG software market is segmented based on type, deployment, vertical, and region. In terms of type, the market is grouped into environmental management software, social management software, governance management software, and others. Based on deployment, the market is bifurcated into on-premises and cloud. Based on vertical, the market is segmented into BFSI, energy & utilities, manufacturing, healthcare, retail, IT & telecommunications, government & public sector, and others. Based on region, the market is segmented into North America, Europe, Asia-Pacific, Central & South America and the Middle East & Africa.

Based on the global ESG software market forecast, environmental management software leads the industry as it enables precise tracking, monitoring, and reduction of environmental impacts like emissions, waste, and resource use—capabilities that are essential under regulations such as the EU Green Deal and Paris Agreement. Innovations in this type focus on integrating IoT sensors, cloud-based real-time dashboards, and AI-powered emissions forecasting, enhancing responsiveness and compliance. Because environmental metrics are the most regulated and quantifiable ESG components globally, this software type dominates market share and adoption.

Social management software is projected to grow rapidly in the global ESG software market due to rising emphasis on human capital, diversity, equity, inclusion (DEI), and ethical labor practices. This has increased demand for tools that monitor workforce diversity, supply chain practices, and community engagement, making Social Management Software essential for meeting evolving ESG expectations and disclosure requirements.

Cloud deployment is dominating the global ESG software market by offering scalable, cost‑effective, and real‑time data capabilities. Companies increasingly migrate ESG platforms to the cloud to integrate seamlessly with enterprise systems, access live dashboards, and optimize costs via pay‑as‑you‑go models. Innovations include IoT sensor integration for real‑time environmental monitoring and AI‑powered analytics hosted in the cloud. Because cloud enables flexibility, faster roll‑outs, remote collaboration, and lower infrastructure investment, it dominates ESG solution deployment.

On‑premise ESG solutions are poised to be fastest growing in the global ESG software market, as highly regulated industries like finance, healthcare, and utilities require stringent control over sensitive data and compliance workflows. This deployment model ensures full data sovereignty, customizable integration with legacy systems, and stronger protection against cyber risks—making it ideal for organizations prioritizing security and governance as ESG reporting standards intensify.

To get detailed segments analysis, Request a Free Sample Report

As per the global ESG software market analysis, North America leads the industry due to strong regulatory frameworks, rising investor demand for sustainable practices, and early technology adoption. The U.S. Securities and Exchange Commission’s climate disclosure rules and Canada’s ESG mandates are accelerating software uptake. Enterprises across sectors increasingly implement AI-driven ESG platforms for compliance, transparency, and competitive advantage, making North America a hub for innovation and strategic ESG software development.

The United States is the largest contributor to North America’s ESG software market, driven by strict regulatory developments such as the SEC’s climate disclosure mandates. U.S. enterprises are heavily investing in AI-powered ESG platforms to meet compliance, investor expectations, and sustainability goals. High digital maturity, robust capital markets, and pressure from stakeholders for transparency further accelerate the country’s leadership in ESG software adoption and innovation.

Canada is steadily expanding its role in the North America ESG software market through government-led sustainability initiatives and increasing demand for corporate ESG transparency. Canadian firms are adopting ESG tools to align with national environmental goals, green finance requirements, and international disclosure standards. With strong institutional interest in ethical investing, Canada is fostering innovation in ESG analytics and reporting solutions, supporting its growing contribution to North America’s ESG software ecosystem.

Europe is the fastest growing country in the global ESG software market, fueled by comprehensive regulatory frameworks such as the Corporate Sustainability Reporting Directive (CSRD) and Sustainable Finance Disclosure Regulation (SFDR). Companies across the region are rapidly adopting ESG platforms to ensure compliance and transparency. With strong institutional backing, advanced digital infrastructure, and rising investor pressure, countries like Germany, France, and the UK are driving sustained growth and innovation in ESG software adoption.

Germany plays a leading role in the Europe ESG software market due to its strong regulatory compliance culture and industrial base. German companies, especially in manufacturing and automotive sectors, are adopting ESG tools to track carbon footprints and align with EU sustainability directives. With software providers like SAP and strong government support for digital sustainability initiatives, Germany is accelerating ESG integration, contributing significantly to Europe’s overall ESG software growth.

The United Kingdom holds a prominent position in the Europe ESG software market, fueled by strong investor demand for sustainability metrics and a dynamic fintech ecosystem. UK firms widely adopt ESG platforms to align with disclosure frameworks such as TCFD and CDP. With London as a global financial center, the UK promotes ESG innovation, particularly through AI-enabled analytics tools, which enhance investment decisions and corporate transparency across various industries.

France is a key contributor to the Europe ESG software market, driven by national laws requiring ESG transparency from institutional investors and large corporations. French companies are investing in software solutions to meet EU-wide disclosure standards and track sustainability performance. With growing interest in green finance, data platforms, and ESG analytics tools, France continues to strengthen its position as a leading hub for responsible investment and corporate sustainability reporting.

Asia Pacific is the fastest-growing region in the global ESG software market, driven by rapid economic development, increasing ESG regulations, and rising awareness of corporate sustainability. Countries like China, India, Japan, and Australia are leading adoption due to government mandates and investor pressure. The region is also embracing AI-powered ESG platforms to meet disclosure standards and track environmental impact, positioning Asia Pacific as a dynamic hub for ESG software innovation and expansion.

Japan is a strong contributor to the Asia Pacific ESG software market, driven by national carbon neutrality goals and rising investor expectations. The government encourages ESG disclosures through frameworks like TCFD, prompting financial institutions and corporations to adopt ESG platforms. Japanese companies are integrating AI and data analytics into their sustainability reporting. With rising innovation and regulatory momentum, Japan is positioning itself as a key player in ESG software adoption across regional analysis.

South Korea is rapidly expanding its ESG software market footprint due to mandatory reporting regulations for large, listed companies and growing climate accountability. The Korean Emissions Trading Scheme (K-ETS) pushes firms to implement carbon and resource tracking software. Tech firms like Samsung SDS are leading ESG digital transformation with AI and IoT integration. As ESG awareness deepens, South Korea is emerging as a fast-growing market for comprehensive ESG software solutions.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

Stringent Regulatory Requirements

Rising Investor and Stakeholder Expectations

Lack of Standardized ESG Reporting Frameworks

Limited Awareness and Expertise

Request Free Customization of this report to help us to meet your business objectives.

The global ESG software market outlook is highly competitive, with key players like SAP, IBM, Microsoft, Wolters Kluwer, and Workiva leading innovation. SAP focuses on AI-integrated sustainability tools, while IBM offers cloud-based ESG reporting platforms. Microsoft enhances ESG analytics via its Cloud for Sustainability. Workiva emphasizes real-time ESG reporting compliance. These companies drive market growth through partnerships, cloud expansion, and regulatory-aligned features to meet increasing global sustainability and disclosure demands.

As per the global ESG software industry analysis, the startup ecosystem is rapidly evolving, driven by demand for automation, accuracy, and regulatory compliance. Startups leverage AI, machine learning, and cloud technologies to simplify ESG data management, reporting, and analytics. Their agility and innovation push market standards higher, challenging established players. With increasing investor and regulatory pressures, these startups secure funding and partnerships to scale their solutions, playing a crucial role in shaping the future of sustainable business practices globally.

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected by means of Primary Exploratory Research backed by robust Secondary Desk research.

As per SkyQuest analysis, the global ESG software industry is rapidly expanding, driven primarily by stringent regulatory mandates like the EU’s CSRD and investor demand for transparent sustainability data. Organizations increasingly adopt ESG platforms to automate reporting, ensure compliance, and build stakeholder trust. Technological innovations, especially AI and cloud integration, enhance data accuracy and real-time analytics, further accelerating adoption.

Environmental management software leads due to regulatory focus on emissions, while social management software is growing fast amid rising social accountability. Regionally, North America, Europe, and Asia Pacific each exhibit strong growth fueled by regulations and investor pressure. Despite challenges from diverse reporting standards and limited expertise, competition among established firms and agile startups fosters continuous innovation, shaping a resilient global ESG software market revenue.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 2.62 Billion |

| Market size value in 2033 | USD 7.56 Billion |

| Growth Rate | 12.5% |

| Base year | 2024 |

| Forecast period | 2026-2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the ESG Software Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the ESG Software Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the ESG Software Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the ESG Software Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients