Report ID: SQMIG45E2360

Report ID: SQMIG45E2360

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG45E2360 |

Region:

Global |

Published Date: December, 2025

Pages:

198

|Tables:

61

|Figures:

75

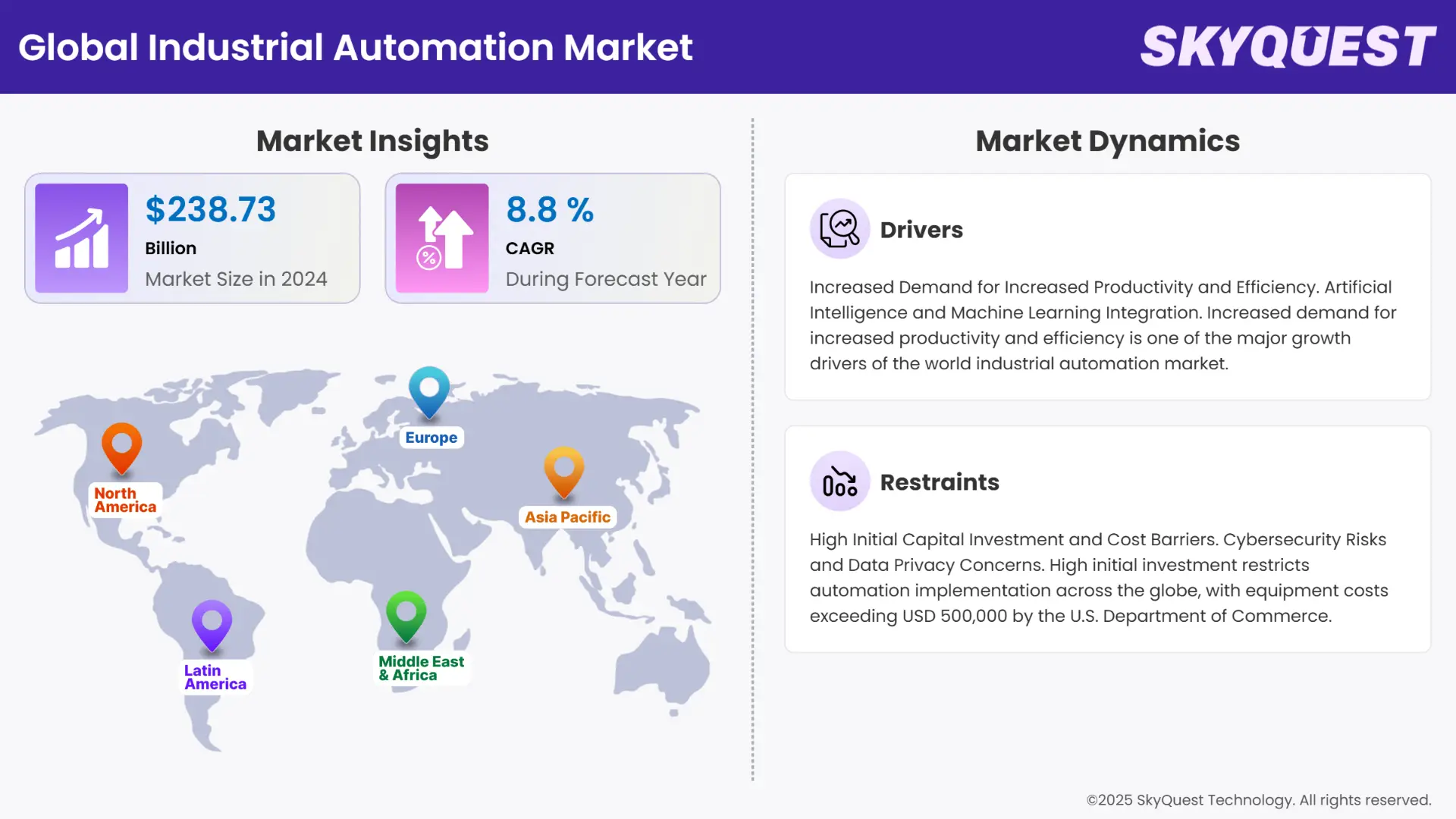

Industrial Automation Market size was valued at USD 240.08 Billion in 2024 and is poised to grow from USD 261.2 Billion in 2025 to USD 512.88 Billion by 2033, growing at a CAGR of 8.8% during the forecast period (2026–2033).

