Bioimpedance Analyzers Market Insights

Market Overview:

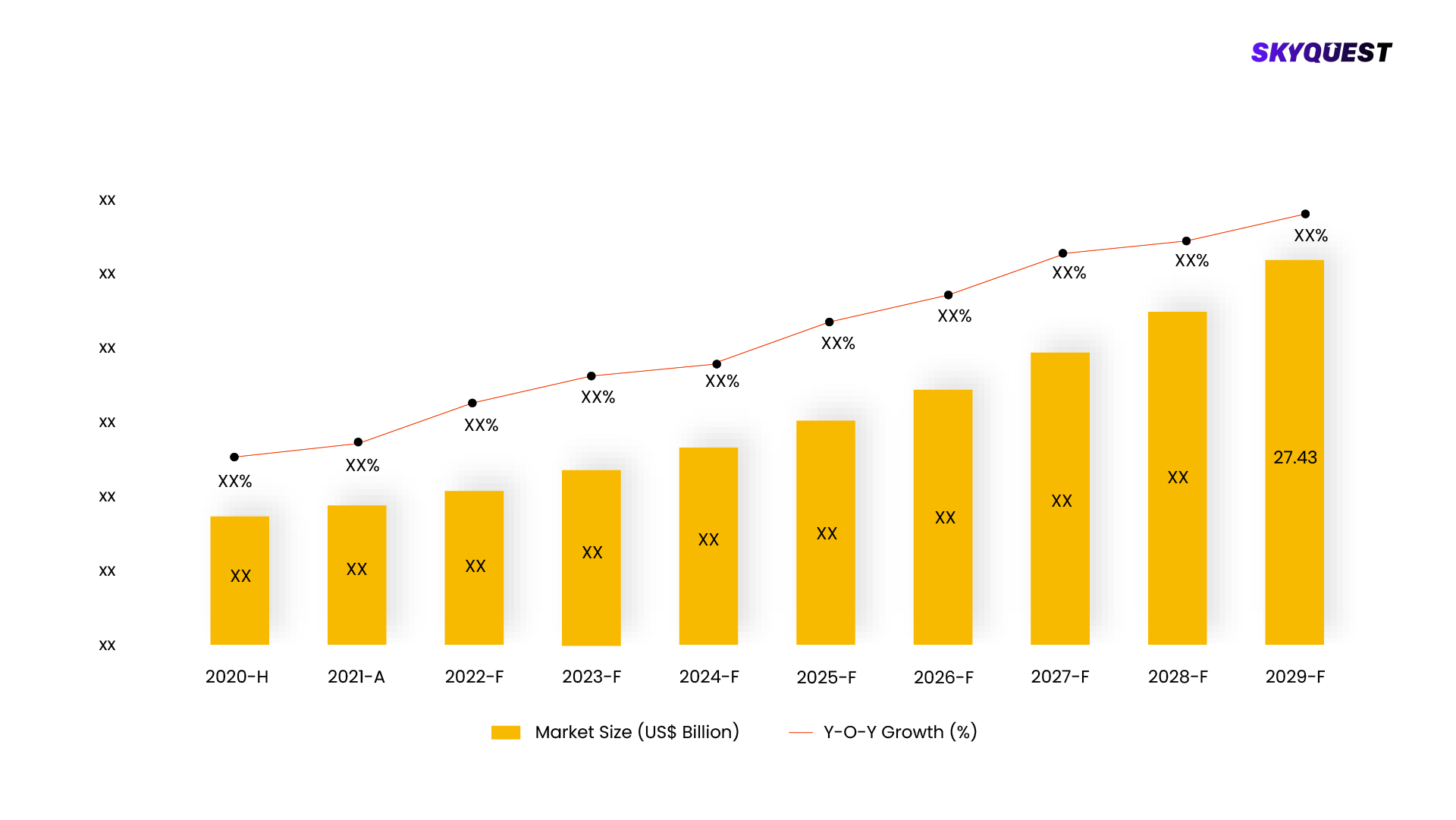

The worldwide market for bioimpedance analyzers, in terms of its financial value, was approximately valued at $564 million in 2023, with potential growth to reach $927 million by 2028. This anticipated expansion signifies a consistent Compound Annual Growth Rate (CAGR) of 10.4% from 2023 to 2028.

Bioimpedance Analyzers Market, Forecast & Y-O-Y Growth Rate, 2020 - 2028

To get more reports on the above market click here to

GET FREE SAMPLEThis report is being written to illustrate the market opportunity by region and by segments, indicating opportunity areas for the vendors to tap upon. To estimate the opportunity, it was very important to understand the current market scenario and the way it will grow in future.

Production and consumption patterns are being carefully compared to forecast the market. Other factors considered to forecast the market are the growth of the adjacent market, revenue growth of the key market vendors, scenario-based analysis, and market segment growth.

The market size was determined by estimating the market through a top-down and bottom-up approach, which was further validated with industry interviews. Considering the nature of the market we derived the Health Care Equipment by segment aggregation, the contribution of the Health Care Equipment in Health Care Equipment & Services and vendor share.

To determine the growth of the market factors such as drivers, trends, restraints, and opportunities were identified, and the impact of these factors was analyzed to determine the market growth. To understand the market growth in detail, we have analyzed the year-on-year growth of the market. Also, historic growth rates were compared to determine growth patterns.

Segmentation Analysis:

The Bioimpedance Analyzers Market is segmented by Product, Modality, Usage Type, Application, End User, Region. We are analyzing the market of these segments to identify which segment is the largest now and in the future, which segment has the highest growth rate, and the segment which offers the opportunity in the future.

Bioimpedance Analyzers Market Basis Point Share Analysis, 2021 Vs. 2028

To get detailed analysis on all segments

<

BUY NOW

- Based on Product the market is segmented as, Multi-frequency Bioimpedance Analyzers, Single-frequency Bioimpedance Analyzers, Dual-frequency Bioimpedance Analyzer

- Based on Modality the market is segmented as, Wired Bioimpedance Analyzers, Wireless Bioimpedance Analyzers

- Based on Usage Type the market is segmented as, Consumer-grade Bioimpedance Analyzers, Professional-grade Bioimpedance Analyzers

- Based on Application the market is segmented as, Whole-body Measurement, Segmental Body Measurement

- Based on End User the market is segmented as, Hospitals & Clinics, Fitness Clubs & Wellness Centers, Home Users, Other End Users

- Based on Region the market is segmented as, North America, Europe, Asia Pacific, Rest of the World, Key Players, OMRON Corporation, Tanita Corporation, InBody, RJL Systems

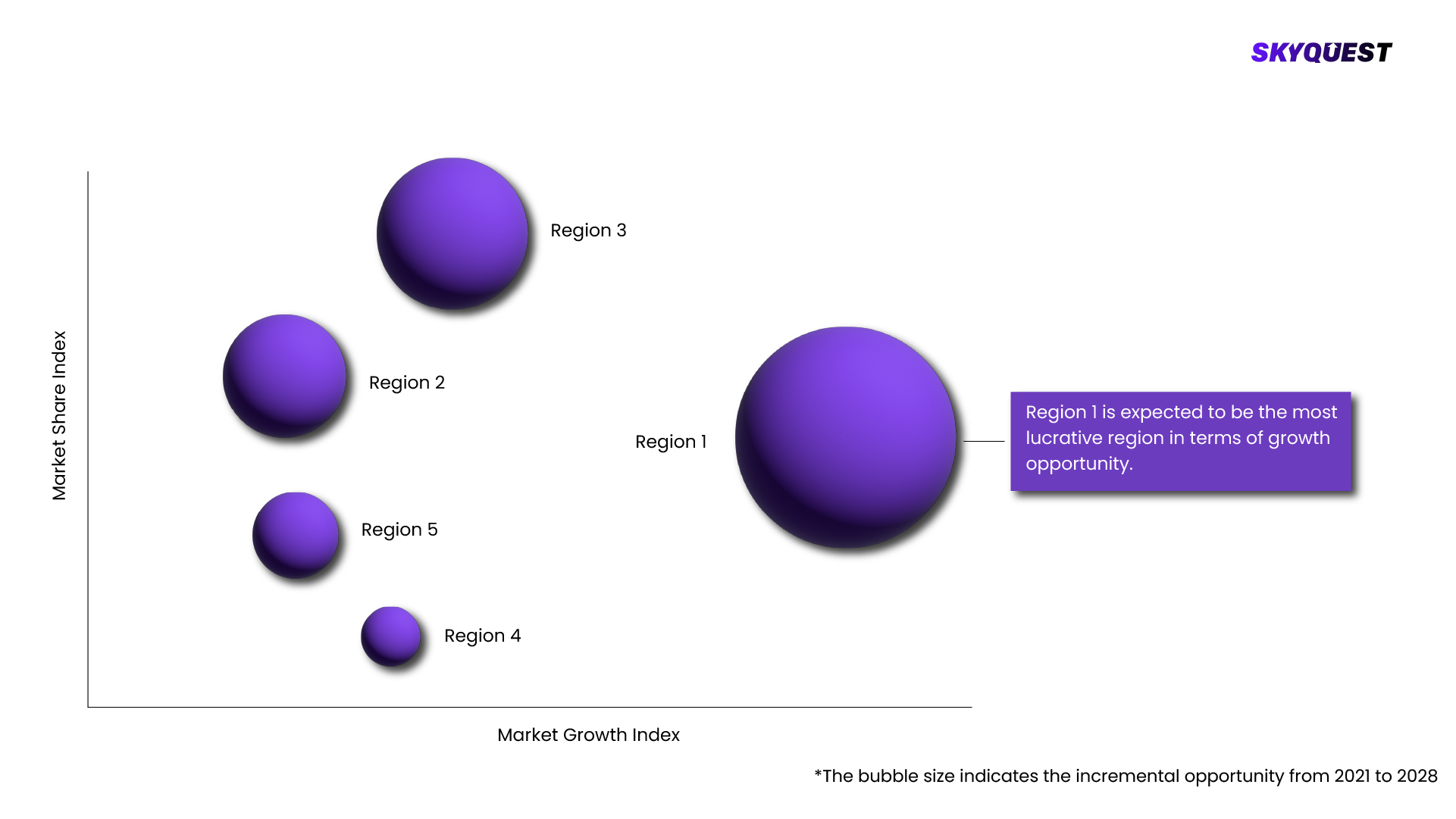

Regional Analysis:

Bioimpedance Analyzers Market is being analyzed by North America, Europe, Asia-Pacific (APAC), Latin America (LATAM), Middle East & Africa (MEA) regions. Key countries including the U.S., Canada, Germany, France, UK, Italy, Spain, China, India, Japan, Brazil, GCC Countries, and South Africa among others were analyzed considering various micro and macro trends.

Bioimpedance Analyzers Market Attractiveness Analysis, By Region 2020-2028

To know more about the market opportunities by region and country, click here to

REQUEST FREE CUSTOMIZATIONBioimpedance Analyzers Market : Risk Analysis

SkyQuest's expert analysts have conducted a risk analysis to understand the impact of external extremities on Bioimpedance Analyzers Market. We analyzed how geopolitical influence, natural disasters, climate change, legal scenario, economic impact, trade & economic policies, social & ethnic concerns, and demographic changes might affect Bioimpedance Analyzers Market's supply chain, distribution, and total revenue growth.

Competitive landscaping:

To understand the competitive landscape, we are analyzing key Bioimpedance Analyzers Market vendors in the market. To understand the competitive rivalry, we are comparing the revenue, expenses, resources, product portfolio, region coverage, market share, key initiatives, product launches, and any news related to the Bioimpedance Analyzers Market.

To validate our hypothesis and validate our findings on the market ecosystem, we are also conducting a detailed porter's five forces analysis. Competitive Rivalry, Supplier Power, Buyer Power, Threat of Substitution, and Threat of New Entry each force is analyzed by various parameters governing those forces.

Key Players Covered in the Report:

- bioimpedance analyzers market in terms of revenue was estimated to be worth $564 million in 2023 and is poised to reach $927 million by 2028, growing at a CAGR of 10.4% from 2023 to 2028. The growth in this market is attributed to the growing prevalence of diabetes, the global increase in the number of hospitals and fitness clubs, and the high rate of obese population. However, alternative methods or techniques restrain the growth of this market.

- Bioimpedance Analyzers Market Dynamics

- DRIVER: Increasing prevalence of lifestyle diseases

- The rising prevalence of various lifestyle diseases, such as obesity, high blood pressure, and diabetes, is probably due to unhealthy lifestyles, such as sedentary work environments, eating more junk food, and increased mobility automation.

- By 2035, more than 4 billion people, over 50% of the global population, may be affected by obesity, up from 2.6 billion in 2020. Obesity rates, with a BMI of 30 or higher, are anticipated to rise from 14% to 24%, impacting nearly 2 billion individuals. Urgent action is needed to address this global health challenge.

- RESTRAINT: High cost of analyzers

- The smaller healthcare facilities, clinics, and resource-constrained regions will get limited by the high cost of analyzers. Depending on the features, capabilities, and frequency, bioimpedance analyzers can range in pricing. For some healthcare facilities, fitness centers, and research institutions, especially smaller or resource-constrained organizations, the cost of acquiring and maintaining these devices can be a significant barrier. The price of bioimpedance analyzers can range from USD 2,000- USD 30,000.

- OPPORTUNITY: Integration with wearable devices

- Wearable devices, such as fitness trackers or smartwatches, to monitor body composition and hydration status could be integrated with bioimpedance analyzers. This integration will allow for real-time data collection and analysis, which will enable individuals to track their health parameters throughout the day and make informed decisions about their lifestyle and behavior.

- CHALLENGE: Inconsistency in the accuracy of different bioimpedance analyzers

- Although valuable information about body composition and hydration status can be obtained with bioimpedance analyzers, their accuracy may vary depending on age, gender, body type, and hydration level. They may not be as accurate as gold standard methods like DEXA or hydrostatic weighing in some cases. The number represents an estimate of the total body fat percentage, even though one gets an accurate reading on a bioimpedance scale. Most of the scales also cannot tell where fat is located in the body. Even though many factors can affect reading accuracy, a regular BIA scale can show changes in body fat over time. However, the obtained number may not be accurate but can still track changes to the body composition. This limitation can deter healthcare professionals and researchers who require exact measurements.

- BIOIMPEDANCE ANALYZERS ECOSYSTEM

- Prominent companies in this market include well-established, financially stable manufacturers of bioimpedance analyzers. These companies have been operating in the market for several years and possess diversified state-of-the-art technologies, product portfolios, and strong global sales and marketing networks.

- In 2022, multi-frequency bioimpedance analyzers segment to observe the highest growth rate of the bioimpedance analyzers industry, by product.

- Based on product, the bioimpedance analyzers market is classified into multi-frequency, single-frequency, and dual-frequency bioimpedance analyzers. In 2022, the multi-frequency bioimpedance analyzers segment dominated the products market. This segment is also estimated to grow at the highest CAGR during the forecast period. The large share can be attributed to features like advanced tissue differentiation and integration with other technologies.

- “In 2022, segmental body measurement segment to dominate the bioimpedance analyzers industry, by application.

- Based on application, the bioimpedance analyzers market is segmented into segmental body measurement and whole-body measurement. The segmental body measurement segment accounted for the largest share of the market in 2022. Also, this segment is estimated to witness the highest growth during the forecast period. The large share is due to tracking changes in specific body segments by athletes and monitoring the effectiveness of the training programs.

- In 2022, North America to dominate in bioimpedance analyzers industry.

- The global bioimpedance analyzers market is segmented into North America, Europe, Asia Pacific, and Rest of the World. North America is expected to dominate during the forecast period, primarily due to the high promotion of healthy lifestyles, sedentary work life, and large population consuming junk food.

- Recent Developments of Bioimpedance Analyzers Industry

- In 2023, Bodystat Ltd. (UK) launched the Multiscan 5000, which incorporates the latest state-of-the-art bioelectrical impedance spectroscopy (BIS) technology based on direct digital synthesis, digital signal processing, and active shielding technology.

- In 2023, InBody Co., Ltd. (South Korea) announced it would supply the US Marine Corps with body composition analysis devices. The US Marine Corps announced refinements in its body composition assessment methods using the InBody 770 analyzer.

- In 2022, InBody Co., Ltd. (South Korea) partnered with iLoveKickboxing (US). The partnership offered iLoveKickboxing members access to high-quality data about their body fat percentage, muscle mass, and other biometrics. It enabled them to monitor changes over time via the InBody App.

- KEY MARKET SEGMENTS

- By Product

- Multi-frequency Bioimpedance Analyzers

- Single-frequency Bioimpedance Analyzers

- Dual-frequency Bioimpedance Analyzer

- By Modality

- Wired Bioimpedance Analyzers

- Wireless Bioimpedance Analyzers

- By Usage Type

- Consumer-grade Bioimpedance Analyzers

- Professional-grade Bioimpedance Analyzers

- By Application

- Whole-body Measurement

- Segmental Body Measurement

- By End User

- Hospitals & Clinics

- Fitness Clubs & Wellness Centers

- Home Users

- Other End Users

- By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

- Key Players

- OMRON Corporation

- Tanita Corporation

- InBody

- RJL Systems

- Seca GmbH & Co. KG

SkyQuest's Expertise:

The Bioimpedance Analyzers Market is being analyzed by SkyQuest's analysts with the help of 20+ scheduled Primary interviews from both the demand and supply sides. We have already invested more than 250 hours on this report and are still refining our date to provide authenticated data to your readers and clients. Exhaustive primary and secondary research is conducted to collect information on the market, peer market, and parent market.

Our cross-industry experts and revenue-impact consultants at SkyQuest enable our clients to convert market intelligence into actionable, quantifiable results through personalized engagement.

Scope Of Report

| Report Attribute |

Details |

| The base year for estimation |

2021 |

| Historical data |

2016 – 2022 |

| Forecast period |

2022 – 2028 |

| Report coverage |

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments covered |

- By Product - Multi-frequency Bioimpedance Analyzers, Single-frequency Bioimpedance Analyzers, Dual-frequency Bioimpedance Analyzer

- By Modality - Wired Bioimpedance Analyzers, Wireless Bioimpedance Analyzers

- By Usage Type - Consumer-grade Bioimpedance Analyzers, Professional-grade Bioimpedance Analyzers

- By Application - Whole-body Measurement, Segmental Body Measurement

- By End User - Hospitals & Clinics, Fitness Clubs & Wellness Centers, Home Users, Other End Users

- By Region - North America, Europe, Asia Pacific, Rest of the World, Key Players, OMRON Corporation, Tanita Corporation, InBody, RJL Systems

|

| Regional scope |

North America, Europe, Asia-Pacific (APAC), Latin America (LATAM), Middle East & Africa (MEA) |

| Country scope |

U.S., Canada, Germany, France, UK, Italy, Spain, China, India, Japan, Brazil, GCC Countries, South Africa |

| Key companies profiled |

- bioimpedance analyzers market in terms of revenue was estimated to be worth $564 million in 2023 and is poised to reach $927 million by 2028, growing at a CAGR of 10.4% from 2023 to 2028. The growth in this market is attributed to the growing prevalence of diabetes, the global increase in the number of hospitals and fitness clubs, and the high rate of obese population. However, alternative methods or techniques restrain the growth of this market.

- Bioimpedance Analyzers Market Dynamics

- DRIVER: Increasing prevalence of lifestyle diseases

- The rising prevalence of various lifestyle diseases, such as obesity, high blood pressure, and diabetes, is probably due to unhealthy lifestyles, such as sedentary work environments, eating more junk food, and increased mobility automation.

- By 2035, more than 4 billion people, over 50% of the global population, may be affected by obesity, up from 2.6 billion in 2020. Obesity rates, with a BMI of 30 or higher, are anticipated to rise from 14% to 24%, impacting nearly 2 billion individuals. Urgent action is needed to address this global health challenge.

- RESTRAINT: High cost of analyzers

- The smaller healthcare facilities, clinics, and resource-constrained regions will get limited by the high cost of analyzers. Depending on the features, capabilities, and frequency, bioimpedance analyzers can range in pricing. For some healthcare facilities, fitness centers, and research institutions, especially smaller or resource-constrained organizations, the cost of acquiring and maintaining these devices can be a significant barrier. The price of bioimpedance analyzers can range from USD 2,000- USD 30,000.

- OPPORTUNITY: Integration with wearable devices

- Wearable devices, such as fitness trackers or smartwatches, to monitor body composition and hydration status could be integrated with bioimpedance analyzers. This integration will allow for real-time data collection and analysis, which will enable individuals to track their health parameters throughout the day and make informed decisions about their lifestyle and behavior.

- CHALLENGE: Inconsistency in the accuracy of different bioimpedance analyzers

- Although valuable information about body composition and hydration status can be obtained with bioimpedance analyzers, their accuracy may vary depending on age, gender, body type, and hydration level. They may not be as accurate as gold standard methods like DEXA or hydrostatic weighing in some cases. The number represents an estimate of the total body fat percentage, even though one gets an accurate reading on a bioimpedance scale. Most of the scales also cannot tell where fat is located in the body. Even though many factors can affect reading accuracy, a regular BIA scale can show changes in body fat over time. However, the obtained number may not be accurate but can still track changes to the body composition. This limitation can deter healthcare professionals and researchers who require exact measurements.

- BIOIMPEDANCE ANALYZERS ECOSYSTEM

- Prominent companies in this market include well-established, financially stable manufacturers of bioimpedance analyzers. These companies have been operating in the market for several years and possess diversified state-of-the-art technologies, product portfolios, and strong global sales and marketing networks.

- In 2022, multi-frequency bioimpedance analyzers segment to observe the highest growth rate of the bioimpedance analyzers industry, by product.

- Based on product, the bioimpedance analyzers market is classified into multi-frequency, single-frequency, and dual-frequency bioimpedance analyzers. In 2022, the multi-frequency bioimpedance analyzers segment dominated the products market. This segment is also estimated to grow at the highest CAGR during the forecast period. The large share can be attributed to features like advanced tissue differentiation and integration with other technologies.

- “In 2022, segmental body measurement segment to dominate the bioimpedance analyzers industry, by application.

- Based on application, the bioimpedance analyzers market is segmented into segmental body measurement and whole-body measurement. The segmental body measurement segment accounted for the largest share of the market in 2022. Also, this segment is estimated to witness the highest growth during the forecast period. The large share is due to tracking changes in specific body segments by athletes and monitoring the effectiveness of the training programs.

- In 2022, North America to dominate in bioimpedance analyzers industry.

- The global bioimpedance analyzers market is segmented into North America, Europe, Asia Pacific, and Rest of the World. North America is expected to dominate during the forecast period, primarily due to the high promotion of healthy lifestyles, sedentary work life, and large population consuming junk food.

- Recent Developments of Bioimpedance Analyzers Industry

- In 2023, Bodystat Ltd. (UK) launched the Multiscan 5000, which incorporates the latest state-of-the-art bioelectrical impedance spectroscopy (BIS) technology based on direct digital synthesis, digital signal processing, and active shielding technology.

- In 2023, InBody Co., Ltd. (South Korea) announced it would supply the US Marine Corps with body composition analysis devices. The US Marine Corps announced refinements in its body composition assessment methods using the InBody 770 analyzer.

- In 2022, InBody Co., Ltd. (South Korea) partnered with iLoveKickboxing (US). The partnership offered iLoveKickboxing members access to high-quality data about their body fat percentage, muscle mass, and other biometrics. It enabled them to monitor changes over time via the InBody App.

- KEY MARKET SEGMENTS

- By Product

- Multi-frequency Bioimpedance Analyzers

- Single-frequency Bioimpedance Analyzers

- Dual-frequency Bioimpedance Analyzer

- By Modality

- Wired Bioimpedance Analyzers

- Wireless Bioimpedance Analyzers

- By Usage Type

- Consumer-grade Bioimpedance Analyzers

- Professional-grade Bioimpedance Analyzers

- By Application

- Whole-body Measurement

- Segmental Body Measurement

- By End User

- Hospitals & Clinics

- Fitness Clubs & Wellness Centers

- Home Users

- Other End Users

- By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

- Key Players

- OMRON Corporation

- Tanita Corporation

- InBody

- RJL Systems

- Seca GmbH & Co. KG

|

| Customization scope |

Free report customization (15% Free customization) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options |

Reap the benefits of customized purchase options to fit your specific research requirements. |

Objectives of the Study

- To forecast the market size, in terms of value, for various segments with respect to five main regions, namely, North America, Europe, Asia-Pacific (APAC), Latin America (LATAM), Middle East & Africa (MEA)

- To provide detailed information regarding the major factors influencing the growth of the Market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the micro markets with respect to the individual growth trends, future prospects, and contribution to the total market

- To provide a detailed overview of the value chain and analyze market trends with the Porter's five forces analysis

- To analyze the opportunities in the market for various stakeholders by identifying the high-growth Segments

- To identify the key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for the market leaders

- To analyze competitive development such as joint ventures, mergers and acquisitions, new product launches and development, and research and development in the market

What does this Report Deliver?

- Market Estimation for 20+ Countries

- Historical data coverage: 2016 to 2022

- Growth projections: 2022 to 2028

- SkyQuest's premium market insights: Innovation matrix, IP analysis, Production Analysis, Value chain analysis, Technological trends, and Trade analysis

- Customization on Segments, Regions, and Company Profiles

- 100+ tables, 150+ Figures, 10+ matrix

- Global and Country Market Trends

- Comprehensive Mapping of Industry Parameters

- Attractive Investment Proposition

- Competitive Strategies Adopted by Leading Market Participants

- Market drivers, restraints, opportunities, and its impact on the market

- Regulatory scenario, regional dynamics, and insights of leading countries in each region

- Segment trends analysis, opportunity, and growth

- Opportunity analysis by region and country

- Porter's five force analysis to know the market's condition

- Pricing analysis

- Parent market analysis

- Product portfolio benchmarking