Wound Closure Devices Market Insights

Market Overview:

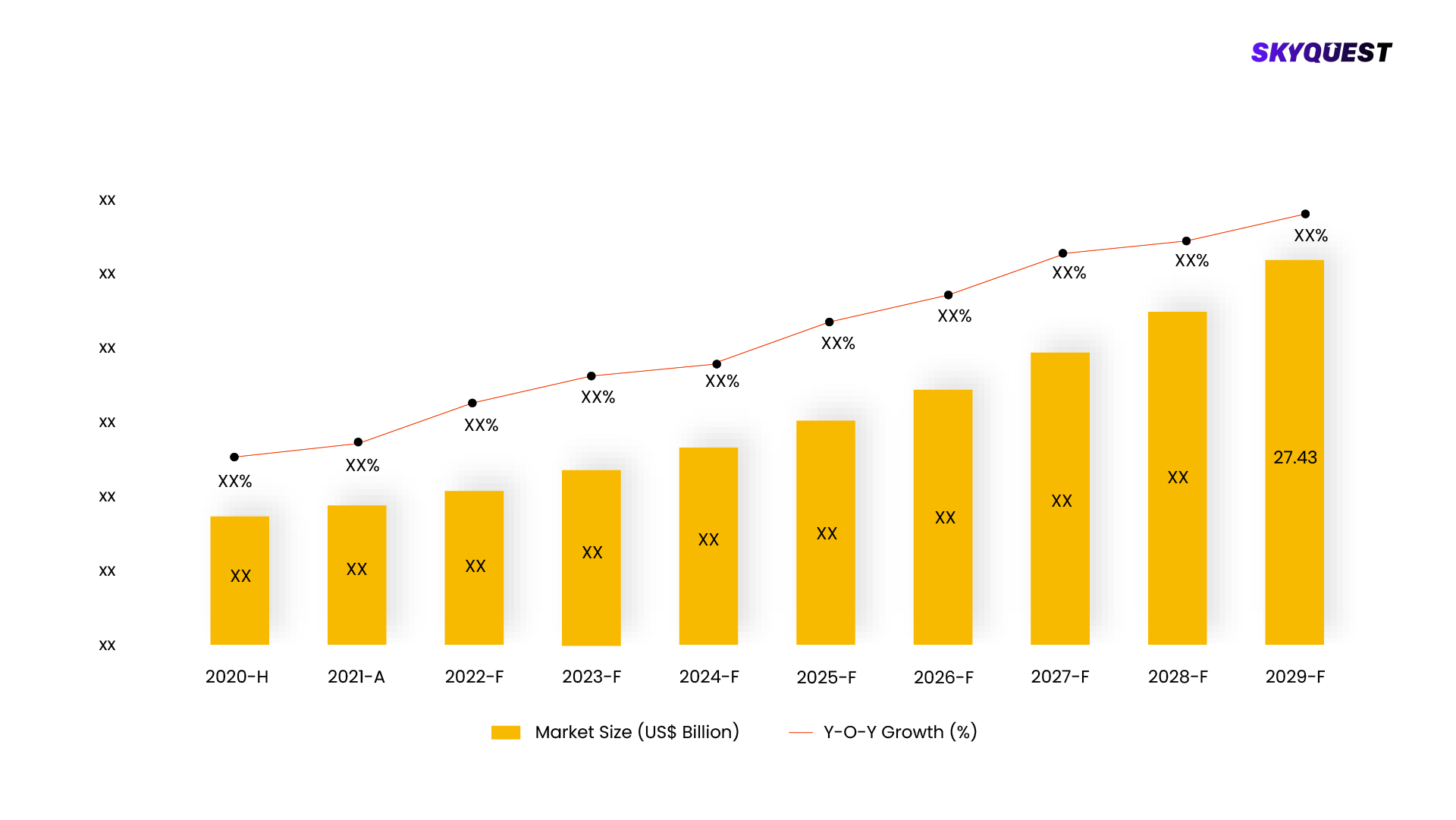

The size of the global market for wound closure devices, which was estimated at USD 13.23 billion in 2018, is anticipated to grow at a CAGR of 7.1% from 2018 to 2023. The incidence of chronic wounds, increased accident rates, and an increase in operations are all contributing to an increase in the demand for wound closure devices. Over the forecast period, it is anticipated that the prevalence of chronic wounds such as pressure ulcers, venous leg ulcers, and diabetic foot ulcers will increase.

Wound Closure Devices Market, Forecast & Y-O-Y Growth Rate, 2020 - 2028

To get more reports on the above market click here to

GET FREE SAMPLEThis report is being written to illustrate the market opportunity by region and by segments, indicating opportunity areas for the vendors to tap upon. To estimate the opportunity, it was very important to understand the current market scenario and the way it will grow in future.

Production and consumption patterns are being carefully compared to forecast the market. Other factors considered to forecast the market are the growth of the adjacent market, revenue growth of the key market vendors, scenario-based analysis, and market segment growth.

The market size was determined by estimating the market through a top-down and bottom-up approach, which was further validated with industry interviews. Considering the nature of the market we derived the Health Care Supplies by segment aggregation, the contribution of the Health Care Supplies in Health Care Equipment & Services and vendor share.

To determine the growth of the market factors such as drivers, trends, restraints, and opportunities were identified, and the impact of these factors was analyzed to determine the market growth. To understand the market growth in detail, we have analyzed the year-on-year growth of the market. Also, historic growth rates were compared to determine growth patterns.

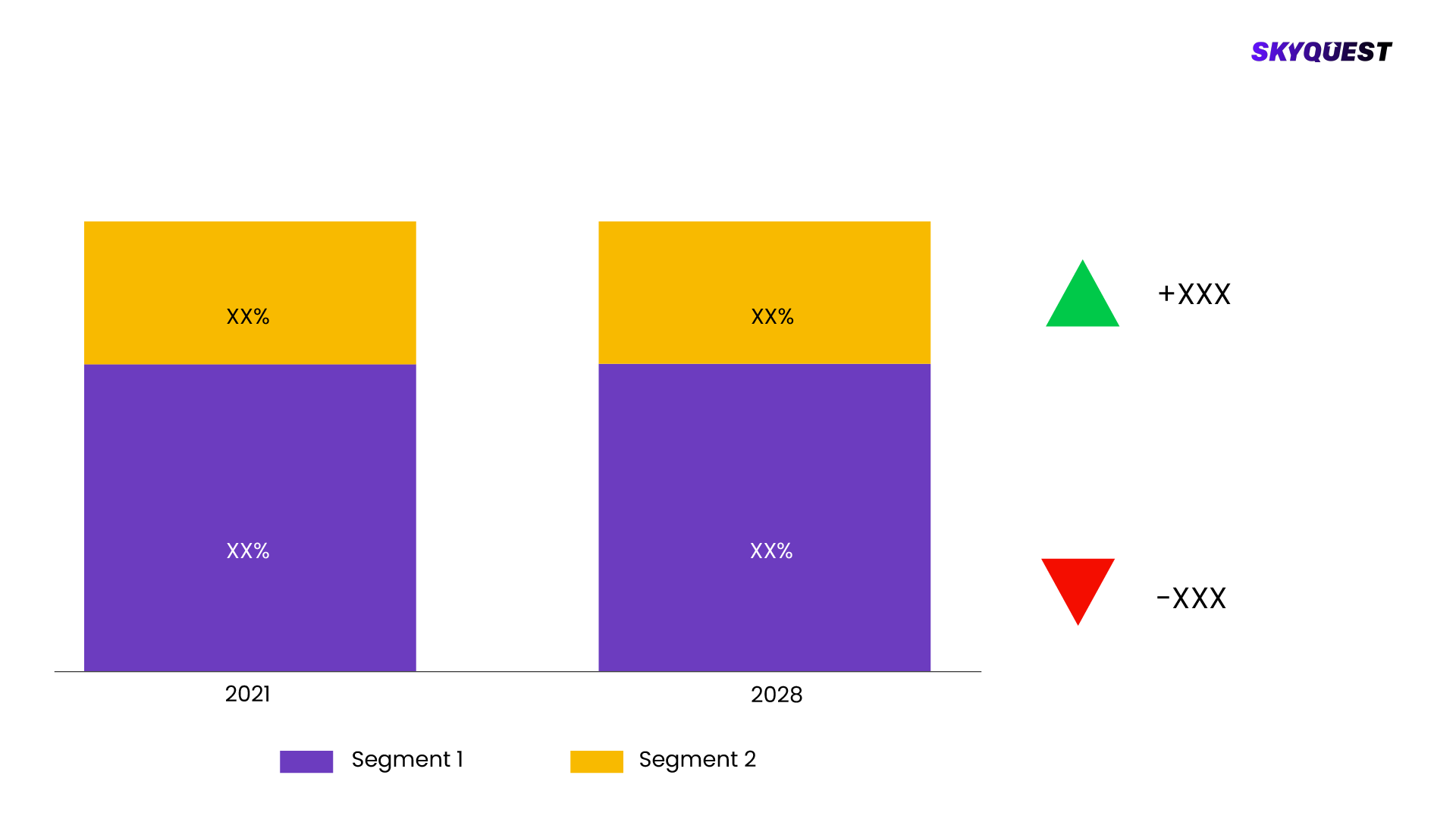

Segmentation Analysis:

The Wound Closure Devices Market is segmented by Product, Wound Type, End-use, Region. We are analyzing the market of these segments to identify which segment is the largest now and in the future, which segment has the highest growth rate, and the segment which offers the opportunity in the future.

Wound Closure Devices Market Basis Point Share Analysis, 2021 Vs. 2028

To get detailed analysis on all segments

<

BUY NOW

- Based on Product the market is segmented as, Adhesives, Staples, Sutures, Absorbable, Non-absorbable, Strips, Sterile, Non-Sterile, Sealants, Synthetic, Non-synthetic, Collagen-based, Mechanical wound closure devices

- Based on Wound Type the market is segmented as, Chronic, Acute

- Based on End-use the market is segmented as, Hospital, Clinics, Trauma centers, Others

- Based on Region the market is segmented as, North America, Europe, Asia Pacific

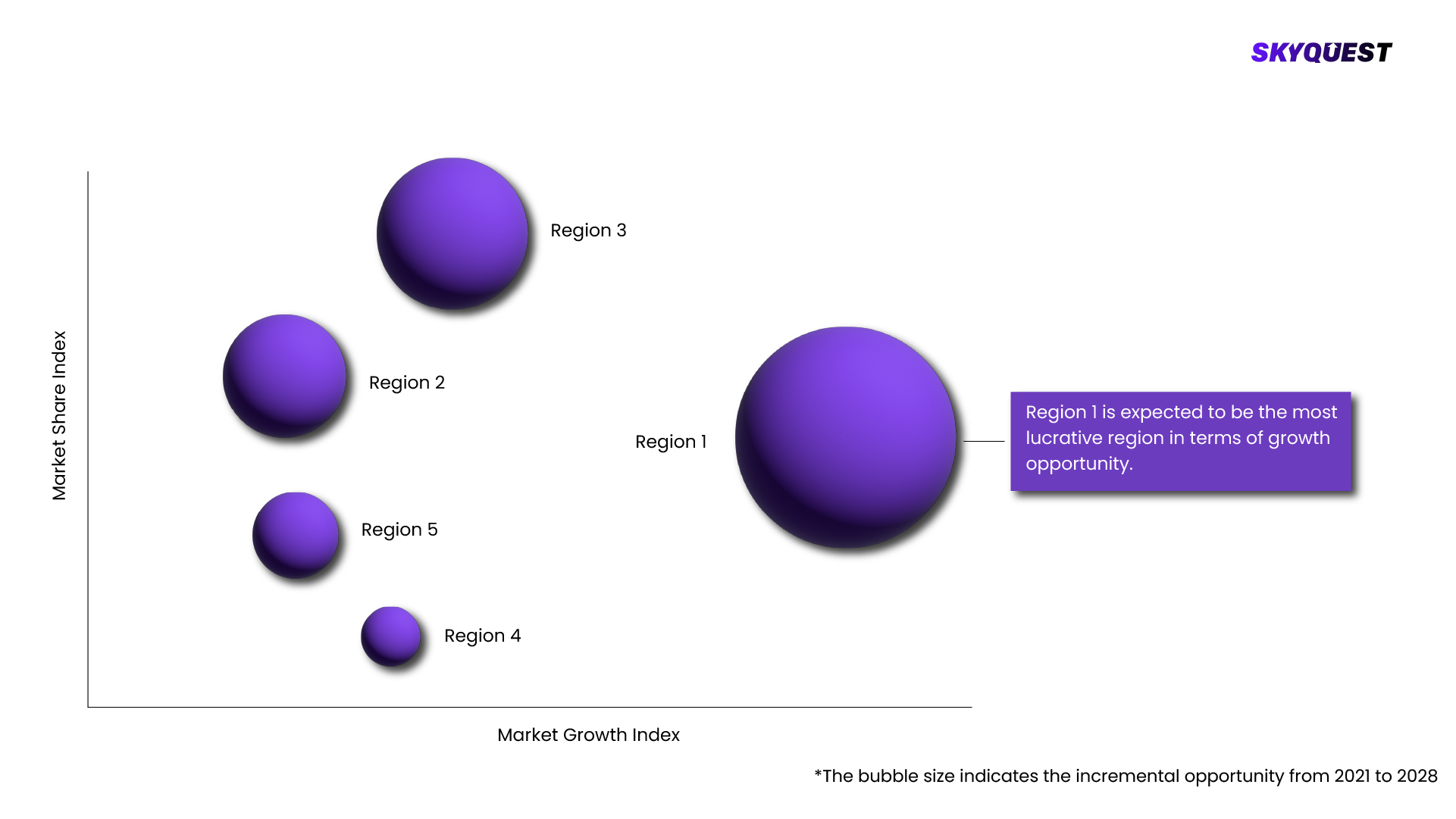

Regional Analysis:

Wound Closure Devices Market is being analyzed by North America, Europe, Asia-Pacific (APAC), Latin America (LATAM), Middle East & Africa (MEA) regions. Key countries including the U.S., Canada, Germany, France, UK, Italy, Spain, China, India, Japan, Brazil, GCC Countries, and South Africa among others were analyzed considering various micro and macro trends.

Wound Closure Devices Market Attractiveness Analysis, By Region 2020-2028

To know more about the market opportunities by region and country, click here to

REQUEST FREE CUSTOMIZATIONWound Closure Devices Market : Risk Analysis

SkyQuest's expert analysts have conducted a risk analysis to understand the impact of external extremities on Wound Closure Devices Market. We analyzed how geopolitical influence, natural disasters, climate change, legal scenario, economic impact, trade & economic policies, social & ethnic concerns, and demographic changes might affect Wound Closure Devices Market's supply chain, distribution, and total revenue growth.

Competitive landscaping:

To understand the competitive landscape, we are analyzing key Wound Closure Devices Market vendors in the market. To understand the competitive rivalry, we are comparing the revenue, expenses, resources, product portfolio, region coverage, market share, key initiatives, product launches, and any news related to the Wound Closure Devices Market.

To validate our hypothesis and validate our findings on the market ecosystem, we are also conducting a detailed porter's five forces analysis. Competitive Rivalry, Supplier Power, Buyer Power, Threat of Substitution, and Threat of New Entry each force is analyzed by various parameters governing those forces.

Key Players Covered in the Report:

- are launching technologically advanced products to ease surgical procedures. For instance, in November 2015, Medtronic launched the VenaSeal (TM) closure system in the U.S. This system is the only non-sclerosant, non-tumescent, and non-thermal product used in the treatment of symptomatic venous reflux. It uses proprietary medical adhesive to close lower extremities’ superficial veins in minimally invasive procedures. The system is currently available in the U.S., Europe, UAE, Hong Kong, New Zealand, Canada, Chile, Australia, and South Africa.

- Product Insights

- On the basis of product, the market has been segmented into adhesives, staples, sutures, strips, sealants, and mechanical wound closure devices. Sutures held the dominant market share in 2018 owing to the rising number of accidents across the globe. Sutures comprise a needle with a thread attached to it and it comes in various shapes, sizes, and a wide variety of thread materials. Sutures market has been further segmented into absorbable and non-absorbable. The absorbable sutures market is anticipated to witness the fastest growth over the forecast period as they are more convenient and easy-to-use as compared to the non-absorbable sutures.

- The staples segment is anticipated to witness the fastest growth over the forecast period. The usage of staples is on a rise as stapling is more convenient and faster than suturing. Surgical staples are usually made of titanium or stainless steel. Staple lines can be circular, straight, or curved. However, unlike sutures, staples are not absorbable, and thus requires constant care. This factor might restrain segment growth.

- Wound Type Insights

- The wound closure devices market has been segmented into chronic and acute. The acute segment held the dominant market share in 2018 owing to the rising number of surgeries and burn cases, globally. For instance, as per WHO, in South Africa, approximately USD 26.00 million is spent every year on the care of burns resulting from kerosene cooking stove incidents. Such acute injuries require quick closure using advanced medical devices. The major reasons leading to the high prevalence of burn cases include poverty, lack of proper safety measures, use of kerosene for non-electric domestic appliances, alcohol abuse, and smoking.

- Chronic wounds include diabetic foot ulcers, venous leg ulcers, and pressure ulcers. Increasing cases of chronic diseases, especially diabetes, and rising geriatric population across the globe are the major factors driving the segment. For instance, as per the United States Census Bureau, the number of people aged 65 and above grew by 1.6 million from 2014 to 2015. Increasing geriatric population susceptible to chronic diseases and injuries is expected to impel the demand for wound closure devices.

- End-use Insights

- End-users of wound closure devices are hospitals, hospitals, clinics, trauma centers, and others. The hospital segment held the largest market share in 2018 due to the rising number of surgeries and increasing cases of road accidents. For instance, as per WHO, around 1.35 million people die every year in road accidents and it costs almost 3.0% of the Gross Domestic Product (GDP) for most of the countries.

- The clinic segment is anticipated to witness the fastest growth over the forecast period owing to the increasing demand for reduced hospital stay. As per the American Hospital Association (AHA), approximately 20.0% of Medicare beneficiaries, when discharged from hospitals, return within 30 days for the closure of fresh wounds. Identifying and reducing avoidable readmissions is expected to improve healthcare safety and minimizing expenditure. Hence, policymakers are striving to reduce the stay of patients in hospitals.

- Regional Insights

- The North America market held the dominant share in 2018 owing to the presence of major players in the region and the rising prevalence of chronic wounds. In addition, the increasing number of patients undergoing surgeries and rising awareness about minimally invasive surgeries are also responsible for regional market growth. KEY PLAYERS operating in the North America market include 3M; Johnson & Johnson Services, Inc.; B. Braun Melsungen AG; Medtronic; and Baxter. These companies are investing in R&D to develop medical devices that can expedite the closure of the wound.

- The Asia Pacific market is anticipated to witness the fastest growth over the forecast period. The growth of the market is attributable to rising medical tourism in the region. For instance, as per a report on Export Health Services by Directorate-General of Commercial Intelligence and Statistics of India, in 2015-2016, India had 58,300 medical tourists on medical visas. The advent of advanced medical devices that can be used for quick and effective closure of wounds will drive regional growth.

- Wound Closure Devices Market Share Insights Prominent players in the market include 3M; Johnson & Johnson Services, Inc.; B. Braun Melsungen AG; Medtronic; Baxter; Integra LifeSciences Corporation; and Smith & Nephew. KEY PLAYERS are involved in adopting strategies such as mergers and acquisitions, collaborations, and partnerships to strengthen their position in the market.

- For instance, in February 2017, Medtronic launched Signia stapling system, a surgical stapler for minimally invasive surgery. The system provides real-time feedback to surgeons and automated response to real-time data. The Adaptive Firing technology in the device detects tissue variability and automatically adjusts the speed of stapling during minimally invasive procedures. Such product development strategies are anticipated to increase the consumer base of the company, thereby, strengthening its foothold in the market.

- KEY MARKET SEGMENTS

- By Product

- Adhesives

- Staples

- Sutures

- Absorbable

- Non-absorbable

- Strips

- Sterile

- Non-Sterile

- Sealants

- Synthetic

- Non-synthetic

- Collagen-based

- Mechanical wound closure devices

- By Wound Type

- Chronic

- Acute

- By End-use

- Hospital

- Clinics

- Trauma centers

- Others

- By Region

- North America

- Europe

- Asia Pacific

- MEA

- KEY PLAYERS

- 3M; Johnson & Johnson Services, Inc.

- B. Braun Melsungen AG

- Medtronic

- Baxter

- Integra LifeSciences Corporation

- Smith & Nephew

SkyQuest's Expertise:

The Wound Closure Devices Market is being analyzed by SkyQuest's analysts with the help of 20+ scheduled Primary interviews from both the demand and supply sides. We have already invested more than 250 hours on this report and are still refining our date to provide authenticated data to your readers and clients. Exhaustive primary and secondary research is conducted to collect information on the market, peer market, and parent market.

Our cross-industry experts and revenue-impact consultants at SkyQuest enable our clients to convert market intelligence into actionable, quantifiable results through personalized engagement.

Scope Of Report

| Report Attribute |

Details |

| The base year for estimation |

2021 |

| Historical data |

2016 – 2022 |

| Forecast period |

2022 – 2028 |

| Report coverage |

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments covered |

- By Product - Adhesives, Staples, Sutures, Absorbable, Non-absorbable, Strips, Sterile, Non-Sterile, Sealants, Synthetic, Non-synthetic, Collagen-based, Mechanical wound closure devices

- By Wound Type - Chronic, Acute

- By End-use - Hospital, Clinics, Trauma centers, Others

- By Region - North America, Europe, Asia Pacific

|

| Regional scope |

North America, Europe, Asia-Pacific (APAC), Latin America (LATAM), Middle East & Africa (MEA) |

| Country scope |

U.S., Canada, Germany, France, UK, Italy, Spain, China, India, Japan, Brazil, GCC Countries, South Africa |

| Key companies profiled |

- are launching technologically advanced products to ease surgical procedures. For instance, in November 2015, Medtronic launched the VenaSeal (TM) closure system in the U.S. This system is the only non-sclerosant, non-tumescent, and non-thermal product used in the treatment of symptomatic venous reflux. It uses proprietary medical adhesive to close lower extremities’ superficial veins in minimally invasive procedures. The system is currently available in the U.S., Europe, UAE, Hong Kong, New Zealand, Canada, Chile, Australia, and South Africa.

- Product Insights

- On the basis of product, the market has been segmented into adhesives, staples, sutures, strips, sealants, and mechanical wound closure devices. Sutures held the dominant market share in 2018 owing to the rising number of accidents across the globe. Sutures comprise a needle with a thread attached to it and it comes in various shapes, sizes, and a wide variety of thread materials. Sutures market has been further segmented into absorbable and non-absorbable. The absorbable sutures market is anticipated to witness the fastest growth over the forecast period as they are more convenient and easy-to-use as compared to the non-absorbable sutures.

- The staples segment is anticipated to witness the fastest growth over the forecast period. The usage of staples is on a rise as stapling is more convenient and faster than suturing. Surgical staples are usually made of titanium or stainless steel. Staple lines can be circular, straight, or curved. However, unlike sutures, staples are not absorbable, and thus requires constant care. This factor might restrain segment growth.

- Wound Type Insights

- The wound closure devices market has been segmented into chronic and acute. The acute segment held the dominant market share in 2018 owing to the rising number of surgeries and burn cases, globally. For instance, as per WHO, in South Africa, approximately USD 26.00 million is spent every year on the care of burns resulting from kerosene cooking stove incidents. Such acute injuries require quick closure using advanced medical devices. The major reasons leading to the high prevalence of burn cases include poverty, lack of proper safety measures, use of kerosene for non-electric domestic appliances, alcohol abuse, and smoking.

- Chronic wounds include diabetic foot ulcers, venous leg ulcers, and pressure ulcers. Increasing cases of chronic diseases, especially diabetes, and rising geriatric population across the globe are the major factors driving the segment. For instance, as per the United States Census Bureau, the number of people aged 65 and above grew by 1.6 million from 2014 to 2015. Increasing geriatric population susceptible to chronic diseases and injuries is expected to impel the demand for wound closure devices.

- End-use Insights

- End-users of wound closure devices are hospitals, hospitals, clinics, trauma centers, and others. The hospital segment held the largest market share in 2018 due to the rising number of surgeries and increasing cases of road accidents. For instance, as per WHO, around 1.35 million people die every year in road accidents and it costs almost 3.0% of the Gross Domestic Product (GDP) for most of the countries.

- The clinic segment is anticipated to witness the fastest growth over the forecast period owing to the increasing demand for reduced hospital stay. As per the American Hospital Association (AHA), approximately 20.0% of Medicare beneficiaries, when discharged from hospitals, return within 30 days for the closure of fresh wounds. Identifying and reducing avoidable readmissions is expected to improve healthcare safety and minimizing expenditure. Hence, policymakers are striving to reduce the stay of patients in hospitals.

- Regional Insights

- The North America market held the dominant share in 2018 owing to the presence of major players in the region and the rising prevalence of chronic wounds. In addition, the increasing number of patients undergoing surgeries and rising awareness about minimally invasive surgeries are also responsible for regional market growth. KEY PLAYERS operating in the North America market include 3M; Johnson & Johnson Services, Inc.; B. Braun Melsungen AG; Medtronic; and Baxter. These companies are investing in R&D to develop medical devices that can expedite the closure of the wound.

- The Asia Pacific market is anticipated to witness the fastest growth over the forecast period. The growth of the market is attributable to rising medical tourism in the region. For instance, as per a report on Export Health Services by Directorate-General of Commercial Intelligence and Statistics of India, in 2015-2016, India had 58,300 medical tourists on medical visas. The advent of advanced medical devices that can be used for quick and effective closure of wounds will drive regional growth.

- Wound Closure Devices Market Share Insights Prominent players in the market include 3M; Johnson & Johnson Services, Inc.; B. Braun Melsungen AG; Medtronic; Baxter; Integra LifeSciences Corporation; and Smith & Nephew. KEY PLAYERS are involved in adopting strategies such as mergers and acquisitions, collaborations, and partnerships to strengthen their position in the market.

- For instance, in February 2017, Medtronic launched Signia stapling system, a surgical stapler for minimally invasive surgery. The system provides real-time feedback to surgeons and automated response to real-time data. The Adaptive Firing technology in the device detects tissue variability and automatically adjusts the speed of stapling during minimally invasive procedures. Such product development strategies are anticipated to increase the consumer base of the company, thereby, strengthening its foothold in the market.

- KEY MARKET SEGMENTS

- By Product

- Adhesives

- Staples

- Sutures

- Absorbable

- Non-absorbable

- Strips

- Sterile

- Non-Sterile

- Sealants

- Synthetic

- Non-synthetic

- Collagen-based

- Mechanical wound closure devices

- By Wound Type

- Chronic

- Acute

- By End-use

- Hospital

- Clinics

- Trauma centers

- Others

- By Region

- North America

- Europe

- Asia Pacific

- MEA

- KEY PLAYERS

- 3M; Johnson & Johnson Services, Inc.

- B. Braun Melsungen AG

- Medtronic

- Baxter

- Integra LifeSciences Corporation

- Smith & Nephew

|

| Customization scope |

Free report customization (15% Free customization) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options |

Reap the benefits of customized purchase options to fit your specific research requirements. |

Objectives of the Study

- To forecast the market size, in terms of value, for various segments with respect to five main regions, namely, North America, Europe, Asia-Pacific (APAC), Latin America (LATAM), Middle East & Africa (MEA)

- To provide detailed information regarding the major factors influencing the growth of the Market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the micro markets with respect to the individual growth trends, future prospects, and contribution to the total market

- To provide a detailed overview of the value chain and analyze market trends with the Porter's five forces analysis

- To analyze the opportunities in the market for various stakeholders by identifying the high-growth Segments

- To identify the key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for the market leaders

- To analyze competitive development such as joint ventures, mergers and acquisitions, new product launches and development, and research and development in the market

What does this Report Deliver?

- Market Estimation for 20+ Countries

- Historical data coverage: 2016 to 2022

- Growth projections: 2022 to 2028

- SkyQuest's premium market insights: Innovation matrix, IP analysis, Production Analysis, Value chain analysis, Technological trends, and Trade analysis

- Customization on Segments, Regions, and Company Profiles

- 100+ tables, 150+ Figures, 10+ matrix

- Global and Country Market Trends

- Comprehensive Mapping of Industry Parameters

- Attractive Investment Proposition

- Competitive Strategies Adopted by Leading Market Participants

- Market drivers, restraints, opportunities, and its impact on the market

- Regulatory scenario, regional dynamics, and insights of leading countries in each region

- Segment trends analysis, opportunity, and growth

- Opportunity analysis by region and country

- Porter's five force analysis to know the market's condition

- Pricing analysis

- Parent market analysis

- Product portfolio benchmarking