Product ID: UCMIG10B2008

Report ID:

UCMIG10B2008 |

Region:

Global |

Published Date: Upcoming |

Pages:

165

| Tables: 55 | Figures: 60

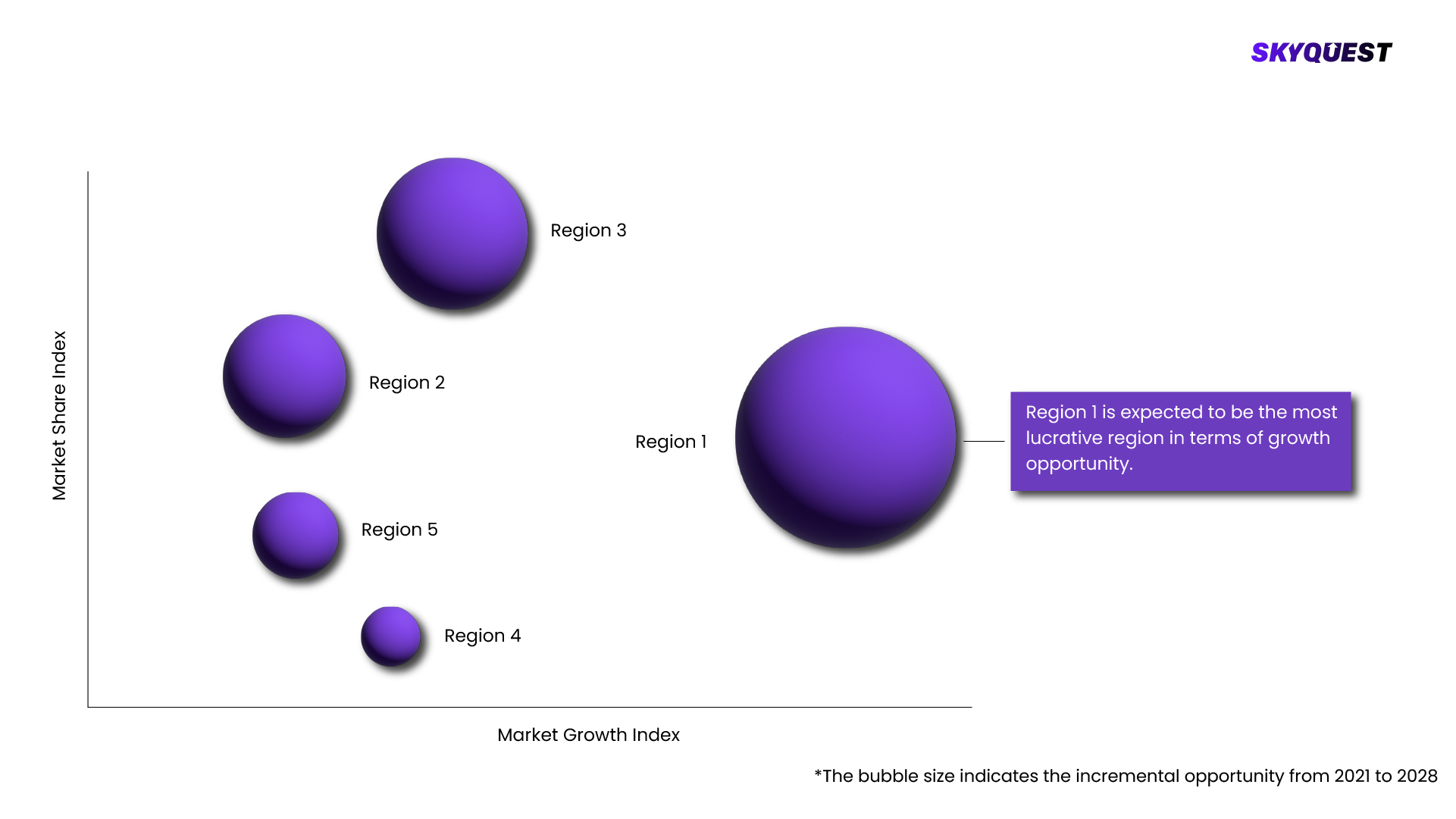

Blockchain In Energy Market is being analyzed by North America, Europe, Asia-Pacific (APAC), Latin America (LATAM), Middle East & Africa (MEA) regions. Key countries including the U.S., Canada, Germany, France, UK, Italy, Spain, China, India, Japan, Brazil, GCC Countries, and South Africa among others were analyzed considering various micro and macro trends.

Our industry expert will work with you to provide you with customized data in a short amount of time.

REQUEST FREE CUSTOMIZATIONThe global market for Blockchain In Energy was estimated to be valued at US$ XX Mn in 2021.

The global Blockchain In Energy Market is estimated to grow at a CAGR of XX% by 2028.

The global Blockchain In Energy Market is segmented on the basis of Category, Application, Region.

Based on region, the global Blockchain In Energy Market is segmented into North America, Europe, Asia Pacific, Middle East & Africa and Latin America.

The key players operating in the global Blockchain In Energy Market are Accenture, Oracle, SAP, Drift, EnergiMine Ltd., Conjoule GmbH, Sun Exchange, Greeneum, Grid Singularity, .

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Product ID: UCMIG10B2008