The growth of the market is driven primarily by the increased adoption of sophisticated technologies to enhance productivity and operational efficiency in industries. Businesses are seeking to minimize downtime and human errors, making smart systems and the implementation of robots in manufacturing and production processes a norm. Additionally, the escalating demand for real-time analytics and data for decision-making capabilities has also triggered growth in these technologies. Growing industrialization and the need for low-cost solutions in order to compete in a rapidly globalized economy have also fueled demand.

Some limitations are preventing the market from fully reaching its potential. High initial expenditures of the deployment of advanced systems can be prohibitive, especially for small and medium-sized enterprises. Secondly, the need for experienced personnel to run and support the systems creates a skill gap that many organizations find difficult to fill. Lastly, incompatibility with older systems within existing infrastructures also raises the complexity of integrating new technologies on board, deterring some firms from adopting them.

Despite these hurdles, advances in technology and government incentives are paving the way for further growth. Driven by increasing investment in research and development, lower-cost and flexible solutions tailored to fit various industries are being created. Growing awareness towards sustainability and energy efficiency is also prompting industries to adopt solutions that reduce waste and optimize the utilization of resources. These forces are set to level out challenges and drive the uptake of sophisticated systems globally.

How is Artificial Intelligence Transforming the Industrial Automation Market Landscape?

Artificial intelligence is revolutionizing industrial operations through the achievement of predictive maintenance, minimizing downtime, and efficiency. For instance, Siemens and Microsoft have joined forces to develop AI-powered assistants to optimize manufacturing processes, while Honeywell and Google Cloud are partnering to infuse AI into industrial processes with the view of automating processes and improving decision-making.

Across the globe, governments are investing a lot in AI as they strive to boost industrial power. In China, for example, it has allocated approximately USD 100 billion to invest in AI and robotics in smart manufacturing and health. In America, the government has allocated approximately USD 2 billion to bring AI and robotics into manufacturing and logistics sectors. These investments are a global commitment to leveraging AI for industrial transformation.

