Next-Generation Solar Cell Market Insights

Market Overview:

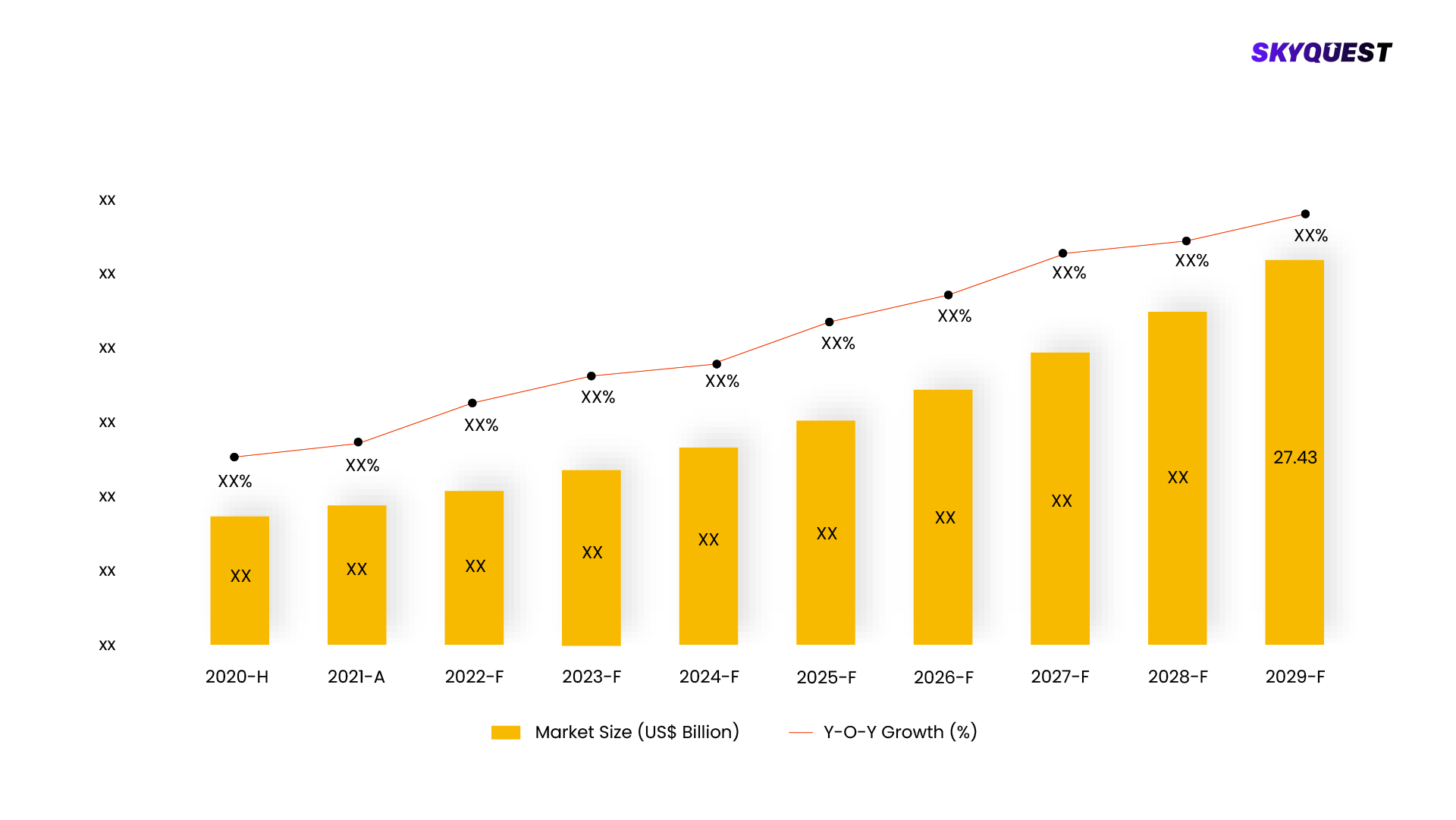

The market for next-generation solar cells is estimated to be worth USD 3.0 billion in 2023 and will increase at a CAGR of 19.5% from 2023 to 2028 to reach USD 7.4 billion. In the coming years, it is anticipated that rising worries about climate change and a focus on decreasing carbon emissions would drive the market growth for next-generation solar cells.

