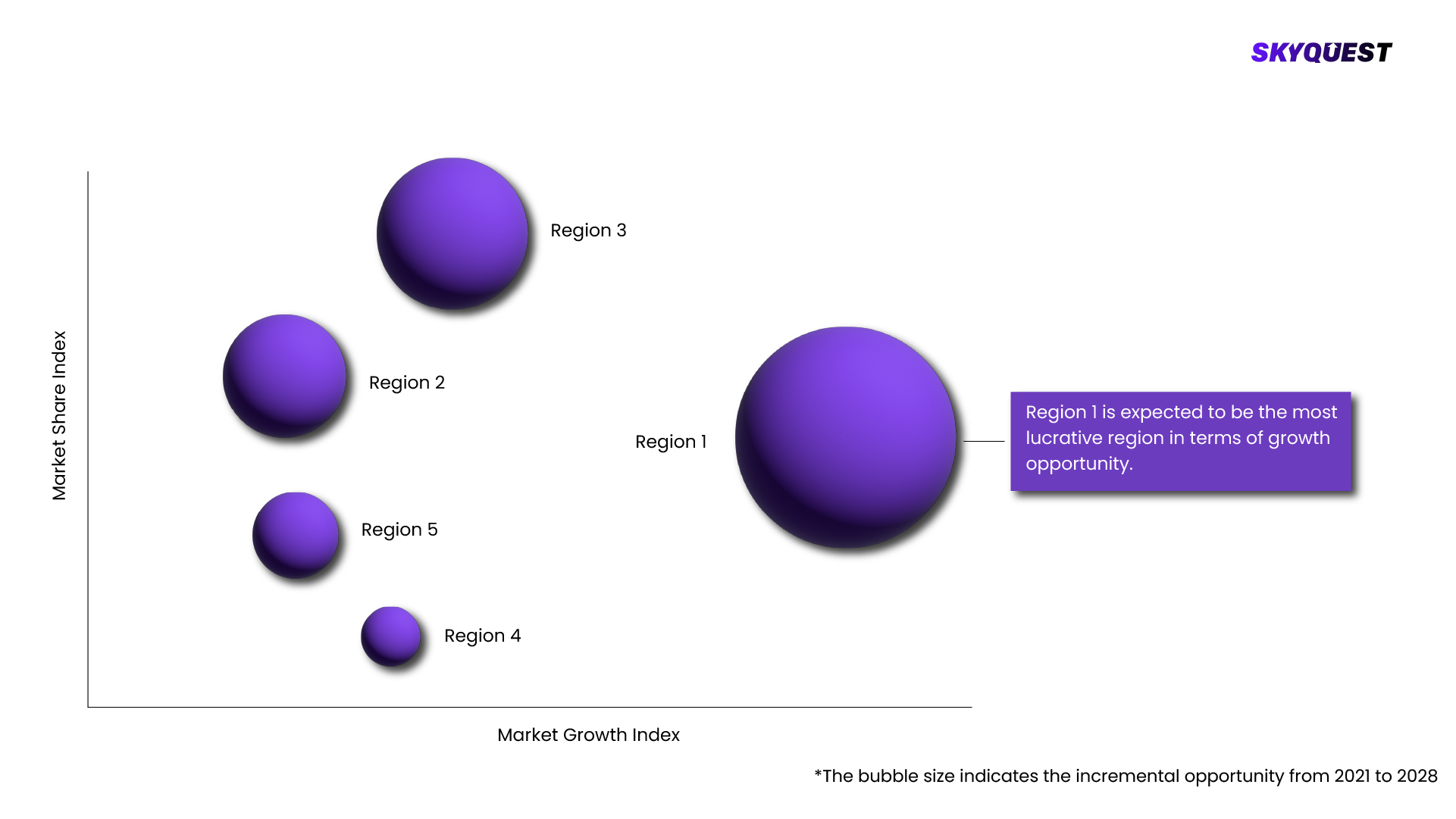

The key players operating in the Autonomous Mobile Robots Market are autonomous mobile robots market size is estimated to be valued USD 1.8 billion in 2023 and is anticipated to reach USD 4.1 billion by 2028, at a CAGR of 17.5% during the forecast period. The market growth is ascribed to increasing demand for AMRs across several industries, growing need for automation and labor optimization in warehouses, and rising demand for supply chain optimization. Additionally, emerging applications of AMR in a variety of industries are contributing to this market growth. , Driver: Rapid advancements in robotics and artificial intelligence , The market for autonomous mobile robots (AMRs) is expanding because of developments in robotics and artificial intelligence (AI) technology, allowing for the creation of sophisticated autonomous mobile robots. These robots are highly effective and versatile for various businesses as they can carry out complicated tasks independently. The development of advanced sensor technologies has greatly enhanced the capabilities of AMRs. Robots can precisely see and navigate their surroundings by using sensors like cameras, ultrasonic sensors, and LiDAR (light detection and ranging) systems. They can detect obstacles, map environments, and make real-time decisions to avoid collisions. For, Instance, Velodyne, which specializes in LiDAR sensors, have made significant advancements in sensor technology, enabling better perception and navigation for AMRs. AI algorithms and machine learning techniques enable AMRs to learn and adapt to their environments. Computer vision allows robots to recognize and interpret objects, people, and gestures, allowing for more sophisticated interaction with the surroundings. For instance, Boston Dynamics have developed AMRs like Spot that utilize advanced computer vision algorithms to perform inspection, surveillance, and data collection tasks. Moreover, AMRs are equipped with intelligent navigation systems utilize AI algorithms to plan efficient paths, avoid obstacles, and adapt to dynamic surroundings. And cloud computing enables real-time data processing and analysis and remote monitoring and control of AMRs. For instance, Mobile Industrial Robots offers collaborative AMRs that use AI-based navigation algorithms to optimize routes and avoid collisions in industrial and warehouse settings. , Restraint: High initial investment , The high initial expenditure required for Autonomous Mobile Robots (AMRs) is a key barrier to their implementation. Implementing Autonomous Mobile Robots (AMRs) requires a significant budget allocation for hardware acquisition, infrastructure modifications, and software development. Organizations need to invest in robotics, sensors, and other relevant equipment and make infrastructure changes such as navigation systems and charging stations. Integrating AMRs with existing enterprise systems such as Warehouse management systems or ERP systems necessitates extra software customization. Moreover, organizations must allocate resources for training employees to effectively work with AMRs and cover ongoing operational costs such as maintenance, repairs, and upgrades. These factors contribute to the high initial investment required for AMR implementation, which can be a barrier for some organizations, especially small and medium-sized enterprises with limited budgets. , Opportunity: potential growth in industry-specific applications , Businesses can open new opportunities and promote innovation by customising AMR technology to match particular sectors' distinct requirements and constraints. AMRs offers solutions to various industries including e-commerce, retail, manufacturing, food & beverage, healthcare, and hospitality. In healthcare industry, AMRs can be customized for supporting tasks such as delivery of supplies and medicines, linen and waste management, disinfection and cleaning, remote monitoring, assistance in patent care and in surgery. For instance, Savioke's Relay robot is designed for healthcare settings, delivering medication and supplies autonomously in hospitals. In retail and e-commerce, AMRs improve inventory management, order fulfillment, and customer experiences by navigating store aisles, restocking shelves, and offering personalized recommendations. The increasing digitalization of supply chains with the advent of Industry 4.0, IoT, big data analytics, and cloud computing has positively impacted application of AMRs. , Challenge: Integrating AMRs into existing workflows and systems , Many industries already have established processes, infrastructure, and legacy systems in place. Integrating autonomous mobile robots (AMRs) with existing systems poses challenges such as compatibility issues, data integration complexities, system scalability, system complexity, customization/configuration requirements, security and privacy concerns, and the need for user training and adoption. , Integrating autonomous mobile robots (AMRs) into various industries poses challenges as they need to coordinate seamlessly with existing systems. In warehouse and logistics operations, AMRs must establish communication with WMS and ERP systems, encountering hurdles such as different protocols and real-time synchronization. Similarly, AMRs must integrate with CAD, MES, and PLC systems to synchronize with machinery in manufacturing. For retail applications, AMRs must integrate with POS systems, barcode scanners, and inventory databases to ensure precise tracking. Moreover, in healthcare, integrating AMRs involves coordinating with EHR, medication management, and patient monitoring systems while prioritizing data security and compliance. Addressing these challenges necessitates meticulous coordination and compatibility to achieve successful integration. , To overcome these obstacles, AMR developers, system integrators, and stakeholders must work together, plan carefully, and have technical know-how. Making effective integration plans and ensuring a successful implementation requires understanding the current systems' limits. , Autonomous Mobile Robots Market: Key Trends , ABB, Omron Automation, Mobile Industrial Robots, Fetch Robotics, OTTO Motors are the top players in the AMR market. These AMR companies with advance robotics and AI technology trends with a comprehensive product portfolio and solid geographic footprint. , Hardware segment accounted for the largest share of autonomous mobile robots market in 2022 , Hardware segment accounted for the largest market share in the autonomous mobile robots (AMR) market due to their essential role in enabling robot functionality. Sensors serve as the robot's senses, batteries supply the necessary power, and actuators allow for movement and manipulation. For AMRs to function, reliably, and productively, efficient and long-lasting batteries, precise and dependable sensors, and high-quality actuators are essential. Robots can see their surroundings, navigate, and interact with objects because of the cooperation of these hardware components, which enables autonomous operation. The ongoing development and broad implementation of AMRs across numerous industries are fueled by advancements in battery technology, sensor capabilities, and actuator precision. , Laser/LiDAR navigation technology to account for the largest share in the market during forecast period. , The Laser/ LiDAR navigation technology account for the largest share in the market during forecast period. For autonomous mobile robots (AMRs), laser/LiDAR technology is essential because it provides accurate environmental sensing, obstacle avoidance, navigation, localization, mapping, and object recognition. AMRs are able to sense and navigate their environment precisely because to laser/LiDAR sensors, which produce accurate 3D maps of the surroundings by producing laser pulses and measuring the reflected light. They aid AMRs in real-time obstacle detection, safe path planning, and collision avoidance. AMRs can construct maps and determine their own positions within them thanks to the simultaneous localization and mapping (SLAM) algorithms that incorporate laser/LiDAR sensors. , North America held the largest autonomous mobile robots market share in 2022. , AMRs are being increasingly adopted in a diverse range of industries in North America, including manufacturing, logistics, retail, healthcare, and e-commerce. These robots are used for several tasks, such as material handling, picking and packing, inventory management, and even healthcare supply. The versatile nature of AMRs makes them suitable for a wide range of applications, driving their adoption across industries in North America. , Recent Developments , In March 2023, Locus Robotics introduced LocusONE, a data science-driven warehouse platform to enable seamless operation and management of large quantities of multiple AMR form factors as a single, coordinated fleet in all sizes of warehouses. , In January 2023, Geek+ launched RoboShuttle Plus, which combines its storage RoboShuttle robot with both tote-carrying P40 and flagship rack-to-person P800 robots into one operational area. , In January 2021, Fetch Robotics launched PalletTransport1500 an autonomous mobile robot designed specifically to replace forklift uses in warehouses. , KEY MARKET SEGMENTS, By Offering , Hardware , Software & Services , By Payload Capacity , <100 kg , 100 kg−500 kg , >500 kg , By Navigation Technology , Laser/LiDAR , Vision Guidance , Others , By Industry , E-commerce , Manufacturing , Retail , Food & Beverage , Healthcare , Logistics , Others , By Region , North America , US , Canada , Mexico , Europe , UK , Germany , France , Rest of Europe , Asia Pacific , China , Japan , South Korea , Rest of Asia Pacific , Rest of the World , Middle East & Africa , South America, KEY MARKET PLAYERS , ABB, Omron Automation , Mobile Industrial Robots , Fetch Robotics , OTTO Motors , Locus Robotic , Geek+ .