To get more insights on this market click here to Request a Free Sample Report

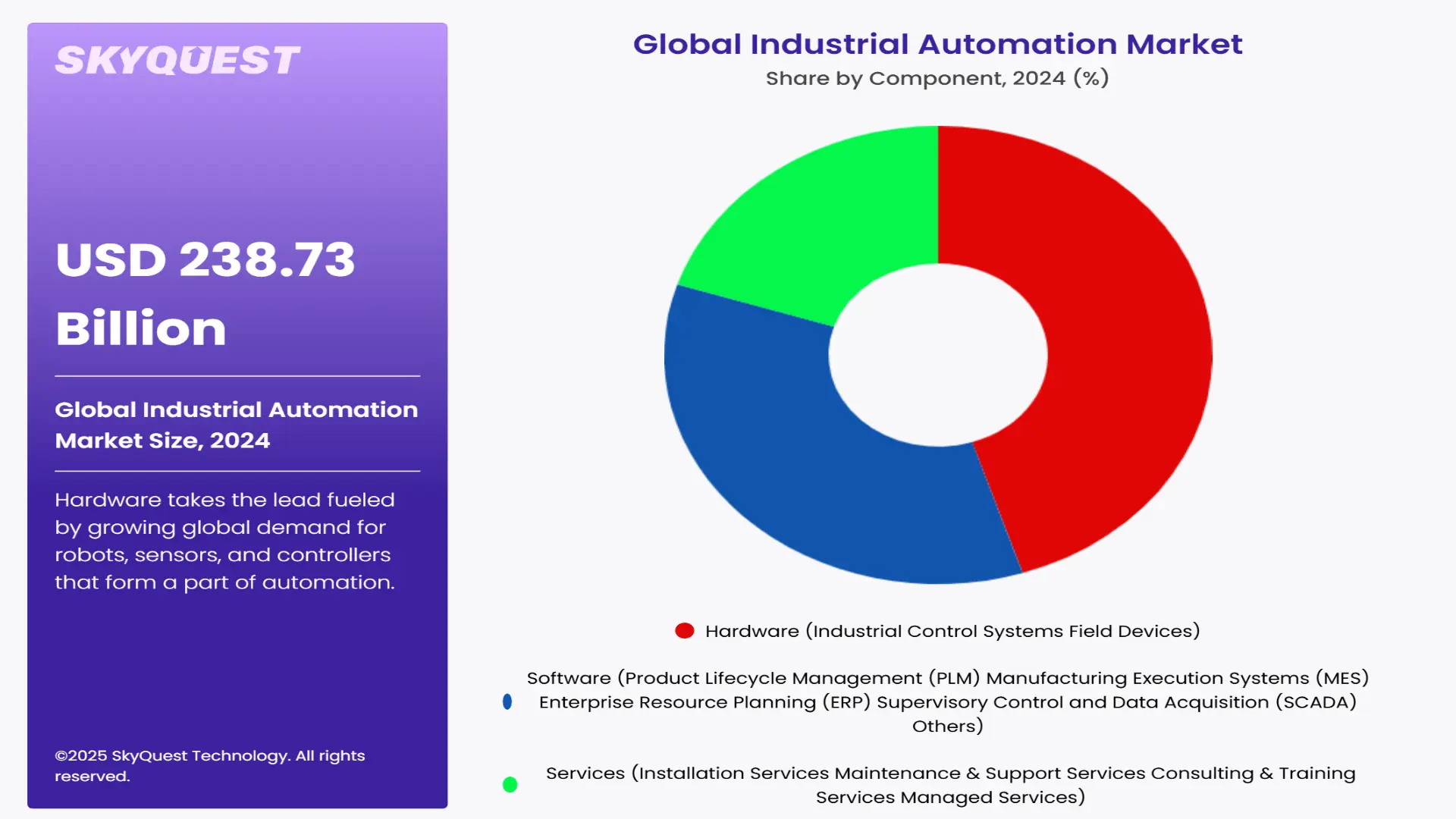

Global Industrial Automation Market is segmented by Component, End Use Industry and region. Based on Component, the market is segmented into Hardware, Software, and Services. Based on End Use Industry, the market is segmented into Transportation Infrastructure, Energy & Power, Nuclear, Oil & Gas, Manufacturing, Life Sciences, Logistics & Supply Chain, Consumer Packaged Goods, Chemical & Material, Infrastructure & Construction, Aerospace & Defense, Technology & Communications, Environmental Services, Mining & Metals, and Others. Based on region, the market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa.

Hardware takes the lead fueled by growing global demand for robots, sensors, and controllers that form a part of automation. China's "Made in China 2025" has driven its manufacturing prowess significantly, particularly in robotics and automation sectors. In the US, players like Rockwell Automation and Honeywell are leading the charge in providing industrial automation solutions. The development of collaborative robots (cobots), which currently represent 11% of all industrial robots, is showcasing this trend. Furthermore, the intersection of AI and IoT in hardware is maximizing efficiency and productivity across industries.

Software is in increasing growth in this industry, driven by the intersection of Industrial IoT (IIoT) and artificial intelligence (AI) technologies to enhance real-time monitoring and predictive maintenance. Global adoption of IIoT devices will surpass 23 billion by 2025, up from 15.1 billion in 2021, reflecting the increasing demand for interconnected systems. Companies such as Siemens are accelerating their digital portfolios through huge buyouts, such as Siemens' USD 10.6 billion buyout of Altair Engineering, to enhance their software capabilities. Additionally, the shift to cloud-based automation offerings is helping industries save on infrastructure costs and enhance operating agility, propelling software adoption further.

Manufacturing leads this market due to worldwide initiatives to promote automation and smart factories. China's "Made in China 2025" program has further enhanced its manufacturing capabilities, particularly in robotics and automation domains.

The United States has competitors like Rockwell Automation and Honeywell that are leading the industry by providing industrial automation solutions. The growing number of cobots, which are now 11% of all industrial robots, indicates this. In addition, the integration of AI and IoT into hardware components is enhancing efficiency and productivity across all sectors.

The oil and gas sector is rapidly embracing automation driven by necessity to become more efficient, reduce costs, and meet high safety and environmental regulations. Emerging technologies such as AI, IoT, and robotics are at the center of this transition. For instance, AI technologies are enabling predictive maintenance, remote site monitoring, and energy management, leading to cleaner and more sophisticated processes like subsea facility construction and autonomous drilling. SLB (formerly Schlumberger) and others have experienced 20% growth in digital revenues to USD 2.44 billion, with the cause attributed to the use of AI and autonomous operations. Besides, AI technologies are becoming less expensive and faster for the production of oil, with companies like BP and Chevron leveraging AI to improve drilling efficiency and operation continuity. The kind of development is indicative of the industry's emphasis on digital transformation, keeping oil and gas at the epicenter of a rapidly growing space within the industrial automation market.

To get detailed segments analysis, Request a Free Sample Report

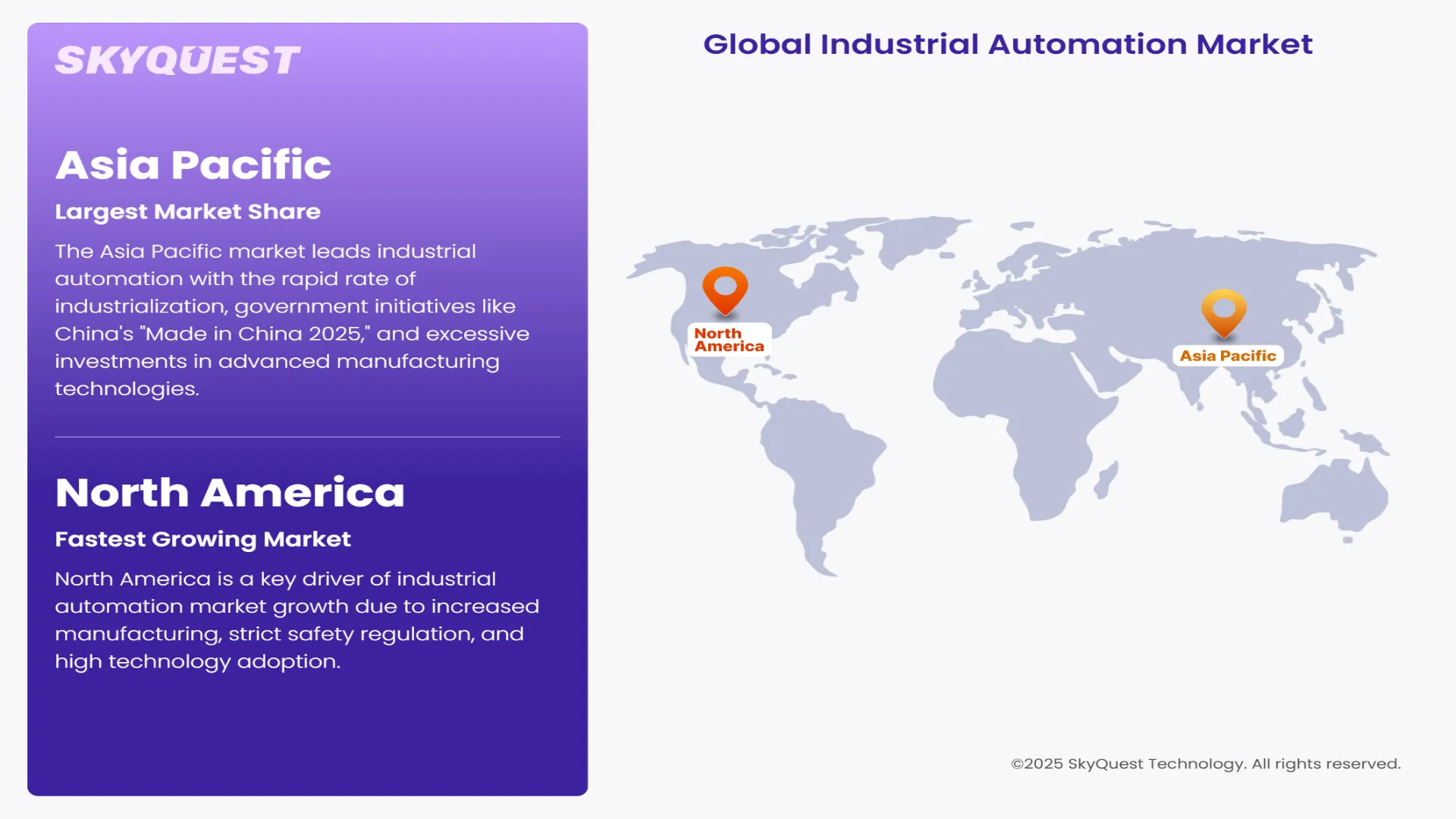

The Asia Pacific market leads industrial automation with the rapid rate of industrialization, government initiatives like China's "Made in China 2025," and excessive investments in advanced manufacturing technologies. China, Japan, and India are some of the top countries to lead adoption levels, followed by a focus on robotics, IoT deployment, and AI-driven solutions to achieve increased productivity and efficiency.

China is at the forefront of Asia Pacific for industrial automation, led by the "Made in China 2025" plan to propel manufacturing with technology. China uses more industrial robots than any other country, and automation is increasing across sectors. Some recent reports feature Audi's newly opened Chinese electric vehicle factory where Chinese-produced robots are at the center of the production line, demonstrating China's focus on automation and technological independence.

Japan is the leader in industrial automation, and it boasts a strong robotics manufacturing industry. IoT, AI, and robotics deployment are encouraged by the "Connected Industries" national strategy. The leaders in developing AI-based automation solutions and cobots are Mitsubishi Electric and OMRON. For example, AI from Mitsubishi Electric optimizes the efficiency of manual tasks by cutting analysis time by up to 99%.

South Korea is quickly emerging in industrial automation, especially in auto and semiconductor industries. The government is set to build 4,500 smart factories by 2025 under the umbrella of automation technologies such as machine vision systems and industrial robots. Hyundai Motor Group is set to invest KRW 21 trillion to build its electric vehicle business, which requires sophisticated automation systems.

North America is a key driver of industrial automation market growth due to increased manufacturing, strict safety regulation, and high technology adoption. The U.S. is the trendsetter in this case, driven by players such as Rockwell Automation and Honeywell, and strong government policies further assisted in pushing the urge for automation to enhance overall productivity, save costs, and improve operational safety.

The United States dominates North America in industrial automation, fueled by a strong manufacturing industry, technology innovation, and massive investments in automation technologies. The government also has policies in place to facilitate the adoption of automation, such as tax relief and grants to companies that invest in cutting-edge technologies. For example, the U.S. Department of Energy's Office of Advanced Manufacturing sponsors projects that help make energy more efficient and decrease emissions in manufacturing. Furthermore, corporations such as Rockwell Automation and Honeywell are leading the charge in providing industrial automation solutions to place the country at the cutting-edge of the industry.

Industrial automation in Canada is expanding fast, especially in industries such as manufacturing, healthcare, and natural resources. Canada's government has also created programs to encourage automation, such as a USD 780 million commitment to create a five-year funding agency to develop robotics and related technologies. The program is created to spur innovation, develop a talent pool, and enhance productivity in many different industries. Businesses such as Montreal-based Vention are at the forefront by offering modular automation solutions and creating global manufacturer partnerships.

Europe is spearheading industrial automation with a strong focus on Industry 4.0 initiatives and smart manufacturing. Germany, the pioneer leader, paves the way by embracing cutting-edge robotics and IoT integration. Encouraging government policies and digitalization expenditure by France and the UK too also add to enhanced efficiency and innovation.

Germany is firmly at the helm in Europe's industrial automation market driven by its robust manufacturing base and Industry 4.0 initiative adopting IoT, AI, and robotics in production. Government support in terms of investment and infrastructure development drives innovation. Recent pointers are Siemens' push in its digital factory solutions and Bosch's announcement of AI-powered automation solutions, cementing Germany's position as a global automation leader. These technologies optimize efficiency and competitiveness in automotive, machinery, and electronics industries.

France is increasing significantly in industrial automation thanks to government-supported digital transformation initiatives such as "France Industrie 4.0." France is committed to AI and robotics implementation in manufacturing with a high emphasis on aerospace and automobile industries. Schneider Electric's recent launch of new innovative energy management automation solutions is a great example of innovation that fuels growth. Public-private partnerships focus on enhancing skills of the industrial workforce in automation technologies towards supporting sustainable industrial growth. The presence of France's great research centers and incentives for investment leads world players in automation to invest in its market, making it strong.

Industrial automation in Italy is evolving based on its focus on intelligent production of textile, automotive, and food processing sectors.

Government policies such as "Industria 4.0" offer tax credits and investment funds for automation adoption. ABB Italy recently launched a new center for robotics innovation dealing with AI and machine learning-based technology solutions. This also enhances Italy's ability to improve productivity and lower manufacturing costs. Industry-university collaborations are propelling innovation of tailor-made automation solutions to cater to the needs of Italy's SME-oriented industrial base.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

Increased Demand for Increased Productivity and Efficiency

Artificial Intelligence and Machine Learning Integration

High Initial Capital Investment and Cost Barriers

Cybersecurity Risks and Data Privacy Concerns

Request Free Customization of this report to help us to meet your business objectives.

The worldwide industrial automation industry is very competitive with major players such as Schneider Electric, Mitsubishi Electric, and Emerson Electric competing on the basis of strategy and innovation partnerships. Governments across the globe are promoting this competition; for example, the U.S. Department of Commerce invested USD 80 million in 2024 to spur R&D partnership initiatives amongst automation companies and universities. Schneider Electric recently won a USD 50 million contract under France's Industry of the Future program focusing on smart factory solutions. Mitsubishi Electric penetrated further through government-sponsored digital transformation initiatives in Japan, consolidating AI deployment in automation. Emerson Electric also gains from the Canadian government's USD 60 million Smart Manufacturing Challenge, which facilitates IoT and cloud-based automation adoption, fueling technology leadership and business growth.

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected using Primary Exploratory Research backed by robust Secondary Desk research.

According to the SkyQuest analysis, a rise in demand for enhanced productivity and efficiency and the swift penetration of artificial intelligence as well as machine learning are likely to spur strong growth in the global industrial automation market through 2032. Nevertheless, high up-front capital costs, security threats, and lack of skilled personnel are set to restrain market adoption. Government spends on digital infrastructure and upskilling of labor markets, tied as they are, and the crème de la crème of automation players in the offer guarantee sustained dominance for North America. Growth opportunities for the players in the global market will likely arise from new technologies like the adoption of edge computing and automation for renewable energy segments.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 240.08 Billion |

| Market size value in 2033 | USD 512.88 Billion |

| Growth Rate | 8.8% |

| Base year | 2024 |

| Forecast period | 2026-2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Industrial Automation Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Industrial Automation Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Industrial Automation Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Industrial Automation Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients