Report ID: SQMIG35G2136

Report ID: SQMIG35G2136

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG35G2136 |

Region:

Global |

Published Date: December, 2025

Pages:

198

|Tables:

134

|Figures:

77

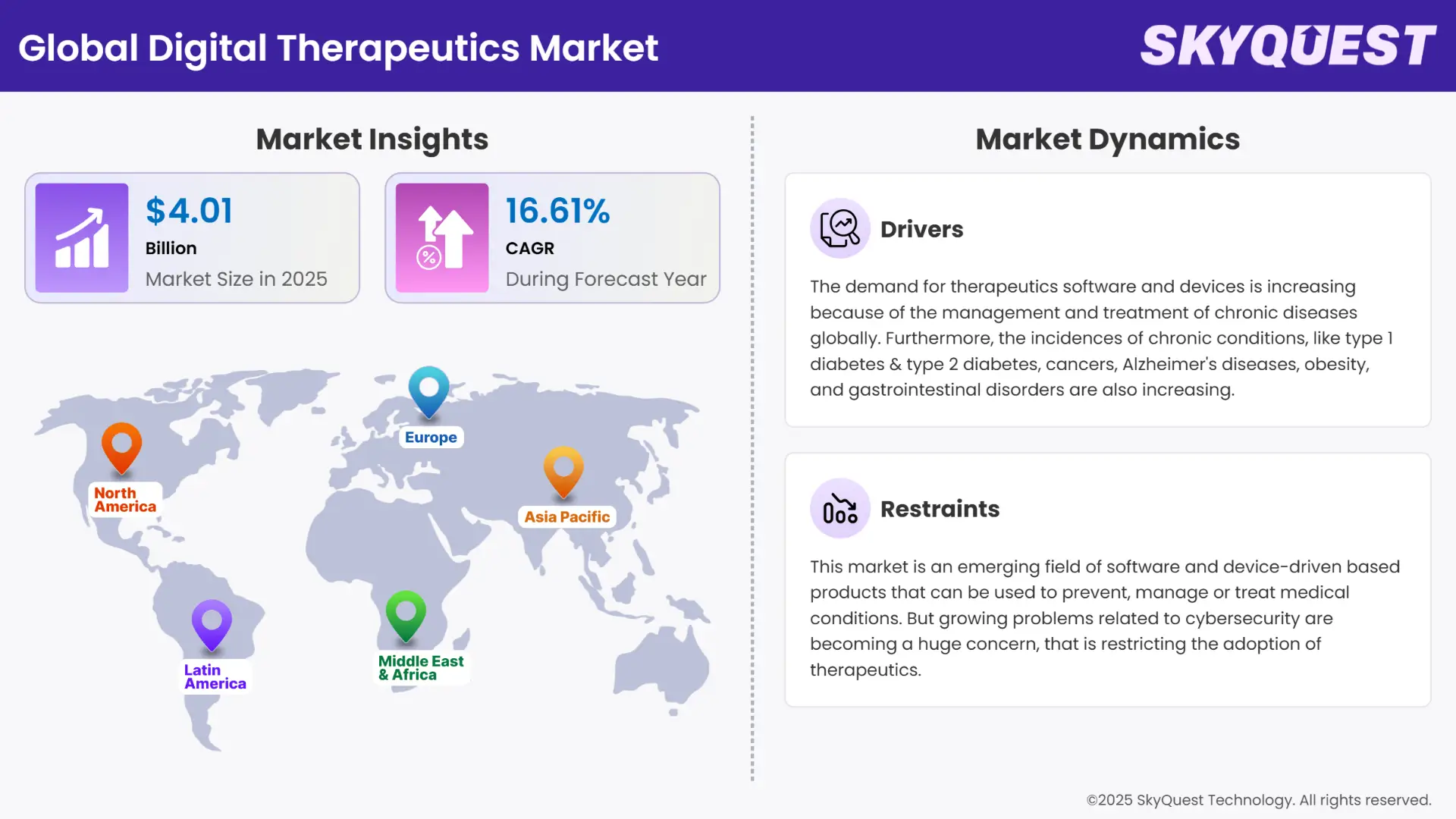

Global Digital Therapeutics Market size was valued at USD 4.01 Billion in 2024 and is poised to grow from USD 4.68 Billion in 2025 to USD 15.99 Billion by 2033, growing at a CAGR of 16.61% during the forecast period (2026–2033).

Digital therapeutics is a part of digital health that integrates innovative technologies, services, and products for healthcare and wellness. Digital therapies are used alone or in conjunction with medical devices to optimize treatments and medications based on patient care and health outcomes. To adopt personalized solutions, digital therapeutics use internet infrastructure, apps on mobile devices, machine learning, big data, and artificial intelligence. Various apps that provide healthcare benefits to patients are developing rapidly.

Digital medicines are changing the design of medical care and drug delivery systems with evidence-based advances and tolerable outcomes. It helps provide direct clinical treatment or therapy to patients using logical reporting, medical test programming used to treat patients, their administration, and medical testing used to anticipate chronic diseases or problems. Its products follow the same concepts and rules as traditional restorative products and medications. Digital therapy should adhere to several fundamental principles, for example, product safety, patient-centeredness, safety, quality, and developing the impact of clinical trials on that product. With the increasing acceptance of smartphones and tablets for the delivery of medical services globally, the demand for computerized utility products is increasing. Unexpectedly, emerging nations lack access to computerized treatment frameworks and mindfulness practices. This provides an opportunity to tap into underdeveloped business sectors in developing countries and acquire significant benefits in the digital therapeutics market.

Chronic diseases are a leading cause of death and morbidity worldwide. The prevalence of these diseases is increasing globally, spreading across regions and affecting all socio-economic classes. According to the World Health Report 2002, deaths, morbidity, and disability from major chronic diseases account for about 60% of all deaths and 43% of the global disease burden, and this figure is projected to rise to 73% of all deaths and 60% of the global disease burden by 2021. Approximately 79% of deaths occur in underdeveloped countries.

The most common chronic diseases are cardiovascular disease (CVD), cancer, chronic obstructive pulmonary disease (COPD), and type 2 diabetes. They are linked by restricted biological risk factors, including high blood pressure, high cholesterol, and obesity, as well as significant behavioral risk factors such as unhealthy diet, inactivity, and cigarette use. Actions to prevent these major chronic diseases should focus on effectively regulating these and other critical risk factors. Depending on the diagnosis, digital treatments offer the potential to prevent or cure such diseases. Because of these chronic diseases, the United States faces an unprecedented economic and healthcare crisis. As a result of the increasing burden of such extreme conditions, digital therapeutics is in demand.

Developing countries across the globe, such as China, India, Russia, Brazil, Mexico, and South Africa, are providing potential growth prospects to telemedicine market players. Telemedicine applications are commonly used in low-income nations to connect patients to specialists, referral hospitals, and tertiary care institutions. As a result, it has proven to be a great option for consumers looking for high-quality healthcare with less investment in infrastructure. More than half of the world's population lives in India and China, creating a large patient base. According to the UN Economic and Social Affairs Report (2019), the population over 60 years of age in Asia is expected to increase from 395.3 million in 2019 to 587.4 million by 2030. The growing population creates more demand for digital health services.

The use of telemedicine has been authorized by many national governments. For example, the US The Department of Health and Human Services Health Resources and Services Administration (HRSA) technologies include video conferencing, web, store-and-forward imaging, streaming media, and terrestrial and wireless communications for medical emergencies and assistance. The Department of Health and Human Services (HHS) and Agriculture (USDA) have announced plans to promote broadband services and technology in rural America.

With the same spirit and ambition, the Government of India set up the NITI Aayog with the aim of providing equal access to quality treatment. Social media platforms, smartphones and mobile applications, wearable devices, cloud-based data platforms, and real-world evidence studies have led to the widespread use of digital health services over the past decade. The global smartphone user base now exceeds three billion and is expected to grow by several hundred million over the forecast period. China, India, and the United States have the largest number of smartphone users, each country surpassing the 100 million user mark and contributing to the digital therapeutics market growth.

To get more insights on this market click here to Request a Free Sample Report

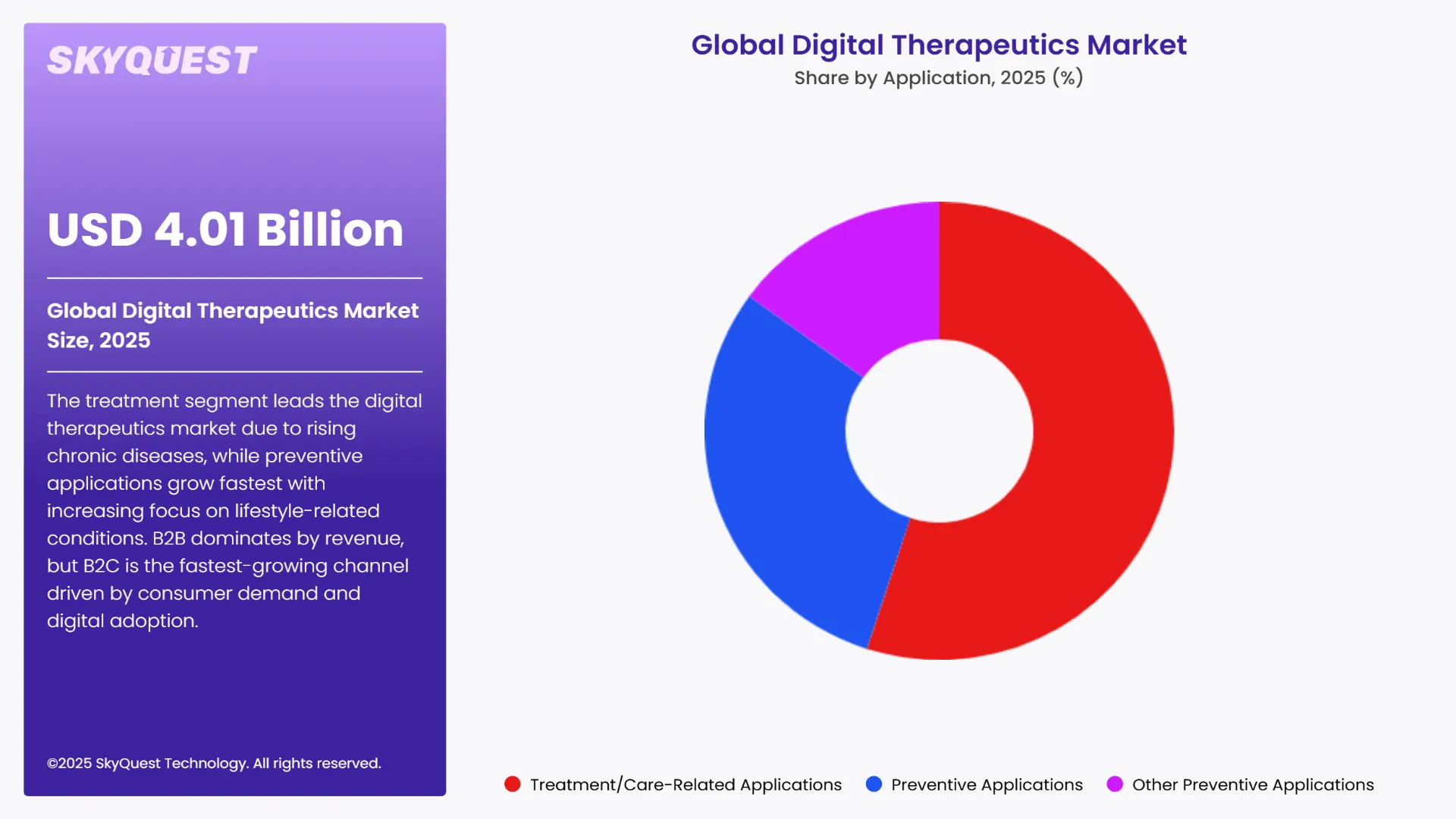

Global digital therapeutics market is segmented on the basis of Offering, Application, Revenue Model, Sales Channel, and region. By Offering, the market is segmented into Software/Platforms, Programs, and Virtual Reality/Games. By Application, the market is segmented into Treatment/Care-Related Applications. Preventive Applications. By Revenue Model, the market is segmented into Subscription-Based Model, One-Time Purchase/Annual Licensing Model, Outcome /Value-Based Model. By Sales Channel, the market is segmented into B2B Sales Channel and B2C Sales Channels. By region, the market is segmented into North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

In terms of application, the demand for digital therapeutics market is segmented into Treatment Applications, and Preventive Applications. The treatment segment is dominating with the largest market share. The growing prevalence of people suffering from cardiovascular diseases, diabetes, and poor mental health conditions is boosting the demand for this application. These therapies are used for efficiently treating these diseases. Furthermore, major key players are focusing on the formation of strategic collaborations with other organizations to introduce medication adherence software. This is increasing the high adoption of these products in the digital therapeutics market. These factors are propelling the growth of the treatment segment in digital therapeutics, leading to the expansion of the market.

The prevention segment is witnessing the fastest growth in the digital therapeutics market. This growth is primarily owing to the increasing modern lifestyle-related conditions such as smoking cessation, obesity, prediabetes, and various other chronic conditions are expected to boost the demand for these devices during the forecast period. Increased awareness and use of preventive healthcare practices, mounting incidence of chronic diseases inducing active healthcare interventions, and facilitating regulatory environments driving the creation and inclusion of preventive digital therapeutics are the drivers fuelling the segmental expansion. Moreover, partnerships between digital health firms and conventional healthcare players also fuel the growth of preventive products in this segment.

Based on sales channel, the market is segmented into B2B and B2C. The B2B segment is expected to dominate the market during the forecast period. The B2B (Business to Business) segment consists of the payer, provider, employer, and pharmaceutical organizations. The digital therapeutics market share is dominated by key market players and pharmaceutical companies because they are engaging more in an increasing number of mergers and collaborations. Companies are also focusing more on launching new products to improve the therapies related to various diseases. Furthermore, many companies are also increasingly providing various therapies to their employees to maintain their wellbeing. This is also expanding the customer base, thereby propelling segmental growth. These factors are exponentially increasing the growth of the digital therapeutics market.

The B2C (Business to Customer) segment is witnessing the fastest growth in the digital therapeutics market. This is because of the growing awareness about the benefits and ease of use of these products amongst patients and caregivers. The increasing consumer demand for convenient and accessible healthcare solutions, growing smartphone penetration and internet connectivity enabling direct-to-consumer delivery models, rising health consciousness and self-management trends among individuals are expected to increase the demand for these therapeutics' apps. Moreover, marketing strategies by players emphasizing user-centric features and benefits play a crucial role in driving product adoption through this sales channel.

To get detailed segments analysis, Request a Free Sample Report

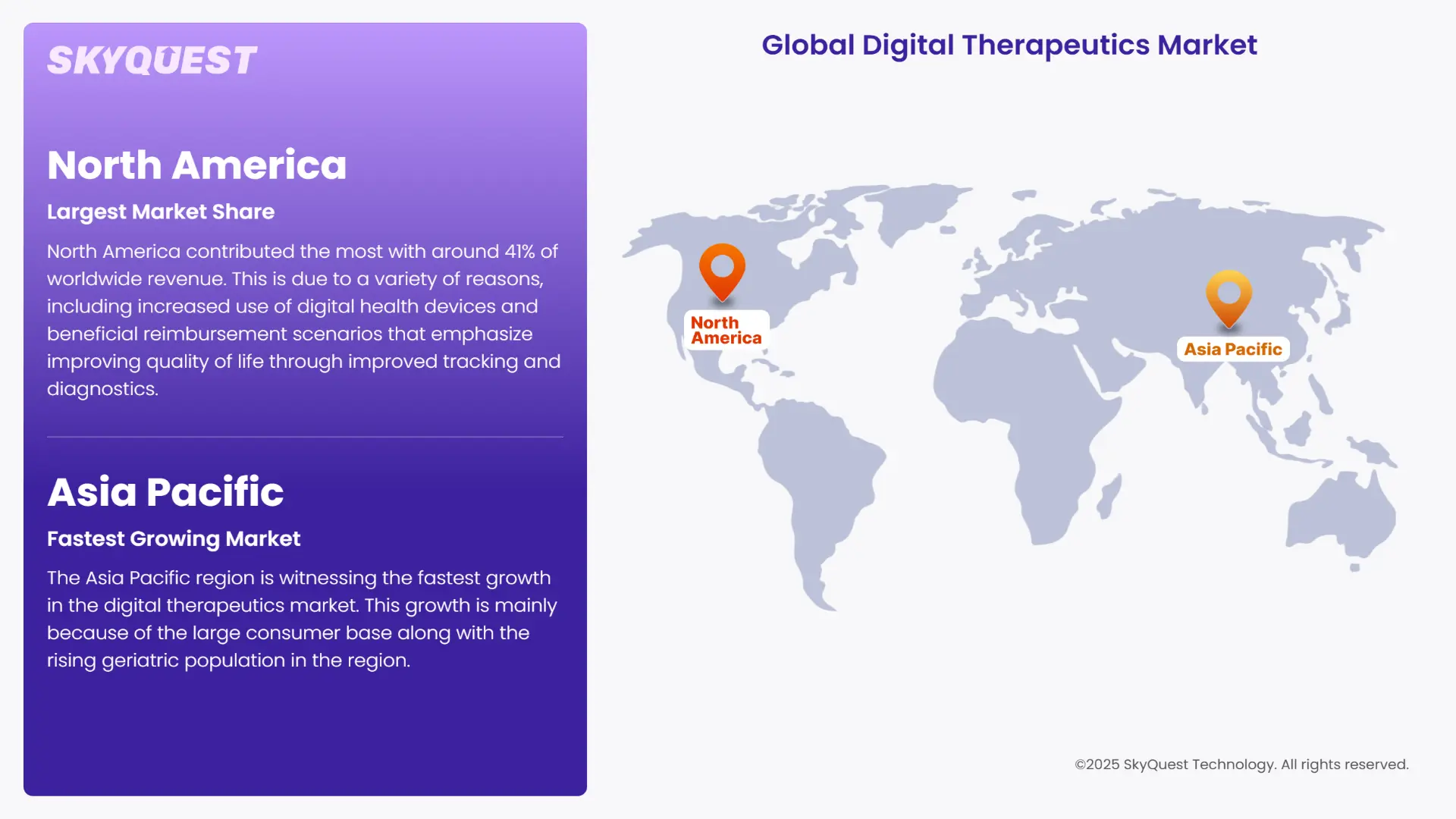

North America contributed the most with around 41% of worldwide revenue. This is due to a variety of reasons, including increased use of digital health devices and beneficial reimbursement scenarios that emphasize improving quality of life through improved tracking and diagnostics. The market is likely to be driven by the frequency of chronic diseases and the increase in the aging population in the region. Furthermore, the region is a hub for many solutions providers for digital therapeutics that again drive the region's market growth. Proteus Digital Health, Inc., Omada Health, Inc., WellDoc, Inc., and Livongo Health, Inc. are some of the leading companies in this field. Most of these corporations are located in the United States, which contributes to their local dominance.

US Digital Therapeutics Market

In the North America region, the US serves as the largest contributor. Due to strong healthcare infrastructure, highly adopted rates of digital health technology, and favourable regulatory environment helps in encouraging innovation and investment in the market which is contributing towards its considerable lead. It also has the presence of major industry players which is bolstering its dominance position.

For instance, in April 2025, the American Telemedicine Association's advocacy branch will merge with the Digital Therapeutics Alliance (DTA) to create the Advancing Digital Health Coalition. Together, the new combined effort will be dedicated to influencing policies that favor emerging healthcare technologies. The coalition is working to establish telehealth, virtual care, and digital therapeutics (DTx) as standard, dependable alternatives for providing patient treatment.

Canada Digital Therapeutics Market

The digital therapeutic market of Canada is smaller in absolute terms as compared to US and it is experiencing a higher growth rate and focuses on the integration of digital solutions into its healthcare system due to which it is contributing continuously in the digital therapeutics market.

For instance, In May 2025, Neuroscience therapeutics Limited has up-scaled its production of primeC to commercial levels which has helped in marking a considerable step towards providing the potential disease-modifying ALS therapy available to all the patients showing the efficacy data demonstrated in the Phase 2b PARADIGM study. The firm is also pushing forward with regulatory work with Health Canada to gain early market access via the Notice of Compliance with Conditions (NOC/c) route. The process is designed to speed access to novel therapies that treat serious diseases with high unmet needs.

The Asia Pacific region is witnessing the fastest growth in the digital therapeutics market. This growth is mainly because of the large consumer base along with the rising geriatric population in the region. Due to its early acceptance of new and innovative technology, and increased investment through funding, the Asia-Pacific is experiencing this surge in the market. The investment is related to increased government investment, and mergers and acquisitions. The demand for healthcare IT systems has been growing as they enable efficient management of hospitals' clinical, financial, and administrative aspects. An increase in demand for adequate healthcare, improved access to the internet, and a rise in smartphone penetration are the factors facilitating a rapid increase in the Asia Pacific market.

China Digital Therapeutics Market

China holds the major share in the Asia Pacific digital therapeutic market. It is due to the factors which include great and strong healthcare infrastructure and regulatory environment. It also has major industry players and a strong capital ecosystem which is further boosting China's dominant position.

For instance, in October 2023, MediLink Therapeutics collaborated with BioNTech and made an agreement for the development of BNT326/YL202 which is the next generation antibiotic drug conjugate ADC targeting HER3. It will use MediLink’s TMALIN ADC technology platform and BioNTech’s advice in immunotherapy to advance cancer treatment options.

Japan Digital Therapeutics Market

Japanese are also proactive in the incorporation of digital therapeutics into its healthcare system. The Ministry of Health, Labour and Welfare in the company has also approved several digital therapeutic applications which include CureApp SC for nicotine addiction treatment.

For instance, the company namely, Jolly good Inc. has also established a specialised DTx division to develop digital therapeutics which uses VR and AI Technologies.

India's digital therapeutics market is also growing rapidly. The government has initiated Ayushman Bharat digital mission (ABDM) which focuses on digitising health records of millions of Indian states citizens by the end of this year which will help in creating a connected ecosystem of digital health services.

For instance Lupin digital health launched an E-clinic in India which specialisation in digital therapeutics platform called digital heart failure clinic.

Europe is the third largest market for Digital therapeutics around the world. The region has strong manufacturing quality and has major technology development in digital healthcare solutions. Germany, the United Kingdom, and France are the forefronts of the regional market and have an advanced Healthcare system and an agent population which is demanding advanced therapeutic measures. For instance, Germany's DiGA Fast-Track Has given certification to 53 apps last year which will bring digital therapeutics into National Healthcare system and will enhance patient outcomes and increased access to novel treatment.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

Prevalence of Chronic Diseases

Increasing Use of Smartphones

Restrictions Related to Digital Therapeutics

High Expense of Manufacturing

Request Free Customization of this report to help us to meet your business objectives.

The digital therapeutics is a dynamic and fragmented market. It consists of many players in digital therapeutics industry who offer a wide range of products, like mobile software and devices. Pear Therapeutics, Inc, is dominating the market with a strong line of software. The growing sales of reSET & reSET-O in the U.S. are supporting its strong market share. Furthermore, the increasing investments in research and development of digital therapeutics products is also contributing towards the expansion of the market globally.

Incorporation of Digital Therapeutics with Healthcare Systems: Digital therapeutics can be smoothly incorporated into electronic health records (EHRs) and other healthcare systems. This helps medical professionals to easily access and monitor patient data in real-time. This restructuring of medical delivery enhances the efficiency of care and helps doctors to make better and more informed decisions. Furthermore, incorporation with medical systems also improves security and standardizes data sharing between digital therapeutics platforms and medical professionals.

Emergence of New Products: Key market players are introducing new products into the market that can improve the efficiency of the therapies and provide opportunities in the future. The potential products of pear therapeutics, clinical therapeutics products in phase III are Pear-011 (anxiety GAD), Pear-015 (depression MDD). These can be utilized for the treatment of chronic insomnia and depression and CT-152 (major depressive disorder), CT-155 (schizophrenia).

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Co-relates and Analyses the Data collected by means of Primary Exploratory Research backed by the robust Secondary Desk research.

According to our global digital therapeutics market analysis, it is a branch of digital health that integrates innovative technologies, services, and products for health and wellness. In 2024, the diabetic application segment accounted for more than 28.5% of the global revenue. In 2024, the patient end-user category accounted for more than 33.0% of global revenue. This growth was mainly due to the adoption of digital therapeutic solutions by patients. In 2024, North America contributed the most with nearly 41% of worldwide revenue. This is due to a variety of reasons, including increased use of digital health devices and beneficial reimbursement scenarios that emphasize improving quality of life through improved tracking and diagnostics. Technological innovation is an emerging trend that is gaining traction in the digital therapeutics market.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 4.01 Billion |

| Market size value in 2033 | USD 15.99 Billion |

| Growth Rate | 16.61% |

| Base year | 2024 |

| Forecast period | 2026-2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Digital Therapeutics Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Digital Therapeutics Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Digital Therapeutics Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Digital Therapeutics Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

The digital therapeutics market is forecasted to grow at a CAGR of 26.3% during the forecast period of 2025 - 2032.

As the prevalence of chronic disease continues to rise throughout the world, with conditions such as diabetes, cancer, and cardiovascular disease, the demand for digital therapeutics is ramping up based on the need for effective, evidence-based methods to manage and prevent chronic conditions.

The increased adoption of smart phones globally allows the widespread use of mobile health apps, cloud-based platforms and digital therapies, driving growth through the ease and personalization of health care delivery.

Digital therapeutics incorporate mobile apps, AI, machine learning, cloud-based platforms, wearables, big data analytics, and internet connectivity to provide evidence-based health care interventions and monitor outcomes.

Main treatment applications are diabetes, cardiovascular diseases, central nervous system disorders, respiratory diseases, gastrointestinal disorders, musculoskeletal disorders, medication adherence, substance use disorder, and rehabilitation therapy.

Preventive digital therapeutics are rapidly expanding in relation to obesity, prediabetes, and lifestyle applications due to increasing awareness of chronic diseases, increased chronic disease burden, and regulatory backing to improve early detection/prevention of disease.

AI is applied across therapeutic areas to enable personalized treatment trajectories and analyze patient health data, and improve clinical decision making, to improve the effectiveness of therapy and patient outcomes. In digital therapeutics, AI continues to facilitate real-time monitoring, diagnostics, and treatment.

B2B is generally looking to engage with providers, payers, and/or pharma for implementation and reimbursement. B2C is more focused on engaging directly with patients to create user-friendly experiences and allowing for more comfortable implementation and interests advancing self-management, accessibility.

For the digital therapeutics market, there are subscription models, single purchase or annual license models, and outcome/value-based models that will be aligned to level of therapeutic success and patient improvement.

Cyber security challenges with in patient data privacy risks, and lack of regulations have limited the use of digital therapeutics because patients and providers are concerned about whether sensitive medical records will be safe.

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients