Certificate authority Market Insights

Market Overview:

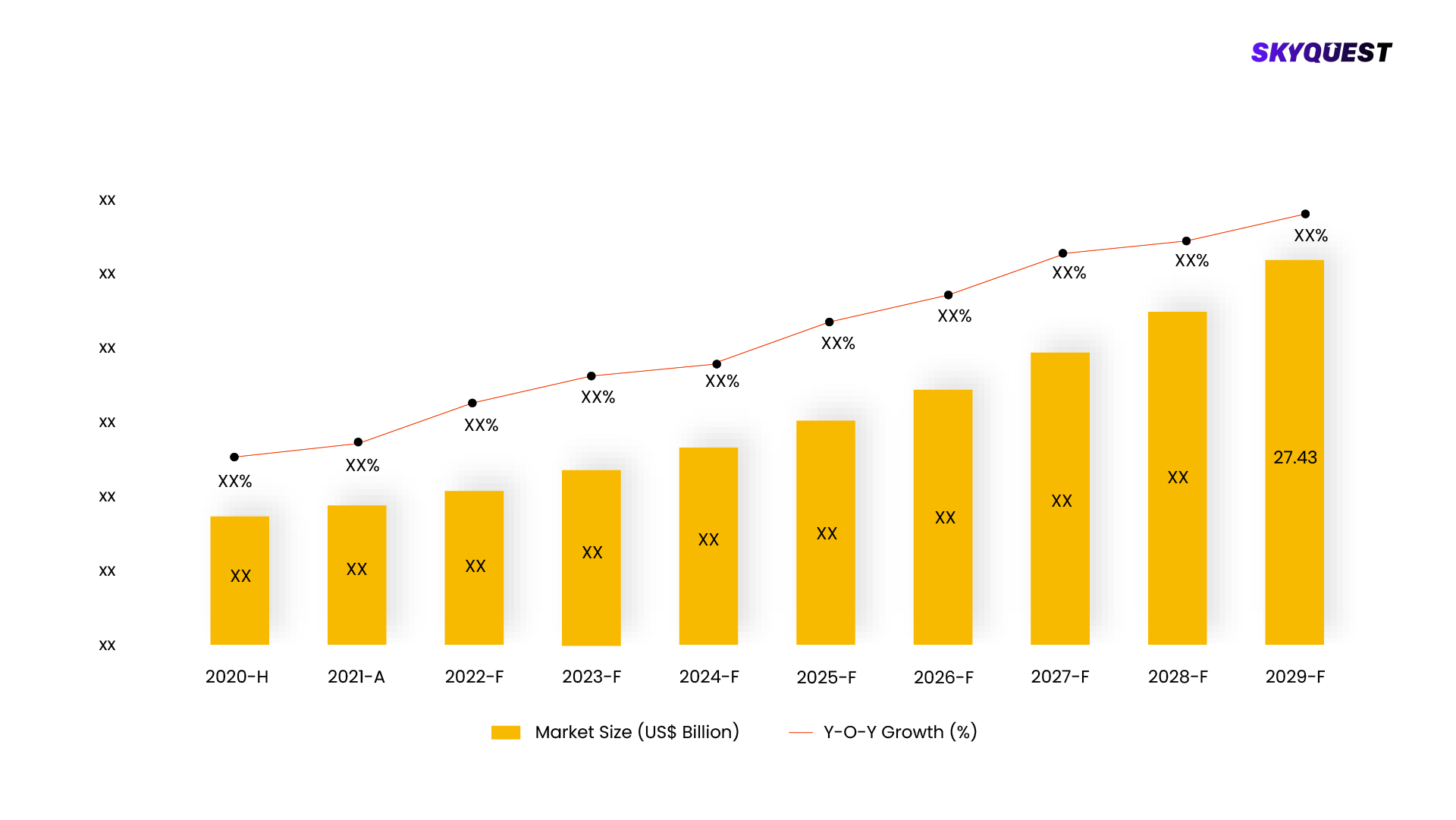

The size of the global certificate authority market is anticipated to increase from USD 167 million in 2023 to USD 282 million in 2028 at a Compound Annual Growth Rate (CAGR) of 11.0%. Rise in HTTPS phishing attacks, Strict Regulatory Standards and Need for Data Privacy Compliance, and Growing Concerns Regarding Loss of Critical Data are some of the main factors driving this market.

