Report ID: SQMIG15E2759

Report ID: SQMIG15E2759

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG15E2759 |

Region:

Global |

Published Date: July, 2025

Pages:

188

|Tables:

67

|Figures:

76

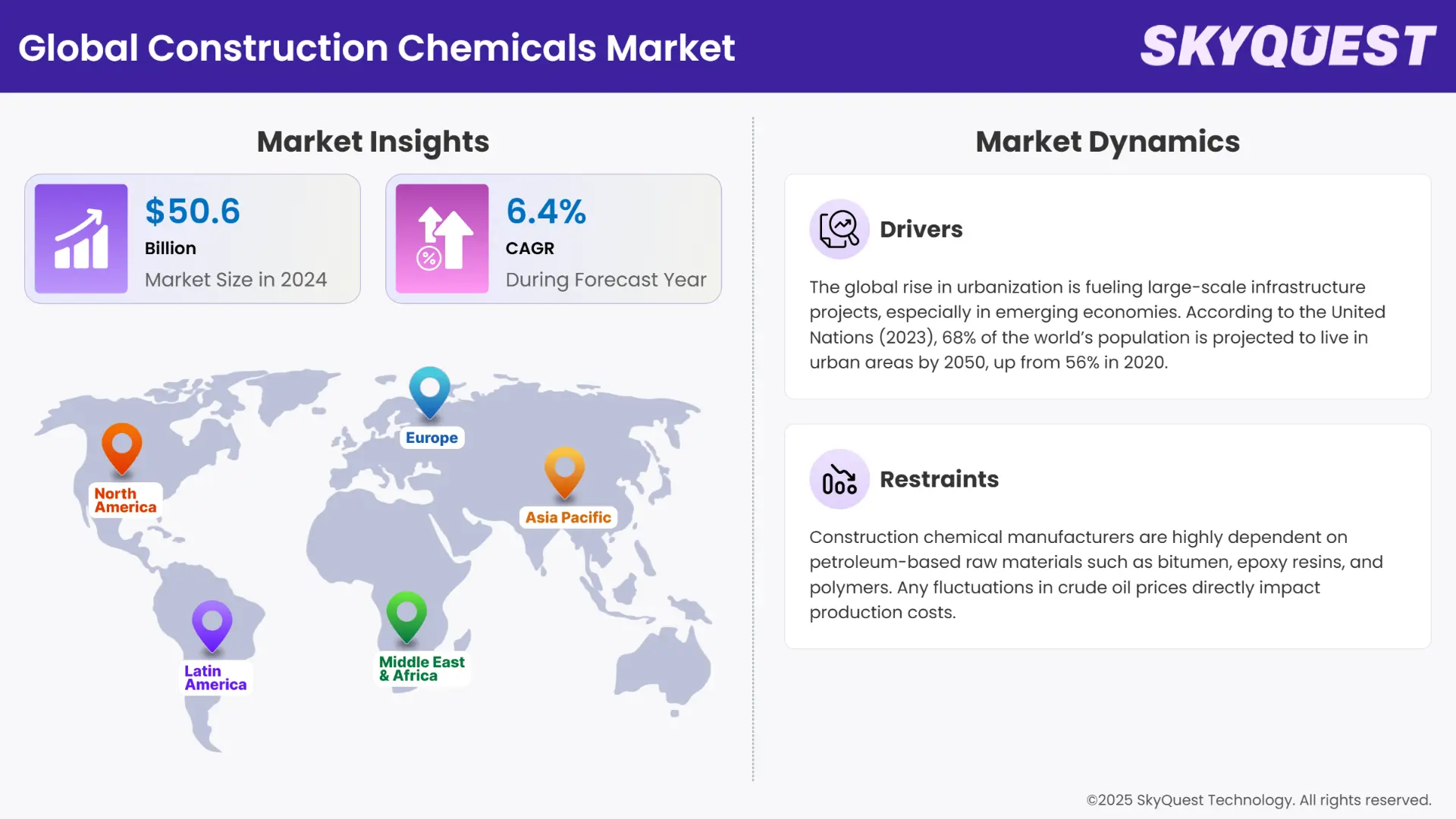

Global Construction Chemicals Market size was valued at USD 50.65 Billion in 2024 and is poised to grow from USD 53.89 Billion in 2025 to USD 88.52 Billion by 2033, growing at a CAGR of 6.4% in the forecast period (2026–2033).

