Report ID: SQMIG35J2131

Report ID: SQMIG35J2131

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG35J2131 |

Region:

Global |

Published Date: June, 2025

Pages:

198

|Tables:

155

|Figures:

78

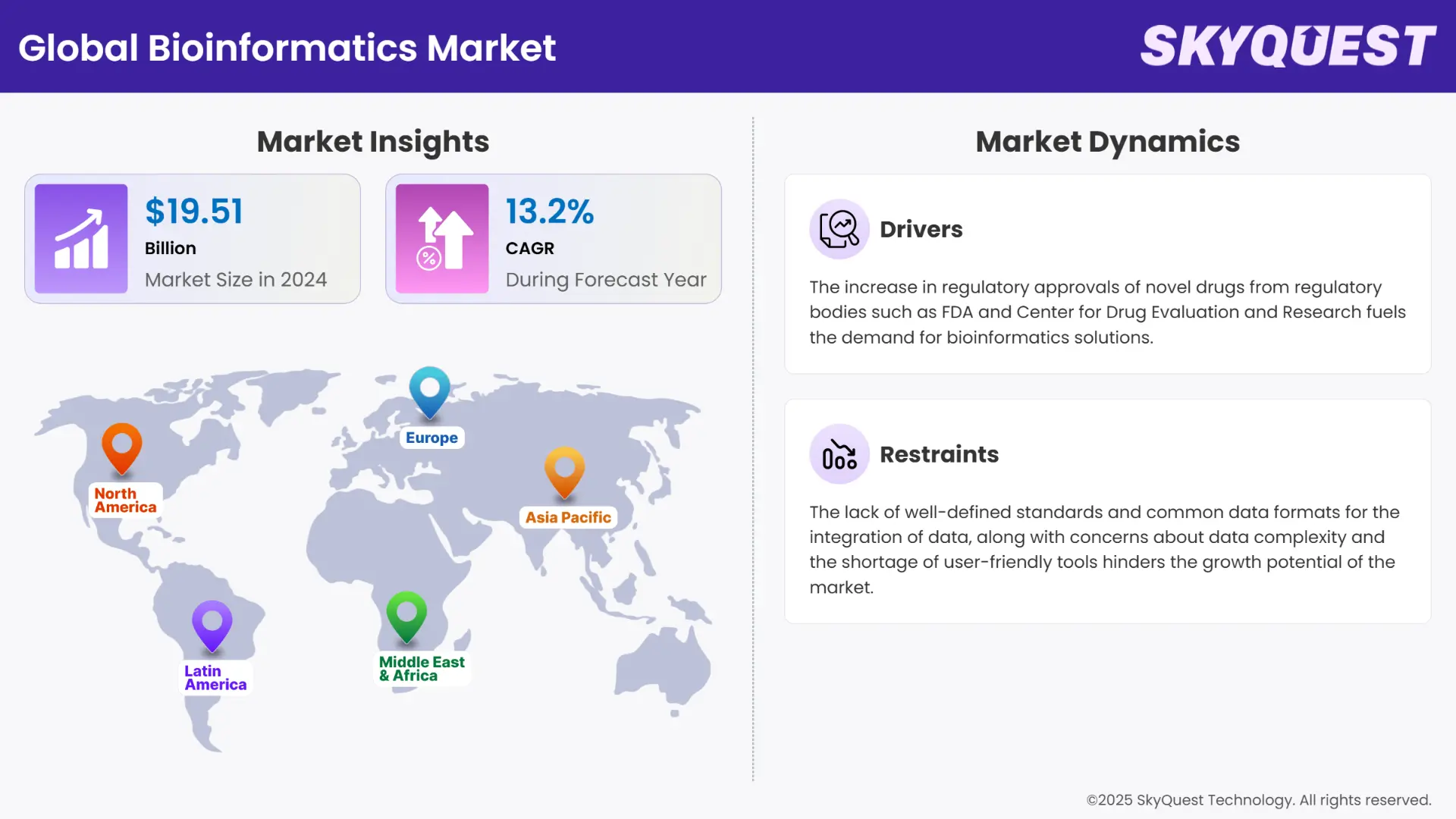

Global Bioinformatics Market size was valued at USD 19.51 Billion in 2024 and is poised to grow from USD 22.09 Billion in 2025 to USD 59.55 Billion by 2033, growing at a CAGR of 13.2% in the forecast period (2026–2033).

Growing emphasis on personalized medicines, genomics, and proteomics research are the main factors driving global bioinformatics market growth. Bioinformatics is an indispensable tool in these types of life science and pharmaceutical R&D. Advances in AI and machine learning technologies are also improving outcomes. Increasing support from the public and private sectors for genomic research is an additional factor driving market expansion.

The increase in strategic alliances and partnerships has also resulted in increasing market competitiveness. However, the high costs associated with buying or subscribing for such tools and platforms and challenges in data integration and standardization act as huge roadblocks for the bioinformatics market’s growth. This can only be overcome by increased spending on research and development and cross-collaboration between the research community and industrial players. By overcoming these challenges, the market is set to witness steady growth ahead in the upcoming years.

Artificial Intelligence (AI) is transforming market dynamics. AI helps improve the accuracy and time required for interpretation of complex biological data. These technologies also uncover hidden patterns in genomics, proteomics, and transcriptomics datasets. This improves predictive modeling, interpretation of variants, and drug discovery. On May 8, 2025, the Swiss Institute of Bioinformatics (SIB) launched ExpasyGPT. This is a generative AI tool which is integrated into its Expasy portal. ExpasyGPT allows researchers to do complex cross-database queries using natural language. Many startups are also taking advantage of the emerging application of AI in bioinformatics and launching their flagship products in the market that utilize AI to provide better precision and speed in bioinformatics.

To get more insights on this market click here to Request a Free Sample Report

The global bioinformatics market is segmented into products & services, purchase mode, sector application, end user and region. By products & services, the market is classified into knowledge management tools (generalized knowledge management tools, specialized knowledge management tools), bioinformatics platforms (data analysis platforms, structural & functional analysis platforms, others), and bioinformatics services (sequencing services, data analysis services, drug discovery services, differential gene expression analysis services, database and management services, others). Depending on purchase mode, it is divided into group purchase, and individual purchase. According to sector, the market is categorized into medical biotechnology, clinical diagnostics & personalized medicine, reproductive health, animal biotechnology, plant biotechnology, environmental biotechnology, forensic biotechnology, and others. Depending on application, it is divided into genomics, chemoinformatics & drug design, proteomics, transcriptomics, metabolomics, and others. According to end user, the market is categorized into research and academic institutes, clinical research organization, biotech and pharmaceutical companies, research laboratories, hospitals, and others. Regionally, the market is analyzed across North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

As per the 2024 global bioinformatics market analysis, the knowledge management tools sub-segment held the largest share of revenue and controlled the market. It was valued at 8.9 billion in 2024. Nowadays, the need to organize, retrieve, and utilize complex biological data efficiently is very high. Knowledge management tools allow the integration and interpretation of data in research projects. This accelerates discovery in genomics, proteomics, and drug development. The wide adoption of these tools in research and pharmaceutical settings shows how critical they are in streamlining workflows and improving scientific outcomes.

The sub segment is also expected to experience the highest compound annual growth rate (CAGR) through the forecasted period with a CAGR of above 13.5%. Technological advancements in AI, machine learning, and semantic technologies are pushing the category to newer heights. Their integration with LLMs and knowledge graphs, as seen in tools like ExpasyGPT, further showcases their value in allowing faster, deeper, and more accurate insights.

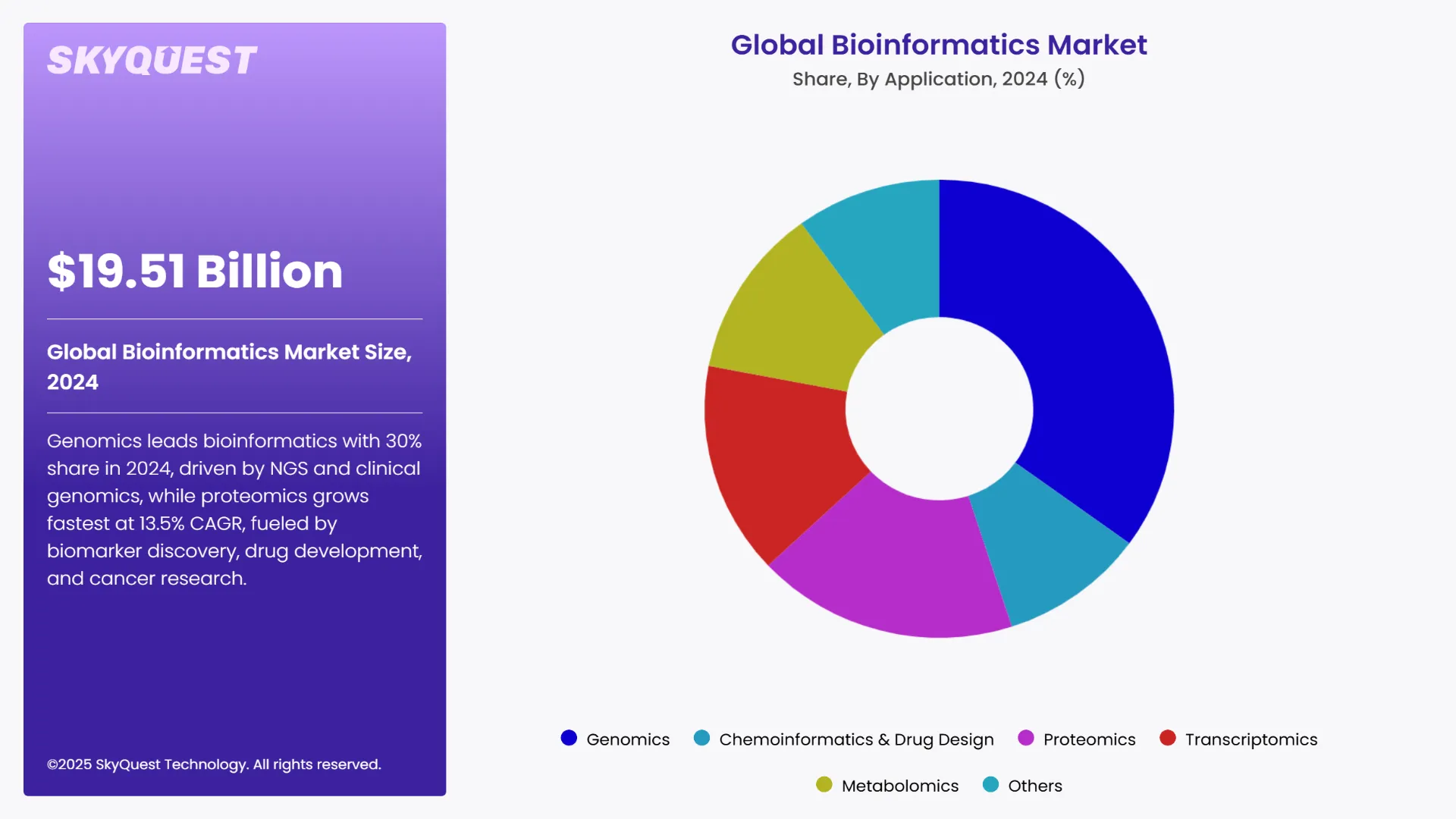

Based on the 2024 global bioinformatics market forecast, the genomics category in the application segment dominated the market. It accounted for about 30% of the total market share in 2024. The exponential growth in next-generation sequencing (NGS) data and its use in various fields such as personalized medicine, disease diagnostics, and population genomics are the reasons behind this dominance. The investments in large-scale genome projects and clinical genomics applications have also cemented its leadership position. Bioinformatics tools play a very important role in managing, analyzing, and interpreting complex genomic datasets.

The proteomics category, at a 13.5% CAGR, is expected to have the highest growth rate during the forecast period of 2025-2032. Bioinformatics is a necessary tool in understanding protein functions, interactions, and dynamics in health and disease. Technological advances in mass spectrometry and high-throughput protein analysis have increased the volume of data. This creates the need for bioinformatics platforms which can provide correct interpretation. Its growing application in biomarker discovery, cancer research, and drug development is also fueling the demand for proteomics-based bioinformatics solutions globally.

