Report ID: SQMIG15F2237

Report ID: SQMIG15F2237

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG15F2237 |

Region:

Global |

Published Date: June, 2025

Pages:

195

|Tables:

125

|Figures:

77

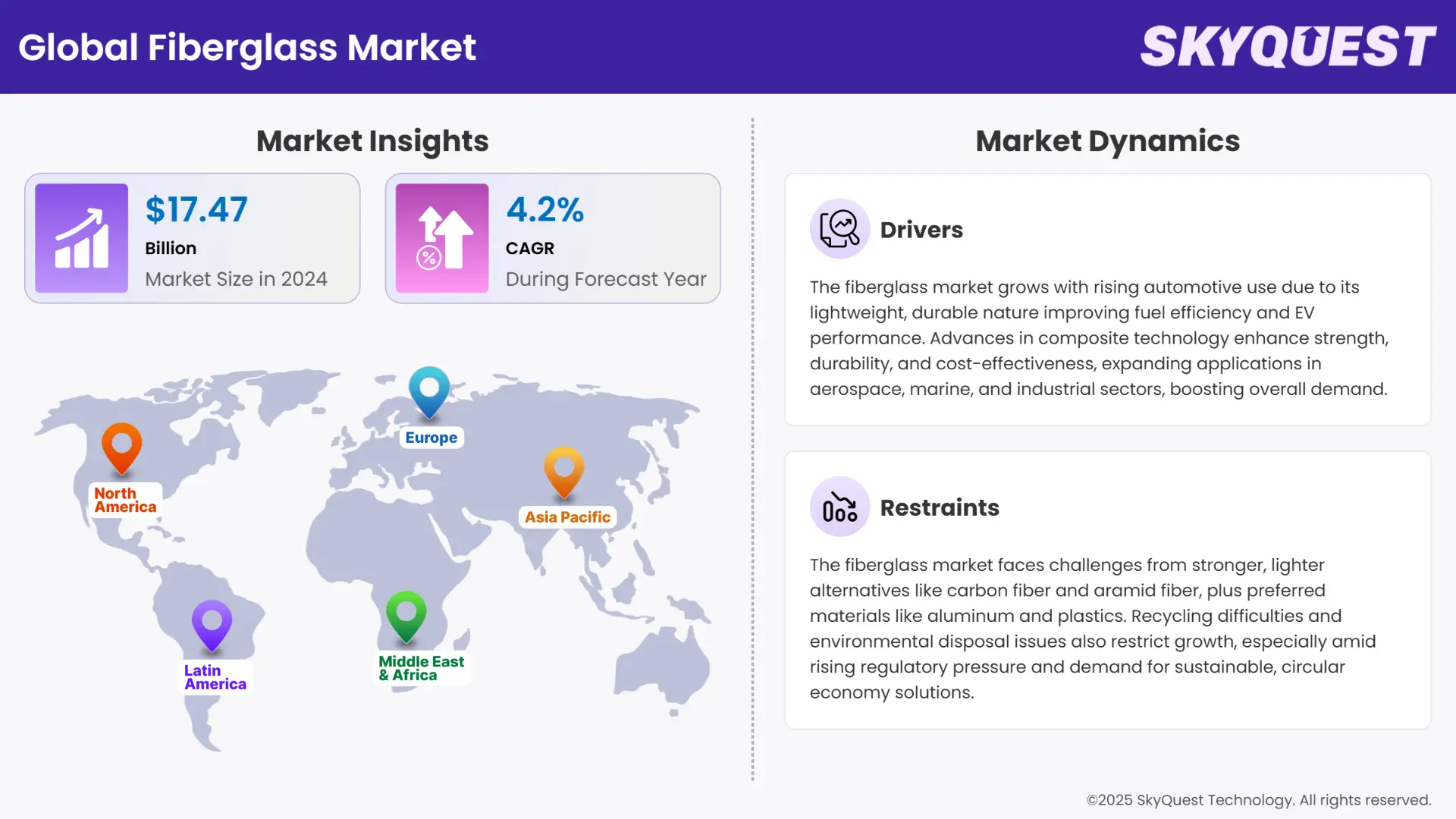

Global Fiberglass Market size was valued at USD 17.47 Billion in 2024 and is poised to grow from USD 18.21 Billion in 2025 to USD 25.31 Billion by 2033, growing at a CAGR of 4.2% during the forecast period (2026–2033).

The fiberglass industry is growing rapidly as the demand from automotive, construction and renewable energy industries increases. Fiberglass is a lightweight, corrosion-resistant material that can be applied in a wide variety of applications as a substitute to traditional materials (e.g. aluminum and steel) that require greater durability and energy efficiency. High fuel economy and emissions standards in automotive manufacturing have expanded the use of fiberglass composites for automotive parts and components. Furthermore, widespread infrastructure development in emerging economies is sustaining fiberglass demand in the construction industry, especially for a manufactured panel for insulation, roofing, and panels.

There are some market restraints, including production costs and environmental concerns regarding the disposal and recycling of fiberglass waste. A major constraint is the energy intensive manufacturing process and limited availability of raw materials, both of which may prevent scalability. Yet new developments in bio-based resins and recycling capabilities are all beginning to address these challenges. Additionally, growing investments in wind energy projects and recent momentum on smart city projects globally are providing emerging markets for fiberglass applications in wind energy blades and advanced building materials, respectively; this will ensure a healthy long-term outlook for the fiberglass market.

Is the shift towards lightweight materials in automotive and aerospace industries accelerating fiberglass demand?

The rapidly evolving demand for lightweight, high strength materials driven by added regulatory scrutiny to reduce emissions and improve fuel economy is being reflected through the broader automotive and aerospace markets. Automakers are gradually starting to use fiberglass composites in vehicle structures, body panels, and interiors to promote weight reduction with no regard to durability. Likewise, airplane manufacturers are incorporating fiberglass in rudimentary components like fairings, floor panels, and ductwork. The opportunities for fiberglass to provide design flexibility while reducing up-front costs position fiberglass to be the material of choice within these high-growth, transport markets.

How is the growing demand for renewable energy infrastructure influencing fiberglass usage?

The expanded development of wind energy projects on a global scale will increase the demand for materials with high durability and weather resistance. The great demand for wind turbine blades, as they need lightweight and resilient materials, has resulted in an increase in the use of fiberglass composites for this composite industry. Their usage compliments global decarbonizing efforts, whereby durable materials with a long lifespan are necessary to support large-scale renewable energy projects. Also, fiberglass is cost effective relative to carbon fiber for many applications, helping to contribute in the shift to low-carbon technologies.

To get more insights on this market click here to Request a Free Sample Report

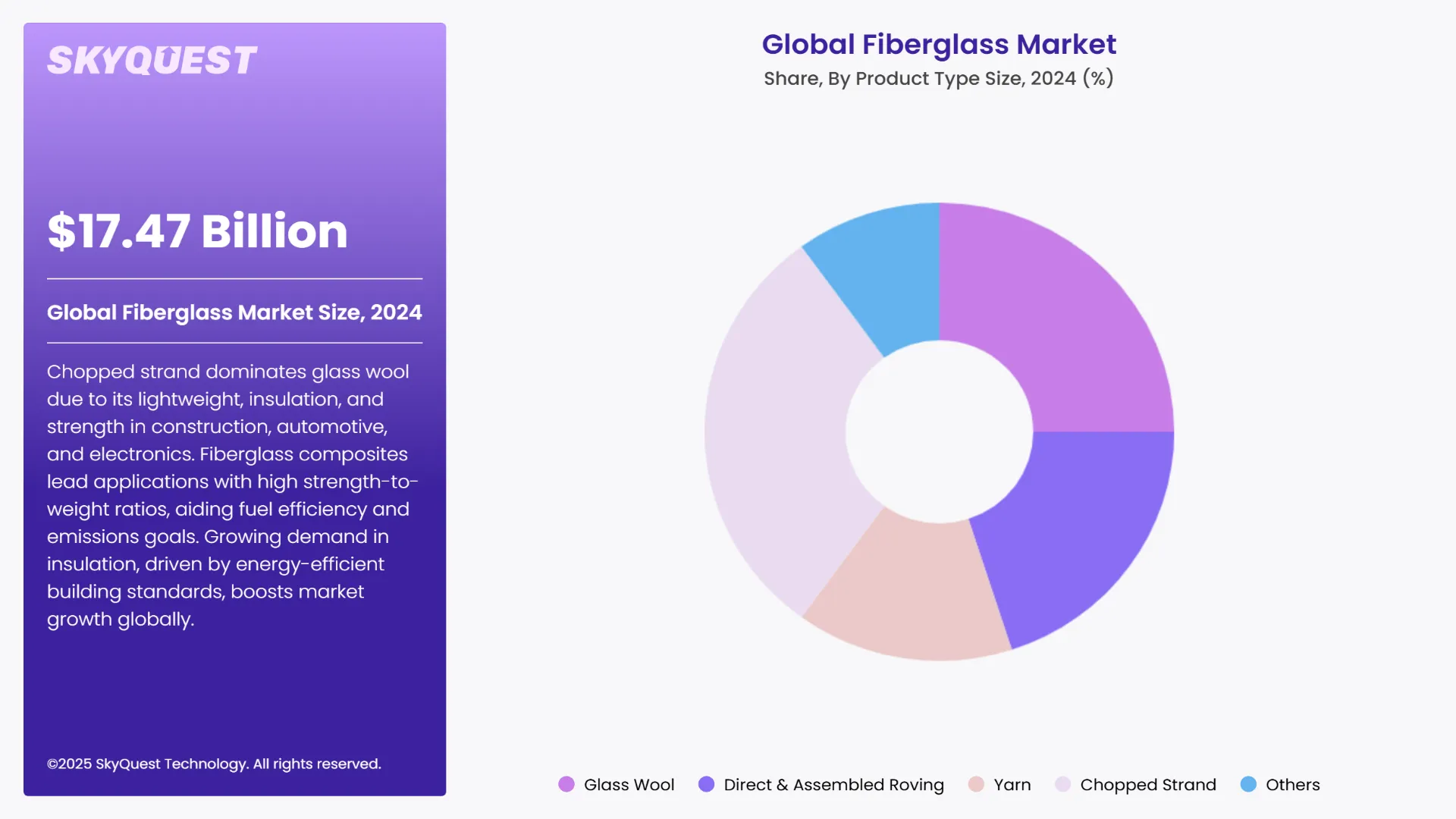

The global fiberglass market is segmented by Product Type, Glass Type, Application, End User and region. Based on Product Type, the market is segmented into Glass Wool, Direct & Assembled Roving, Yarn, Chopped Strand and Others. Based on Glass Type, the market is segmented into E Glass, ECR Glass, H Glass, AR Glass, S Glass and Others. Based on Application, the market is segmented into Composites and Insulation. Based on End User, the market is segmented into Transportation, Building & Construction, Electrical & Electronics, Pipe & Tank, Consumer Goods, Wind Energy and Others. Based on region, the fiberglass market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa.

Why is Glass Wool the Dominating Product Type in the Fiberglass Market?

Chopped strand is the dominant sub-segment in glass wool because it can be applied in a wide range of applications in construction, automotive and electronics. All of these applications use short glass fibers to provide insulation, strength and chemical compatibility with thermoset resins primarily in injection molding and compression molding. Because chopped strand is lightweight (low density), and multifunctional in building plastics, short strand glass fibers are used to steel reinforce composite automotive parts as the automotive industry replaces metal for better fuel economics. Chopped strands are very competitive in roofing systems, waterproofing applications and piping applications which assures consistent annual demand for chopped strand. Current global trends for energy-efficient buildings and new emissions standards are also adding momentum for the adoption of chopped strand products for thermal insulation and lightweight composites particularly in the developed economies.

Why is Composites the Dominating Application Segment in the Fiberglass Market?

Composites remain the leading application of fiberglass due to their extensive use in automotive, aerospace, construction, and electrical sectors. Fiberglass-reinforced composites have a good strength-to-weight ratio, thermal stability, corrosion resistance, and, compared to traditional materials like steel or aluminum, composites are economical. The composites industry is recognized by the automotive industry as an opportunity to reduce vehicle weight and meet strict fuel efficiency and emissions standards.

The construction industry, however, makes use of fiberglass composites in applications like bridges, rebar, and structural panels due to wear properties and resistance to extreme climates. The shift toward replacing metal with composites in infrastructure or transport has continued to increase demand in this sector. The fastest growing segment is insulation, driven by a global focus on energy-efficient buildings and green building standards. Fiberglass insulation has good thermal, fire, and acoustic properties, and is relatively inexpensive. Governments in the U.S., EU, and Asia-Pacific are providing incentives for retrofitting projects and enacting building codes that created better insulation standards.

To get detailed segments analysis, Request a Free Sample Report

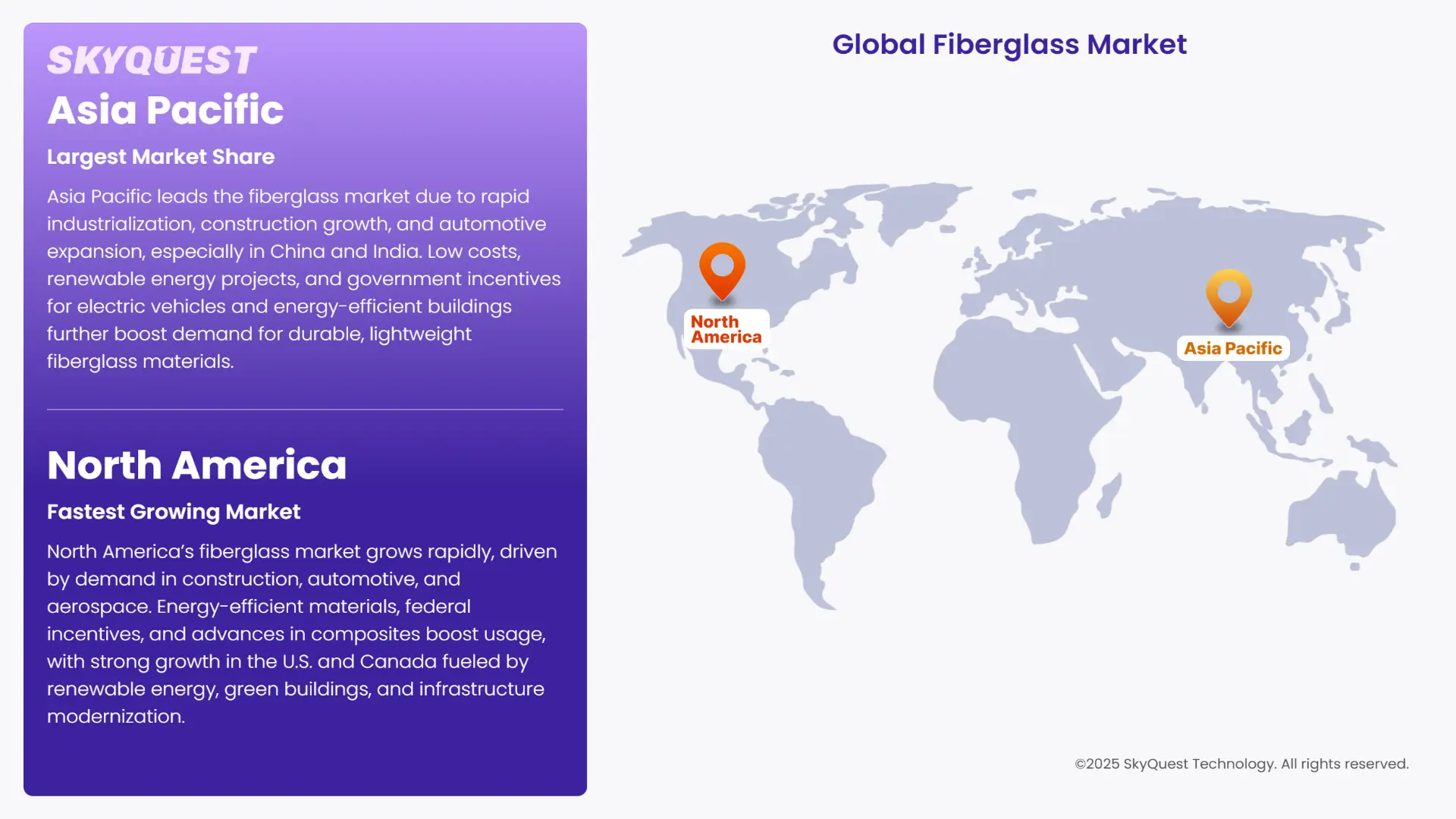

Why is Asia Pacific Dominates Fiberglass in 2024?

Asia Pacific tops the global fiberglass market share with fast industrialization, booming construction, and expanding automobile manufacture in major economies. Countries like China and India have also required heavy investment in comprehensive development, with lots of activities taking place, causing demand for lightweight building materials that have high durability and strength, even high-end, durable materials such as fiberglass. The low manufacturing costs with affordable raw materials available will keep demand in on-going standards with positive conditions. In addition, renewable energy installations in the region, for example, wind power along with composites, will also contribute to increase demand. The governments are providing incentives for electric vehicles but also in energy-efficient buildings also for future demand.

China Fiberglass Market

China leads the Asia Pacific fiberglass market growth owing to its vast construction and automotive sectors. The country is the largest global fiberglass producer and exporter. Local firms are expanding capacity and adopting advanced production techniques. In April 2024, China Jushi Co., Ltd., a leading fiberglass manufacturer, announced the expansion of its intelligent production line in Tongxiang, aiming to increase output and reduce energy consumption. The nation's "New Infrastructure" strategy and continued investments in smart grids, 5G base stations, and high-speed rail are creating steady demand for fiberglass-reinforced products.

India Fiberglass Market

India's fiberglass market demand is witnessing strong growth due to infrastructure development, renewable energy expansion, and rising demand in wind energy and automotive sectors. The government's "Make in India" initiative and production-linked incentive (PLI) schemes are encouraging local manufacturing. In February 2024, Owens Corning announced plans to expand its fiberglass insulation plant in India to cater to the increasing demand in residential and commercial buildings. Moreover, the country’s ambitious renewable targets, especially for wind power, are driving the use of fiberglass composites in turbine blades and related applications.

Why North America is the fastest-growing region for Fiberglass?

North America is emerging as the fastest-growing region in the fiberglass market share due to rising demand across construction, automotive, and aerospace industries. The region is seeing increasing preference for energy-efficient, sustainable, and lightweight materials, particularly in green buildings and electric vehicles. Advancements in composite technologies and higher penetration of fiberglass in industrial applications are contributing factors. Federal incentives for renewable energy projects and EV adoption are also accelerating fiberglass usage. Moreover, major manufacturers are investing in research and development to create high-performance fiberglass solutions tailored to regional needs.

U.S. Fiberglass Market

The U.S. is a significant contributor to the North American fiberglass market growth, driven by demand in construction, automotive, and defense sectors. Increasing retrofitting activities and energy-efficient construction projects are fueling the need for fiberglass insulation and reinforcements. In March 2024, Johns Manville, a Berkshire Hathaway company, announced a new high-performance fiberglass product line targeting electric vehicle components. Additionally, robust investments in wind energy and infrastructure modernization projects under the Bipartisan Infrastructure Law are boosting market prospects for fiberglass composites across applications.

Canada Fiberglass Market

Canada’s fiberglass market trends is benefiting from growing applications in building insulation, renewable energy, and transportation. The government’s focus on reducing carbon emissions is encouraging the adoption of sustainable materials like fiberglass. In January 2024, Saint-Gobain expanded its production capabilities in Ontario, focusing on eco-friendly fiberglass insulation products. Strong housing demand, coupled with green building certifications such as LEED, is driving the use of fiberglass materials in residential and commercial sectors. Additionally, increased investments in wind and hydro energy infrastructure are opening new avenues for fiberglass composite applications.

How is Europe Maintaining its Dominance in Fiberglass Industry?

Europe holds a strong position in the fiberglass market share supported by its well-established automotive and aerospace industries, stringent environmental regulations, and aggressive renewable energy targets. The region’s focus on sustainability and energy efficiency under the EU Green Deal is driving demand for fiberglass composites in construction, wind energy, transportation, and industrial applications. Continuous investments in infrastructure modernization, coupled with rising retrofit activities to improve building insulation, also stimulate fiberglass consumption. Furthermore, Europe’s advanced manufacturing capabilities and innovation in high-performance composites enable it to maintain competitiveness globally.

Germany Fiberglass Market

Germany is a key fiberglass market player, driven primarily by its automotive and wind energy sectors. The country is a pioneer in adopting lightweight composites for electric and hybrid vehicles to enhance fuel efficiency. The German government’s Renewable Energy Sources Act (EEG) encourages wind power investments, which require high volumes of fiberglass for turbine blades and components. In April 2024, Röchling Group unveiled a new range of fiberglass-reinforced composites designed specifically for electric vehicles, offering improved strength-to-weight ratios. Additionally, Germany’s construction sector is undergoing extensive retrofitting to meet stringent energy efficiency standards, further boosting demand for fiberglass insulation. The country’s strong R&D infrastructure supports continuous development of sustainable fiberglass products with reduced environmental impact.

France Fiberglass Market

France’s fiberglass market growth is driven by energy-efficient building initiatives and renewable energy expansion. The government’s commitment to achieving carbon neutrality by 2050 is accelerating the use of fiberglass insulation and composites in residential and commercial construction. In early 2024, Saint-Gobain launched an innovative recyclable fiberglass insulation product line aligned with EU Green Deal targets, enhancing thermal performance while reducing waste. France is also expanding its offshore wind capacity, increasing demand for fiberglass materials in turbine manufacturing. Moreover, growing urbanization and infrastructure upgrades are stimulating use of fiberglass in bridges, facades, and transportation sectors. The French market benefits from supportive policies, including subsidies for green buildings and energy renovations.

Italy Fiberglass Market

Italy’s fiberglass market growth is expanding mainly due to demand from marine, construction, and automotive sectors. The country’s extensive coastline drives significant fiberglass use in boat building and marine equipment. In March 2024, Saertex Italy partnered with leading shipbuilders to supply high-performance fiberglass fabrics for lightweight, durable hull construction, improving fuel efficiency and durability. Italy’s construction sector is also adapting to EU energy efficiency regulations, increasing fiberglass insulation adoption for residential retrofits and new builds. Furthermore, the Italian automotive industry is exploring fiberglass composites to reduce vehicle weight and emissions. Government incentives for renewable energy projects, particularly solar and wind, provide additional growth drivers. Italy’s strong tradition in craftsmanship combined with technological advancements fosters innovation in fiberglass applications.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

Increasing Use in Automotive Industry

Advancements in Composite Technology

Competition from Alternative Materials

Recycling and Disposal Challenges

Request Free Customization of this report to help us to meet your business objectives.

The global fiberglass market is characterized by intense competition, with leading players employing targeted strategies to solidify their positions. China's Jushi Group, the world's largest fiberglass producer with an annual capacity of 2 million metric tons, is expanding its global footprint by constructing a 120,000-ton facility in Egypt and acquiring a French fiberglass fabric manufacturer to enhance its European presence. Owens Corning, producing approximately 1.4 million metric tons annually, is focusing on innovation and sustainability. The company has developed fiberglass insulation from recycled materials and, in partnership with Pultron Composites, launched PINKBAR™ fiberglass rebar for concrete reinforcement.

Saint-Gobain is also expanding its market share through strategic acquisitions, such as the purchase of U.P. Twiga Fiberglass Ltd. in India, strengthening its position in the glass wool insulation sector. These companies are not only increasing production capacities but also investing in sustainable and innovative solutions to meet the evolving demands of industries like construction, automotive, and renewable energy.

Emerging Trends Shaping the Future of Fiberglass

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected using Primary Exploratory Research backed by robust Secondary Desk research.

As per SkyQuest analysis, the global fiberglass market is witnessing steady growth, driven by the increasing demand for lightweight and durable materials across various industries, particularly in construction, automotive, and wind energy. A key driver fueling this growth is the rising focus on energy efficiency and sustainability. Fiberglass, known for its excellent insulation properties and corrosion resistance, is widely used in applications such as building insulation and composite materials for automotive and aerospace parts. As industries seek to reduce carbon emissions and enhance fuel efficiency, fiberglass composites have become vital substitutes for traditional materials like metal and wood.

Asia Pacific dominates the fiberglass market, led by rapid industrialization, infrastructure development, and expanding manufacturing sectors in countries like China, India, and Southeast Asia. Government investments in renewable energy and construction further bolster regional demand. By product type, glass wool holds the largest market share due to its widespread use in thermal and acoustic insulation. In terms of application, the composites segment is the leading category, driven by its extensive use in automotive, aerospace, and wind turbine blades, offering a blend of strength, flexibility, and reduced weight. However, the market is restrained by the high energy consumption in fiberglass manufacturing and concerns over environmental emissions during production.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 17.47 Billion |

| Market size value in 2033 | USD 25.31 Billion |

| Growth Rate | 4.2% |

| Base year | 2024 |

| Forecast period | 2026–2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Fiberglass Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Fiberglass Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Fiberglass Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Fiberglass Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

Global Fiberglass Market size was valued at USD 17.47 Billion in 2024 and is poised to grow from USD 18.21 Billion in 2025 to USD 25.31 Billion by 2033, growing at a CAGR of 4.2% during the forecast period (2026–2033).

The global fiberglass market is characterized by intense competition, with leading players employing targeted strategies to solidify their positions. China's Jushi Group, the world's largest fiberglass producer with an annual capacity of 2 million metric tons, is expanding its global footprint by constructing a 120,000-ton facility in Egypt and acquiring a French fiberglass fabric manufacturer to enhance its European presence. Owens Corning, producing approximately 1.4 million metric tons annually, is focusing on innovation and sustainability. The company has developed fiberglass insulation from recycled materials and, in partnership with Pultron Composites, launched PINKBAR™ fiberglass rebar for concrete reinforcement. 'Owens Corning', 'Saint-Gobain', 'Nippon Electric Glass', 'Jushi Group Co. Ltd.', 'PPG Industries', 'Johns Manville', 'Chongqing Polycomp International Corp.', 'Knauf Insulation', 'China Beihai Fiberglass Co., Ltd.', 'AGY Holding Corp.', 'Fulltech Fiber Glass Corp.', 'BGF Industries Inc.', 'Lanxess AG', 'China National Materials Group Corp. Ltd. (Sinoma)', 'Advanced Composites Inc.', 'Nitto Boseki Co., Ltd.', 'Amatex Corporation', 'TUF Glass Fiber Co., Ltd.', 'Jiangsu Jiuding New Material Co., Ltd.', 'Ticona Engineerig Polymers'

The adoption of fiberglass composites is gaining traction in the automotive industry, thanks to their durable and lightweight nature, which improves fuel efficiency and reduces emissions. Components made of fiberglass are used in body panels, bumpers, and interior components, giving manufacturers an available option to comply with stricter environmental regulations. Increased consumer demand for electric vehicles (EVs) has contributed to the expanding use of lightweight materials, including fiberglass, to boost performance and reduce overall vehicle weight. The shift towards adopting fiberglass is expanding the fiberglass market, especially as more automakers place importance on sustainability and seek cost-effective replacements for metals.

Short-Term: The fiberglass market is now experiencing increased demand from the construction and automotive sectors in the near term. With renewed infrastructure development and lightweight material needs, specifically highlighting the demand for infrastructure development across several regions post-COVID. Governments are putting in place stimulus packages creating green investments towards infrastructure development, leading energy efficiency initiatives, and adoption of fiberglass insulation for energy efficiency. Manufacturers are also focused on implementing new processes to stabilize supply chains, gaining some clarity for repricing raw materials.

Why is Asia Pacific Dominates Fiberglass in 2024?

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients