Report ID: SQMIG15P2005

Report ID: SQMIG15P2005

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG15P2005 |

Region:

Global |

Published Date: June, 2025

Pages:

199

|Tables:

149

|Figures:

75

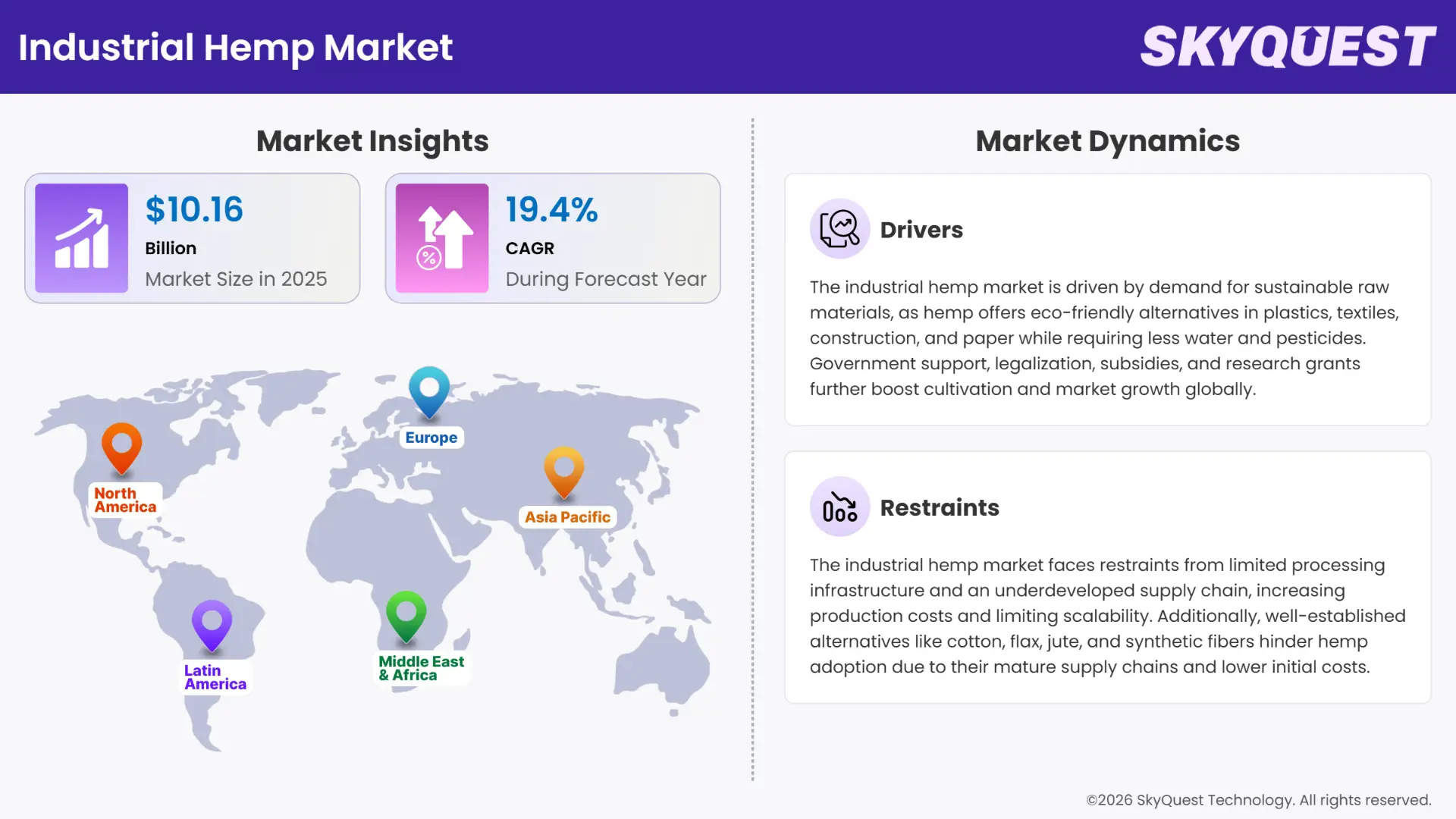

Global Industrial Hemp market size was valued at USD 8.51 Billion in 2024 and is poised to grow from USD 10.16 Billion in 2025 to USD 41.99 Billion by 2033, growing at a CAGR of 19.4% in the forecast period (2026–2033).

Industrial hemp has emerged as a significant cash crop across the world. China, the US, France and Canada are among the major producers of industrial hemp in the world. Its growing applications in major industries such as food and beverages, textile, biofuel, automotive, pharmaceuticals, etc. are the main factors driving the global industrial hemp market growth. Industrial hemp has garnered the name of a sustainable alternative to many traditional, conventional raw materials in these industries. Advances in technologies of bioprocessing and extraction of industrial hemp are also creating room for further growth. Increasing government support in the form of legalization and regulatory relaxation are additional factors driving market expansion.

However, industrial hemp faces competition from already established crops and raw materials. The lack of agronomic knowledge and standardization of seeds for their cultivation also act as huge roadblocks for the market’s growth.

How are Modern Bioprocessing and Extraction Technologies Creating New Opportunities in the Market?

Advanced bioprocessing and extraction technologies are transforming market dynamics. These technologies help in enabling the production of high-purity cannabinoids, fibers, and bio-based materials. Innovations like supercritical CO₂ extraction and enzyme-assisted processing not only improve yield and quality but also lessen impact on environmental. They have the potential to unlock new applications in pharmaceuticals, textiles, packaging, etc. In 2024, PAPACKS and Ukrainian Hemp launched a scalable supply chain. This is for certified industrial hemp to produce renewable and recyclable hemp-based packaging.

To get more insights on this market click here to Request a Free Sample Report

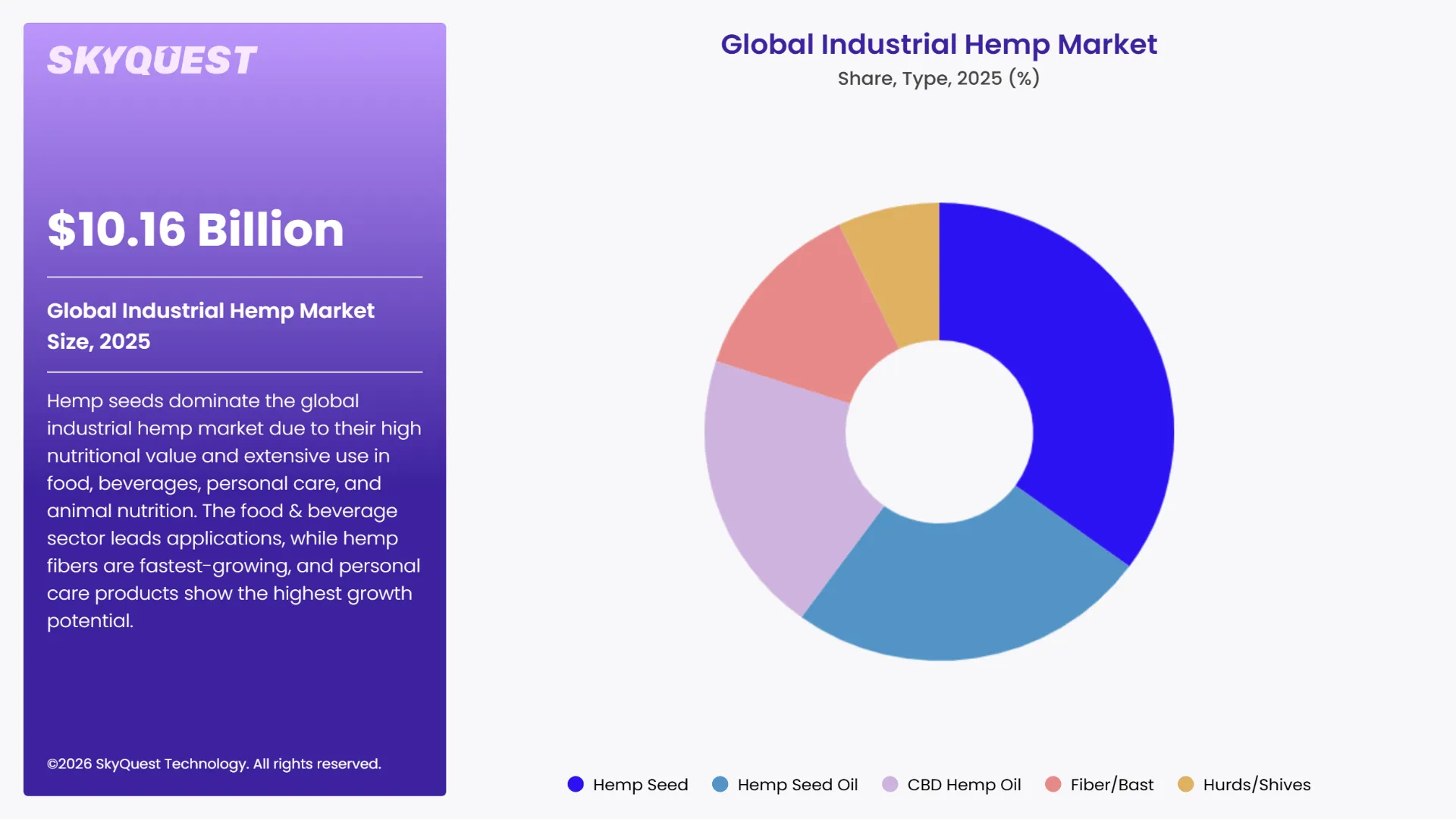

The global industrial hemp market is segmented into type, form, source, application, sales channel, and region. By type, the market is classified into hemp seed, hemp seed oil, CBD hemp oil, fiber/bast, and hurds/shives. Depending on form, it is divided into raw, and processed. According to source, the market is categorized into conventional, and organic. Depending on application, it is divided into food & beverages (dietary supplements, functional foods, others), textiles, pharmaceuticals, personal care products, animal nutrition, paper, construction materials, biofuel, and others. According to sales channel, the market is categorized into B2B, and B2C. Regionally, the industrial hemp market is analyzed across North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

As per the 2024 global industrial hemp market analysis, the hemp seeds sub-segment held the largest share of revenue and controlled the market. The sub-segment enjoyed dominance due to its high nutritional value. Hemp seeds are rich in proteins, fatty acids, and essential minerals. This makes them find extensive use in the food and beverage industry for various products like plant-based milks, protein powders, snacks, cooking oils, etc. They cater to the growing consumer preferences for healthy and plant-based diets. They also find increasing applications in personal care and animal nutrition.

The fiber/bast sub segment is expected to experience the highest compound annual growth rate (CAGR) through the forecasted period. Hemp fibers are marketed as sustainable and eco-friendly materials across multiple industries. They are highly valued as they are strong, durable, and versatile. This makes them an optimum choice for textiles, paper, construction materials, and automotive composites. Their growing application across multiple industries is a key contributor towards their high growth rate.

Based on the 2024 global industrial hemp market forecast, the food & beverages in the application segment dominated the market. The growing consumer demand for healthy, natural, and plant-based products is the reason behind this dominance. Hemp seed and hemp seed oil are rich in essential fatty acids, protein, and vitamins. These products of industrial hemp seeds are widely used in many food items like milk, protein powders, snacks, and cooking oils.

The personal care products category is expected to have the highest growth rate during the forecast period of 2025-2032. Consumers are becoming aware of hemp's moisturizing, anti-inflammatory, and nourishing properties. Hemp oil and extracts are being incorporated into formulations for skincare, haircare, and cosmetics. The shift of preference towards natural and organic personal care products also has an important role in the demand for hemp-based ingredients in this sector.

To get detailed segments analysis, Request a Free Sample Report

As per the 2024, the North American industrial hemp market share is predicted to hold the largest share among all regions in 2024. The favorable legislative changes in the region along with factors such as adequate climate required for cultivation of industrial hemp in the region and adoption of modern agricultural techniques all contribute to its growth. The strong demand for industrial hemp as raw material in textiles, bioplastics, CBD, etc. also continues to spur adoption in the region. The US emerges as the hub for industrial hemp in the region.

U.S. Industrial Hemp Market

In North America, the U.S. leads the industrial hemp market share. The U.S. market for industrial hemp is small compared to other markets in the country. It faces a significant amount of competition from other established materials. In the US, hemp bast fibers are used in textiles, paper, and composites. Hemp hurds are used for animal bedding and producing low-quality paper. Hemp seeds offer a niche market with application in food and oil products. Hemp oil faces limitations due to processing issues, small shelf life, and competition with other oils. Oversupply remains a huge risk for the US. In 2024, South Dakota expanded its industrial hemp acreage by 22%. The state harvests 3,700 acres. Texas also saw a massive increase of about 1,860% in planted acres, though only 1,500 acres were harvested.

Canada Industrial Hemp Market

Canada in North America falls behind the U.S in the industrial hemp market. The country has a mature and well-regulated industrial hemp market. Its history of commercial cultivation dates back to the 1990s. Government support through clear regulations and incentives has also encouraged a strong agricultural base positioning Canada in a favorable environment in both domestic and international markets. The Canadian Industrial Hemp Promotion-Research Agency Proclamation officially established the Canadian Industrial Hemp Promotion-Research Agency (PRA) in November 2024. This agency will operate under the Farm Products Agencies Act. It will coordinate national research and marketing efforts in industrial hemp. It will be self-funded through a 0.5% levy on primary and imported hemp products. The PRA will promote Canadian hemp consumption and create new opportunities in the sector.

Asia-Pacific is predicted to grow at the highest rate in the industrial hemp market share over the projection period of 2025-2032. The growth in the region is led by increasing adoption of hemp-based products in various industries and the positively changing legal frameworks in countries like China, India, and Australia. Other factors such as supportive government policies and increase in consumer interest also support greater growth of industrial hemp. All these factors contribute to the fast rate at which the industrial hemp market of Asia Pacific is growing.

China Industrial Hemp Market

The China industrial hemp market demand grew at a steady rate during the forecast period. Industrial hemp is an important cash crop in China. China is one of the countries in the world which has the largest area of industrial hemp cultivation. Industrial hemp is cultivated in above a dozen provinces in China. However, only two provinces, namely Yunnan and Heilongjiang, have legislation that allows them cultivation of industrial hemp. In October 2023, a new "Integrated Water and Fertilizer Cultivation Technology" for industrial hemp in Yunnan, China, demonstrated an increase in yield by 14.4%.

India Industrial Hemp Market

India is among the most dominant countries of Asia Pacific’s industrial hemp market growth in 2024. India’s market growth is spurred by increasing awareness of hemp's diverse applications in textiles, pharmaceuticals, personal care, and food and beverages. The evolving regulatory landscape in India surrounding legalization of industrial hemp is also promoting growth. Himachal Pradesh approved a pilot study for controlled industrial hemp cultivation for industrial, scientific, and medicinal purposes in February 2025. This is a collaborative effort conducted by agricultural universities and the state's Agriculture Department. This is a very important step towards industrial hemp’s legalization in the Indian state.

Europe held a significant industrial hemp market share in 2024 and is likely to continue so during the forecast period of 2025-2032. This can be due to the increase in demand for sustainable products, along with evolving regulatory landscapes that support industrial hemp cultivation with THC content below 0.3%. Europe had a long history of hemp cultivation which is now witnessing a resurgence. Countries in the region are also focusing on research and development to expand the hemp's applications.

Germany Industrial Hemp Market

Germany has the one of the largest European markets for industrial hemp. Its growth is supported by its consumer base of hemp fibers in the automotive industry and in construction. Legislative reforms and increased investments in processing infrastructure are also helping market expansion. Recognized agricultural businesses are generally allowed to grow industrial hemp in Germany.

France Industrial Hemp Market

The France industrial hemp market is also experiencing steady growth. France is the third largest industrial hemp producer in the world and the largest in Europe. Hemp production in France has nearly tripled here in the last decade reaching about 24,000 hectares. Its market benefits from its long-standing tradition of hemp cultivation and its strong focus on industrial applications. This makes the French industrial hemp market a highly opportune market in upcoming years.

UK Industrial Hemp Market

The UK industrial hemp market emerges as the one of the most prominent industrial hemp markets in the European region. This is attributed to the growing interest in eco-friendly materials which is increasing demand for hemp-derived products. The regulatory environment in the UK supports industrial hemp cultivation by issuing licenses by the Home Office which are valid up to 3 growing seasons. This hugely supports market dynamics. There is also an evident push from the farmers and industry players' side to unlock the full potential of hemp cultivation and processing.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

Demand for Sustainable Raw Materials

Regulatory and Government Support

Lack of Processing Infrastructure and Integration in Supply Chain

Presence of Well-Established Alternatives

Request Free Customization of this report to help us to meet your business objectives.

The industrial hemp market observes competition among local and global players. Leading companies, such as Hemp, Inc, Ecofibre Ltd, Hempflax Group B.V., etc. have been adopting strategies centred around expanding processing capabilities and diversifying product portfolios. Strategic partnerships and vertical integration from cultivation to manufacturing has also been observed in the market. This plays a critical role in improving supply chain control and quality of products. Market expansion through geographic diversification and compliance with evolving regulations is crucial. In 2025, PAPACKS and Ukrainian Hemp collaborated with each other to develop a scalable industrial hemp supply chain for sustainable, recyclable packaging alternatives to wood pulp and plastics. Their packaging which is made of hemp meets the EU and international safety standards. Other tactics that players follow to remain competitive in the market include efforts in branding and improving consumer awareness.

Expansion of Cultivation Acreage:

Integration of Sustainable Farming Practices:

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected using Primary Exploratory Research backed by robust Secondary Desk research.

As per SkyQuest analysis, the industrial hemp market is witnessing mild growth. Its growth can be credited to the expanding applications of industrial hemp, supportive regulatory approvals, and growing partnerships and alliances. However, the market is hampered by the lack of standardization of seed varieties, lack of processing infrastructure, and presence of well-established alternative crops and raw materials. North America is anticipated to lead the market owing to its cultivation capabilities. Asia Pacific, on the other hand emerges as fastest growing region with countries such as China and India holding the positions of the most dominant industrial hemp markets in Asia Pacific.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 8.51 Billion |

| Market size value in 2033 | USD 41.99 Billion |

| Growth Rate | 19.4% |

| Base year | 2024 |

| Forecast period | 2026–2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Industrial Hemp Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Industrial Hemp Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Industrial Hemp Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Industrial Hemp Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

Global Industrial Hemp market size was valued at USD 8.51 Billion in 2024 and is poised to grow from USD 10.16 Billion in 2025 to USD 41.99 Billion by 2033, growing at a CAGR of 19.4% in the forecast period (2026–2033).

Hemp, Inc (United States), Ecofibre Ltd (Australia), Hempflax Group B.V. (Netherlands), Dun Agro Hemp Group (Netherlands), Liaoning Qiaopai Biotech Co., Ltd. (China), Konoplex Group (Russia), Canah International (Romania), Tilray Brands Inc. (Fresh Hemp Foods Ltd) (Canada), Gencanna (United States), Curaleaf Holdings, Inc. (United States), Australis Capital Inc (Aurora Cannabis Inc.) (Canada), South Hemp Tecno (Italy), RAMM PHARMA (Hempoland) (Poland), Gohemp Agro Ventures Pvt. Ltd (India), Colorado Hemp Works, Inc. (United States), Bombay Hemp Company Pvt. Ltd. (India), Parkland Industrial Hemp Growers Co\u2011Op. Ltd. (Canada)

The key driver of the industrial hemp market is the growing demand for sustainable and eco-friendly products. Increased use of hemp in textiles, construction, and bio-based materials, along with favorable regulations, supports market expansion globally.

A key market trend in the industrial hemp market is the rising adoption of hemp-based products across industries like textiles, construction, and personal care. Additionally, innovation in hemp extraction methods and growing consumer preference for natural, sustainable materials are shaping market growth.

North America accounted for the largest share in the industrial hemp market, driven by supportive regulations, growing awareness of hemp’s environmental benefits, and increasing demand for hemp-based products in industries like textiles, food, and personal care.

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients