Report ID: SQMIG25A2459

Report ID: SQMIG25A2459

sales@skyquestt.com

USA +1 351-333-4748

Report ID:

SQMIG25A2459 |

Region:

Global |

Published Date: June, 2025

Pages:

197

|Tables:

59

|Figures:

75

Global Automotive Tire Market size was valued at USD 151.08 Billion in 2024 and is poised to grow from USD 166.82 Billion in 2025 to USD 368.67 Billion by 2033, growing at a CAGR of 10.42% in the forecast period (2026–2033).

Increased competition among tire manufacturers is driving the global automotive tire market growth. To meet the increasing demand for automobiles and further lower production costs, major automakers are continuing to invest in emerging nations due to their low labor costs. The tire industry has grown significantly over the last ten years as a result of the increased demand for automobiles and the use of collaborative and consolidation manufacturing. At the same time, the automobile industry has grown at an exponential rate.

As a result, the global automotive tire industry expands. Hankook Tire created the "Dynapro AT2" for both off-road and on-road SUVs. These tires perform exceptionally well in all driving conditions due to their quietness, comfortable ride, and robust off-road capabilities.

In addition, the global automotive tire market has progressed rapidly over the past several years, driven by record sales in commercial vehicles, driven mostly by trucks, tractors, and trailers, which have resulted from rapid industrialization. In January 2025, retail sales of commercial vehicles in the country had reached 99,425 units, which was an increase of 8.22% year-on-year. Sales were attributed to the improved freight rates and a renewed demand for passenger carriers, despite the need for funding and slower industrial activity.

What Role Do Embedded Sensors Play in Modern Automotive Tires?

Contemporary tires are more than just rubber tubes; they are now complex tools with sensors that monitor real-time metrics of the tire, such as temperature, pressure, tread depth, etc. This makes the vehicle safer and helps vehicles operate more effectively and efficiently.

A notable example from 2024 is Goodyear and Gatik, a standalone middle-mile logistics provider, who together put Goodyear's SightLine technology on Gatik's self-driving fleet. The SightLine technology utilized the tires to collect and transmit data on road conditions and the health of the tires. By linking this technology with Gatik's self-driving trucks, delivery reliability and uptime increased praps because the trucks were quickly able to pivot to a safe, secured mode of operation for various road conditions.

To get more insights on this market click here to Request a Free Sample Report

The global automotive tire market is segmented into tire type, application, vehicle type, end user, and region. By tire type, the market is divided into winter tires and summer tires. Depending on the application, it is bifurcated into on-the-road and off-the-road. According to vehicle type, the market is categorized into passenger cars and commercial vehicles. As per end user, it is segregated into OEM and aftermarket. Regionally, it is analyzed across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

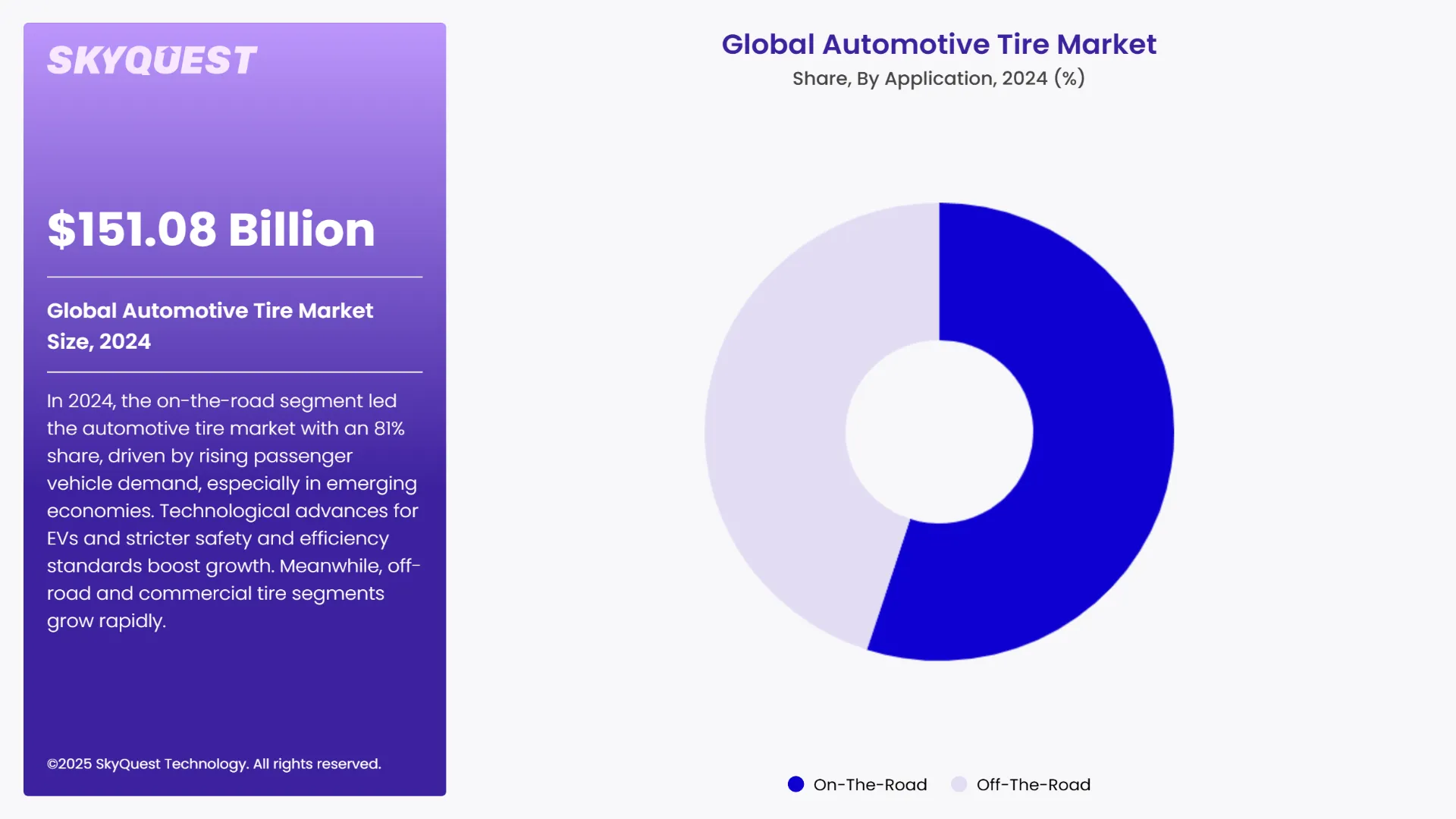

Why Does the On-the-Road Segment Lead the Automotive Tire Market in 2024?

As per the 2024 global automotive tire market analysis, the on-the-road segment dominates the market, holding an approximate 81% market share. This huge market has thus been fairly seized upon because of the high demand for passenger vehicles, particularly in emerging and developing economies. The growing demand for higher-performance and protective tires also assures the further growth of the segment, including the technological innovations being brought forth. The need for high technological tires for passenger cars is on an upward trajectory due to the introduction of stricter standards regarding tire safety and fuel efficiency. Major tire manufacturers are focusing their efforts on the development of tires for the electric vehicle sector with features such as reduced rolling resistance and superior noise damping. Significant innovation in tire compounds and tread patterns is also occurring in this segment to improve handling, traction, and the overall driving experience while maintaining maximum fuel efficiency.

The off-the-road category is expected to grow at the fastest rate in the automotive tire market, with an estimated growth rate of about 4% over the forecast period of 2025–2032. The primary force behind this expansion is the developed world's increasing demand for efficient and productive agricultural machinery. Tractor sales are increasing globally because of the segment's significant growth and farmers have decreased reliance on labor. Numerous factors, such as the migration of people from rural to urban areas, the lack of skilled workers in many developing countries, and rising labor costs, have contributed to the high demand for off-road tires and agricultural vehicles.

Why Are Emerging Economies Key to Passenger Cars Tire Growth?

Based on the 2024 global automotive tire market forecast, the market is dominated by the passenger cars segment, which is expected to hold a 69% market share. Rising disposable incomes, urbanization patterns, and the global demand for passenger cars, particularly in emerging economies, can all be attributed to this dominance. The remarkable performance of the segment is a result of the growing use of electric vehicles in the passenger car market, which calls for particular tire solutions. The increased focus on fuel efficiency and environmental regulations has led to advancements in passenger vehicle tire technology, such as low rolling resistance tires and environmentally friendly materials.

The commercial vehicle segment is expected to grow at the fastest rate, at roughly 4%, during the 2025–2032 forecast period. The primary cause of this faster growth is the expansion of the logistics and e-commerce sectors, which has increased demand for light commercial vehicles and heavy-duty trucks. Infrastructure development projects in various locations and the growing usage of electric commercial vehicles both support the segment's expansion. Tire manufacturers are responding to this growth by developing specially designed tires for commercial vehicles that offer improved durability, load-bearing capacity, and fuel efficiency.

To get detailed segments analysis, Request a Free Sample Report

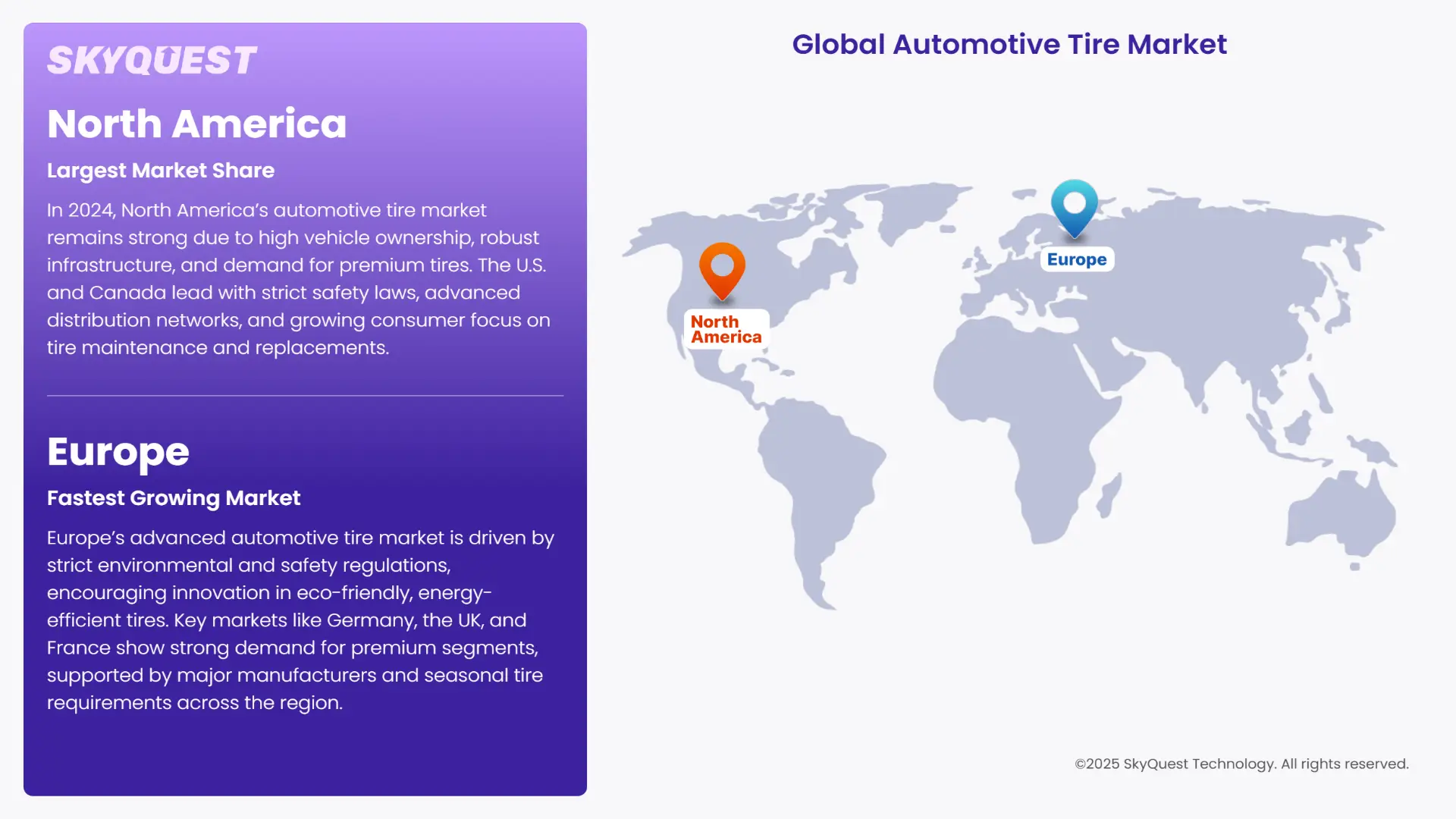

As per the 2024 automotive tire market regional forecast, the mature and advanced market in North America is characterized by high vehicle ownership rates and advanced transportation infrastructure. The two largest markets in the region are the US and Canada, both of which have significant demand for premium, high-performance tires. The presence of major automakers and a flourishing aftermarket sector have a significant impact on the dynamics of the regional market. The region benefits from strict tire safety laws, advanced distribution systems, and rising consumer awareness of tire replacement and maintenance schedules.

U.S. Automotive Tire Market

The United States dominates the North American automotive tire market growth, holding approximately 85% of the regional market share in 2024. The country's market is defined by powerful domestic and international tire producers with extensive distribution networks in each country. The U.S. market benefits from a large automotive manufacturing base that includes major OEMs and a thriving aftermarket sector. The automotive tire market is growing as a result of consumer preference for premium tire segments, the rising demand for all-season tires, and the growing popularity of electric vehicles. The country's diverse climate also affects the demand for specialty tire types, such as summer, winter, and all-season tires. The size of the US tire market is a significant factor in the global market.

Canada Automotive Tire Market

Canada is a large automotive tire market in North America, with a projected growth rate of about 3% between 2025 and 2032. The harsh weather conditions that characterize the Canadian market, particularly during the winter, have led to a strong demand for winter and all-season tires. The country's market is supported by stringent tire safety regulations and, in certain provinces, the requirement for seasonal tire changes. Canadian consumers are increasingly drawn to high-end tire brands and innovative tire technologies. The market is also aided by a strong network of tire dealers and auto repair shops that ensure accessibility and professional installation services.

Europe is home to a sophisticated and technologically advanced automotive tire market, with major presences in Germany, the UK, France, and Italy. The region's market is defined by strict regulations pertaining to environmental and tire safety standards, which also encourage advancements in tire technology. In the European automotive tire market, which also shows a strong preference for premium tire segments, eco-friendly and energy-efficient tires are growing in popularity. The presence of significant tire manufacturers and automotive OEMs influences the market dynamics of the region, even though seasonal tire requirements in many countries drive consistent demand.

Germany Automotive Tire Market

Germany leads the European automotive tire market growth with about 18% of the regional market share in 2024. Germany is the largest automotive market in Europe due to its robust luxury automakers and booming automotive component industry. The high degree of consumer awareness regarding tire performance and safety in the country's market is what drives the demand for premium tire segments. Continuous improvements in tire technology are supported by the presence of major tire manufacturers and research facilities. German consumers are increasingly selecting eco-friendly and sustainable tire options, which is consistent with the country's high level of environmental consciousness.

Italy Automotive Tire Market

Italy has significant growth potential in the European market, with a growth rate of about 3% anticipated between 2025 and 2032. The Italian automotive tire market stands out for having a significant presence of premium and ultra-high performance tire segments because of the country's lengthy history of automobile manufacturing and large number of luxury automakers. Customers' growing awareness of tire performance and safety features benefits the market. Summer tires are still very popular in Italy due to the country's Mediterranean climate, but all-season tires are becoming more and more popular. The country's market is supported by a robust network of auto repair shops and tire dealers.

UK Automotive Tire Market

The UK automotive tire market demand is undergoing a significant transition due to emerging technologies and shifting consumer preferences. In 2024, the market witnessed a surge in demand for eco-friendly tires, and manufacturers focused on using low rolling resistance and sustainable materials to meet environmental regulations. At the same time, tires made especially to satisfy the unique needs of electric vehicles (EVs), such as greater load capacity and reduced noise levels, have become more and more popular.

A thriving and rapidly evolving automotive tire market can be found in Asia-Pacific, which includes major economies like China, Japan, India, and South Korea. The market in the region is defined by different consumer preferences, different regulatory frameworks, and different levels of market maturity among countries. The presence of major auto manufacturing hubs, rising car ownership rates, and urbanization all contribute to market growth. The region's strong demand for tires across all price points, from budget to luxury, reflects the diverse economic landscapes and consumer preferences of different countries.

China Automotive Tire Market

China dominates the Asia-Pacific tire market by using its position as the world's largest automotive market. The country's tire market is influenced by robust distribution networks, a wide range of domestic tire brands, and substantial domestic manufacturing capacity. The Chinese market is witnessing an increase in demand for premium tire segments, which suggests that consumer tastes are evolving. Because of the rapid adoption of electric vehicles and government support for the development of the automotive industry, the market is still expanding. The country's diverse climate and expanding road system sustain a consistent demand for tires across several categories.

India Automotive Tire Market

India is the Asia-Pacific market that is expanding at the fastest rate and has a lot of potential for future expansion. The Indian market benefits from rising car ownership rates, a developing middle class, and a growing automotive manufacturing sector. The country's need for tires for both passenger and commercial vehicles is growing thanks to government initiatives to boost domestic production. Customers' tastes are shifting, and they are paying more attention to safety features and tire performance. The expansion of distribution networks and the emergence of international tire brands support automotive tire market growth.

To know more about the market opportunities by region and country, click here to

Buy The Complete Report

Expanding Automobile Manufacturing and Sales Worldwide

Technological Developments Improving Tire Performance

Volatility of Raw Material Prices

Environmental Rules and Difficulties with Disposal

Request Free Customization of this report to help us to meet your business objectives.

Large companies like Bridgestone, Michelin, and Goodyear dominate the global automotive tire market and make significant investments in R&D and sustainability projects. Their market position is strengthened through acquisitions, regional expansion into developing nations, and strategic alliances with automakers. To stay ahead of the competition, satisfy consumer demands, and adhere to legal requirements, companies concentrate on developing innovative eco-friendly materials and intelligent tire technologies.

SkyQuest’s ABIRAW (Advanced Business Intelligence, Research & Analysis Wing) is our Business Information Services team that Collects, Collates, Correlates, and Analyses the Data collected by means of Primary Exploratory Research backed by robust Secondary Desk research.

As per SkyQuest analysis, the global automotive tire market outlook is anticipated to continuously grow due to increasing vehicle production and technology to enhance tire performance and safety. However, stringent regulations on the environment and raw material prices are challenges that still could hinder the industry. Sustainability and innovations related to smart tires are actively pursued by industry stakeholders to meet consumer and regulatory demands. To remain competitive and take advantage of growth opportunities, strategic partnerships and diversification of capabilities will be required in new emerging areas.

| Report Metric | Details |

|---|---|

| Market size value in 2024 | USD 151.08 Billion |

| Market size value in 2033 | USD 368.67 Billion |

| Growth Rate | 10.42% |

| Base year | 2024 |

| Forecast period | 2026–2033 |

| Forecast Unit (Value) | USD Billion |

| Segments covered |

|

| Regions covered | North America (US, Canada), Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (South Africa, GCC Countries, Rest of MEA) |

| Companies covered |

|

| Customization scope | Free report customization with purchase. Customization includes:-

|

To get a free trial access to our platform which is a one stop solution for all your data requirements for quicker decision making. This platform allows you to compare markets, competitors who are prominent in the market, and mega trends that are influencing the dynamics in the market. Also, get access to detailed SkyQuest exclusive matrix.

Table Of Content

Executive Summary

Market overview

Parent Market Analysis

Market overview

Market size

KEY MARKET INSIGHTS

COVID IMPACT

MARKET DYNAMICS & OUTLOOK

Market Size by Region

KEY COMPANY PROFILES

Methodology

For the Automotive Tire Market, our research methodology involved a mixture of primary and secondary data sources. Key steps involved in the research process are listed below:

1. Information Procurement: This stage involved the procurement of Market data or related information via primary and secondary sources. The various secondary sources used included various company websites, annual reports, trade databases, and paid databases such as Hoover's, Bloomberg Business, Factiva, and Avention. Our team did 45 primary interactions Globally which included several stakeholders such as manufacturers, customers, key opinion leaders, etc. Overall, information procurement was one of the most extensive stages in our research process.

2. Information Analysis: This step involved triangulation of data through bottom-up and top-down approaches to estimate and validate the total size and future estimate of the Automotive Tire Market.

3. Report Formulation: The final step entailed the placement of data points in appropriate Market spaces in an attempt to deduce viable conclusions.

4. Validation & Publishing: Validation is the most important step in the process. Validation & re-validation via an intricately designed process helped us finalize data points to be used for final calculations. The final Market estimates and forecasts were then aligned and sent to our panel of industry experts for validation of data. Once the validation was done the report was sent to our Quality Assurance team to ensure adherence to style guides, consistency & design.

Analyst Support

Customization Options

With the given market data, our dedicated team of analysts can offer you the following customization options are available for the Automotive Tire Market:

Product Analysis: Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis: Further analysis of the Automotive Tire Market for additional countries.

Competitive Analysis: Detailed analysis and profiling of additional Market players & comparative analysis of competitive products.

Go to Market Strategy: Find the high-growth channels to invest your marketing efforts and increase your customer base.

Innovation Mapping: Identify racial solutions and innovation, connected to deep ecosystems of innovators, start-ups, academics, and strategic partners.

Category Intelligence: Customized intelligence that is relevant to their supply Markets will enable them to make smarter sourcing decisions and improve their category management.

Public Company Transcript Analysis: To improve the investment performance by generating new alpha and making better-informed decisions.

Social Media Listening: To analyze the conversations and trends happening not just around your brand, but around your industry as a whole, and use those insights to make better Marketing decisions.

REQUEST FOR SAMPLE

Global Automotive Tire Market size was valued at USD 151.08 Billion in 2024 and is poised to grow from USD 166.82 Billion in 2025 to USD 368.67 Billion by 2033, growing at a CAGR of 10.42% in the forecast period (2026–2033).

Bridgestone Corporation, Michelin Group, Goodyear Tire & Rubber Company, Continental AG, Pirelli & C. S.p.A., Hankook Tire & Technology, Yokohama Rubber Company, Sumitomo Rubber Industries, Apollo Tyres Ltd., Cooper Tire & Rubber Company, Kumho Tire Co., Ltd., Toyo Tire Corporation, CEAT Limited, MRF Limited, Giti Tire

The key driver of the automotive tire market is the increasing global demand for vehicles, including passenger cars, commercial vehicles, and electric vehicles, which drives the need for high-performance, durable, and fuel-efficient tires.

A key market trend in the automotive tire market is the growing adoption of smart and sustainable tires, including energy-efficient, eco-friendly, and sensor-equipped tires that enhance safety, performance monitoring, and vehicle efficiency.

Asia-Pacific accounted for the largest share in the automotive tire market, driven by rapid vehicle production, high demand for passenger and commercial vehicles, growing automotive manufacturing hubs, and increasing consumer preference for quality and durable tires.

Want to customize this report? This report can be personalized according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time. We offer $1000 worth of FREE customization at the time of purchase.

Feedback From Our Clients