Next-Generation Solar Cell Market, Forecast & Y-O-Y Growth Rate, 2020 - 2028

To get more reports on the above market click here to

GET FREE SAMPLEThis report is being written to illustrate the market opportunity by region and by segments, indicating opportunity areas for the vendors to tap upon. To estimate the opportunity, it was very important to understand the current market scenario and the way it will grow in future.

Production and consumption patterns are being carefully compared to forecast the market. Other factors considered to forecast the market are the growth of the adjacent market, revenue growth of the key market vendors, scenario-based analysis, and market segment growth.

The market size was determined by estimating the market through a top-down and bottom-up approach, which was further validated with industry interviews. Considering the nature of the market we derived the Semiconductors by segment aggregation, the contribution of the Semiconductors in Semiconductors & Semiconductor Equipment and vendor share.

To determine the growth of the market factors such as drivers, trends, restraints, and opportunities were identified, and the impact of these factors was analyzed to determine the market growth. To understand the market growth in detail, we have analyzed the year-on-year growth of the market. Also, historic growth rates were compared to determine growth patterns.

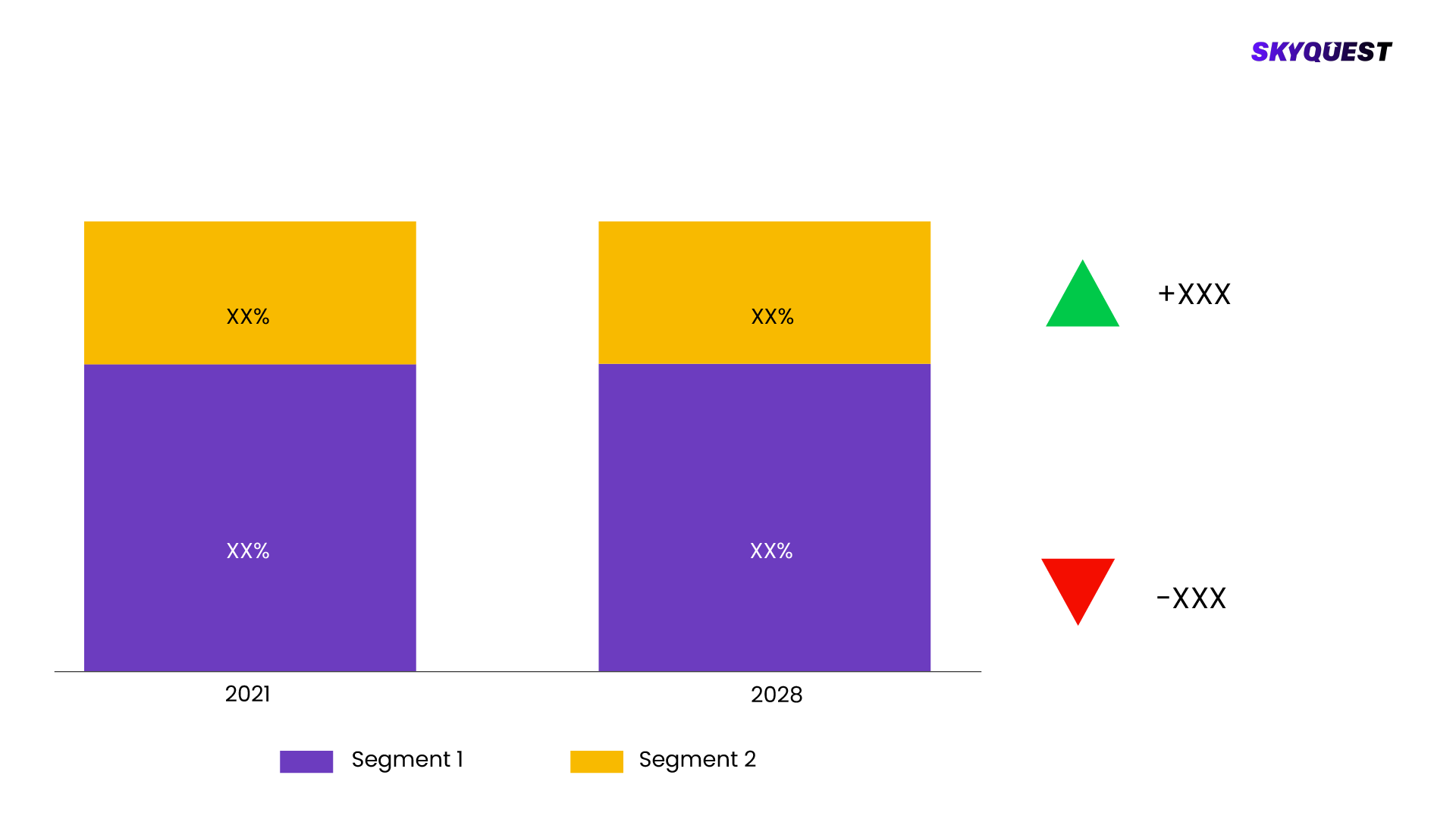

Segmentation Analysis:

The Next-Generation Solar Cell Market is segmented by Material Type, Installation, End User Industry. We are analyzing the market of these segments to identify which segment is the largest now and in the future, which segment has the highest growth rate, and the segment which offers the opportunity in the future.

Next-Generation Solar Cell Market Basis Point Share Analysis, 2021 Vs. 2028

To get detailed analysis on all segments

<

BUY NOW

- Based on Material Type the market is segmented as, Transceivers, Cadmium Telluride (CdTe), Copper Indium Gallium Selenide(CIGS), Amorphous Silicon (a-Si), Gallium-Arsenide (GaAs), Others, Organic Solar Cells, Dye Sensitized Solar Cells, Perovskite Solar Cell

- Based on Installation the market is segmented as, On Grid, Off Grid

- Based on End User Industry the market is segmented as, Residential, Commercial & Industrial, Utilities, Others, KEY MARKET PLAYERS, First Solar, Hanwha Q CELLS, Ascent Solar Technologies, Oxford PV, Kaneka Solar Energy, Flisom, Solactron, Mitsubishi Chemical Group, MiaSole, Hanergy thin film power group

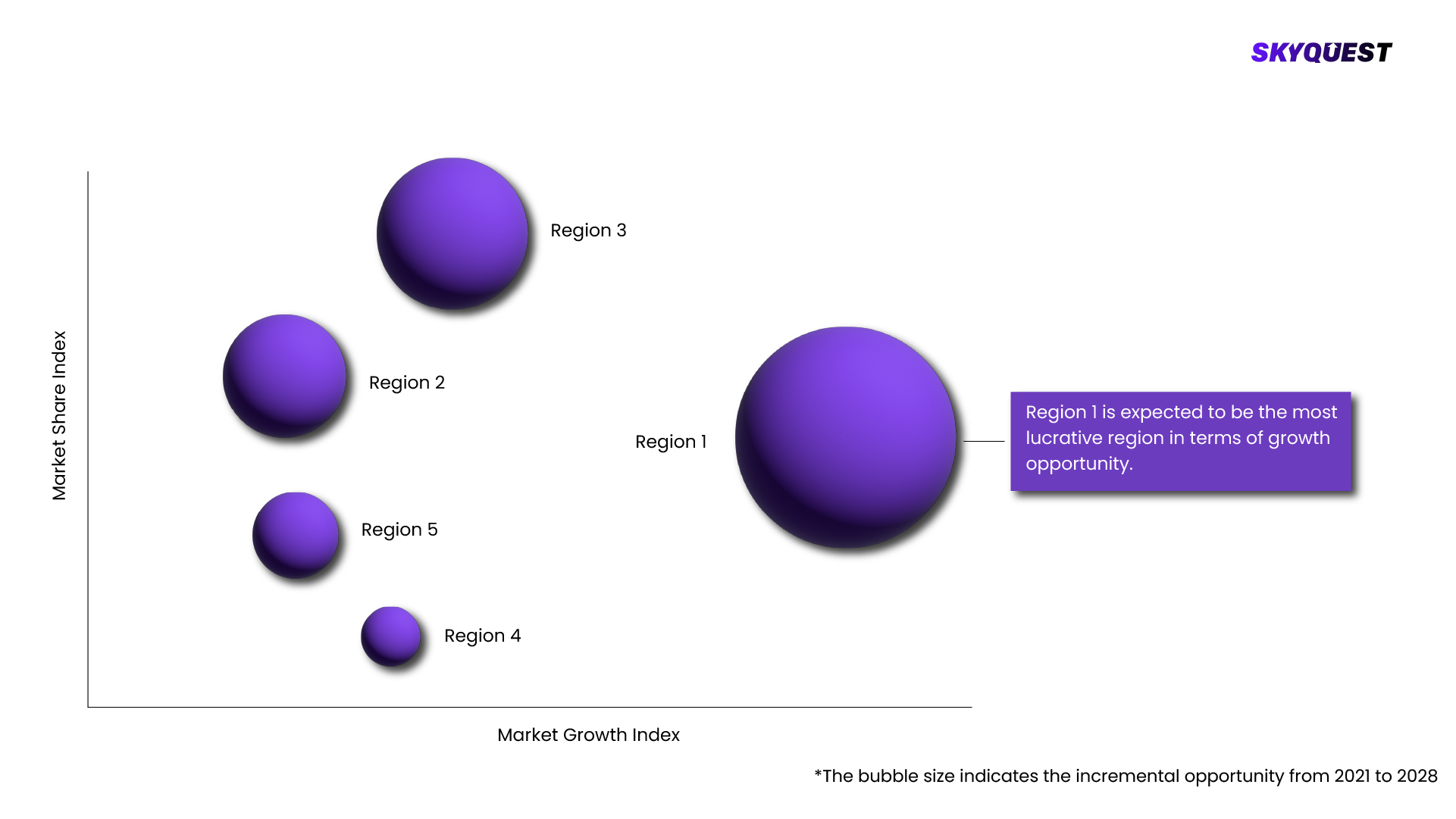

Regional Analysis:

Next-Generation Solar Cell Market is being analyzed by North America, Europe, Asia-Pacific (APAC), Latin America (LATAM), Middle East & Africa (MEA) regions. Key countries including the U.S., Canada, Germany, France, UK, Italy, Spain, China, India, Japan, Brazil, GCC Countries, and South Africa among others were analyzed considering various micro and macro trends.

Next-Generation Solar Cell Market Attractiveness Analysis, By Region 2020-2028

To know more about the market opportunities by region and country, click here to

REQUEST FREE CUSTOMIZATIONNext-Generation Solar Cell Market : Risk Analysis

SkyQuest's expert analysts have conducted a risk analysis to understand the impact of external extremities on Next-Generation Solar Cell Market. We analyzed how geopolitical influence, natural disasters, climate change, legal scenario, economic impact, trade & economic policies, social & ethnic concerns, and demographic changes might affect Next-Generation Solar Cell Market's supply chain, distribution, and total revenue growth.

Competitive landscaping:

To understand the competitive landscape, we are analyzing key Next-Generation Solar Cell Market vendors in the market. To understand the competitive rivalry, we are comparing the revenue, expenses, resources, product portfolio, region coverage, market share, key initiatives, product launches, and any news related to the Next-Generation Solar Cell Market.

To validate our hypothesis and validate our findings on the market ecosystem, we are also conducting a detailed porter's five forces analysis. Competitive Rivalry, Supplier Power, Buyer Power, Threat of Substitution, and Threat of New Entry each force is analyzed by various parameters governing those forces.

Key Players Covered in the Report:

- neration solar cell market is valued at USD 3.0 billion in 2023 and is projected to reach USD 7.4 billion by 2028, growing at a CAGR of 19.5% from 2023 to 2028. High installation cost is a major restraint on the market's growth. One of the major challenges for the market is supply chain. The supply chain requires collaborating with industry stakeholders, material suppliers, manufacturers, and research institutes.

- Market Dynamics:

- Driver: Technological advancements in next-generation solar cells

- The solar cell has different generations based on development. The first-generation solar cell includes solar cells based on crystalline silicon material. The second-generation solar cells are thin film solar cells which is the primary focus of this report. It includes materials cadmium telluride (CdTe), amorphous silicon (a-Si), copper indium gallium selenide (CIGS), and Gallium Arsenide (GaAs). The third generation of solar cells is new in the market; some are not yet commercialized. Third-generation solar cells in organic solar cells, dye-sensitized solar cells, and perovskite solar cells have been included in other sections. Technological advancements such as the development of Thin-Film technology are making it possible to create solar cells that are more efficient, cost-effective, and durable while using less material. For instance, In June 2022, researchers at Princeton University developed the first commercially viable perovskite solar cells, which can be manufactured at room temperature and requires less energy to produce than any other solar cell, such as silicon-based solar cells.

- Overall, the empowerment and development of new and improved solar cell technologies are helping to make solar energy more cost-effective and practical for a broader range of applications. As solar power technologies continue to evolve and mature, they are expected to grow during the forecast period.

- Restraint: High installation costs

- Solar energy is cost competitive compared to traditional fossil fuels, but the installation costs of solar cells are relatively high, which is a significant barrier for homeowners and businesses, especially with limited financial resources. The permits and inspection costs from local authorities depend highly on locations and the installed system type. In some cases, additional equipment such as inverters, batteries, and monitoring systems costs can add up. Labor costs can also be a significant factor in solar installation costs. Highly skilled workers are often required to install solar panels and related equipment, and these workers may charge higher wages. Other factors, such as site preparation for solar installation, can also be costly, particularly in cases where the ground needs to be leveled or other site preparation is required.

- Opportunity: Surging demand for renewable energy

- In the past few years, the demand for renewable energy has surged. With governments worldwide coming together for initiatives such as the Paris Climate Agreement, the demand for renewable energy, such as solar, is set to rise in the coming years. According to a 2018 report by the International Energy Agency, renewables will have the fastest growth in the electricity sector, catering to almost 30% of the power demand by 2023. During this period, renewables are forecast to account for more than 70% of global electricity generation, led by solar PV. Moreover, according to a March 2020 report by the International Renewable Energy Agency, solar and wind energy continued to dominate renewable capacity expansion, jointly accounting for 90% of all net renewable additions in 2019. Solar energy prices are already below retail electricity prices in major countries such as China. Besides, the cost of solar power is anticipated to decline by 15–35% by 2024, which is expected to spur the demand for solar cells and create growth opportunities for the next-generation solar cell market players.

- Challenge: Supply chain issues in the next-generation solar cell market

- Although there are many promising advantages of next-generation solar cells over traditional solar cells, some challenges need to be addressed before next-generation solar cells are widely adopted. Some of these challenges are the manufacturing costs of next-generation solar cells. The cost is generally higher than that of traditional solar cells. As the next-generation solar cells are not widely adopted, and their efficiency is still under research, they are manufactured in scale, so the cost is usually high. As the next-generation solar cells are still in the early stages of development, scaling up their production needs for large-scale energy systems will be challenging. New manufacturing techniques and supply chains will need to be developed to support their mass production.

- Along with this, toxicity is one of the major concerns. Some next-generation solar cells, such as those based on cadmium, contain toxic materials that can pose health and environmental risks. Finding safe and sustainable materials for use in these cells will be an essential consideration for their widespread adoption. Thus, the harmful effects of these toxic materials are expected to hamper their demand and market growth challenges.

- Perovskites solar cells, organic solar cells, and dye-sensitized solar cells materials to hold the highest CAGR during the forecast period

- Other material includes perovskites solar cells, organic solar cell, and dye-sensitized solar cells. Perovskite-structured materials used in solar cells are generally hybrid organic-inorganic lead or tin-halide materials, such as methylammonium lead halide. The fabrication of these materials is simple and inexpensive as they are solution-processed. Hybrid metal halide perovskite solar cells (PSCs) have garnered great attention due to their low price, thinner design, low-temperature processing, and excellent light absorption properties (good performance under low and diffuse light).

- Aerospace & defense and portable electronic devices end-user industries segment to dominate the market during the forecast period

- Other end-user industries include aerospace & defense and portable electronic devices. In the aerospace & defense vertical, solar panels are used in drones and high-altitude pseudo satellites (HAPS). Aerospace & defense vertical companies are constantly developing solar energy-based products to meet the cost and energy demands while maximizing the aerodynamic efficiency to perform missions efficiently. Solar cell-powered aircraft fly at higher elevations for long periods but with relatively limited applications, such as a tiny wing loading for cargo.

- Asia Pacific region is expected to exhibit the highest CAGR during the forecast period

- Asia Pacific is expected to continue to dominate the next-generation solar cell market from 2023 to 2028. The growing adoption of PV modules in countries such as China, Japan, and India is fueling the regional market's growth. Next-generation solar cells have higher efficiency and excellent natural and artificial light performance than silicon-based cells. The thickness of a next-generation solar cell is under one micron and can be manufactured at low temperatures using low-cost technologies, such as printing.

- Recent developments

- In July 2022, Hanwha Q CELLS acquired 66% of LYNQTECH GmbH, a subsidiary of enercity AG, to further its focus as a full-service provider of clean energy solutions for residential and commercial end-users.

- In April 2022, First Solar announced that its responsibly produced photovoltaic (PV) solar module technology would power 17% of the annual energy needs of Nevada Gold Mines (NGM), the single largest gold-producing complex in the world. NGM is a joint venture between Barrick Gold Corporation and Newmont Corporation operated by Barrick.

- In January 2022, Ascent Solar Technologies partnered with Momentus, a developer and manufacturer of novel 'last mile space solutions, to produce customized, flexible CIGS PV modules to provide power to a demonstration deployable PV array to fly on an upcoming Vigoride spacecraft—scheduled for flight in 2022.

- KEY MARKET SEGMENTS

- By Material Type

- Transceivers

- Cadmium Telluride (CdTe)

- Copper Indium Gallium Selenide(CIGS)

- Amorphous Silicon (a-Si)

- Gallium-Arsenide (GaAs)

- Others

- Organic Solar Cells

- Dye Sensitized Solar Cells

- Perovskite Solar Cell

- By Installation

- On Grid

- Off Grid

- By End User Industry

- Residential

- Commercial & Industrial

- Utilities

- Others

- KEY MARKET PLAYERS

- First Solar

- Hanwha Q CELLS

- Ascent Solar Technologies

- Oxford PV

- Kaneka Solar Energy

- Flisom

- Solactron

- Mitsubishi Chemical Group

- MiaSole

- Hanergy thin film power group

SkyQuest's Expertise:

The Next-Generation Solar Cell Market is being analyzed by SkyQuest's analysts with the help of 20+ scheduled Primary interviews from both the demand and supply sides. We have already invested more than 250 hours on this report and are still refining our date to provide authenticated data to your readers and clients. Exhaustive primary and secondary research is conducted to collect information on the market, peer market, and parent market.

Our cross-industry experts and revenue-impact consultants at SkyQuest enable our clients to convert market intelligence into actionable, quantifiable results through personalized engagement.

Scope Of Report

| Report Attribute |

Details |

| The base year for estimation |

2021 |

| Historical data |

2016 – 2022 |

| Forecast period |

2022 – 2028 |

| Report coverage |

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments covered |

- By Material Type - Transceivers, Cadmium Telluride (CdTe), Copper Indium Gallium Selenide(CIGS), Amorphous Silicon (a-Si), Gallium-Arsenide (GaAs), Others, Organic Solar Cells, Dye Sensitized Solar Cells, Perovskite Solar Cell

- By Installation - On Grid, Off Grid

- By End User Industry - Residential, Commercial & Industrial, Utilities, Others, KEY MARKET PLAYERS, First Solar, Hanwha Q CELLS, Ascent Solar Technologies, Oxford PV, Kaneka Solar Energy, Flisom, Solactron, Mitsubishi Chemical Group, MiaSole, Hanergy thin film power group

|

| Regional scope |

North America, Europe, Asia-Pacific (APAC), Latin America (LATAM), Middle East & Africa (MEA) |

| Country scope |

U.S., Canada, Germany, France, UK, Italy, Spain, China, India, Japan, Brazil, GCC Countries, South Africa |

| Key companies profiled |

- neration solar cell market is valued at USD 3.0 billion in 2023 and is projected to reach USD 7.4 billion by 2028, growing at a CAGR of 19.5% from 2023 to 2028. High installation cost is a major restraint on the market's growth. One of the major challenges for the market is supply chain. The supply chain requires collaborating with industry stakeholders, material suppliers, manufacturers, and research institutes.

- Market Dynamics:

- Driver: Technological advancements in next-generation solar cells

- The solar cell has different generations based on development. The first-generation solar cell includes solar cells based on crystalline silicon material. The second-generation solar cells are thin film solar cells which is the primary focus of this report. It includes materials cadmium telluride (CdTe), amorphous silicon (a-Si), copper indium gallium selenide (CIGS), and Gallium Arsenide (GaAs). The third generation of solar cells is new in the market; some are not yet commercialized. Third-generation solar cells in organic solar cells, dye-sensitized solar cells, and perovskite solar cells have been included in other sections. Technological advancements such as the development of Thin-Film technology are making it possible to create solar cells that are more efficient, cost-effective, and durable while using less material. For instance, In June 2022, researchers at Princeton University developed the first commercially viable perovskite solar cells, which can be manufactured at room temperature and requires less energy to produce than any other solar cell, such as silicon-based solar cells.

- Overall, the empowerment and development of new and improved solar cell technologies are helping to make solar energy more cost-effective and practical for a broader range of applications. As solar power technologies continue to evolve and mature, they are expected to grow during the forecast period.

- Restraint: High installation costs

- Solar energy is cost competitive compared to traditional fossil fuels, but the installation costs of solar cells are relatively high, which is a significant barrier for homeowners and businesses, especially with limited financial resources. The permits and inspection costs from local authorities depend highly on locations and the installed system type. In some cases, additional equipment such as inverters, batteries, and monitoring systems costs can add up. Labor costs can also be a significant factor in solar installation costs. Highly skilled workers are often required to install solar panels and related equipment, and these workers may charge higher wages. Other factors, such as site preparation for solar installation, can also be costly, particularly in cases where the ground needs to be leveled or other site preparation is required.

- Opportunity: Surging demand for renewable energy

- In the past few years, the demand for renewable energy has surged. With governments worldwide coming together for initiatives such as the Paris Climate Agreement, the demand for renewable energy, such as solar, is set to rise in the coming years. According to a 2018 report by the International Energy Agency, renewables will have the fastest growth in the electricity sector, catering to almost 30% of the power demand by 2023. During this period, renewables are forecast to account for more than 70% of global electricity generation, led by solar PV. Moreover, according to a March 2020 report by the International Renewable Energy Agency, solar and wind energy continued to dominate renewable capacity expansion, jointly accounting for 90% of all net renewable additions in 2019. Solar energy prices are already below retail electricity prices in major countries such as China. Besides, the cost of solar power is anticipated to decline by 15–35% by 2024, which is expected to spur the demand for solar cells and create growth opportunities for the next-generation solar cell market players.

- Challenge: Supply chain issues in the next-generation solar cell market

- Although there are many promising advantages of next-generation solar cells over traditional solar cells, some challenges need to be addressed before next-generation solar cells are widely adopted. Some of these challenges are the manufacturing costs of next-generation solar cells. The cost is generally higher than that of traditional solar cells. As the next-generation solar cells are not widely adopted, and their efficiency is still under research, they are manufactured in scale, so the cost is usually high. As the next-generation solar cells are still in the early stages of development, scaling up their production needs for large-scale energy systems will be challenging. New manufacturing techniques and supply chains will need to be developed to support their mass production.

- Along with this, toxicity is one of the major concerns. Some next-generation solar cells, such as those based on cadmium, contain toxic materials that can pose health and environmental risks. Finding safe and sustainable materials for use in these cells will be an essential consideration for their widespread adoption. Thus, the harmful effects of these toxic materials are expected to hamper their demand and market growth challenges.

- Perovskites solar cells, organic solar cells, and dye-sensitized solar cells materials to hold the highest CAGR during the forecast period

- Other material includes perovskites solar cells, organic solar cell, and dye-sensitized solar cells. Perovskite-structured materials used in solar cells are generally hybrid organic-inorganic lead or tin-halide materials, such as methylammonium lead halide. The fabrication of these materials is simple and inexpensive as they are solution-processed. Hybrid metal halide perovskite solar cells (PSCs) have garnered great attention due to their low price, thinner design, low-temperature processing, and excellent light absorption properties (good performance under low and diffuse light).

- Aerospace & defense and portable electronic devices end-user industries segment to dominate the market during the forecast period

- Other end-user industries include aerospace & defense and portable electronic devices. In the aerospace & defense vertical, solar panels are used in drones and high-altitude pseudo satellites (HAPS). Aerospace & defense vertical companies are constantly developing solar energy-based products to meet the cost and energy demands while maximizing the aerodynamic efficiency to perform missions efficiently. Solar cell-powered aircraft fly at higher elevations for long periods but with relatively limited applications, such as a tiny wing loading for cargo.

- Asia Pacific region is expected to exhibit the highest CAGR during the forecast period

- Asia Pacific is expected to continue to dominate the next-generation solar cell market from 2023 to 2028. The growing adoption of PV modules in countries such as China, Japan, and India is fueling the regional market's growth. Next-generation solar cells have higher efficiency and excellent natural and artificial light performance than silicon-based cells. The thickness of a next-generation solar cell is under one micron and can be manufactured at low temperatures using low-cost technologies, such as printing.

- Recent developments

- In July 2022, Hanwha Q CELLS acquired 66% of LYNQTECH GmbH, a subsidiary of enercity AG, to further its focus as a full-service provider of clean energy solutions for residential and commercial end-users.

- In April 2022, First Solar announced that its responsibly produced photovoltaic (PV) solar module technology would power 17% of the annual energy needs of Nevada Gold Mines (NGM), the single largest gold-producing complex in the world. NGM is a joint venture between Barrick Gold Corporation and Newmont Corporation operated by Barrick.

- In January 2022, Ascent Solar Technologies partnered with Momentus, a developer and manufacturer of novel 'last mile space solutions, to produce customized, flexible CIGS PV modules to provide power to a demonstration deployable PV array to fly on an upcoming Vigoride spacecraft—scheduled for flight in 2022.

- KEY MARKET SEGMENTS

- By Material Type

- Transceivers

- Cadmium Telluride (CdTe)

- Copper Indium Gallium Selenide(CIGS)

- Amorphous Silicon (a-Si)

- Gallium-Arsenide (GaAs)

- Others

- Organic Solar Cells

- Dye Sensitized Solar Cells

- Perovskite Solar Cell

- By Installation

- On Grid

- Off Grid

- By End User Industry

- Residential

- Commercial & Industrial

- Utilities

- Others

- KEY MARKET PLAYERS

- First Solar

- Hanwha Q CELLS

- Ascent Solar Technologies

- Oxford PV

- Kaneka Solar Energy

- Flisom

- Solactron

- Mitsubishi Chemical Group

- MiaSole

- Hanergy thin film power group

|

| Customization scope |

Free report customization (15% Free customization) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options |

Reap the benefits of customized purchase options to fit your specific research requirements. |

Objectives of the Study

- To forecast the market size, in terms of value, for various segments with respect to five main regions, namely, North America, Europe, Asia-Pacific (APAC), Latin America (LATAM), Middle East & Africa (MEA)

- To provide detailed information regarding the major factors influencing the growth of the Market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the micro markets with respect to the individual growth trends, future prospects, and contribution to the total market

- To provide a detailed overview of the value chain and analyze market trends with the Porter's five forces analysis

- To analyze the opportunities in the market for various stakeholders by identifying the high-growth Segments

- To identify the key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for the market leaders

- To analyze competitive development such as joint ventures, mergers and acquisitions, new product launches and development, and research and development in the market

What does this Report Deliver?

- Market Estimation for 20+ Countries

- Historical data coverage: 2016 to 2022

- Growth projections: 2022 to 2028

- SkyQuest's premium market insights: Innovation matrix, IP analysis, Production Analysis, Value chain analysis, Technological trends, and Trade analysis

- Customization on Segments, Regions, and Company Profiles

- 100+ tables, 150+ Figures, 10+ matrix

- Global and Country Market Trends

- Comprehensive Mapping of Industry Parameters

- Attractive Investment Proposition

- Competitive Strategies Adopted by Leading Market Participants

- Market drivers, restraints, opportunities, and its impact on the market

- Regulatory scenario, regional dynamics, and insights of leading countries in each region

- Segment trends analysis, opportunity, and growth

- Opportunity analysis by region and country

- Porter's five force analysis to know the market's condition

- Pricing analysis

- Parent market analysis

- Product portfolio benchmarking