Report ID: SQMIG45D2167

Report ID: SQMIG45D2167

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG45D2167 |

Region:

Global |

Published Date: August, 2025

Pages:

188

|Tables:

123

|Figures:

77

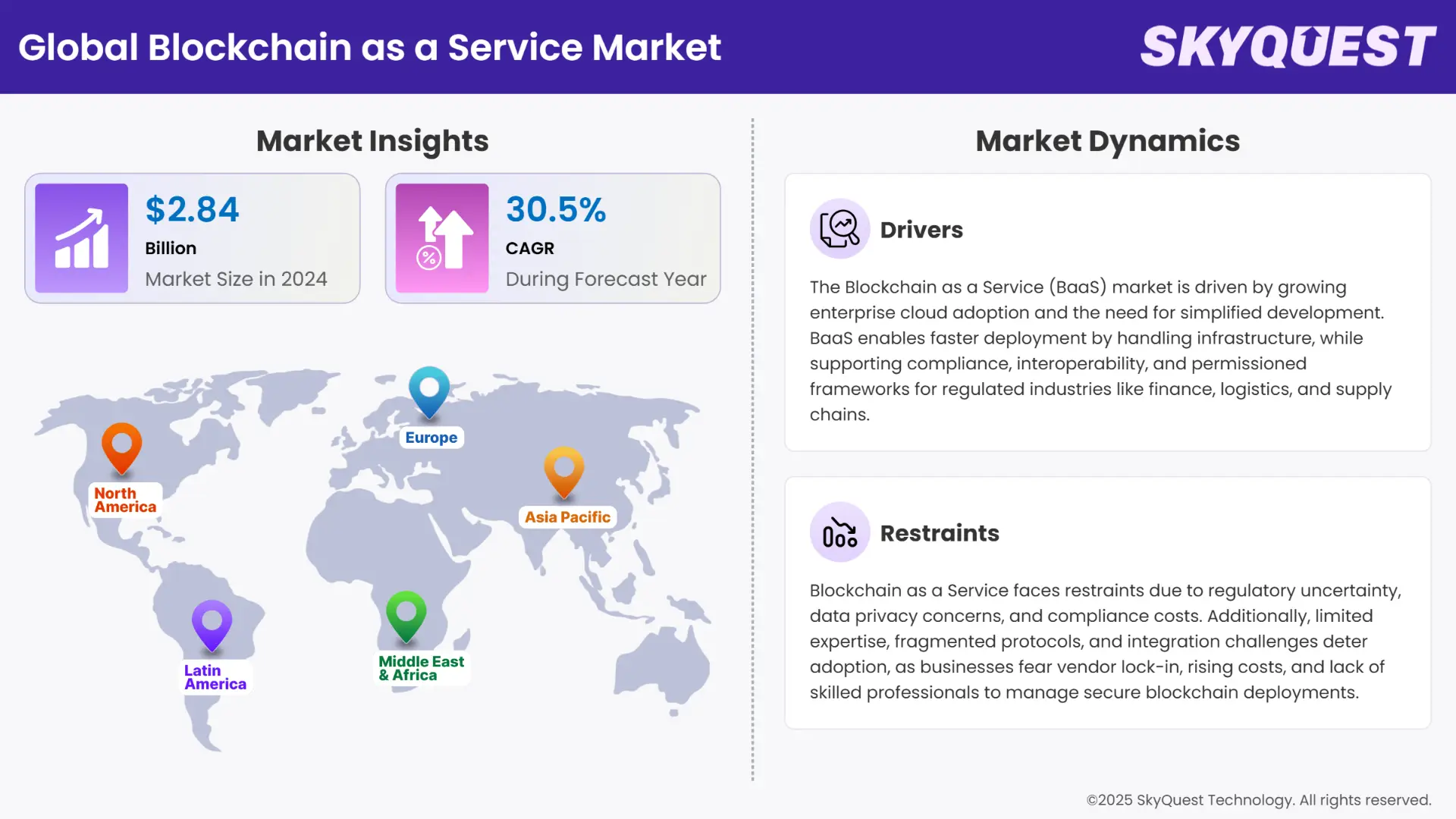

Global Blockchain as a Service Market size was valued at USD 3.25 Billion in 2024 and is poised to grow from USD 4.24 Billion in 2025 to USD 35.67 Billion by 2033, growing at a CAGR of 30.5% during the forecast period (2026–2033).

As small and medium-sized businesses are increasingly using blockchain-as-a-service (BaaS) tools and services to develop their blockchain applications, smart contracts, and payment systems, the blockchain as a service market growth is expected to expand. Small and medium-sized businesses are benefitting from BaaS services' secure decentralization, high immutability, efficiency, cost-effectiveness, security, etc.

In addition, the growth of cryptocurrencies and efforts to raise awareness and encourage large companies to use blockchain-as-a-service will be predicted to contribute to the global blockchain as a service industry expansion. Moreover, the market is evolving in response to the sluggish regulatory clarity for stablecoins and tokenization. EU member states questioned the MiCA regulations including licensing, capital and disclosure obligations for stablecoin issuers, coming into play in December 2024. Which will offer some stability for banks to explore on-chain settlement. As demonstrated by Mastercard's 2025 agreement with Fiserv to allow FIUSD to be integrated into its card network establish clear barriers for mainstream pilots. Central bank experiments such as BIS Project Agorá can provide technical blueprints for compliant back-end services to private providers. By reducing legal uncertainty, each milestone incentivizes companies to commit to multi-year budgets.

Why is AI Integration Becoming Essential in the BaaS Market?

As Blockchain as a Service (BaaS) experiences a transformation through artificial intelligence (AI), security, efficiency, and decision-making are all significantly improved. AI algorithms analyze large volumes of blockchain datasets to identify fraudulent transactions, optimize smart contracts, and identify trends. In 2024, IBM Blockchain Platform introduced an AI-powered anomaly detection feature to its BaaS offerings, allowing customers to easily identify unusual occurrences or patterns in their supply chain documentation. Together, they enabled retail and logistics clients to proactively manage the potential risks of fraud and increased operational inefficiencies.

To get more insights on this market click here to Request a Free Sample Report

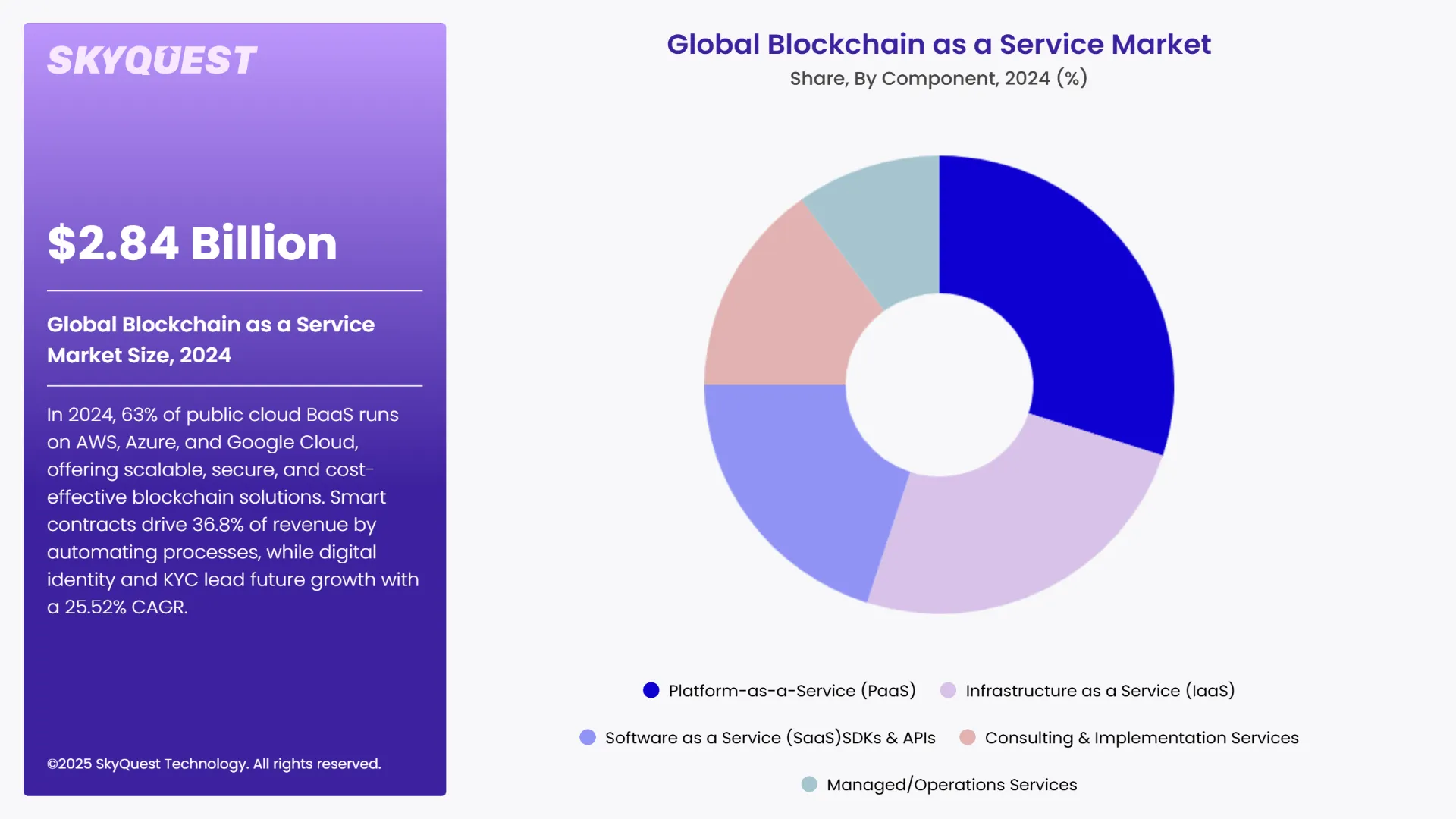

The global blockchain as a service market is segmented into component, deployment model, application, end user, and region. By component, the market is classified into platform-as-a-service (PaaS), infrastructure as a service (IaaS), software as a service (SaaS) SDKS & APIS, consulting & implementation services, and managed/operations services. Depending on deployment mode, it is trifurcated into public cloud, private cloud, and hybrid cloud. According to the application, the market is divided into smart contracts, supply-chain traceability, digital identity & kyc, payments & settlement, and governance, risk & compliance. As per end user, it is categorized into BFSI, healthcare & life sciences, it & telecom, retail & e-commerce, manufacturing, energy & utilities, and government & public sector. Regionally, it is analyzed across North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa.

What Makes Public Cloud the Preferred Choice for BaaS Deployment?

As per the 2024 blockchain as a service market analysis, majorly 63% of public cloud blockchain-as-a-service is being run through heavy providers like AWS, Azure, and Google Cloud, which provides examples for environments about strong SLAs, easy scaling, and performance reliability. Currently, the BaaS and public cloud market is overhyped with crypto SaaS tools. For example, AWS is doing well in increasing its BaaS portfolio in 2024 with added security features, like better data encryption, which are especially useful for industries that require compliance. Global companies looking for quick, safe infrastructure can start blockchain projects without buying hefty hardware and worrying about legal restrictions or upfront costs; they can just pay-as-they-go. This, in turn, will be reducing overall expenses in setting them up more rapidly.

Deployment of the hybrid cloud is projected to grow at a 22.10% CAGR growth rate, as several sectors that employ use cases on the blockchain will hold sensitive data on-premises to satisfy residency demands outlined under MiCA and other regulations. This approach allows for a controlled blockchain installation, while simultaneously benefiting from the public cloud's scalability for non-critical applications.

How are Smart Contracts Powering Automation in BaaS Solutions?

As per the 2024 blockchain as a service market forecast, the smart contracts segment contributed 36.8% of BaaS revenue by automating processes involving escrow, invoicing, and compliance verification. Organizations are increasingly utilizing smart contracts to eliminate human error and increase transparency in transactions. Adding smart contract capabilities to its supply chain service allowed SAP to reduce processing times by over 40% in 2024 and allowed for real-time settlements and compliance verifications on transactions involving cross-border trade.

However, the digital identity & kyc category is anticipated to have the highest blockchain as a service market share, generating a CAGR of 25.52% through 2032. This is due to stricter international customer due diligence regulations. BaaS providers are adopting identity verification solutions based on blockchain technology so that they have a secure, immutable record as their products change to satisfy new anti-money-laundering and data protection regulations.

To get detailed segments analysis, Request a Free Sample Report

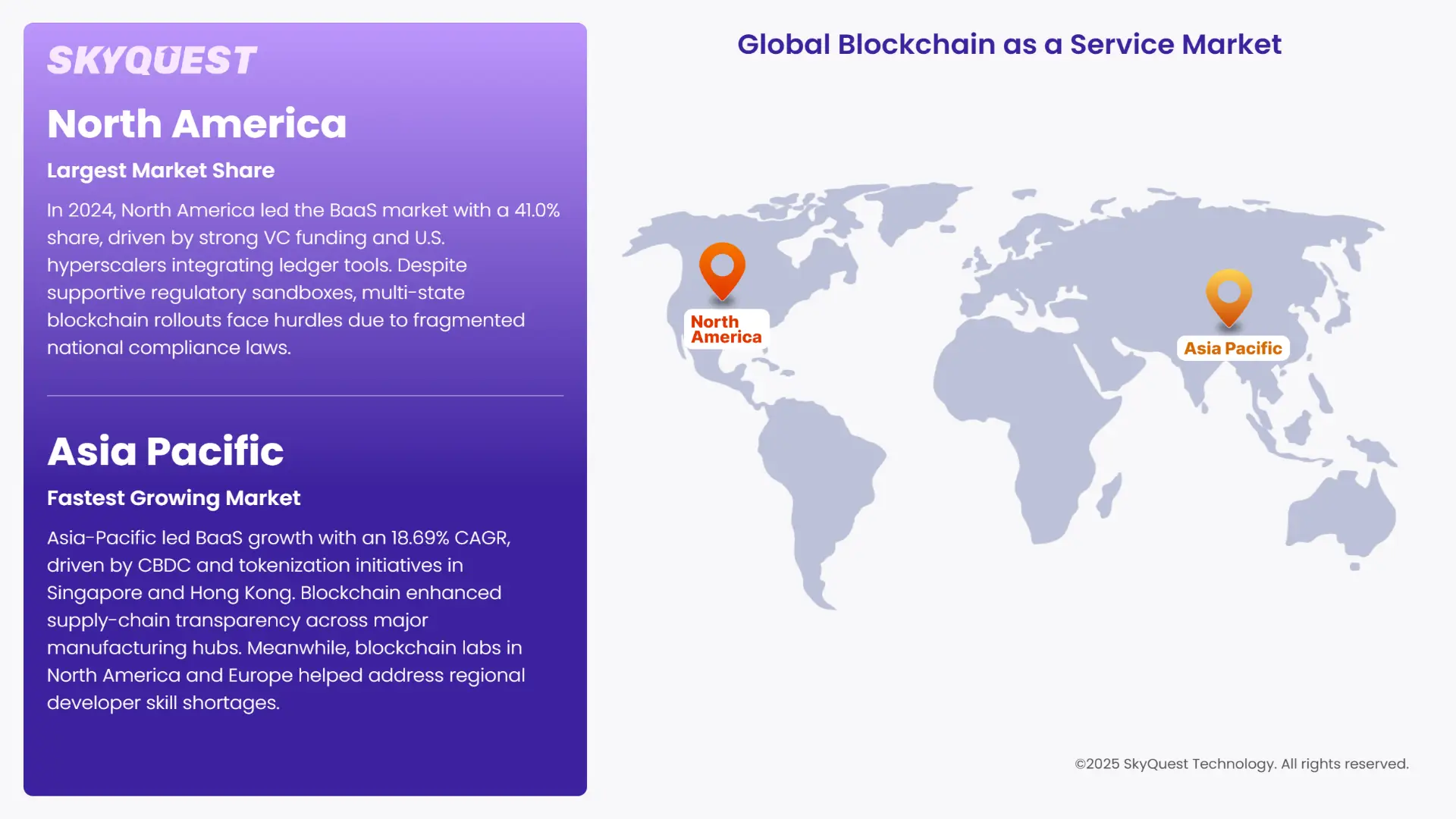

How are Venture Funding and Hyperscalers Powering BaaS Growth in North America?

As per the blockchain as a service market regional analysis, with a 41.0% market share in 2024, North America dominated the market due to robust venture capital, especially Digital Asset's USD 135 million round led by Citadel and Goldman Sachs. In the future, U.S. hyperscalers will include ledger tools into their popular cloud offerings so that existing customers can quickly utilize them. Regulatory sandboxes in many states would have made piloting such models faster; however, multi-state blockchain rollouts still have to contend with compliance issues due to the fragementation of national laws.

U.S. Blockchain as a Service Market

As hyperscalers like AWS, Microsoft Azure, and Google Cloud have incorporated blockchain capabilities into their cloud menu for quick acceptance by clients, the U.S. is currently the leader in BaaS adoption across the region. In 2024, Digital Asset raised USD 135 million to build blockchain infrastructure for companies. State-level sandboxes are great for innovation, yet widespread use of blockchain solutions across industries in the U.S. is still limited by the lack of federal regulation.

Canada Blockchain as a Service Market

Currently, BaaS growth in Canada is influenced chiefly by the adoption of fintech and its penetration into cross-border trade processes. Several of the Canadian banks as well as logistics companies have been testing blockchain technology in government-backed innovation hubs. Demos examining use cases for distributed-ledger-based trade finance and identity verification were slated for consideration in provincial pilots in 2024. Local enterprises will be able to take advantage of these blockchain tools through partnerships with international hyperscalers so that they could use distributed ledger technology without paying for upfront infrastructure.

Why is Asia-Pacific the Fastest-Growing BaaS Market?

The blockchain as a service sector had the highest CAGR in Asia-Pacific (18.69%) due to government-backed CBDC and tokenization projects in Singapore and Hong Kong. Trade networks in Asia, with manufacturing clusters in China, South Korea, and Japan, improved supply-chain transparency and sustainability reporting through the use of blockchain technology. To address the skills shortage in North America and Europe, university-affiliated blockchain labs-built competencies for developers in their respective regions.

South Korea Blockchain as a Service Market

The South Korean government has implemented a Digital New Deal strategy that invests in blockchain infrastructure for banking and logistics, which is positively fueling South Korea's momentum around BaaS. The Korea Customs Service was able to reduce the processing time for trade clearing by 30% in 2024 by applying blockchain technology to its processes. In order to enhance customer credibility and compliance, local fintechs also partnered with telecoms to offer block chain-based identity services.

Japan Blockchain as a Service Market

The use of BaaS is increasing in Japan, following commitments to disclose supply chains and carbon footprints. In 2024, the Mitsubishi Corporation used blockchain technology to trace the source of raw materials for its environmentally sustainable production. The potential of blockchain was confirmed more broadly through tokenized green bond pilots that were sponsored by the government and encouraged banks and firms to use commercial BaaS platforms as their vehicle for operational transparency and compliance in aligning to jurisdictional standards.

What Role Does the ECB Play in Accelerating BaaS Adoption in Europe?

The European Blockchain as a Service (BaaS) sector is expected to dominate the market throughout the forecast period, due to strong regulatory frameworks, especially the Markets in Crypto-Assets (MiCA) standardized regulatory framework due to become fully operational in December 2024, which will be a positive for Europe. The automotive, luxury, and food industries are implementing blockchain provenance solutions to address requirements from customers and regulators, as evident with Renault's XCEED supply-chain system. The banks are also digitizing the back-office operations in response to the European Central Bank's adoption of digital assets, which is creating a steady stream of BaaS deals amongst member states.

UK Blockchain as a Service Market

Blockchain testbeds supported by the government and London's fintech industry are driving the UK's adoption of BaaS. In such a huge retail bank, trials of blockchain technology were initiated in 2024 for mortgage settlements, through which processing time could be reduced from weeks to days. The regulatory distinctiveness which followed Brexit has increased enterprise usage, especially in trade documents and financial services.

France Blockchain as a Service Market

The BaaS market in France is experiencing immense growth led by luxury goods and agri-food supply chains, as well as the possibilities of product traceability through blockchain (e.g. Renault’s XCEED technology, a flagship project that conforms to EU regulations). French banks used blockchain in 2024 to experiment with inter-bank settlement and leverage the standardized European regulation in MiCA to streamline cross-border financial transactions and record keeping in the eurozone.

Germany Blockchain as a Service Market

Germany's large industrial base, in part, supports the development of the BaaS market there. In 2024, automotive suppliers are using blockchain technology primarily to support sustainable reporting of component provenance and to support compliance with various regulatory obligations. Significant growth in BaaS also occurred as German banks began integrating blockchain technology into securities settlement systems, facilitated by the European Central Bank's digital asset initiatives, suggesting that manufacturing as well as financial services began moving toward adoption.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

Blockchain as a Service Market Drivers

Use of Enterprise Clouds and the Demand for Developers

Standardized Frameworks, Controlled Use Cases, and Interoperability

Blockchain as a Service Market Restraints

Concerns About Data Privacy and Unclear Regulations

Insufficient Knowledge and Disjointed Protocols

Request Free Customization of this report to help us to meet your business objectives.

With integrated BaaS services that take advantage of global cloud scalability, SLAs, and corporate sales channels, major cloud providers (AWS, Azure, IBM, and Oracle) control the market. Blockdaemon, Alchemy, QuickNode, and Chainstack are a few examples of specialized infrastructure companies that compete on developer DX, latency, and multi-chain support. Vertical bundling (financial, supply-chain), strategic alliances with protocol foundations, controlled governance templates, and SDK/analytics add-ons are some of the tactics. Through M&A, wallet, indexer, and node capabilities can also be integrated into cohesive stacks.

Top Player’s Company Profile

Recent Developments in Blockchain as a Service Market

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected by means of Primary Exploratory Research backed by robust Secondary Desk research.

As per SkyQuest analysis, from experimental pilots to mainstream enterprise infrastructure, BaaS is evolving. Cloud giants offer the assurance of size and compliance, while specialized platforms offer superior developer experience, latency and multichain flexibility. Growth is being driven by regulated use cases (trade finance, supply chain, tokenized assets), better developer tooling, and speed to market. However, managed, hybrid deployments are preferred because of factors associated with adoption such as regulatory risk or protocols. The short-term winners are those who deliver meaningful multi-cloud services, share consistent governance templates, and focus on the developer stack (APIs, indexers, analytics). When companies can focus on business level integration and outsource their blockchain operations, BaaS is most predicted to grow exponentially.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 3.25 Billion |

| Market size value in 2033 | USD 35.67 Billion |

| Growth Rate | 30.5% |

| Base year | 2024 |

| Forecast period | 2026–2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Blockchain as a Service Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Blockchain as a Service Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Blockchain as a Service Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Blockchain as a Service Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

Global Blockchain as a Service Market size was valued at USD 3.25 Billion in 2024 and is poised to grow from USD 4.24 Billion in 2025 to USD 35.67 Billion by 2033, growing at a CAGR of 30.5% during the forecast period (2026–2033).

With integrated BaaS services that take advantage of global cloud scalability, SLAs, and corporate sales channels, major cloud providers (AWS, Azure, IBM, and Oracle) control the market. Blockdaemon, Alchemy, QuickNode, and Chainstack are a few examples of specialized infrastructure companies that compete on developer DX, latency, and multi-chain support. Vertical bundling (financial, supply-chain), strategic alliances with protocol foundations, controlled governance templates, and SDK/analytics add-ons are some of the tactics. Through M&A, wallet, indexer, and node capabilities can also be integrated into cohesive stacks. 'Amazon Web Services (Managed Blockchain)', 'Microsoft Azure (Blockchain + Web3 services)', 'IBM (IBM Blockchain Platform)', 'Oracle (Oracle Blockchain Cloud)', 'Google Cloud (Blockchain Node Engine / partners)', 'ConsenSys / Infura & Kaleido', 'Alchemy', 'Blockdaemon', 'QuickNode', 'Chainstack', 'Blockstream', 'Chainalysis (enterprise compliance tooling)', 'Ripple (RippleNet / enterprise payments integrations)'

Companies are increasingly utilizing plug-and-play blockchain technology in business especially for the purpose of avoiding consensus issues and managing nodes. With BaaS, development teams can focus on smart contracts and connections because wallet management, node operations, and APIs are already abstracted. Fintechs, logistics companies and larger enterprises preferring cloud consumption models are embracing BaaS to speed up time-to-market for tokenization, supply-chain provenance and financial use cases.

Middleware Standardization and BaaS Deployments in Different Clouds and Mixed Environments: Businesses need standardizations of BaaS solutions that are agnostic of the cloud provider or a hybrid on-prem/cloud configuration to address business need for latency, sovereignty of applications, and resiliency. Cloud providers have responded with standardized APIs, multi-cloud connectors, and middleware (indexers, event streams) that expedite enterprises’ pilots into multi-region, production deployments through the ability to facilitate cloud or chain switching.

How are Venture Funding and Hyperscalers Powering BaaS Growth in North America?

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients