CNG, RNG, and Hydrogen Tanks Market Insights

Market Overview:

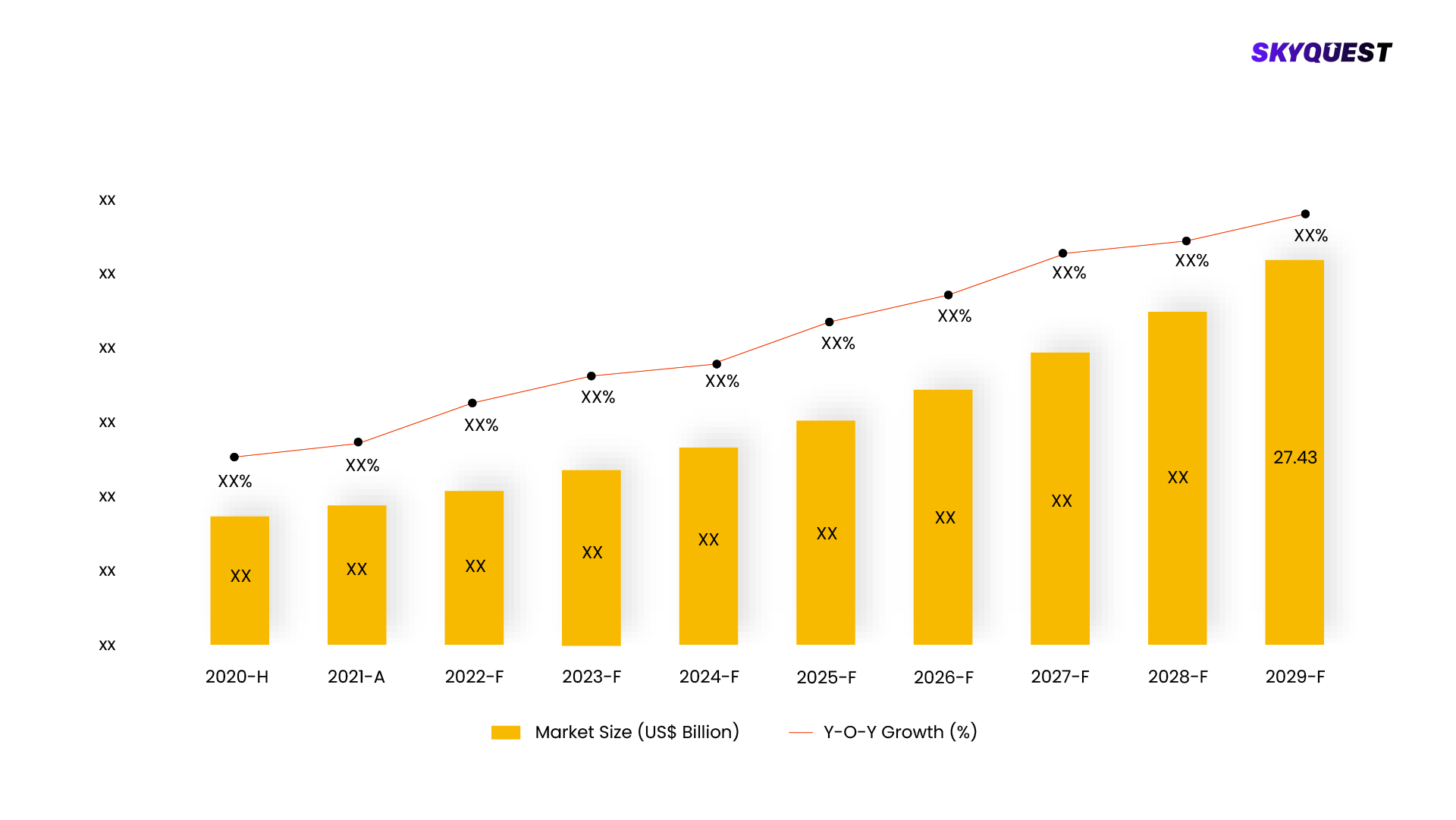

In 2022, it is projected that the worldwide market for CNG, RNG, and hydrogen storage tanks will reach approximately USD 2.5 billion and experience a compound annual growth rate (CAGR) of 10.7% over the forecasted duration. This growth is being driven by a strong commitment to transitioning away from conventional fossil fuels towards cleaner and more environmentally sustainable energy options. Heightened concerns surrounding climate change and air quality have spurred a growing interest in alternative fuel vehicles, including those powered by CNG, RNG, and hydrogen, further boosting the demand for these fuels.

CNG, RNG, and Hydrogen Tanks Market, Forecast & Y-O-Y Growth Rate, 2020 - 2028

To get more reports on the above market click here to

GET FREE SAMPLEThis report is being written to illustrate the market opportunity by region and by segments, indicating opportunity areas for the vendors to tap upon. To estimate the opportunity, it was very important to understand the current market scenario and the way it will grow in future.

Production and consumption patterns are being carefully compared to forecast the market. Other factors considered to forecast the market are the growth of the adjacent market, revenue growth of the key market vendors, scenario-based analysis, and market segment growth.

The market size was determined by estimating the market through a top-down and bottom-up approach, which was further validated with industry interviews. Considering the nature of the market we derived the Oil & Gas Storage & Transportation by segment aggregation, the contribution of the Oil & Gas Storage & Transportation in Energy Fuel and vendor share.

To determine the growth of the market factors such as drivers, trends, restraints, and opportunities were identified, and the impact of these factors was analyzed to determine the market growth. To understand the market growth in detail, we have analyzed the year-on-year growth of the market. Also, historic growth rates were compared to determine growth patterns.

Segmentation Analysis:

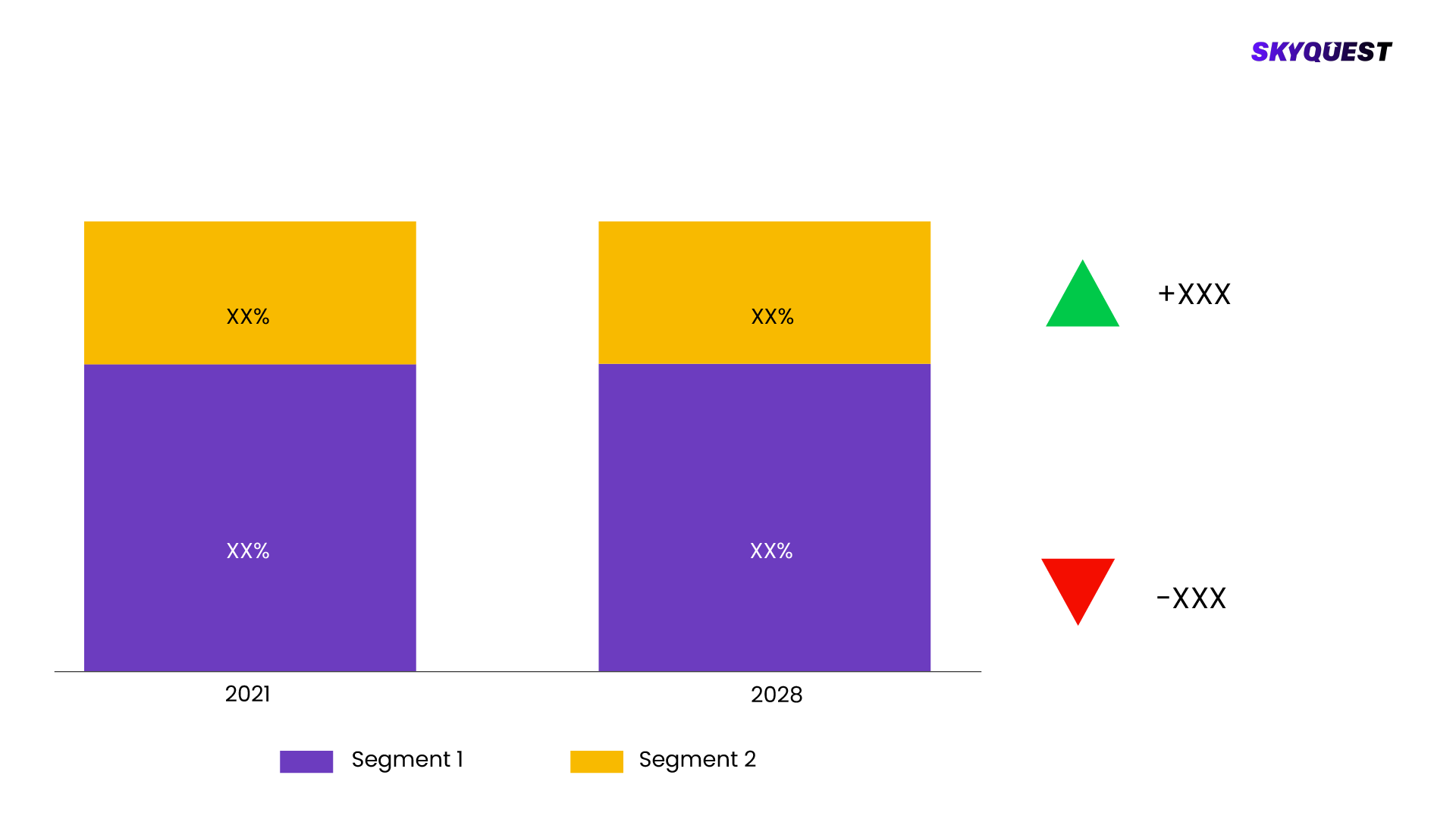

The CNG, RNG, and Hydrogen Tanks Market is segmented by Material Type, Tank Type, Gas Type, Application, Region. We are analyzing the market of these segments to identify which segment is the largest now and in the future, which segment has the highest growth rate, and the segment which offers the opportunity in the future.

CNG, RNG, and Hydrogen Tanks Market Basis Point Share Analysis, 2021 Vs. 2028

To get detailed analysis on all segments

<

BUY NOW

- Based on Material Type the market is segmented as, Metal, Glass Fiber, Carbon Fiber

- Based on Tank Type the market is segmented as, Type 1, Type 2, Type 3, Type 4

- Based on Gas Type the market is segmented as, CNG, RNG, Hydrogen

- Based on Application the market is segmented as, Fuel Tank, Transportation Tank

- Based on Region the market is segmented as, North America, Asia Pacific, Europe, Latin America

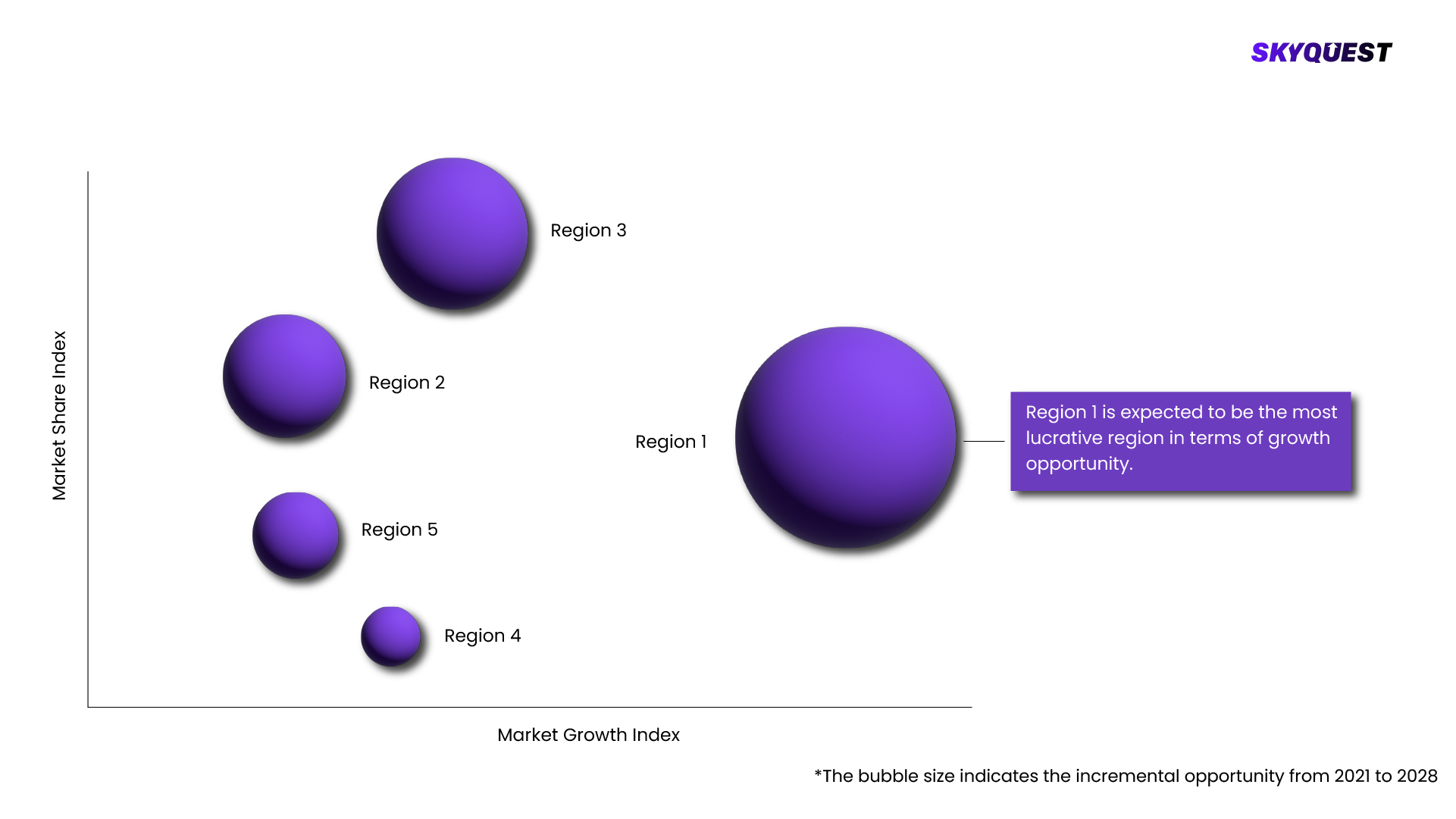

Regional Analysis:

CNG, RNG, and Hydrogen Tanks Market is being analyzed by North America, Europe, Asia-Pacific (APAC), Latin America (LATAM), Middle East & Africa (MEA) regions. Key countries including the U.S., Canada, Germany, France, UK, Italy, Spain, China, India, Japan, Brazil, GCC Countries, and South Africa among others were analyzed considering various micro and macro trends.

CNG, RNG, and Hydrogen Tanks Market Attractiveness Analysis, By Region 2020-2028

To know more about the market opportunities by region and country, click here to

REQUEST FREE CUSTOMIZATIONCNG, RNG, and Hydrogen Tanks Market : Risk Analysis

SkyQuest's expert analysts have conducted a risk analysis to understand the impact of external extremities on CNG, RNG, and Hydrogen Tanks Market. We analyzed how geopolitical influence, natural disasters, climate change, legal scenario, economic impact, trade & economic policies, social & ethnic concerns, and demographic changes might affect CNG, RNG, and Hydrogen Tanks Market's supply chain, distribution, and total revenue growth.

Competitive landscaping:

To understand the competitive landscape, we are analyzing key CNG, RNG, and Hydrogen Tanks Market vendors in the market. To understand the competitive rivalry, we are comparing the revenue, expenses, resources, product portfolio, region coverage, market share, key initiatives, product launches, and any news related to the CNG, RNG, and Hydrogen Tanks Market.

To validate our hypothesis and validate our findings on the market ecosystem, we are also conducting a detailed porter's five forces analysis. Competitive Rivalry, Supplier Power, Buyer Power, Threat of Substitution, and Threat of New Entry each force is analyzed by various parameters governing those forces.

Key Players Covered in the Report:

- Worthington Industries, Inc.

- Faber Industrie SpA

- Luxfer Group

- Hexagon Composites ASA

- Everest Kanto Cylinders Ltd.

- In terms of value, the industrial cleaning solvents market size is projected to increase from USD USD 1.1 billion in 2022 to USD 1.4 billion by 2028, at a CAGR of 4.3%. One of the major reasons making an positive outlook for the industrial cleaning solvents market is the fast industrial development, mounting demand from end-use industries for cleaning applications, and hygiene initiatives at place of work. Also, the mounting demand of bio-derived and green industrial cleaning solvents is pushing the market. Due to these reasons, the consumption of industrial cleaning solvents is grown significantly.

- Market Dynamics

- Driver: mounting demand from end-use industries for cleaning applications

- Industries such as heathcare, retail businesses, hospitality, and various institutions, there is a direct client interaction; thus, these industries and institutions are focuses on cleanliness. Additionally, industrial cleaning solvents plays important role in cleaning products as it is widely used in various products and forumulations to improves efficacy of cleaning solutions. Therefore, the demand for industrial cleaning solvents in rising form end-use industries.

- Restraints: strict government and ecological regulations

- The regulations from environmental and government authorities from regions such as North America and Europe are imposed due to the VOC contents of various industrial cleaning solvents. These industrial cleaning solvent products made from mineral spirits, which contains volatile organic compounds. Because of these VOC contents in products, products are becoming more difficult to control their exposure of workers. Therefore, regions such as North America, Europe and Asia Pacific implements regulations. Thus, they create a challenge for the industrial cleaning solvents.

- Opportunities: Growing need for bio-derived cleaning solvents

- Bio-derived cleaning solvents are contemplated more natural friendly as compared to traditional industrial cleaning solvents. Also, the mounting necessity for bio-derived cleaning solvents grants a substantial chance for manufacturers working in the industrial cleaning solvents market. Moreover, many countries have authorized regulations directing the use of bio-derived cleaning solvents due to their low toxicity and eco friendliness. This has led to an growth in demand for industrial cleaning solvents, which creates an opportunity for producers to tap into this growing market.

- Challenges : Harmfulness of some solvents

- Industrial cleaning solvents such as acetone, toluene, methyl ethyl ketone, trichloroethylene, tetrachloroethylene, and among others are toxic in nature and a cause of concern. Gernerally, they damage liver, kidneys and central nervous system, shows skin cancer in mice, and respiratory distress. Thus, the harmfulness of these industrial cleaning solvents is a major challenge for manufacturers.

- Industrial Cleaning Solvents Market Ecosystem

- Prominent companies in this market include well-established, financially stable industrial cleaning solvents business. These businesses have been in business for a while and have a extensive range of products, pioneering technologies, and strong international sales and marketing networks. Top companies in this market include Exxon Mobil Corporation (US), Shell plc (UK), BASF SE (Germany), Dow Inc. (US), and Lyondellbasell Industries N.V. (US).

- Based on application, general & medical device cleaning is projected to be the largest market for industrial cleaning solvents, in terms of value, during the forecast period.

- The industrial cleaning solvents market segmented in metal cleaners, food cleaners, general & medical device cleaning, commercial laundry and others on the basis of application. General & medical device cleaning segment is projected to be the largest application of industrial cleaning solvents. This is due to the cleaning solvents used in this applications is for various kinds such as cleaning of hard surfaces, desks, walls, and many others. Moreovers, they shows antimicrobial properties which helps to prevent from diseases thus they are more used to clean medical devices.

- Based on end-use industry, manufacturing and commercial offices is projected to be the largest market for industrial cleaning solvents, in terms of value, during the forecast period.

- The industrial cleaning solvents are used in wide range of application and the market segmented into food processing, healthcare, hospitality, automotive & aerospace, manufacturing & commerical offices, retail & food service and others. The manufacturing and commercial offices end-use industry needs more cleaning solvents products for machinery cleaning, hard surface cleaning, and disinfection. Also, the solvents are suitable for cleaning products in industries as they does not leave any residue and evaporates fastly which allows it to use them to clean dirt from complicated parts. Hence, the manufacturing and commercial offices segment is the largest application for the industrial cleaning solvents market.

- “Asia Pacific accounted for the largest market share for industrial cleaning solvents market, in terms of value, in 2022”

- In terms of value, Asia Pacific was the largest market for industrial cleaning solvents, in terms of value, in 2022, followed by the North America. This is due to the heavy industrial development, rise in population, low labour cost, improved living standards and accessibility of raw materials in this region. Also, the regulations in this region is not much strict as compared to other regions. Thus, due to these reasons the Asia Pacific holds the largest market share for industrial cleaning solvents.

- Recent Developments

- In May 2022, BASF has started a new production site for methan sulfonic acid at its Ludwigshafen Verbund site.

- In February 2022, Eastman Chemical Company completed the expansion of its tertiary amine capacity. From this expansion its Ghent manufacturing site became a largest tertiary amine facility in entire globe.

- In March 2021, Celanese Corporation planned to expand its acetyl chain capacities to support the demand of customers.

- KEY MARKET SEGMENTS

- On The Basis Of Application

- General & Medical Device Cleaning

- Metal Cleaners

- Disinfectants

- Commercial Laundry

- Food Cleaners

- Others

- On The Basis Of End-use Industry

- Manufacturing and Commercial Offices

- Healthcare

- Retail & Food Service

- Hospitality

- Automotive and Aerospace

- Food Processing

- Others

- On The Basis Of Region

- Asia Pacific

- North America

- Europe

- Middle East & Arica

- South America

- KEY PLAYERS

- Exxon Mobil Corporation

- Shell plc

- BASF SE

- Dow Inc.

- Lyondellbasell Industries N.V.

- Solvay S.A., Eastman Chemical Company

- Celanese Corporation

- Ashland Inc.

- Clariant AG

SkyQuest's Expertise:

The CNG, RNG, and Hydrogen Tanks Market is being analyzed by SkyQuest's analysts with the help of 20+ scheduled Primary interviews from both the demand and supply sides. We have already invested more than 250 hours on this report and are still refining our date to provide authenticated data to your readers and clients. Exhaustive primary and secondary research is conducted to collect information on the market, peer market, and parent market.

Our cross-industry experts and revenue-impact consultants at SkyQuest enable our clients to convert market intelligence into actionable, quantifiable results through personalized engagement.

Scope Of Report

| Report Attribute |

Details |

| The base year for estimation |

2021 |

| Historical data |

2016 – 2022 |

| Forecast period |

2022 – 2028 |

| Report coverage |

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments covered |

- By Material Type - Metal, Glass Fiber, Carbon Fiber

- By Tank Type - Type 1, Type 2, Type 3, Type 4

- By Gas Type - CNG, RNG, Hydrogen

- By Application - Fuel Tank, Transportation Tank

- By Region - North America, Asia Pacific, Europe, Latin America

|

| Regional scope |

North America, Europe, Asia-Pacific (APAC), Latin America (LATAM), Middle East & Africa (MEA) |

| Country scope |

U.S., Canada, Germany, France, UK, Italy, Spain, China, India, Japan, Brazil, GCC Countries, South Africa |

| Key companies profiled |

- Worthington Industries, Inc.

- Faber Industrie SpA

- Luxfer Group

- Hexagon Composites ASA

- Everest Kanto Cylinders Ltd.

- In terms of value, the industrial cleaning solvents market size is projected to increase from USD USD 1.1 billion in 2022 to USD 1.4 billion by 2028, at a CAGR of 4.3%. One of the major reasons making an positive outlook for the industrial cleaning solvents market is the fast industrial development, mounting demand from end-use industries for cleaning applications, and hygiene initiatives at place of work. Also, the mounting demand of bio-derived and green industrial cleaning solvents is pushing the market. Due to these reasons, the consumption of industrial cleaning solvents is grown significantly.

- Market Dynamics

- Driver: mounting demand from end-use industries for cleaning applications

- Industries such as heathcare, retail businesses, hospitality, and various institutions, there is a direct client interaction; thus, these industries and institutions are focuses on cleanliness. Additionally, industrial cleaning solvents plays important role in cleaning products as it is widely used in various products and forumulations to improves efficacy of cleaning solutions. Therefore, the demand for industrial cleaning solvents in rising form end-use industries.

- Restraints: strict government and ecological regulations

- The regulations from environmental and government authorities from regions such as North America and Europe are imposed due to the VOC contents of various industrial cleaning solvents. These industrial cleaning solvent products made from mineral spirits, which contains volatile organic compounds. Because of these VOC contents in products, products are becoming more difficult to control their exposure of workers. Therefore, regions such as North America, Europe and Asia Pacific implements regulations. Thus, they create a challenge for the industrial cleaning solvents.

- Opportunities: Growing need for bio-derived cleaning solvents

- Bio-derived cleaning solvents are contemplated more natural friendly as compared to traditional industrial cleaning solvents. Also, the mounting necessity for bio-derived cleaning solvents grants a substantial chance for manufacturers working in the industrial cleaning solvents market. Moreover, many countries have authorized regulations directing the use of bio-derived cleaning solvents due to their low toxicity and eco friendliness. This has led to an growth in demand for industrial cleaning solvents, which creates an opportunity for producers to tap into this growing market.

- Challenges : Harmfulness of some solvents

- Industrial cleaning solvents such as acetone, toluene, methyl ethyl ketone, trichloroethylene, tetrachloroethylene, and among others are toxic in nature and a cause of concern. Gernerally, they damage liver, kidneys and central nervous system, shows skin cancer in mice, and respiratory distress. Thus, the harmfulness of these industrial cleaning solvents is a major challenge for manufacturers.

- Industrial Cleaning Solvents Market Ecosystem

- Prominent companies in this market include well-established, financially stable industrial cleaning solvents business. These businesses have been in business for a while and have a extensive range of products, pioneering technologies, and strong international sales and marketing networks. Top companies in this market include Exxon Mobil Corporation (US), Shell plc (UK), BASF SE (Germany), Dow Inc. (US), and Lyondellbasell Industries N.V. (US).

- Based on application, general & medical device cleaning is projected to be the largest market for industrial cleaning solvents, in terms of value, during the forecast period.

- The industrial cleaning solvents market segmented in metal cleaners, food cleaners, general & medical device cleaning, commercial laundry and others on the basis of application. General & medical device cleaning segment is projected to be the largest application of industrial cleaning solvents. This is due to the cleaning solvents used in this applications is for various kinds such as cleaning of hard surfaces, desks, walls, and many others. Moreovers, they shows antimicrobial properties which helps to prevent from diseases thus they are more used to clean medical devices.

- Based on end-use industry, manufacturing and commercial offices is projected to be the largest market for industrial cleaning solvents, in terms of value, during the forecast period.

- The industrial cleaning solvents are used in wide range of application and the market segmented into food processing, healthcare, hospitality, automotive & aerospace, manufacturing & commerical offices, retail & food service and others. The manufacturing and commercial offices end-use industry needs more cleaning solvents products for machinery cleaning, hard surface cleaning, and disinfection. Also, the solvents are suitable for cleaning products in industries as they does not leave any residue and evaporates fastly which allows it to use them to clean dirt from complicated parts. Hence, the manufacturing and commercial offices segment is the largest application for the industrial cleaning solvents market.

- “Asia Pacific accounted for the largest market share for industrial cleaning solvents market, in terms of value, in 2022”

- In terms of value, Asia Pacific was the largest market for industrial cleaning solvents, in terms of value, in 2022, followed by the North America. This is due to the heavy industrial development, rise in population, low labour cost, improved living standards and accessibility of raw materials in this region. Also, the regulations in this region is not much strict as compared to other regions. Thus, due to these reasons the Asia Pacific holds the largest market share for industrial cleaning solvents.

- Recent Developments

- In May 2022, BASF has started a new production site for methan sulfonic acid at its Ludwigshafen Verbund site.

- In February 2022, Eastman Chemical Company completed the expansion of its tertiary amine capacity. From this expansion its Ghent manufacturing site became a largest tertiary amine facility in entire globe.

- In March 2021, Celanese Corporation planned to expand its acetyl chain capacities to support the demand of customers.

- KEY MARKET SEGMENTS

- On The Basis Of Application

- General & Medical Device Cleaning

- Metal Cleaners

- Disinfectants

- Commercial Laundry

- Food Cleaners

- Others

- On The Basis Of End-use Industry

- Manufacturing and Commercial Offices

- Healthcare

- Retail & Food Service

- Hospitality

- Automotive and Aerospace

- Food Processing

- Others

- On The Basis Of Region

- Asia Pacific

- North America

- Europe

- Middle East & Arica

- South America

- KEY PLAYERS

- Exxon Mobil Corporation

- Shell plc

- BASF SE

- Dow Inc.

- Lyondellbasell Industries N.V.

- Solvay S.A., Eastman Chemical Company

- Celanese Corporation

- Ashland Inc.

- Clariant AG

|

| Customization scope |

Free report customization (15% Free customization) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options |

Reap the benefits of customized purchase options to fit your specific research requirements. |

Objectives of the Study

- To forecast the market size, in terms of value, for various segments with respect to five main regions, namely, North America, Europe, Asia-Pacific (APAC), Latin America (LATAM), Middle East & Africa (MEA)

- To provide detailed information regarding the major factors influencing the growth of the Market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the micro markets with respect to the individual growth trends, future prospects, and contribution to the total market

- To provide a detailed overview of the value chain and analyze market trends with the Porter's five forces analysis

- To analyze the opportunities in the market for various stakeholders by identifying the high-growth Segments

- To identify the key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for the market leaders

- To analyze competitive development such as joint ventures, mergers and acquisitions, new product launches and development, and research and development in the market

What does this Report Deliver?

- Market Estimation for 20+ Countries

- Historical data coverage: 2016 to 2022

- Growth projections: 2022 to 2028

- SkyQuest's premium market insights: Innovation matrix, IP analysis, Production Analysis, Value chain analysis, Technological trends, and Trade analysis

- Customization on Segments, Regions, and Company Profiles

- 100+ tables, 150+ Figures, 10+ matrix

- Global and Country Market Trends

- Comprehensive Mapping of Industry Parameters

- Attractive Investment Proposition

- Competitive Strategies Adopted by Leading Market Participants

- Market drivers, restraints, opportunities, and its impact on the market

- Regulatory scenario, regional dynamics, and insights of leading countries in each region

- Segment trends analysis, opportunity, and growth

- Opportunity analysis by region and country

- Porter's five force analysis to know the market's condition

- Pricing analysis

- Parent market analysis

- Product portfolio benchmarking