To get detailed segments analysis, Request a Free Sample Report

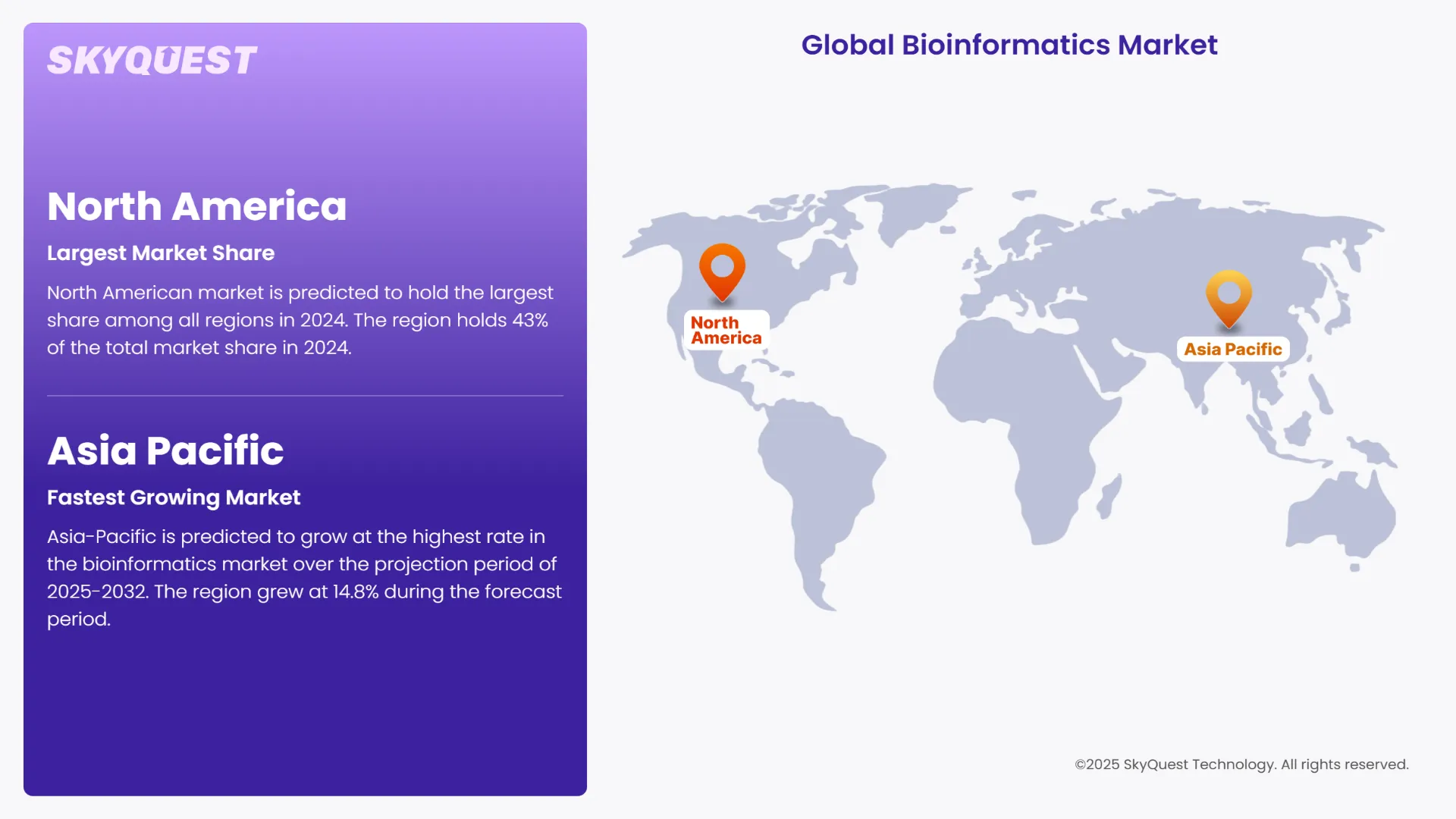

As per the 2024 bioinformatics market regional forecast, the North American market is predicted to hold the largest share among all regions in 2024. The region holds 43% of the total market share in 2024. The high spending the region observes on healthcare along with factors such as presence of leading biotech and pharmaceutical companies in the region and strong government funding all contribute to its growth. The high concentration of genomic research initiatives also continues to spur adoption in the region. The US emerges as the hub for bioinformatics in the region.

U.S. Bioinformatics Market

In North America, U.S. leads the bioinformatics market especially capturing more that 85% of the market in North America. This is due to its advanced research infrastructure, strong presence of major biotech and pharmaceutical companies, and substantial government and private sector investments. Many key players in the market such as Thermo Fisher Scientific, Inc., Illumina, Inc., Waters Corporation, Azenta, Inc. etc. are headquartered here. The presence of these major industry players and increased R&D funding creates an environment for innovation in bioinformatics. In April 2025, Signios Bio, which was formerly the U.S. research arm of MedGenome Inc., announced its rebranding from to establish its position as one of the leaders in AI-driven bioinformatics and multiomics. The company now offers an integrated platform for various applications starting from genomics to spatial biology.

Canada Bioinformatics Market

Canada in North America is just behind the U.S. Its growth rate surpassed that of US amounting to 13.63% during 2025-2032. The country’s bioinformatics market’s growth can be credited to government-funded initiatives such as Genome Canada and collaborations with international partners. In October 2024, Bioinformatics Solutions Inc. (BSI), a Canada-based bioinformatics firm and SCIEX cemented their collaboration with the launch of PEAKS 12.5. PEAKS 12.5 is a next-gen proteomics software which is compatible with the ZenoTOF 7600+ system. It claims to offer better accuracy, sensitivity, and interactive visualization. Such innovations showcase the huge potential of the market.

Asia-Pacific is predicted to grow at the highest rate in the bioinformatics market over the projection period of 2025-2032. The region grew at 14.8% during the forecast period. The growth in the region is led by investments in biotechnology, adoption of precision medicine, and rise in genomic research across countries like China, India, and Japan. Other factors such as supportive government policies, growing healthcare awareness, and increase in regional collaborations also support greater growth of bioinformatics. All of these factors contribute to the fast rate at which the bioinformatics market of Asia Pacific is growing.

China Bioinformatics Market

The China bioinformatics market grew at a steady rate of 14.72 % during the forecast period. This expansion can be credited for various reasons. It can be strong government support, massive genomic datasets, and increasing focus on precision medicine and biotechnology. Rapid innovation in the market is also a huge reason behind the market’s progress. MGI Tech, a Chinese biotech company, launched the Microbial Isolates Whole-Genome Sequencing Package for its CycloneSEQ platform in May 2025. This package gives a 3-step library preparation and integrated MGA software for automating genome assembly, annotation, and visualization. It combines long- and short-read sequencing for microbial analysis with high-accuracy rates. This streamlines bioinformatics workflows for researchers in microbial genomics.

India Bioinformatics Market

India holds 38.2 % of Asia Pacific’s bioinformatics market in 2025. India’s market growth is spurred by rising investments in genomics, personalized medicine, and biotech research. Government initiatives like the Genome India Project and local innovation from companies like MedGenome Labs Ltd. have also played huge roles in positioning India as an influential market for bioinformatics. In 2024, Singleron Biotechnologies established a partnership with Bioscreen. In this partnership, Bioscreen exclusively distributes its single cell multi-omics solutions in India. This makes access to end-to-end single cell analysis tools better in the country.

Europe held a significant bioinformatics market share of 3.72 billion in 2024 and is likely to continue so during the forecast period of 2025-2032. This can be due to the increase in research activities in genomics and molecular biology, along with funding from the European Union and national governments. The well-established academic and research infrastructure encourages innovation. Collaborations among biotech firms, universities, and public institutions create room for innovation across various applications in bioinformatics.

Germany Bioinformatics Market

Germany has the one of the largest European markets for bioinformatics. It grew at a rate of 12.39% during the forecast period. Its growth is supported by its life sciences industry and strong R&D capabilities. The country’s focus on genome sequencing, biomedical informatics, and pharmaceutical research has also encouraged adoption. German research institutions and biotech firms are increasingly modern analytical tools into bioinformatics platforms to make drug discovery and clinical diagnostics better and faster.

France Bioinformatics Market

The France bioinformatics market is also experiencing steady growth. The market benefits from its focus on research in genomics, proteomics, and systems biology. France excels in innovation in pharmaceutical and lays emphasis on collaborative research in drug development. Bioinformatics is playing a central role in France’s biomedical research. This makes the French bioinformatics market a highly opportune market in upcoming years.

UK Bioinformatics Market

The UK bioinformatics market emerges as the most prominent bioinformatics market in the European region. It held about 41.13% of the total European bioinformatics market share in 2024. This is attributed to the thriving biotech sector in the UK and initiatives like Genomics England. The UK is focusing on integrating genomics into public healthcare. A strong base of academic excellence and public-private partnerships provides the perfect environment for bioinformatics platforms and services’ growth in the country.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

Increased Regulatory Approvals

Growing Demand for Personalised Medicine

Lack of Standardization

High Cost of Bioinformatics Tools and Infrastructure

Request Free Customization of this report to help us to meet your business objectives.

The bioinformatics market observes intense competition and innovation. Leading players, such as are Eurofins Scientific, Thermo Fisher Scientific, Inc., and Illumina, Inc., have been adopting strategies centred around integration of technological advances and strategic collaborations. Companies like Qiagen, Agilent Technologies, My Intelligent Machines (MIMs), and LatchBio are using their innovative tools such as QIAGEN’s Microbiome WGS SeqSets and Agilent’s oncology-focused partnership with Theragen Bio. This helps them to improve the precision and efficiency. Many firms are also entering strategic R&D partnerships. Few such instances were seen in Illumina’s alliance with AstraZeneca and Thermo Fisher’s startup incubator collaboration in 2022. These efforts were made to expand the companies’ research capabilities; make bioinformatics tools democratized and gain competitive advantage in the market. Startups are also entering the market to take advantage of its growth.

Subscription-Based and Pay-Per-Use Models:

Collaborations and Knowledge Sharing:

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected using Primary Exploratory Research backed by robust Secondary Desk research.

As per SkyQuest analysis, the bioinformatics market is progressing considerably due to the expanding applications of bioinformatics, supportive regulatory approvals, and growing partnerships and alliances. However, the market is hampered by lack of standardization, huge pricing of tools and platforms, and competition pressure. North America is anticipated to lead the market owing to its well-developed pharmaceutical market that demands advanced bioinformatics, focus on research and development, and technological improvements. Asia Pacific, on the other hand, emerges as the fastest growing region.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 19.51 Billion |

| Market size value in 2033 | USD 59.55 Billion |

| Growth Rate | 13.2% |

| Base year | 2024 |

| Forecast period | 2026-2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Bioinformatics Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Bioinformatics Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Bioinformatics Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Bioinformatics Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

The CAGR is projected to be 13.24% between 2025 and 2032 for the global bioinformatics market. Growth will be driven by advances in personalized medicine, genomics and proteomics research, and increased support for genomic research efforts.

The bioinformatics market's largest segment is Knowledge Management Tools which was valued at USD 8.9 billion in 2024. Knowledge Management Tools consist of various systems and applications that organize, integrate, and interpret biological data, all of which are crucial in the research and pharmaceutical workforce.

Genomics has the largest application in bioinformatics, accounting for about 30% of the market share in 2024. This is due to the influx of next-generation sequencing data and the importance of genomics to personalized medicine and diagnostics, as well as large-scale genome projects.

AI is improving bioinformatics tools and platforms by improving the understanding of complex biological information, increasing the speed and accuracy of predictive modeling, variants analysis, and drug discovery. Tools like ExpasyGPT, allow researchers to create natural language queries across databases.

Cloud-based bioinformatics platforms are making the way in bioinformatics, increasing speed, scalability and cost-effectiveness for what can become incredibly large biological datasets. They allow for real time collaboration, data integration, and access to data, reducing the barrier to entry for many advanced bioinformatics tools.

North America is the leader in bioinformatics with a projected 43% market share in 2024. The U.S has one of the highest healthcare expenditures when compared to other countries and has extensive government support. The above factors have led to North America having some of the world's best biotechnology firms as well as having a heavy concentration of genomic research. The U.S. alone is expected to account for over 85% of the North American market.

Asia-Pacific is the fastest growing region, supported by increased investments in genomics, the adoption of precision medicine, and government support. Countries such as China and India have rapidly increased research and encouraged innovation, thus quickly expanding their bioinformatics ecosystems.

Europe is advancing bioinformatics innovation by building on a rich tradition of fundamental and translational research in genomics and molecular biology, continuous EU and national funding for genomic research, and the institutional and institutional collaboration between academic institutions, biotech companies, and publically funded institutions. The UK is at the forefront in Europe, with initiatives such as Genomics England supporting genomic data analysis.

Genomics is the popular bioinformatic application because it has widespread use in personalized medicine, diagnostics, and population genomics. Moreover, recent advances in next-gen sequencing technologies, combined with low-cost investments to develop genomes and analyze them more rapidly has made genomic data analysis the focus of the future of bioinformatics and its research applications.

Bioinformatics is being used to provide personalized medicine through the utilization of genomic and proteomic data to provide treatments that match individual genetic profiles. Bioinformatics data analysis helps investigators provide better diagnostic specificity and a more individualized treatment option, particularly in oncology and precision diagnostics.

Global Bioinformatics Market size was valued at USD 19.51 Billion in 2024 and is poised to grow from USD 22.09 Billion in 2025 to USD 59.55 Billion by 2033, growing at a CAGR of 13.2% in the forecast period (2026–2033).

The bioinformatics market observes intense competition and innovation. Leading players, such as are Eurofins Scientific, Thermo Fisher Scientific, Inc., and Illumina, Inc., have been adopting strategies centred around integration of technological advances and strategic collaborations. Companies like Qiagen, Agilent Technologies, My Intelligent Machines (MIMs), and LatchBio are using their innovative tools such as QIAGEN’s Microbiome WGS SeqSets and Agilent’s oncology-focused partnership with Theragen Bio. This helps them to improve the precision and efficiency. Many firms are also entering strategic R&D partnerships. Few such instances were seen in Illumina’s alliance with AstraZeneca and Thermo Fisher’s startup incubator collaboration in 2022. These efforts were made to expand the companies’ research capabilities; make bioinformatics tools democratized and gain competitive advantage in the market. Startups are also entering the market to take advantage of its growth. 'Thermo Fisher Scientific, Inc. (United States)', 'Eurofins Scientific SE (Luxembourg)', 'Illumina, Inc. (United States)', 'Revvity Inc (United States)', 'Qiagen N.V. (Netherlands)', 'Agilent Technologies, Inc. (United States)', 'DNASTAR, Inc. (United States)', 'Waters Corporation (United States)', 'Azenta, Inc. (United States)', 'MedGenome Labs Ltd. (India)', 'Fios Genomics (United Kingdom)', 'Genscript Biotech Corporation (China)', 'Dotmatics (United States)', 'Dnanexus, Inc. (United States)', 'Synbio Technologies (United States)', 'NeoGenomics Laboratories (United States)', 'Limerston Capital (Source BioScience) (United Kingdom)', 'Psomagen, Inc. (formerly Macrogen Corp.) (United States / South Korea)', 'LabVantage Solutions, Inc. (Biomax Informatics AG) (United States)', 'Sophia Genetics (Switzerland)'

The increase in regulatory approvals of novel drugs from regulatory bodies such as FDA and Center for Drug Evaluation and Research fuels the demand for bioinformatics solutions. In 2023 alone, the CDER approved 55 novel drugs. This is the second-highest number of approvals in a single year. This increase in approvals shows that the market is progressive towards drug development. This, in turn, indicates the presence of a suitable environment for innovation and market entry. The increased number of FDA approvals directly correlates with heightened research and development (R&D) activities. This creates a direct demand for advanced databases and software tools. Thus, the role of bioinformatics in this transformative journey is more evident now than ever before.

There has been a shift of consumer preference towards subscription-based and pay-per-use models. Companies like Qiagen and Genentech are providing their users access to software and analysis tools through different flexible and affordable subscription plans. This is departing from the traditional upfront licensing fees. This model promotes accessibility and provides cost-effective and adaptable solutions.

As per the 2024 bioinformatics market regional forecast, the North American market is predicted to hold the largest share among all regions in 2024. The region holds 43% of the total market share in 2024. The high spending the region observes on healthcare along with factors such as presence of leading biotech and pharmaceutical companies in the region and strong government funding all contribute to its growth. The high concentration of genomic research initiatives also continues to spur adoption in the region. The US emerges as the hub for bioinformatics in the region.

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients