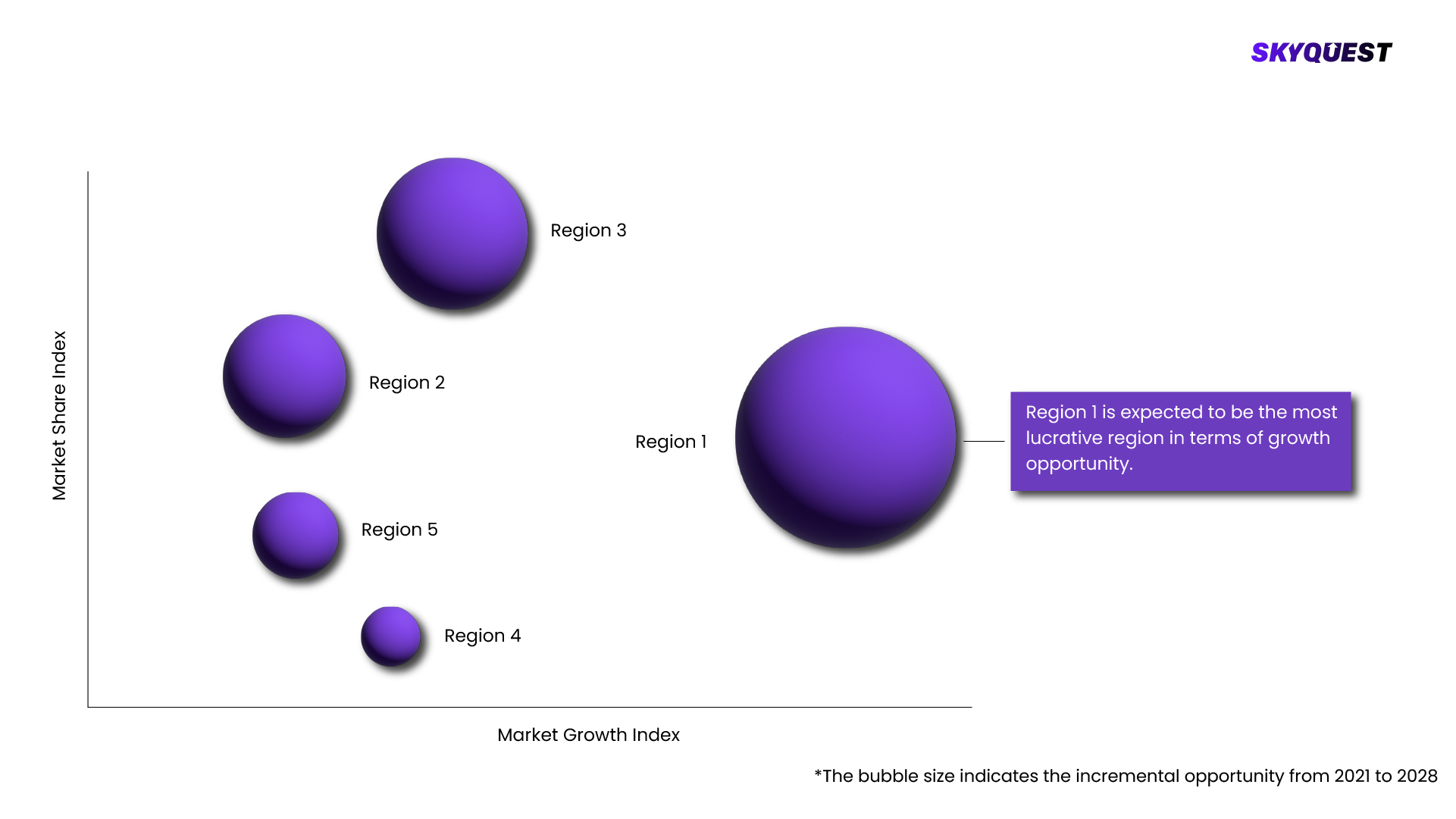

The key players operating in the Veterinary Anti-infectives Market are sights, The veterinary anti-infectives market size was valued at USD 5.18 billion in 2018 and is expected to expand at a CAGR of 6.4% during the forecast period. The increasing awareness regarding better animal health is anticipated to drive the growth. According to a 2017 survey by the Centers for Disease Control and Prevention (CDC), approximately 48 million people get infected, 128,000 are hospitalized, and 3,000 die each year due to foodborne diseases in the U.S. Therefore, there is a rising need to curb these outbreaks with effective treatment which will further render an exponential growth for the market. Rising pressure on livestock owners to uphold the veterinary health standards to meet the demand for dairy products, fresh meat, dietary nutrition, and animal vaccines is anticipated to further speed up the adoption of veterinary anti-infectives in near future., Rising pet adoption coupled with rising concerns regarding pet health and prevalence of bacterial infection, especially in dogs, is anticipated to further propel the market growth. Leptospirosis, staphylococcal infection, bacterial ear infection, actinomycosis, and nocardiosis are some of the most common forms of infections in pets. As per a report published by the Michigan Department of Agriculture and Rural Development 2018, 115 cases were recorded. Moreover, pets are susceptible to bacterial diseases, such as plague, brucellosis, and Lyme disease. According to the qualitative report by the CDC in 2018, cats are more prone to plague than dogs and can pass on the infection to humans as well., The market players are investing in clinical trials of veterinary medicines, which is anticipated to bode well for the growth of the veterinary medicines market. For instance, Zoetis Inc. and Regeneron Pharmaceuticals, Inc. entered into a 5 years collaboration in June 2018, for monoclonal antibody therapeutics research to discover new animal health treatment. From this collaboration, Zoetis Inc. is licensed for Regeneron’s VelocImmune, an antibody technology for the development of monoclonal antibodies modified for species-specific use in livestock and companion animals., Animal health insurance is also growing in line with the rise in livestock farming and the adoption of companion animals. Factors, such as increasing government efforts to prevent zoonosis and new product inventions are expected to exhibit a positive impact on market growth. For instance, in 2016, as per the European External Action Service (EEAS), the government invested USD 4.7 million in veterinary healthcare., Animal Type Insights, Livestock accounted for the largest revenue share of the veterinary anti-infectives market in 2018. Livestock is sub-segmented into poultry, swine, cattle, sheep and goats, fish, and others. This segment is anticipated to witness significant growth owing to increasing meat consumption, growing daily needs, and environmental sustainability. As per the 2017 data by the North American Meat Institute, the poultry and meat industries are the largest division of the U.S. agriculture sector. This factor is anticipated to positively influence the livestock segment over the forecast period., However, the companion animal segment is projected to register the fastest CAGR over the forecast period. Rising awareness regarding the health benefits associated with the adoption of small companion animals is anticipated to bode well for the growth of the segment. Some of these health benefits include decreased blood pressure, stress, anxiety, cholesterol levels, and increased psychological stability and opportunities for socialization. According to American Pet Products Association (APPA), National Pet Owners Survey 2017, households with children are three times more likely to adopt small animals as pets which leads to growing concerns as well as expenditure for veterinary healthcare needs., Product Insights, Antibacterials segment accounted for the largest revenue share in the market for veterinary anti-infectives in 2018, owing to the rising prevalence of bacterial infections in livestock and companion animals. Major anti-bacterial, such as cephalosporins, tetracyclines, penicillins, macrolides, quinolones, sulfonamides, and polymyxins, are specifically developed for animals. The World Health Organization (WHO) engages in various activities to address health threats at the human-animal-ecosystem interface including antibacterial resistance, food-borne zoonoses, and food consumption. This is expected to drive the need for better healthcare facilities for vets and demand for veterinary anti-infectives in near future., The antivirals segment is expected to showcase lucrative growth in the market for veterinary anti-infectives, as animals are susceptible to various viral infections, such as rabies and feline calicivirus among others. As recorded by WHO in 2019, humans are highly susceptible to contract rabies virus through a dog bite. It is recorded that up to 99% of cases, dogs are accountable for rabies transmission to humans. An awareness program; United Against Rabies Collaboration, involving four partners, namely, WHO, the Alliance for Rabies Control (GARC), the World Organisation for Animal Health (OIE), and the Food and Agriculture Organization of the United Nations (FAO), works toward Zero by 30—zero human rabies deaths by 2030., Route of Administration Insights, The oral route of administration segment accounted for the largest market share in 2018 and is anticipated to witness the fastest growth during the forecast period, primarily owing to ease of use offered by this method. Moreover, incorporation of oral route of administration is beneficial to extend the duration of action as it limits the visits to hospitals and veterinary clinics. Tetracyclines, β lactams, aminoglycosides, diazepam, macrolides, and sulphonamides are some of the commonly used antimicrobials drugs., Injectables held the second largest market share in 2018 as injectables help with good absorption of drugs, especially for the drugs with a low oral bioavailability along with quick onset action. Though, sometimes it may be difficult to administer an injection to animals. NSAIDs such as Ketoprofen and Metacam are some of the most commonly administered injectables., Distribution Channel Insights, Retail pharmacies held the largest market share in 2018, attributed to easy distribution and availability of vaccines and medicines through retail pharmacies. Moreover, digitization of retail pharmacies to reduce the risk of errors in the prescriptions is anticipated to propel the segment growth in the forthcoming years., The E-commerce segment is anticipated to witness exponential growth over the forecast period, attributed to increased convenience for patients unwilling to purchase medicines from retail or hospital pharmacies. Besides, an improved regulatory framework for animal products and consistent efforts by government authorities, such as the U.S. Food and Drug Administration (FDA) to eliminate counterfeit, expired, and adulterated products in online pharmacies are likely to present remunerative growth opportunities to this segment in near future., Regional Insights, North America accounted for the largest revenue share in 2018. The presence of advanced animal healthcare programs coupled with awareness regarding animal health is projected to drive the regional market growth. For instance, the North American Pet Health Insurance Association focuses on promoting awareness of pet health insurance coverage and developing and exploring partnerships to address the challenges affecting the animal health industry. Moreover, rising disease prevalence in pets and livestock is further pushing the need for effective and quick treatment options which is anticipated to drive the regional demand for veterinary anti-infectives., Latin America is expected to expand at a lucrative CAGR during the forecast period. The market is marked by high R&D investments by international players as well as consistent efforts for commercialization of veterinary pharmaceuticals and vaccines at relatively lower prices and by the foodborne disease outbreaks in countries like Brazil, Mexico, and Argentina., KEY MARKET SEGMENTS, By Animal, Livestock, Poultry, Swine, Cattle, Sheep & Goats, Fish, Others, Companion animal, Dog, Cat, Others, By Product , Antibacterial, Cephalosporins, Tetracyclines, Penicillin, Macrolides, Others (Quinoles, sulfonamides, polymyxins), Antifungals, Antivirals, Others, By Route of Administration , Oral, Injectables, Others, By Distribution Channel , Veterinary Clinics, Retail Pharmacies, E-commerce, By Region , North America, Europe, Asia Pacific, Latin America, Middle East & Africa, KEY MARKET SEGMENTS, Zoetis, Inc., Boehringer Ingelheim GmbH, Ceva Santé Animale, Vetoquinol S.A., Merck & Co., Inc., Phibro Animal Health Corporation.