Certificate authority Market, Forecast & Y-O-Y Growth Rate, 2020 - 2028

To get more reports on the above market click here to

GET FREE SAMPLEThis report is being written to illustrate the market opportunity by region and by segments, indicating opportunity areas for the vendors to tap upon. To estimate the opportunity, it was very important to understand the current market scenario and the way it will grow in future.

Production and consumption patterns are being carefully compared to forecast the market. Other factors considered to forecast the market are the growth of the adjacent market, revenue growth of the key market vendors, scenario-based analysis, and market segment growth.

The market size was determined by estimating the market through a top-down and bottom-up approach, which was further validated with industry interviews. Considering the nature of the market we derived the Internet Software & Services by segment aggregation, the contribution of the Internet Software & Services in Software & Services and vendor share.

To determine the growth of the market factors such as drivers, trends, restraints, and opportunities were identified, and the impact of these factors was analyzed to determine the market growth. To understand the market growth in detail, we have analyzed the year-on-year growth of the market. Also, historic growth rates were compared to determine growth patterns.

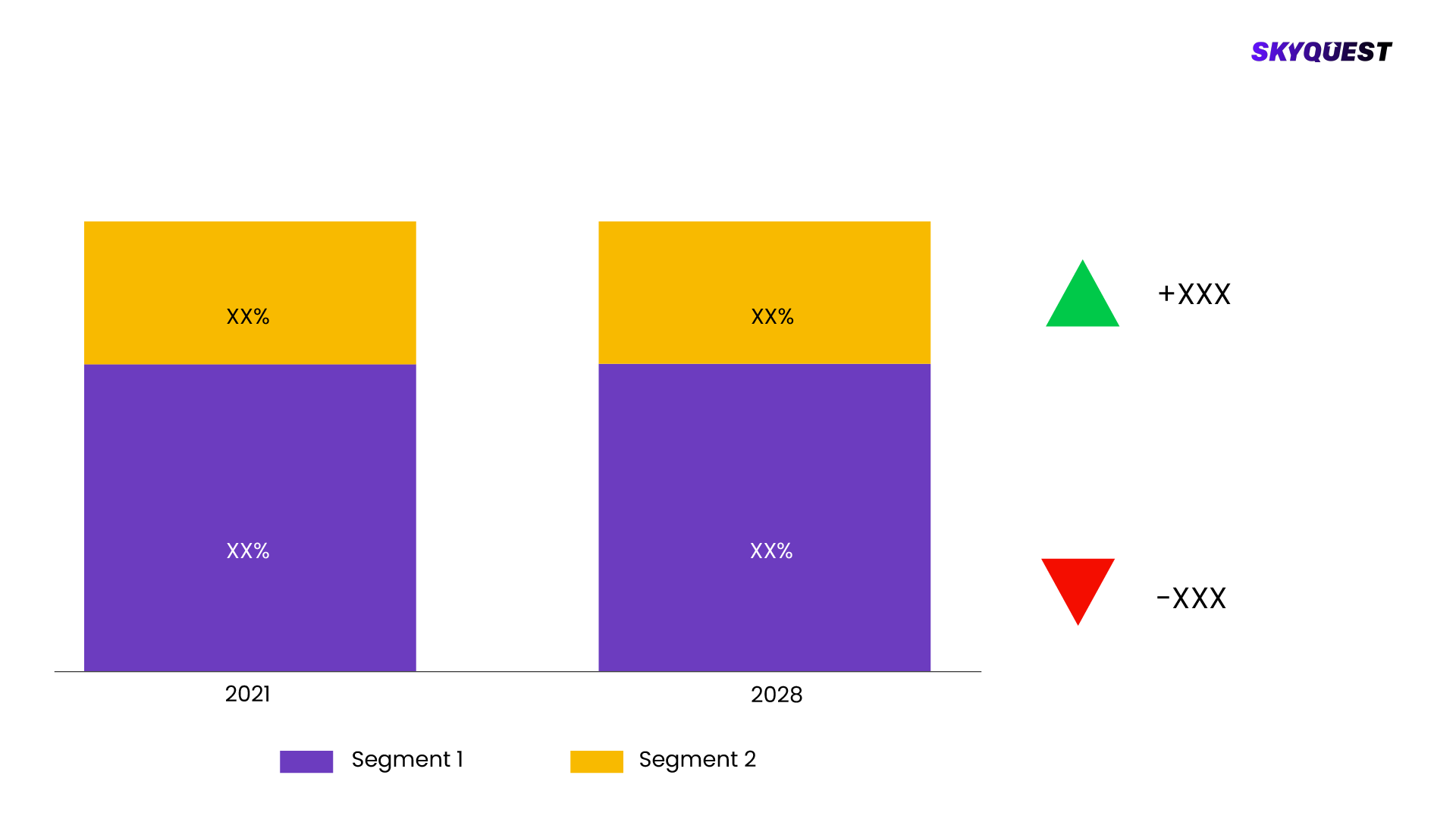

Segmentation Analysis:

The Certificate authority Market is segmented by Offerings, SSL Certification Validation Type, organization size, Verticals, Region. We are analyzing the market of these segments to identify which segment is the largest now and in the future, which segment has the highest growth rate, and the segment which offers the opportunity in the future.

Certificate authority Market Basis Point Share Analysis, 2021 Vs. 2028

To get detailed analysis on all segments

BUY NOW

- Based on Offerings the market is segmented as, Certificate Type, Services

- Based on SSL Certification Validation Type the market is segmented as, Domain Validation, Organization Validation, Extended Validation

- Based on organization size the market is segmented as, Large Organization, SMEs

- Based on Verticals the market is segmented as, BFSI, Retail and eCommerce, Government and Defence, Healthcare and Life Sciences, IT and Telecom, Travel and Hospitality, Education, Other Verticals

- Based on Region the market is segmented as, North America, Europe, Asia Pacific, Middle East & Africa, Latin America, KEY MARKET PLAYERS, Sectigo, Digicert, GlobalSign, GoDaddy, IdenTrust, Entrust, Certum, Actalis, Lets Encrypt, SSL.Com, E-Tugra, WISekey, Trustwave, SwissSign, TWCA, Buypass, Camerfirma, Harica, Certigna, NETLOCK, TURKTRUST, certSIGN, Disig, Network Solutions

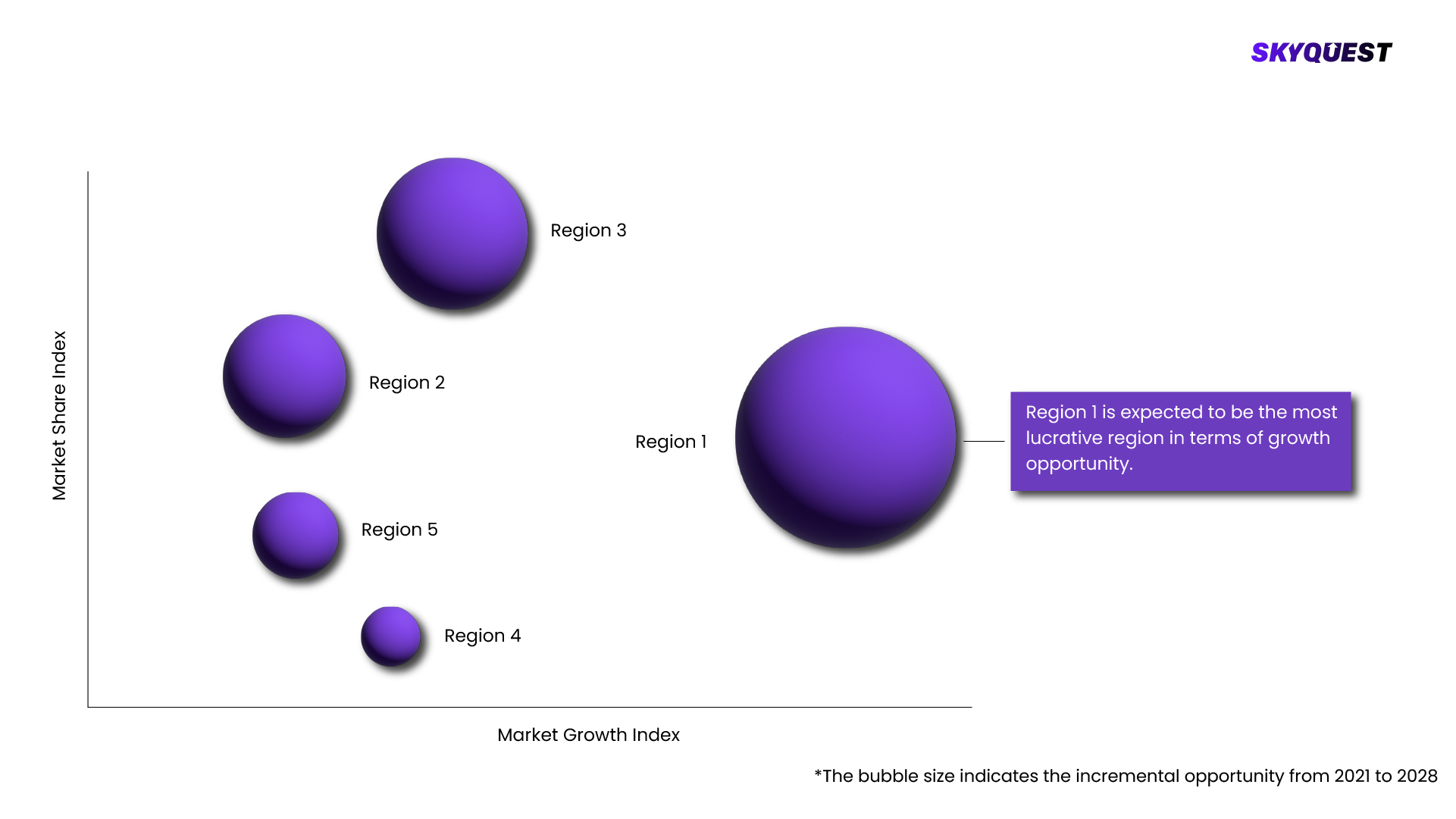

Regional Analysis:

Certificate authority Market is being analyzed by North America, Europe, Asia-Pacific (APAC), Latin America (LATAM), Middle East & Africa (MEA) regions. Key countries including the U.S., Canada, Germany, France, UK, Italy, Spain, China, India, Japan, Brazil, GCC Countries, and South Africa among others were analyzed considering various micro and macro trends.

Certificate authority Market Attractiveness Analysis, By Region 2020-2028

To know more about the market opportunities by region and country, click here to

REQUEST FREE CUSTOMIZATIONCertificate authority Market : Risk Analysis

SkyQuest's expert analysts have conducted a risk analysis to understand the impact of external extremities on Certificate authority Market. We analyzed how geopolitical influence, natural disasters, climate change, legal scenario, economic impact, trade & economic policies, social & ethnic concerns, and demographic changes might affect Certificate authority Market's supply chain, distribution, and total revenue growth.

Competitive landscaping:

To understand the competitive landscape, we are analyzing key Certificate authority Market vendors in the market. To understand the competitive rivalry, we are comparing the revenue, expenses, resources, product portfolio, region coverage, market share, key initiatives, product launches, and any news related to the Certificate authority Market.

To validate our hypothesis and validate our findings on the market ecosystem, we are also conducting a detailed porter's five forces analysis. Competitive Rivalry, Supplier Power, Buyer Power, Threat of Substitution, and Threat of New Entry each force is analyzed by various parameters governing those forces.

Key Players Covered in the Report:

- certificate authority market size is projected to grow from USD 167 million in 2023 to USD 282 million by 2028 at a Compound Annual Growth Rate (CAGR) of 11.0% during the forecast period. The expansion of the certificate authority market can be attributed to a rise in instances of HTTPS phishing attacks and stringent regulatory standards and data privacy compliances.

- By vertical, retail, and eCommerce segment is to grow at the highest CAGR during the forecast period.

- The retail and eCommerce industry is a frequent target of phishing attacks and fraudulent activities. Certificate authorities provide SSL/TLS certificates that help prevent these malicious activities by displaying visual cues, such as the padlock icon or the organization's verified name, which distinguish legitimate websites from fraudulent ones. By implementing SSL/TLS certificates, retail and eCommerce businesses can protect their customers from phishing scams, build trust, and maintain the integrity of their brands.

- The retail and eCommerce industry heavily relies on online transactions, including purchases, payments, and customer data exchanges. Certificate authorities play a critical role in providing SSL/TLS certificates that secure these transactions by encrypting sensitive data, such as credit card information, ensuring secure communication channels, and protecting customer privacy. Implementing SSL/TLS certificates instills confidence in customers, reduces the risk of data breaches, and promotes a secure shopping experience.

- By offerings, the services segment is expected to grow at higher CAGR during the forecast period

- Certificate authority services are the support offered by vendors to assist their customers with the efficient use and operation of certificates. These services include support, implementation, integration, and managed PKI services. Moreover, these services offer guidelines on the use of certificates and help embed best practices in organizations. The complex nature of digital security requires collaboration between various stakeholders, including certificate authorities, software vendors, cybersecurity firms, and industry consortiums. Market drivers for certificate authority services include the need for collaboration and partnerships to develop and implement standardized security practices and frameworks.

- By region, North America accounts for the highest market size during the forecast period.

- North America consists of developed countries that are technologically advanced with well-developed infrastructure. Being the strongest economies, the US and Canada are the top contributing countries in North America in the certificate authority market. The digital revolution of several industries, including banking, healthcare, e-commerce, and government services, is leading the way in North America. The need for certificate authority and digital certificates has risen due to the development of cloud computing, Internet of Things (IoT) devices, and mobile apps, raising the requirement for secure communication and data security. Moreover, the cyberattack surge is expected to drive the need for SSL certificate solutions and services across North America. North America is a major target for cyberattacks, and certificate authority plays an important role in protecting businesses and individuals from these attacks.

- Driver: Rise in instances of HTTPS phishing attacks

- The increase in HTTP phishing assaults emphasizes the importance of providing safe and reliable communication channels by employing reputable certificate authorities and legitimate SSL/TLS certificates. Certificate authorities are essential in phishing attack risk prevention and mitigation, safeguarding users and organizations from potential data breaches and monetary losses. The SSL/TLS certificates that enable safe and encrypted communication between websites and users are provided by certificate authorities, which are essential to this process. Phishing attacks frequently make use of bogus websites that seem like authentic websites. Legitimate websites may prove their legitimacy and encrypt the communication channel by getting SSL/TLS certificates from trustworthy certificate authorities, making it more difficult for hackers to intercept or tamper sensitive data.

- Challenge:Lack of awareness among organizations about the importance of SSL certificates

- Organizations across industry verticals do not use digital certificates for their websites due to their lack of awareness about the importance of secured websites. Lack of insight into the certificate system is also a prime concern. The lack of a systematic process causes certificates to be lost on the network because several departments from different locations request and enroll certificates onto endpoints. For instance, it could be quite challenging for administrators to hunt down and renew one certificate after it has expired. A lack of understanding of certificate authority and a shortage of skilled PKI management personnel are other challenges many organizations face.

- Opportunity: Exponential increase in the adoption of IoT trends across industry verticals

- The importance of certificate authority in supplying secure identity management, authentication, and encryption for IoT devices and applications increases as the IoT ecosystem develops and diversifies. Certificate authority has proven itself as a highly secure and flexible solution for protecting and managing the entire connected devices life cycle in an IoT environment. IoT systems and solutions can seamlessly manage and integrate certificates with the help of certificate authority services. In addition to guaranteeing safe and scalable certificate administration, this enables organizations to take advantage of their current IoT infrastructure.

- Recent Developments

- In January 2023, DigiCert launched Trust Lifecycle Manager. The solution unifies CA-agnostic certificate management, private PKI services, and public trust issuance for seamless digital trust infrastructure.

- In March 2023, GlobalSign announced the successful establishment of a technology partnership with essendi it. The partnership will integrate essendi xc with GlobalSign’s certificate platform, Atlas.

- In May 2022, IdenTrust issued new Subordinate CA (SubCA), "IGC Device CA 2" to remain compliant with all Federal Public Key Infrastructure Policy Authority (FPKIPA) requirements. It will replace the current "IGC Device CA 1" SubCA.

- In February 2022, Sectigo announced accessibility updates to its flagship product Sectigo Certificate Manager (SCM) that meet global compliance guidelines. SCM's new artificial intelligence automatic accessibility solution through Equal Web improves the user experience.

- In November 2021, Sectigo partnered with Infinite Rangers. Infinite Ranges is one of the leading experts in public key infrastructure (PKI), encryption, and identity and access management. It offers DevSecOps consulting services. Infinite Ranges provided Sectigo professional services in the United States through this collaboration.

- KEY MARKET SEGMENTS

- By Offerings

- Certificate Type

- Services

- By SSL Certification Validation Type

- Domain Validation

- Organization Validation

- Extended Validation

- By organization size

- Large Organization

- SMEs

- By Verticals

- BFSI

- Retail and eCommerce

- Government and Defence

- Healthcare and Life Sciences

- IT and Telecom

- Travel and Hospitality

- Education

- Other Verticals

- By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

- KEY MARKET PLAYERS

- Sectigo

- Digicert

- GlobalSign

- GoDaddy

- IdenTrust

- Entrust

- Certum

- Actalis

- Lets Encrypt

- SSL.Com

- E-Tugra

- WISekey

- Trustwave

- SwissSign

- TWCA

- Buypass

- Camerfirma

- Harica

- Certigna

- NETLOCK

- TURKTRUST

- certSIGN

- Disig

- Network Solutions

- OneSpan

SkyQuest's Expertise:

The Certificate authority Market is being analyzed by SkyQuest's analysts with the help of 20+ scheduled Primary interviews from both the demand and supply sides. We have already invested more than 250 hours on this report and are still refining our date to provide authenticated data to your readers and clients. Exhaustive primary and secondary research is conducted to collect information on the market, peer market, and parent market.

Our cross-industry experts and revenue-impact consultants at SkyQuest enable our clients to convert market intelligence into actionable, quantifiable results through personalized engagement.

Scope Of Report

| Report Attribute |

Details |

| The base year for estimation |

2021 |

| Historical data |

2016 – 2022 |

| Forecast period |

2022 – 2028 |

| Report coverage |

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments covered |

- By Offerings - Certificate Type, Services

- By SSL Certification Validation Type - Domain Validation, Organization Validation, Extended Validation

- By organization size - Large Organization, SMEs

- By Verticals - BFSI, Retail and eCommerce, Government and Defence, Healthcare and Life Sciences, IT and Telecom, Travel and Hospitality, Education, Other Verticals

- By Region - North America, Europe, Asia Pacific, Middle East & Africa, Latin America, KEY MARKET PLAYERS, Sectigo, Digicert, GlobalSign, GoDaddy, IdenTrust, Entrust, Certum, Actalis, Lets Encrypt, SSL.Com, E-Tugra, WISekey, Trustwave, SwissSign, TWCA, Buypass, Camerfirma, Harica, Certigna, NETLOCK, TURKTRUST, certSIGN, Disig, Network Solutions

|

| Regional scope |

North America, Europe, Asia-Pacific (APAC), Latin America (LATAM), Middle East & Africa (MEA) |

| Country scope |

U.S., Canada, Germany, France, UK, Italy, Spain, China, India, Japan, Brazil, GCC Countries, South Africa |

| Key companies profiled |

- certificate authority market size is projected to grow from USD 167 million in 2023 to USD 282 million by 2028 at a Compound Annual Growth Rate (CAGR) of 11.0% during the forecast period. The expansion of the certificate authority market can be attributed to a rise in instances of HTTPS phishing attacks and stringent regulatory standards and data privacy compliances.

- By vertical, retail, and eCommerce segment is to grow at the highest CAGR during the forecast period.

- The retail and eCommerce industry is a frequent target of phishing attacks and fraudulent activities. Certificate authorities provide SSL/TLS certificates that help prevent these malicious activities by displaying visual cues, such as the padlock icon or the organization's verified name, which distinguish legitimate websites from fraudulent ones. By implementing SSL/TLS certificates, retail and eCommerce businesses can protect their customers from phishing scams, build trust, and maintain the integrity of their brands.

- The retail and eCommerce industry heavily relies on online transactions, including purchases, payments, and customer data exchanges. Certificate authorities play a critical role in providing SSL/TLS certificates that secure these transactions by encrypting sensitive data, such as credit card information, ensuring secure communication channels, and protecting customer privacy. Implementing SSL/TLS certificates instills confidence in customers, reduces the risk of data breaches, and promotes a secure shopping experience.

- By offerings, the services segment is expected to grow at higher CAGR during the forecast period

- Certificate authority services are the support offered by vendors to assist their customers with the efficient use and operation of certificates. These services include support, implementation, integration, and managed PKI services. Moreover, these services offer guidelines on the use of certificates and help embed best practices in organizations. The complex nature of digital security requires collaboration between various stakeholders, including certificate authorities, software vendors, cybersecurity firms, and industry consortiums. Market drivers for certificate authority services include the need for collaboration and partnerships to develop and implement standardized security practices and frameworks.

- By region, North America accounts for the highest market size during the forecast period.

- North America consists of developed countries that are technologically advanced with well-developed infrastructure. Being the strongest economies, the US and Canada are the top contributing countries in North America in the certificate authority market. The digital revolution of several industries, including banking, healthcare, e-commerce, and government services, is leading the way in North America. The need for certificate authority and digital certificates has risen due to the development of cloud computing, Internet of Things (IoT) devices, and mobile apps, raising the requirement for secure communication and data security. Moreover, the cyberattack surge is expected to drive the need for SSL certificate solutions and services across North America. North America is a major target for cyberattacks, and certificate authority plays an important role in protecting businesses and individuals from these attacks.

- Driver: Rise in instances of HTTPS phishing attacks

- The increase in HTTP phishing assaults emphasizes the importance of providing safe and reliable communication channels by employing reputable certificate authorities and legitimate SSL/TLS certificates. Certificate authorities are essential in phishing attack risk prevention and mitigation, safeguarding users and organizations from potential data breaches and monetary losses. The SSL/TLS certificates that enable safe and encrypted communication between websites and users are provided by certificate authorities, which are essential to this process. Phishing attacks frequently make use of bogus websites that seem like authentic websites. Legitimate websites may prove their legitimacy and encrypt the communication channel by getting SSL/TLS certificates from trustworthy certificate authorities, making it more difficult for hackers to intercept or tamper sensitive data.

- Challenge:Lack of awareness among organizations about the importance of SSL certificates

- Organizations across industry verticals do not use digital certificates for their websites due to their lack of awareness about the importance of secured websites. Lack of insight into the certificate system is also a prime concern. The lack of a systematic process causes certificates to be lost on the network because several departments from different locations request and enroll certificates onto endpoints. For instance, it could be quite challenging for administrators to hunt down and renew one certificate after it has expired. A lack of understanding of certificate authority and a shortage of skilled PKI management personnel are other challenges many organizations face.

- Opportunity: Exponential increase in the adoption of IoT trends across industry verticals

- The importance of certificate authority in supplying secure identity management, authentication, and encryption for IoT devices and applications increases as the IoT ecosystem develops and diversifies. Certificate authority has proven itself as a highly secure and flexible solution for protecting and managing the entire connected devices life cycle in an IoT environment. IoT systems and solutions can seamlessly manage and integrate certificates with the help of certificate authority services. In addition to guaranteeing safe and scalable certificate administration, this enables organizations to take advantage of their current IoT infrastructure.

- Recent Developments

- In January 2023, DigiCert launched Trust Lifecycle Manager. The solution unifies CA-agnostic certificate management, private PKI services, and public trust issuance for seamless digital trust infrastructure.

- In March 2023, GlobalSign announced the successful establishment of a technology partnership with essendi it. The partnership will integrate essendi xc with GlobalSign’s certificate platform, Atlas.

- In May 2022, IdenTrust issued new Subordinate CA (SubCA), "IGC Device CA 2" to remain compliant with all Federal Public Key Infrastructure Policy Authority (FPKIPA) requirements. It will replace the current "IGC Device CA 1" SubCA.

- In February 2022, Sectigo announced accessibility updates to its flagship product Sectigo Certificate Manager (SCM) that meet global compliance guidelines. SCM's new artificial intelligence automatic accessibility solution through Equal Web improves the user experience.

- In November 2021, Sectigo partnered with Infinite Rangers. Infinite Ranges is one of the leading experts in public key infrastructure (PKI), encryption, and identity and access management. It offers DevSecOps consulting services. Infinite Ranges provided Sectigo professional services in the United States through this collaboration.

- KEY MARKET SEGMENTS

- By Offerings

- Certificate Type

- Services

- By SSL Certification Validation Type

- Domain Validation

- Organization Validation

- Extended Validation

- By organization size

- Large Organization

- SMEs

- By Verticals

- BFSI

- Retail and eCommerce

- Government and Defence

- Healthcare and Life Sciences

- IT and Telecom

- Travel and Hospitality

- Education

- Other Verticals

- By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

- KEY MARKET PLAYERS

- Sectigo

- Digicert

- GlobalSign

- GoDaddy

- IdenTrust

- Entrust

- Certum

- Actalis

- Lets Encrypt

- SSL.Com

- E-Tugra

- WISekey

- Trustwave

- SwissSign

- TWCA

- Buypass

- Camerfirma

- Harica

- Certigna

- NETLOCK

- TURKTRUST

- certSIGN

- Disig

- Network Solutions

- OneSpan

|

| Customization scope |

Free report customization (15% Free customization) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options |

Reap the benefits of customized purchase options to fit your specific research requirements. |

Objectives of the Study

- To forecast the market size, in terms of value, for various segments with respect to five main regions, namely, North America, Europe, Asia-Pacific (APAC), Latin America (LATAM), Middle East & Africa (MEA)

- To provide detailed information regarding the major factors influencing the growth of the Market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the micro markets with respect to the individual growth trends, future prospects, and contribution to the total market

- To provide a detailed overview of the value chain and analyze market trends with the Porter's five forces analysis

- To analyze the opportunities in the market for various stakeholders by identifying the high-growth Segments

- To identify the key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for the market leaders

- To analyze competitive development such as joint ventures, mergers and acquisitions, new product launches and development, and research and development in the market

What does this Report Deliver?

- Market Estimation for 20+ Countries

- Historical data coverage: 2016 to 2022

- Growth projections: 2022 to 2028

- SkyQuest's premium market insights: Innovation matrix, IP analysis, Production Analysis, Value chain analysis, Technological trends, and Trade analysis

- Customization on Segments, Regions, and Company Profiles

- 100+ tables, 150+ Figures, 10+ matrix

- Global and Country Market Trends

- Comprehensive Mapping of Industry Parameters

- Attractive Investment Proposition

- Competitive Strategies Adopted by Leading Market Participants

- Market drivers, restraints, opportunities, and its impact on the market

- Regulatory scenario, regional dynamics, and insights of leading countries in each region

- Segment trends analysis, opportunity, and growth

- Opportunity analysis by region and country

- Porter's five force analysis to know the market's condition

- Pricing analysis

- Parent market analysis

- Product portfolio benchmarking