Expansion of the construction industry across the globe, increasing a critical demand for chemicals used in construction applications. The construction industry is expanding rapidly in the Asia Pacific region, which creates a lucrative opportunity to invest in it. Urbanization and Industrialization are key drivers that support market growth for the long term. As per our research, the growth rate of urbanization is around 4-5% per annum and for industrialization the growth rate is around 9% per annum. It indicates growth for investors in the construction chemicals market.

Simultaneously, established players such as Saint Gobain in February 2025, have completed the acquisition of FORSOC, a leader in the Construction Chemical market. Saint Gobain has set a strategy to expand FORSOC’s construction chemicals business from the MEA and Asia Pacific region worldwide. For Instance, FORSOC was experiencing significant growth in the construction chemicals business around 11% every year. In terms of innovation, the construction chemical industry spends about 3% of its sales on R&D of new products and applications. This shows a strategy for capturing a larger share and position in the construction chemicals market. Overall, all these indications reveal the market will expand in the coming years.

Construction chemicals are undergoing a green chemistry, bio-based, revolution due to growing environmental regulations, green building requirements and a desire to implement the principles of a circular economy. For instance, producers are currently making the shift from petrochemical based additives to bio-based additives such as plant- based resins, enzymes, and/or biodegradable plastics. Within these green construction chemicals, there is a reduction of VOCs and better indoor air quality as well as building potential to LEED, BREEAM, and WELL certification. The EU Green Deal, India’s Smart Cities Mission and other programs have led to governments of the EU, US, and Asia- Pacific regions to incentivize green building. These bio-plasticizers, non-toxic retarders, and bio waterproofing agents are now being integrated into construction, helping to reduce carbon in the building process. These technologies also fit the commercial viability and environmental mandates of real estate developers and infrastructure firms, meaning there is a significantly high demand for green building materials that meet this twofold requirement.

For instance, in 2024, Sika AG launched its “SikaProof Eco-Line” waterproofing membranes manufactured using more than 70% renewable raw materials, for the green buildings in Europe and North America. Thermax Limited of India also, developed in partnership with IIT Bombay in 2023, bio-based admixtures that provide equivalent strengths and achieve 45% reduction in carbon emissions. According to the U.S. Environmental Protection Agency (EPA), the adoption of green chemicals in construction could reduce VOC emissions by up to 80%, making these formulations not only technologically advanced but also regulatory compliant and market-ready.

To get more insights on this market click here to Request a Free Sample Report

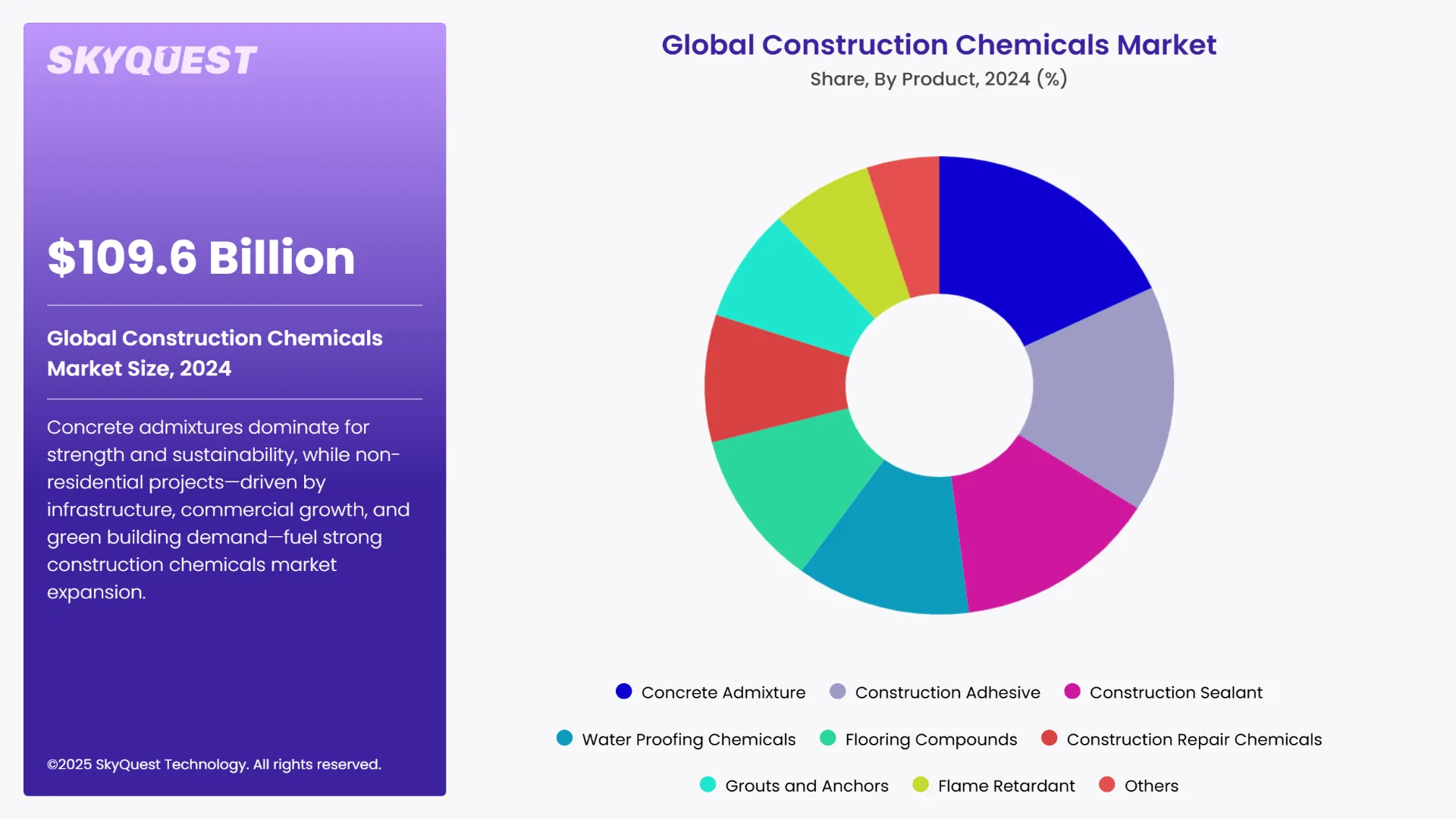

Global Construction Chemicals Market is segmented by Product, Application and region. Based on Product, the market is segmented into Concrete Admixture, Construction Adhesive, Construction Sealant, Water Proofing Chemicals, Flooring Compounds, Construction Repair Chemicals, Grouts and Anchors, Flame Retardant and Others. Based on Application, the market is segmented into Residential and Non-residential. Based on region, the market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa.

Concrete admixtures have emerged as the dominant segment within the construction chemicals market due to their pivotal role in enhancing the performance, durability, and sustainability of concrete in modern infrastructure projects. Water reducers, accelerators, retarders, plasticizers, and superplasticizers are some of the commonly used concrete admixtures to modify workability and curing time, as well as strength under different climate conditions. The increasing need for high performance concrete due to fast-paced urbanization, particularly in the Asia-Pacific and Middle Eastern regions will certainly further propel this trend of admixtures usage.

The demand for such advanced additives was significantly fueled, for instance, by a 17% YOY increase in urban infrastructure projects as per the Ministry of Housing and Urban Affairs (India) for FY2023. Public transport projects and green building projects have generated a growing market for admixture systems from companies like Sika AG and BASF Construction Solutions among other global companies. For example, Sika AG’s annual 2023 report lists the Delhi-Meerut RRTS project in India, stating their use of specialized admixtures for fast setting and high strength concrete. In addition, sustainability goals in more developed areas are pushing for admixture novelties that cut carbon footprints down, thus making them even more dominant in the segment.

While the residential construction sector remains vital, it is the non-residential segment—comprising infrastructure, commercial buildings, healthcare, and institutional projects—that is witnessing robust growth and subsequently driving higher consumption of construction chemicals. The U.S. Census Bureau reported that public sector construction projects jumped to 391.7 billion dollars in 2023, representing an 8.4 increment from last year which the ACA attributes primarily on the modernization of infrastructure as well as government-backed commercial expansion.

Also, large scale mega infrastructures as NEOM from Saudi Arabia and the Belt and Road in China are adopting construction chemical systems to guarantee resiliency in the long term, waterproofing, thermal protection and seismic resistance. For example, in 2023 MAPEI S.p.A. supplied bespoke sealants and epoxy-based flooring compounds to the Riyadh Metro project, which speaks to the size and complexity of many non-residential projects as well as the potential for specialized product demand. Plus, as green certifications like LEED and BREEAM have been more greatly prioritized for office buildings, developers have become more likely to have sustainable chemicals and admixtures incorporated. So, this area is anticipated to have a robust growth outlook fueled by the fast pace of urban migration and investments in smart cities and resilient infrastructure around the world.

To get detailed segments analysis, Request a Free Sample Report

Asia-Pacific leads the global construction chemicals market, driven by rapid urbanization, massive infrastructure projects, and favorable government initiatives. Countries like China, India, and those in Southeast Asia are tremendously investing in the building of residential, commercial, and industrial space. The Asian Development Bank estimates that Asia faces an annual $1.7 trillion financing needs for infrastructure until 2030. In addition, there is growing market acceptance for green buildings and high-performance materials in earthquake- affected areas, which further drives product usage. Supply is also bolstered by the presence of important regional players such as MAPEI (India), Sika and Nippon Paint Holdings. On top of that, public-private collaborations for transport and housing development throughout APAC also increase the overall market for construction chemicals.

China Construction Chemicals Market

China dominates the regional market due to its booming construction sector and strong government spending. In 2023, the Ministry of Housing and Urban-Rural Development announced ¥650 billion ($90 billion) in new urban infrastructure investments. Chinese giants like China National Building Material Company (CNBM) and regional arms of Sika and BASF have scaled operations to cater to this demand. In April 2023, Sika opened a new production facility in Chongqing focused on concrete admixtures to serve Western China's infrastructure projects. Additionally, China’s "dual carbon" policy is pushing adoption of low-VOC and energy-efficient construction chemicals, supporting green urbanization initiatives.

Japan Construction Chemicals Market

Japan's demand for construction chemicals is anchored in its need for high-quality, earthquake-resistant infrastructure and renovation of aging buildings. In 2023, the Japanese Ministry of Land, Infrastructure, Transport and Tourism allocated ¥10.7 trillion ($75 billion) to public works, with a strong focus on resilient and sustainable infrastructure. Companies like Nippon Paint Holdings and Chugoku Marine Paints are investing in R&D for anti-corrosion coatings and sealants. For instance, in July 2023, Nippon Paint expanded its Fukui facility to enhance production of waterproofing compounds suited for Japan's humid climate and seismic activity zones, reflecting the push toward specialized performance chemicals.

South Korea Construction Chemicals Market

South Korea’s construction chemical market is evolving rapidly due to smart city development and eco-friendly construction norms. In 2023, the Korean government allocated ₩24.5 trillion ($18.6 billion) for smart infrastructure under the Korean New Deal. Companies like KCC Corporation and LG Chem are developing advanced sealants and thermal insulation materials for energy-efficient buildings. In October 2023, KCC completed the expansion of its Yeosu plant, increasing capacity for high-performance construction sealants used in smart urban projects. Sustainability-driven policies such as “Green Remodeling Support Project” also encourage adoption of durable, low-emission chemical solutions in residential retrofitting.

Europe is witnessing the fastest growth in construction chemicals, propelled by stringent environmental regulations, EU Green Deal targets, and widespread renovation efforts. The European Commission has mandated all new public buildings to be zero-emission by 2027, pushing demand for low-VOC adhesives, sealants, and waterproofing solutions. Major manufacturers like BASF, Saint-Gobain, and Mapei are innovating eco-friendly product lines. Rising investments in sustainable construction, particularly in Germany, France, and the UK, coupled with incentives for retrofitting old structures, have accelerated market penetration. The Renovation Wave strategy alone targets 35 million building upgrades by 2030, underlining robust future demand.

Germany Construction Chemicals Market

Germany remains a leader in sustainable construction practices. The Federal Ministry for Economic Affairs and Climate Action allocated €12.2 billion in 2023 toward green building initiatives. German chemical giant BASF has committed to CO₂-neutral production and invested in bio-based construction admixtures. In 2023, BASF’s Ludwigshafen site expanded its production of eco-efficient construction resins used in concrete formulations. Additionally, Knauf Group and Henkel are pioneering spray-applied plastering compounds and PU sealants for thermal insulation. The German Construction Industry Federation forecasts continued growth in renovation and infrastructure, particularly in energy-efficient housing supported by government subsidies.

France Construction Chemicals Market

France’s construction chemical demand is buoyed by housing renovation programs and transport infrastructure upgrades. In 2023, the French government pledged €10 billion under the “France Relance” plan to decarbonize buildings. Saint-Gobain, a French multinational, invested €150 million in 2023 to modernize its Chalon-sur-Saône facility for producing low-carbon wallboards and sealants. The RE2020 regulation mandates stricter energy and emissions standards, increasing usage of advanced insulation and low-emission concrete additives. Moreover, with Paris hosting the 2024 Olympics, numerous stadiums and transport hubs underwent upgrades, directly increasing the demand for high-performance grouts, adhesives, and waterproofing solutions.

United Kingdom Construction Chemicals Market

The UK is embracing construction chemicals through urban regeneration and climate-resilient infrastructure. The Department for Levelling Up, Housing and Communities committed £11.5 billion (2023–2026) under the Affordable Homes Programme. Companies like Fosroc and Bostik are key suppliers of waterproofing and repair compounds for housing and rail projects. In July 2023, Fosroc launched its “Renderoc” range for concrete repair in London’s Thames Tideway Tunnel project. The UK’s Build Back Greener policy also mandates improved building insulation, fire safety, and water resistance—areas where construction chemicals play a critical role. Growing emphasis on post-Grenfell safety upgrades fuels demand for advanced fire-retardant solutions.

North America maintains a significant presence in the construction chemicals industry owing to aging infrastructure, demand for smart buildings, and federal investments in public projects. The U.S. Infrastructure Investment and Jobs Act (IIJA) allocates over $1.2 trillion for upgrading roads, bridges, and water systems, creating a robust pipeline for sealants, grouts, and repair chemicals. Additionally, sustainability mandates and net-zero building goals in both the U.S. and Canada are encouraging the use of green-certified chemical materials. Strong regional players like RPM International and Tremco enhance product innovation and distribution across this mature but evolving market landscape.

The United States Construction Chemicals Market

The U.S. construction chemical market is being revitalized through large-scale infrastructure spending. In 2023, the Biden administration rolled out over $300 billion in infrastructure contracts under IIJA. RPM International Inc., through its subsidiaries like Tremco and Euclid Chemical, expanded R&D operations in Cleveland to develop advanced coatings and concrete admixtures tailored for extreme climate resilience. In January 2023, Tremco launched the “Vulkem EWS” waterproofing system used in highway bridge renovations in Texas and Ohio. Additionally, increased demand for LEED-certified buildings has propelled usage of non-toxic adhesives and low-emission sealants in commercial real estate.

Canada Construction Chemicals Market

Canada’s construction chemical market is shaped by climate-resilient infrastructure and housing development. In 2023, Infrastructure Canada allocated CA$33 billion under the Investing in Canada Plan, with emphasis on public transit, clean energy buildings, and flood defenses. Sika Canada expanded its Montreal facility in 2023 to support increased demand for waterproofing and insulation products used in retrofit projects. The Canadian Green Building Council reported a 20% rise in LEED-certified construction starts in 2023, underscoring growing use of low-carbon concrete additives and high-durability sealants. Government subsidies for net-zero housing further strengthen the long-term outlook for construction chemicals.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

Rapid Urbanization and Infrastructure Development

Growing Emphasis on Sustainable and Green Construction

Volatility in Raw Material Prices

Stringent Environmental and Regulatory Compliance

Request Free Customization of this report to help us to meet your business objectives.

The construction chemicals industry is marked by strategic M&A, regional capacity expansion, and green product innovation. In 2023, Sika AG completed its €5.3 billion acquisition of MBCC Group, significantly expanding its global reach and sustainable product portfolio. JSW Cement entered the Indian construction chemicals segment in 2024, aiming to tap into its pan-India distribution network and infrastructure boom. Meanwhile, Henkel AG invested €130 million in a new production facility in Serbia in 2023 to scale eco-friendly adhesives. These moves highlight fierce competition through vertical integration and ESG-aligned innovation.

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected using Primary Exploratory Research backed by robust Secondary Desk research.

SkyQuest's study concludes that the global construction chemicals market is witnessing robust growth, projected to reach USD 83.2 billion by 2032. A key driver is rapid urbanization and infrastructure expansion, especially in Asia-Pacific, where countries like India and China are investing heavily in smart cities and public infrastructure. However, volatile raw material prices—mainly petroleum-based inputs—pose a major restraint by inflating production costs. Asia-Pacific remains the dominant region, fueled by large-scale government projects and private-sector participation. Among product segments, concrete admixtures lead due to their critical role in enhancing strength and sustainability in infrastructure. A secondary growth driver is the rising emphasis on green construction, with innovations in bio-based and low-VOC chemicals aligning with LEED and BREEAM standards.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 50.65 Billion |

| Market size value in 2033 | USD 88.52 Billion |

| Growth Rate | 6.4% |

| Base year | 2024 |

| Forecast period | 2026-2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Construction Chemicals Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Construction Chemicals Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Construction Chemicals Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Construction Chemicals Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

The construction chemicals market is expected to experience a CAGR of 6.4% from 2025 to 2032 - forecast to increase from USD $50.6 billion in 2024 to USD $83.2 billion in 2032, mainly due to the continuing trends of urbanization and infrastructure expansion.

Concrete admixtures are leading the global construction chemicals market, because it expands and improves the properties related to strength, durability, and sustainability of concrete within urban infrastructure, particularly in growing regions including Asia-Pacific and the Middle-East.

Green chemistry is introducing bio-based additives that reduce VOC emissions by more than 80%. Innovations in plant-based resins and eco-membranes that achieve the LEED, BREEAM and circular economy objectives propelled sustainable construction at unprecedented speed around the world.

Eco-friendly construction chemicals, such as low-VOC adhesives and bio-based waterproofing agents improve indoor air quality and energy efficiency and can address LEED and BREEAM criteria to get their buildings to meet green certification standards.

Asia Pacific is the top construction chemicals market because the region is experiencing rapid urbanization as the annual need for infrastructure is $1.7 trillion, and many of these projects are government-led green initiatives. With strong regional players and developments related to smart cities, the demand for high-performance construction chemicals will continue to accelerate.

Japan is a country that is focused on building earthquake-resilient structures and is driving demand for specialized waterproofing and anti-corrosion construction chemicals. In 2023, the government has allocated $75 billion to its planned public works program in the near term. Corporations such as Nippon Paint have recently expanded their production of compounds that meet seismic-mitigation qualities.

Waterproofing agents will help protect buildings from moisture damage and prolong their structure, while enabling compliance for green benchmarks. They are vital agents to include, especially in infrastructure jobs where the work may be subject to extreme elements or longevity is a central factor.

Innovations include hybrid products like Mapei’s Mapeflex MS 55, which brings silicone and polyurethane together to provide elasticity, durability, and eco-friendliness. Many of these products bring versatility to construction products. They can be applied on professional work sites or for households across a variety of surface applications.

Strategic mergers & acquisitions, such as Saint-Gobain's recent acquisition of FOSROC for $1.025 billion, allow companies to obtain global reach and a sustainable portfolio. Opportunities like these allow companies to better their competitiveness against economy-wide issues, while making it easier to serve emerging markets.

Concrete admixtures will improve workability, cure time, and strength, all very important in urban settings with considerable deadline pressures. Also, as multiple construction industries set green goals, including admixtures reduces the carbon footprint, which will become critical for sustainable (green), performance (high quality) infrastructure.

Global Construction Chemicals Market size was valued at USD 50.65 Billion in 2024 and is poised to grow from USD 53.89 Billion in 2025 to USD 88.52 Billion by 2033, growing at a CAGR of 6.4% in the forecast period (2026–2033).

The construction chemicals industry is marked by strategic M&A, regional capacity expansion, and green product innovation. In 2023, Sika AG completed its €5.3 billion acquisition of MBCC Group, significantly expanding its global reach and sustainable product portfolio. JSW Cement entered the Indian construction chemicals segment in 2024, aiming to tap into its pan-India distribution network and infrastructure boom. Meanwhile, Henkel AG invested €130 million in a new production facility in Serbia in 2023 to scale eco-friendly adhesives. These moves highlight fierce competition through vertical integration and ESG-aligned innovation. 'ACC Ltd (India)', 'JSW Group (India)', 'MAPEI S.p.A. (Italy)', 'Sika AG (Switzerland)', 'Ashland, Inc. (United States)', 'Arkema SA (France)', 'Evonik Industries (Germany)', 'Henkel AG & Co. KGaA (Germany)', 'Dow Chemical Company (United States)', 'Thermax Group (India)', 'Compagnie de Saint-Gobain SA (Brazil)', 'Chembond Chemicals Limited (India)', 'Cera-Chem Pvt. Ltd. (India)', 'SWC Brother Company Limited (Thailand)', 'BASF SE (Germany)', 'RPM International Inc. (United States)', 'Standard Industries Ltd (India)'

The global rise in urbanization is fueling large-scale infrastructure projects, especially in emerging economies. According to the United Nations (2023), 68% of the world’s population is projected to live in urban areas by 2050, up from 56% in 2020. India’s government, through initiatives like the National Infrastructure Pipeline (NIP), plans to invest over INR 111 lakh crore ($1.4 trillion) by 2025. This massive urban expansion is driving demand for concrete admixtures, waterproofing systems, and repair chemicals to meet quality, longevity, and sustainability requirements in modern infrastructure. In 2024, Sika AG supplied its advanced concrete admixtures and sealants for the Mumbai Coastal Road Project, one of India’s largest urban infrastructure developments, highlighting real-time adoption of performance-enhancing construction chemicals.

Circular Construction and Low-Carbon Formulations: Manufacturers are increasingly adopting circular economy models, such as using industrial byproducts in admixtures. In 2023, Saint-Gobain’s Weber division expanded its low-carbon mortars using recycled aggregates, helping reduce carbon emissions by up to 40%.

Asia-Pacific leads the global construction chemicals market, driven by rapid urbanization, massive infrastructure projects, and favorable government initiatives. Countries like China, India, and those in Southeast Asia are tremendously investing in the building of residential, commercial, and industrial space. The Asian Development Bank estimates that Asia faces an annual $1.7 trillion financing needs for infrastructure until 2030. In addition, there is growing market acceptance for green buildings and high-performance materials in earthquake- affected areas, which further drives product usage. Supply is also bolstered by the presence of important regional players such as MAPEI (India), Sika and Nippon Paint Holdings. On top of that, public-private collaborations for transport and housing development throughout APAC also increase the overall market for construction chemicals.

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients